WHO IS RESPONSIBLE TO PAY INSURANCE PREMIUMS

The calculation and payment of insurance premiums is regulated by the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation).

Insurance premiums are understood as mandatory payments for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, collected from organizations and individuals for the purpose of financial security for the implementation of the rights of insured persons to receive insurance coverage for the corresponding type compulsory social insurance (Article 8 of the Tax Code of the Russian Federation).

Payers of insurance premiums are (clause 1 of Article 419 of the Tax Code of the Russian Federation):

• persons making payments and other remuneration to individuals:

– organizations;

- individual entrepreneurs;

– individuals who are not individual entrepreneurs;

- individual entrepreneurs, lawyers, mediators, notaries engaged in private practice, arbitration managers, appraisers, patent attorneys and other persons engaged in private practice in accordance with the legislation of the Russian Federation.

If the payer simultaneously belongs to several categories indicated above, he calculates and pays insurance premiums separately for each basis.

Insurance premiums: types, rates, terms of accrual and payment

An employee’s remuneration is a remuneration for his work activity, which is calculated based on his qualifications, the complexity of the work performed, the number of hours worked, the quality of work and other criteria. In addition to wages, such remunerations include incentive and compensation payments.

According to the legislation of the Russian Federation, the employer pays mandatory amounts from such payments, which go to the country’s budget. They are called insurance premiums (hereinafter - IC).

What are insurance premiums?

The Tax Code, or rather its eighth article, says that these are payments that the state collects from employers for financial support for the implementation of the rights of insured persons to receive security for one or another type of compulsory social insurance.

Types of insurance premiums: what are they?

Article 8 of the Tax Code distinguishes between the following types of contributions for compulsory insurance:

—

for pension (OPS);

—

for medical (compulsory medical insurance);

—

for social - in case of temporary disability and in connection with maternity (VNiM);

—

on injuries (from accidents and occupational diseases).

SV are calculated from salaries and other payments to employees, which include (Article 420 of the Tax Code):

—

bonuses;

—

vacation pay and compensation for unspent vacation;

—

financial assistance more than 4000 rubles. per employee per year.

Payers of insurance premiums: who are they?

SV must be paid by all employers who pay wages and other payments to employees (clause 1 of Article 419 of the Tax Code of the Russian Federation).

Payment of contributions is made directly from the organization’s funds: this amount is not deducted from the employee’s salary.

Payers can be both legal entities (organizations and individual entrepreneurs) and individuals.

An important point: individual entrepreneurs pay SV not only for their employees, but also for themselves (clause 2 of Article 419 of the Tax Code of the Russian Federation).

Contributions are levied on payments to employees hired under an employment contract and (or) a civil law agreement (GPC).

If an employee is hired under a GPC agreement, then the employer does not need to pay compensation for VNIM and injuries. But you will still have to pay for compulsory medical insurance and compulsory health insurance.

Payments not subject to taxation

According to Article 422 of the Tax Code, contributions are not subject to taxation:

—

Benefits from the state: unemployment, temporary disability, pregnancy and childbirth and others.

—

Compensation payments: compensation for harm caused to health, payment for rent of residential premises, reimbursement of food costs, sponsorship of advanced training, etc.

—

Lump sum financial assistance – due to an emergency, natural disaster, death of a family member, birth of a child.

—

Income (except salary) received by members of communities of small indigenous peoples of the Russian Federation.

—

Financial assistance – up to 4,000 rubles. per employee.

—

Reimbursement of employee expenses for repaying loans and borrowings for the purchase or construction of housing.

—

Other types of compensation payments.

Maximum base of insurance premiums

When calculating the amount of contributions, not only the rates are important, but also the maximum value of the base for them - that is, the maximum limits. The base limit is established only for contributions to mandatory pension insurance and VNiM. According to the SV for compulsory medical insurance and for injuries - no. In 2022, the maximum values of the SV base are as follows:

—

for OPS – RUB 1,292,000.

—

at VNiM – 912,000 rubles.

Insurance premium rates

In 2022, the following SV rates (tariffs) have been established.

| View SV | SV rates | |

| Employee income WITHIN the established maximum base amount | The employee's income is ABOVE the established base limit | |

| On OPS | 22% | 10% |

| On compulsory medical insurance | 5,1% | |

| At VNiM | 2,9% | Not credited |

For some companies, reduced (preferential) CB rates have been established. Companies that comply with the conditions of clause 5 of Art. have the right to use them. 427 Tax Code of the Russian Federation. For example, IT companies that develop computer software. They can use CB rates of 8% for compulsory medical insurance, 4% for compulsory medical insurance, 2% for VNiM.

