What payment is guaranteed by law?

If an employee goes on a business trip, the employer, that is, the head of a budgetary institution, must provide such a specialist with compensation for his expenses.

Such expenses are associated not only with the purchase of tickets or renting a hotel room. Additionally, the payment for a business trip includes expenses that are aimed at compensating for the inconveniences associated with living outside the place of the main residence, that is, daily allowances. This is not a definitive list of guarantees. According to Article 168 of the Labor Code of the Russian Federation, the employer must guarantee the preservation of the workplace and payment according to the average earnings of the business trip.

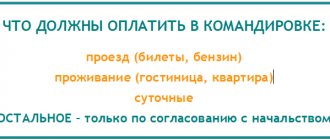

Composition of travel expenses:

- Average salary for days spent on a business trip. Calculated based on the average for the 12 months preceding the month of business trip.

- Daily allowance. The organization must have a limit for payment. There are no legal restrictions; the size depends on the financial capabilities of the enterprise. The amount depends on the number of days of the business trip.

- Fare. Includes payment for tickets, commissions, insurance, and other types of expenses. For example, compensation for fuel and lubricants for an employee using a personal car on a business trip.

- Living expenses. It is acceptable to include payment for a hotel room, payment for a bed or room in a dormitory, or payment for renting an apartment on a daily basis.

- Other expenses agreed with the employer. For example, an employee uses personal transport for a work trip. The cost of maintaining the car while on the road can be paid by the employer.

IMPORTANT!

Not all trips and trips of specialists can be classified as business trips. The article “Which trips are considered a business trip” will help you understand the situation.

We calculate daily allowances

For civil servants, calculating daily allowances for business trips in 2022 will not be difficult: for the day of a business trip, an official can receive only 100 rubles.

For employees of commercial organizations, the amount of daily allowance is, so to speak, unlimited. Before the entry into force of Federal Law No. 122 of August 22, 2004, Article 168 of the Labor Code of the Russian Federation stated that “the amount of compensation cannot be less than the amount established by the Government of the Russian Federation...”. Now this is no longer the case, and the daily allowance can start from one ruble, and is not limited by an upper limit.

The amount of daily allowance is determined by the local regulatory act of the organization, but when determining it, it is necessary to remember that daily allowance is not subject to personal income tax within the limits of 700 rubles in Russia and 2,500 rubles abroad for each day of a business trip. Amounts exceeding the specified values are subject to taxation in accordance with Article 217 of the Tax Code of the Russian Federation.

How is a business trip paid in 2022?

All expenses of an employee on a business trip must be compensated. But legislators have made a number of recommendations to limit such expenses. What does it mean? A specialist may qualify for compensation, but not more than the established maximum amount of expenses. This rule applies mainly to daily allowances. But some government agencies have also limited spending on hotel accommodations.

The institution determines and regulates limits independently, based on its own financial capabilities. For example, for some federal civil servants the maximum daily allowance is 100 rubles per day, and the standard payment for a hotel room is 1000 rubles per day, while in commercial firms there are no restrictions at all.

In accordance with Art. 168 (Labor Code - business trips) payment (its amount) is not limited. This is solely the decision of the institution. Such limits must be approved by a separate order or local management order.

Travel expenses are paid in advance. Upon return, the specialist draws up an advance report and documents the costs. Attaches invoices, checks, tickets, contracts and receipts to the report. The accountant or responsible person checks the statements and then submits them to management for approval.

Read about the procedure for processing expenses in the separate material “How to process travel expenses in 2022.”

Calculation of average earnings for travel allowances

To correctly calculate the amount of payment for the period of an employee’s business trip, follow the current Government Decree No. 922 of December 24, 2007. We present the basic rules in the form of instructions:

- We determine the billing period. For such payments, the calculation period is 12 calendar months preceding the month in which the employee is sent on a trip. For example, a business trip in April 2022, therefore, the billing period: February 2022 - March 2022.

- We calculate the basis for the calculation. We collect information about all accruals and income of the specialist. Then we exclude payments that are named in paragraph 5 of Resolution No. 92. For example, sick leave benefits, maternity leave and similar cases.