And if payments to an employee exceed the maximum bases (limits), then there is no need to accrue SV for OPS and VNiM from payments to this employee.

As for the insurance policy for injuries, the rates for this type in 2020 remain at the same level. The rate depends on the professional risk class of the company. To calculate the SV in 2020, the organization needed to confirm its main type of activity by April 15, 2022 - so the Social Insurance Fund will set its tariff for the current year.

There are 32 tariffs in total, they are formed taking into account different areas of activity (Article 1 of Law No. 179-FZ). The minimum rate is 0.2%, it corresponds to the first class of pro-free. The maximum rate is 8.5%, corresponding to the thirty-second class.

Here are examples of injury rates in 2022.

| Occupational risk class | SV rate for injuries |

| First | 0,2% |

| Fifth | 0,6% |

| Tenth | 1,1% |

| Twenty fifth | 4,5% |

| Thirty second | 8,5% |

Procedure and terms of accrual and payment

SV for compulsory medical insurance, compulsory medical insurance and VNIM are paid to the Federal Tax Service at the location of the payers, SV for injuries - to the Social Insurance Fund. Contributions to the Pension Fund in 2020 are not paid at all.

If a company has separate divisions in other cities, then the CB is paid at the location of the parent company, except in cases where the “separate division” is vested with special powers.

SV is accrued monthly for each employee on the last day of the month, based on the base for calculating SV. And they are paid no later than the 15th day of the next calendar month. If the 15th falls on a weekend (Sat/Sun/holiday), then contributions are paid on the working day following the weekend. For example, CB for October must be paid no later than November 16.

You can pay earlier, but not later. For each day of delay, penalties are charged.

Paid CBs are issued in the form of separate payment documents.

Reporting on insurance premiums

So, the employer who has entered into an employment contract and (or) civil service contract with an individual and pays him remuneration is required to submit reports on insurance premiums. When accruing remuneration, he is obliged to calculate insurance premiums from them, pay them, and then submit reports to government agencies.

Organizations report on insurance premiums in any case: regardless of whether payments were made to individuals in the reporting period or not. If there have been no payments, so-called zero reports are submitted.

With individual entrepreneurs the situation is different. If an individual entrepreneur does not have employees and is not registered as an employer, then he does not submit reports on insurance premiums.

The reporting periods for all types of insurance premiums are the same: quarterly, half-year, nine months. The billing period is one year. At the end of each of the specified periods, SV payers must report on the base, the amount in which insurance premiums were calculated, and which payments were not subject to contributions.

Reporting forms for 2020-2021 consist of 4-FSS and a unified calculation of insurance premiums. 4-FSS is intended for calculating the base and contributions for injuries; it is submitted to the FSS. In a single calculation, SVs are calculated for pension, health insurance and in case of disability. This document is submitted to the tax service.

Deadlines for submitting reports

The deadline for submitting 4-FSS depends on the method of submission - paper or electronic. If the report is submitted on paper (for companies with an average headcount (SAH) or number of employees of less than 25 people), then the deadline is before the 20th day of the month following the reporting period. If the report is sent electronically (for companies with a capital account or the number of employees over 25 people), then the deadlines are increased by 5 days.

Employers submit a single calculation of insurance premiums by the 30th day of the month following the reporting period. Here, the deadline for delivery does not depend on the method of sending. However, there is also a requirement for the number of employees. Employers with SSC or more than 10 employees must submit the report electronically.

With services for submitting reports electronically from Taxcom, you will not miss a single report. The accountant's personal calendar will remind you of due dates, and the error checking system will prevent you from sending an incorrectly completed report. When filling out, there is a hint system that will help you fill out the form.

Taxcom offers a choice of three services for electronic reporting, depending on the size of the business, its needs and the accounting and information systems used.

Thus, the cloud solution ]Online-Sprinter[/anchor] is perfect for small and medium-sized businesses. This is a web office, in which you only need any PC and Internet access. Online Sprinter is an additional tab in the browser through which you can submit reports and correspond with the Federal Tax Service. Data is securely stored in a cloud archive.

There is no need to update the service: users always see only the current version of the software.

Form 4-FSS in Online Sprinter:

Form of a single calculation for SV in Online Sprinter:

The Dockliner solution is suitable for larger enterprises and those who are inclined to choose software solutions installed on their work computer. Data storage is carried out on the user's PC. At the same time, working in the service is as simple as in Sprinter.

Several employees can work in Documenter at the same time, which is convenient for companies with several accountants responsible for different areas of reporting. You can configure different access rights for them.

Dockliner has a background update mode that does not distract the PC user. The program can also automatically determine the type of document, sender and recipient - just transfer the document from a folder on your computer to the Documenter window. The service starts instantly even with a large database of documents.

And for those who are used to working in the 1C system, Taxcom offers to submit reports directly from it. Solution 1C: Electronic reporting supports most popular configurations of the 1C family. Thus, the solution allows you to work from the familiar interface of a familiar program, without transferring data and without re-entering it.

reporting

Send

Stammer

Tweet

Share

Share

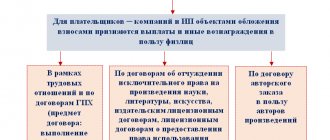

WHAT IS THE SUBJECT TO INSURANCE PREMIUMS

The object of taxation with insurance contributions is payments and other remuneration in favor of individuals subject to compulsory social insurance:

- within the framework of labor relations and under civil law contracts, the subject of which is the performance of work and the provision of services;

- under copyright contracts in favor of the authors of works;

- under agreements on the alienation of the exclusive right to the results of intellectual activity;

- publishing licensing agreements;

- licensing agreements granting the right to use the results of intellectual activity, etc.

Payments and other remuneration within the framework of civil contracts, the subject of which is the transfer of ownership or other proprietary rights to property (property rights), and contracts related to the transfer of property (property rights) for use are not recognized with insurance premiums, with the exception of copyright contracts, contracts on the alienation of the exclusive right to the results of intellectual activity.

Answers to common questions

Question No. 1. Our company plans to enter into an agreement with a medical institution to provide medical services to employees. In order not to pay insurance premiums, can you enter into contracts with any medical institutions?

You can enter into an agreement with any medical institution, but only for those institutions that have a license issued in accordance with the legislation of the Russian Federation, payments are not subject to insurance premiums.

Question No. 2. If we send an employee on a business trip around Russia and the daily allowance is 1000 rubles, then we must charge insurance premiums from the entire amount.

No, only from the amount paid in excess of the established norm. For a business trip in Russia, this limit is 700 rubles, which means that insurance premiums need to be charged only for 300 rubles.

WHAT IS THE BASIS FOR CALCULATING INSURANCE PREMIUMS

The base for calculating insurance premiums is determined at the end of each calendar month as the amount of payments and other remunerations accrued separately in respect of each individual from the beginning of the billing period on an accrual basis.

For payers, a maximum base value is established for calculating insurance contributions for compulsory pension insurance and compulsory social insurance in case of temporary disability and in connection with maternity.

NOTE

Insurance premiums are not collected from amounts of payments and other remuneration in favor of an individual that exceed the maximum value of the base for calculating insurance premiums established for the corresponding billing period, determined on an accrual basis from the beginning of the billing period.

The maximum value of the base for calculating insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity is subject to annual indexation from January 1 of the corresponding year based on the growth of average wages in the Russian Federation.

The maximum value of the base for calculating insurance contributions for compulsory pension insurance is established taking into account the average salary in the Russian Federation determined for the corresponding year, increased by twelve times, and the following increasing coefficients applied to it for the corresponding calendar year ( in 2022 - 2. 3) .

The size of the corresponding maximum base for calculating insurance premiums is annually established by the Government of the Russian Federation.

Additional list

In paragraph 3 of Art. 422 of the Tax Code of the Russian Federation lists a number of payments that are classified as non-taxable for certain types of insurance. These are, in particular:

- monthly payments to investigators, prosecutors and magistrates in terms of insurance payments for compulsory pension insurance;

- a similar rule applies to student income received from activities in student groups;

- remuneration under GPC agreements in terms of payments for compulsory social insurance.

In addition, remunerations received by individuals for tutoring, assistance with housekeeping, and caring for children, the elderly and sick people are not subject to insurance premiums.