- We calculate the number of days actually worked. The indicator does not include days that fell during illness and vacation, as well as other periods that fell on excluded payments (Article 5 of Resolution No. 922).

- Now we divide the calculation base into the days actually worked. The resulting amount of average daily earnings is due to the specialist for each day he is on a business trip.

Calculation of travel expenses

If the organization does not provide a procedure for ordering and paying for travel documents, the employee can independently organize his trip to the place of business trip and back by ordering and paying for tickets from the amount of the advance payment issued to him.

To prevent employees from flying business class or traveling on trains in sleeping cars, employers can set certain restrictions on expenses, as was done for civil servants in Government Resolution No. 729 of October 2, 2002.

Limitations on travel expenses to and from the place of business travel:

- by rail - only in the compartment carriage of a fast branded train;

- by water transport - in the cabin of the V group of a sea vessel of regular transport lines and lines with comprehensive passenger services, in the cabin of the II category of a river vessel of all lines of communication, in the cabin of the I category of a ferry vessel;

- by air - in the economy class cabin;

- by road - in a public vehicle, except for a taxi.

Calculation example

Travelers Eduard Antipovich was sent on business for 20 calendar days in April 2022.

Its calculated data for the period February 2022 – March 2022:

| Indicators | Periods, days | Charges, rubles |

| Total number of days | 254 | 900 000,00 |

| Sick leave | 41 | 150 000,00 |

| Annual leave | 28 | 90 000,00 |

| Total | 185 | 660 000,00 |

Average daily earnings: 660,000 / 185 = 3,567.57 rubles.

Payment for a business trip based on average earnings: 3567.57 × 20 days. = 71,351.40 rubles.

For information about which accounting entries to reflect these transactions in accounting, read the article “How to keep records of travel expenses in a budget organization.”

Overtime work on a business trip

The question of how overtime hours are paid on a business trip is not regulated at the legislative level. Overtime work is considered to be work outside the normal working hours. However, when employees are sent on business, records of the time they worked during the trip are not kept. Consequently, there are no standards for determining normal working hours on a business trip.

The issue also concerns forms of payment. After all, during the days of a business trip, an employee receives an average salary. This is a guaranteed type of compensation, but not a type of remuneration. Consequently, the provisions of Article 99 of the Labor Code of the Russian Federation are inapplicable in such a situation. But what should an employer do, since not one of his subordinates will agree to work for free, especially beyond the established standards.

Procedure:

- Set standards. The procedure and amount of overtime payment should be specified in the regulations on business trips. For example, establish that for the first two hours of overtime, payment is 1.5 times the average earnings. For the rest of the overtime work - 2 times the amount. But additional payments may be higher, depending on the financial capabilities of the company.

- Obtain the employee's consent. To do this, send a written notice to the employee with a proposal for overtime work. In your application, be sure to include information about the increased payment. There is no unified proposal form; prepare a document in any form.

- Place an order. Having received the written consent of the subordinate, it is necessary to issue an order to engage in overtime work during the business trip.

- Ensure time is tracked. This is necessary for payment in full. Use a unified form of working time sheet or develop and approve your own, which the employee will fill out to record overtime and overtime.

IMPORTANT!

If duties on a business trip occur at night, then similar actions must be taken. Set the amount of payment in the business trip regulations.

Please note that if travel time falls during the night hours, from 00:00 to 06:00, then no additional payments or surcharges are due. For example, if an employee returns on a night flight, there is no need to pay for night hours.

What payments are not subject to indexation?

So, when increasing average earnings, tariff rates, salaries, monetary remuneration are taken into account, as well as payments established to tariff rates, salaries, monetary remuneration in a fixed amount (interest, multiple).

(See the examples discussed above. In particular, in them the amount of the salary was subject to indexation, as well as the amount of the bonus established for the employee in a fixed amount - 30% of the salary.) The following are not subject to indexation:

- payments set to tariff rates, salaries, monetary remuneration in a range of values (interest, multiple). Let me explain. Payments to salary in a range of values are payments established, for example, by the provision on bonuses in the amount of 10 to 50% of the official salary, depending on the employee’s fulfillment of certain criteria (that is, if the size of the bonus in the billing period is not the same);

- payments taken into account when determining average earnings, established in absolute amounts (that is, payments established not in relation to the tariff rate or salary). These include, for example, payments for long service.