WHAT AMOUNT ARE NOT SUBJECT TO INSURANCE PREMIUMS

According to Art. 422 of the Tax Code of the Russian Federation the following are not subject to insurance premiums :

1) state benefits , including unemployment benefits, as well as benefits and other types of compulsory insurance coverage for compulsory social insurance;

2) all types of compensation payments (within the limits established in accordance with the legislation of the Russian Federation) related to:

- compensation for harm caused by injury or other damage to health;

- free provision of residential premises, payment for residential premises and utilities, food and products, fuel or appropriate monetary compensation;

- payment of the cost and (or) issuance of the due allowance in kind, as well as payment of funds in exchange for this allowance;

- payment for the cost of food, sports equipment, equipment, sports and dress uniforms received by athletes and employees of physical education and sports organizations for the training process and participation in sports competitions, as well as sports judges for participation in sports competitions;

- dismissal of employees, with the exception of compensation for unused vacation, the amount of payments in the form of severance pay and average monthly earnings for the period of employment in a part generally exceeding three times the average monthly earnings;

- reimbursement of expenses for professional training, retraining and advanced training of employees;

- performance by an individual of labor duties, including in connection with moving to work in another area;

- employment of workers dismissed due to a reduction in the number or staff of employees, reorganization or liquidation of the organization, etc.;

3) amounts of one-time financial assistance provided by payers:

- to individuals in connection with a natural disaster or other emergency in order to compensate for material damage caused to them or harm to their health, as well as to individuals who suffered from terrorist acts on the territory of the Russian Federation;

- to an employee in connection with the death of a member (members) of his family;

- to employees (parents, adoptive parents, guardians) at the birth (adoption) of a child, establishment of guardianship over a child, paid during the first year after birth (adoption), establishment of guardianship, but not more than 50,000 rubles. for each child;

4) income (except for wages of employees) received by members of duly registered family (tribal) communities of indigenous peoples of the North, Siberia and the Far East of the Russian Federation engaged in traditional economic activities, from the sale of products obtained as a result of their traditional activities fishing;

5) the amount of insurance payments ( contributions ) for compulsory insurance of employees, carried out by the payer in the manner established by the legislation of the Russian Federation, the amount of payments (contributions) of the payer under contracts of voluntary personal insurance of employees, concluded for a period of at least one year, providing for payment by insurers of medical expenses of these insured persons, the amount of payments (contributions) of the payer under contracts for the provision of medical services to employees, concluded for a period of at least one year with medical organizations that have appropriate licenses to carry out medical activities, etc.;

6) employer contributions paid by the payer in accordance with Federal Law No. 56-FZ dated April 30, 2008 (as amended on October 1, 2019) “On additional insurance contributions for funded pensions and state support for the formation of pension savings”, in the amount of contributions paid, but not more than 12,000 rubles. per year per each employee in whose favor the employer’s contributions were paid;

7) the cost of travel of the employee to the place of use of the vacation and back and the cost of transporting luggage weighing up to 30 kg, as well as the cost of travel of non-working members of his family (husband, wife, minor children actually living with the employee) and the cost of transporting their baggage;

amounts paid to individuals by election commissions, referendum commissions, as well as from the election funds of candidates for the position of President of the Russian Federation, candidates for deputies of the State Duma, candidates for deputies of a legislative (representative) body of state power of a constituent entity of the Russian Federation, candidates for a position in another state body of a constituent entity of the Russian Federation, provided for by the constitution, charter of a constituent entity of the Russian Federation, elected directly by citizens, etc.;

9) the cost of uniforms and uniforms issued to employees in accordance with the legislation of the Russian Federation, as well as to civil servants of federal government bodies free of charge or with partial payment and remaining for their personal permanent use;

10) the cost of travel benefits provided by the legislation of the Russian Federation to certain categories of employees;

11) the amount of financial assistance provided by employers to their employees, not exceeding 4,000 rubles. per employee per billing period;

12) the amount of tuition fees for employees in basic professional educational programs and additional professional programs;

13) amounts paid by payers to their employees to reimburse the costs of paying interest on loans (credits) for the acquisition and (or) construction of residential premises;

14) the amount of monetary allowance , food and clothing support and other payments received by military personnel, employees of internal affairs bodies, institutions and bodies of the penal system, enforcement agencies of the Russian Federation, etc.;

15) the amount of payments and other remuneration under employment contracts and civil contracts, including under contracts of author’s order in favor of foreign citizens and stateless persons temporarily staying in the territory of the Russian Federation, with the exception of the amount of payments and other remuneration in favor of such persons, recognized as insured persons in accordance with federal laws on specific types of compulsory social insurance;

16) amounts paid by the payer to reimburse actually incurred and documented expenses of an individual related to the performance of work, provision of services under civil contracts, as well as payment by the payer of such expenses.

WHAT ARE THE RATES OF INSURANCE PREMIUMS?

The insurance premium rate is the amount of the insurance premium per unit of measurement of the base for calculating insurance premiums.

Insurance premium rates are set in the following amounts:

- for compulsory pension insurance ( OPS ):

– within the established limit value of the base for calculating insurance premiums for this type of insurance - 22 %;

- over the established maximum base for calculating insurance premiums for this type of insurance - 10 %;

- for compulsory social insurance ( OSI ) in case of temporary disability and in connection with maternity within the established maximum value of the base for calculating insurance premiums for this type of insurance - 2.9% ;

- for compulsory social insurance in case of temporary disability and in connection with maternity in relation to payments and other remuneration in favor of foreign citizens and stateless persons temporarily staying in Russia (with the exception of highly qualified specialists), within the established limit of the base for this type of insurance - 1,8 %;

- for compulsory medical insurance ( CHI ) - 5.1% .

Insurance premium rates effective in 2022 are presented in table. 1.

| Table 1. Current insurance premium rates | ||||

| Base for calculating insurance premiums | Insurance premium rates | |||

| on OPS | on OSS in case of temporary disability and in connection with maternity | on compulsory medical insurance | ||

| in relation to payments and other remuneration in favor of foreigners and stateless persons temporarily staying in the territory of the Russian Federation | for other payments | |||

| Within the established limit value | 22 % | 1,8 % | 2,9 % | 5,1 %* |

| Above the established limit | 10 % | X | X | |

| * For the purpose of calculating insurance premiums for compulsory medical education, a maximum base value is not established, therefore the specified tariff is charged from the full amount of payments subject to insurance premiums. | ||||

FOR YOUR INFORMATION

Reduced insurance premium rates have been established for certain categories of payers. The procedure and conditions for applying reduced insurance premium rates are established in Art. 427 Tax Code of the Russian Federation.

Before the entry into force of Federal Law No. 303-FZ dated August 3, 2018 (as amended on October 30, 2018) “On Amendments to Certain Legislative Acts of the Russian Federation on Taxes and Fees” (hereinafter referred to as Federal Law No. 303-FZ), Art. . 426 Tax Code of the Russian Federation. In accordance with this article, in 2017–2020. a combined insurance premium rate of 30% was applied. After 2022, pension insurance contributions were to increase from 22 to 26%, the total tariff - to 34%.

After the entry into force of Federal Law No. 303-FZ Art. 426 of the Tax Code of the Russian Federation lost force, and the aggregate tariff of 30% became permanent.

What kind of norm is this

Art. 422 of the Tax Code of the Russian Federation, as amended for 2022, with comments and explanations from regulatory and supervisory authorities, gives an idea of those types of income of citizens that are not taken into account when calculating insurance premiums payable for compulsory types of insurance (pension, medical and social).

Article 422 of the Tax Code of the Russian Federation, as amended for 2022, is contained in the Tax Code of the Russian Federation, in Chapter 34, in Section 11. This codified document is one of the main ones in the Russian Federation and is available on all known legal platforms.

HOW TO DETERMINE THE LIMIT VALUES OF THE BASES FOR CALCULATING INSURANCE PREMIUMS IN 2022?

The maximum values of the bases for calculating insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity are determined by:

- for 2022 - in accordance with Decree of the Government of the Russian Federation dated November 6, 2019 No. 1407;

- for 2022 - in accordance with Decree of the Government of the Russian Federation dated November 26, 2020 No. 1935.

Table 2 presents the maximum values of the bases for calculating insurance premiums for 2022 and 2022.

| Table 2. Limit values of bases for calculating insurance premiums for 2022 and 2022. | ||

| Type of contributions | Limit value of the taxable base, rub. | |

| 2020 | 2021 | |

| Insurance contributions for compulsory pension insurance (OPI) | 1 292 000 | 1 465 000 |

| Insurance contributions for compulsory social insurance (OSI) in case of temporary disability and in connection with maternity | 912 000 | 966 000 |

| Insurance premiums for compulsory health insurance (CHI) | No limit | |

EXAMPLE

Alpha LLC applies general insurance premium rates. Let's consider the calculation of contributions to each fund for an employee of the company Sidorov S.S. (Table 3).