Business trips on weekends and holidays

How days on a business trip that fall on holidays and weekends are paid depends on whether the subordinate worked or not.

If an employee did not work on a weekend or holiday, then there is no need to pay for the days according to average earnings. For example, a specialist is sent on a business trip for 10 days, including 1 holiday and 2 days off. Calculate the average earnings only for the 7 working days of your stay on a business trip.

IMPORTANT!

You pay per diem for all days, regardless of whether the specialist worked or not. Include in the calculation working days, holidays, weekends, travel and downtime days, departure and return days.

If an employee worked on a weekend or holiday while on a business trip, then pay for this time in the following amount:

- at least one time from the tariff rate (official salary), if the employee requested additional rest time;

- no less than twice the tariff rate (official salary), if the employee decides to refuse time off.

IMPORTANT!

When calculating payment for work on weekends and holidays, take into account not only the official salary, but also compensation and incentive payments, allowances and additional payments provided for by the current remuneration system. For example, regional coefficients, additional payment for experience, bonus for qualifications.

A similar payment procedure applies if an employee goes on a business trip on a weekend or holiday. Or returns from it. For example, a specialist goes on a trip on May 1. This is a holiday. Therefore, the employer must offer double pay or time off and pay in a single amount.

We pay average earnings as well as salaries

At its core, the average earnings during a business trip are part of the salary (Articles 57, 167 of the Labor Code of the Russian Federation). Salaries must be paid on the day established by the company at least every half month. Therefore, you need to pay the average salary during a business trip on the day the salary is paid.

Nowadays, when in most cases employee salaries are transferred to bank cards, paying the average salary to a posted employee is not a problem. If the employee does not have a plastic card, then the money can be given to him immediately upon arrival. In case of urgent need for money, the employee’s salary must be sent by transfer at the expense of the organization (Articles 136, 137 of the Labor Code of the Russian Federation, clause 11 of the Regulations, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

Daily allowance is a compensation payment to an employee related to staying outside his place of permanent residence. In general, it is logical to compensate the employee for the costs caused by living in an unusual place in the interests of the employer. For example, the cost of organizing meals and meeting other daily needs (for more information, see “We pay daily allowance before leaving on a business trip”).

Calculation example

Morkovkin Stepan Igorevich was sent on a business trip for 15 days. - from April 17 to May 1 inclusive. He worked for 11 days. (10 on weekdays and 1 on weekends). Average earnings for the billing period are 2000 rubles. The tariff daily rate is 2500 rubles. For work on days off, double pay is due; Morkovkin did not take time off.

Standards for reimbursement of travel allowances by organization:

- daily allowance - 1000 rubles per day;

- travel: tickets - 5000 rubles one way;

- accommodation: hotel - 2000 rubles per day.

The accountant accrued the following travel payments:

- daily allowance: 1000 × 15 days. = 15,000 rubles.

IMPORTANT!

There is a limit for personal income tax on daily allowances. In Russia - 700 rubles per day and 2500 rubles. - abroad. Withhold personal income tax from the difference and charge insurance premiums.

- Personal income tax: 15,000 - (700 × 15 days) × 13% = 585 rubles;

- insurance premiums: 15,000 - (700 × 15 days) × 30.2% = 1359 rubles;

- transportation costs: 5000 × 2 = 10,000 rubles;

- living expenses: 2000 × 14 days. = 28,000 rubles;

- average earnings: 10 workers. days × 2000 rub. = 20,000 rub.;

- payment for work on holidays and weekends: 2500 × 2 size × 2 days. = 10,000 rub.

Why do we pay for two days at an increased rate? After all, the employee only worked on one day off? The fact is that Morkovkin was returning home on the May 1st holiday. He didn't take time off. Therefore, a specialist is entitled to payment of no less than double the tariff rate or official salary, taking into account incentives and compensation allowances.