| Table 3. Calculation of insurance premiums in 2022 for Sidorov S.S., rub. | |||||

| Month | Base for calculating insurance premiums | Base for calculating insurance premiums on an accrual basis | Pension contributions | Contributions for illness and maternity | Medical fees |

| 1 | 2 | 3 | 4 | 5 | 6 |

| January | 120 000 | 120 000 | 26 400 | 3480 | 6120 |

| February | 110 000 | 230 000 | 24 200 | 3190 | 5610 |

| March | 120 000 | 350 000 | 26 400 | 3480 | 6120 |

| April | 124 000 | 474 000 | 27 280 | 3596 | 6324 |

| May | 115 000 | 589 000 | 25 300 | 3335 | 5865 |

| June | 120 000 | 709 000 | 26 400 | 3480 | 6120 |

| July | 115 000 | 824 000 | 25 300 | 3335 | 5865 |

| August | 118 000 | 942 000 | 25 960 | 3422 | 6018 |

| September | 120 000 | 1 062 000 | 26 400 | 696 | 6120 |

| October | 117 000 | 1 179 000 | 25 740 | 0 | 5967 |

| November | 113 000 | 1 292 000 | 24 860 | 0 | 5763 |

| December | 160 000 | 1 452 000 | 35 200 | 0 | 8160 |

Column 2 presents the employee’s monthly income, which is the basis for calculating insurance premiums. In column 3, the base for accrual is calculated on an accrual basis from the beginning of the year (to see when the limit for accrual of insurance premiums will be reached).

The maximum values of the bases for calculating insurance premiums for 2021 are:

- for pension contributions - RUB 1,465,000 ;

- for contributions in case of illness and maternity - 966,000 rubles .

There is no limit for medical contributions (the rate is 5.1%).

For pension contributions in the example under consideration, the base for calculating insurance contributions on an accrual basis from the beginning of the year does not exceed the limit value (RUB 1,465,000 more than RUB 1,452,000). Therefore, the calculation is made monthly at a rate of 22% of the entire amount of accrued wages.

For sickness and maternity contributions, the contribution limit will be reached in September. In all previous months (from January to August) the rate will be 2.9% of the entire amount of accrued wages.

In September the calculation will look like this:

(966,000 rub. – 942,000 rub.) × 2.9% = 696 rub ., where 942,000 rub. — base for accrual on an accrual basis from January to August inclusive.

From October to December, deductions will become zero.

Federal Law No. 102-FZ dated April 1, 2020 “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation” added clause 1 of Art. 427 of the Tax Code of the Russian Federation with a new sub-clause. 17, establishing from 2022 reduced rates of insurance premiums for payers recognized as small and medium-sized businesses in accordance with Federal Law No. 209-FZ dated July 24, 2007 (as amended on December 30, 2020) “On the development of small and medium-sized businesses in the Russian Federation "

Reduced tariffs apply to the portion of payments in favor of an individual, determined at the end of each calendar month as an excess over the minimum wage approved at the beginning of the billing period (year).

From 01/01/2021, the portion paid in excess of the minimum wage will be taxed using the following reduced tariffs:

- for compulsory pension insurance - 10% (within the established limit of the base and above it);

- for compulsory social insurance in case of temporary disability and in connection with maternity - 0 %;

- for compulsory health insurance - 5 %.

Thus, if is not exceeded , part of the earnings within the minimum wage is subject to contributions to compulsory pension insurance at a rate of 22% , above the minimum wage - 10% .

Payments in the amount of the minimum wage must pay contributions to compulsory social insurance in case of temporary disability and in connection with maternity at a rate of 2.9% ; no contributions are paid for payments in excess of the minimum wage.

Basic rate of contributions for compulsory health insurance for payments:

- within the minimum wage - 5,1 %;

- above the minimum wage - 5 %.

Company liability for non-payment of insurance premiums

If the deadlines for payment of contributions are violated, the employer will face punishment in the form of the following measures:

- penalties accrued for each day of delay (as a percentage of the missing amount);

- a fine imposed for non-payment of contributions, provided in a fixed amount.

If an employer evades payment of insurance premiums, he faces criminal liability, although until recently policyholders only faced a fine. Evasion from paying insurance premiums on a large and especially large scale is considered a crime. Large - this is an excess of arrears in the amount of 15 million rubles. Or non-payment of insurance premiums exceeds 5 million rubles for 3 years in a row. A particularly large amount is 45 million rubles, or 15 million rubles for the last 3 financial years. The maximum fine for violation is 500 thousand rubles, and the criminal term is 6 years.

HOW AN EMPLOYER PAYS INSURANCE PREMIUMS

Payers-employers calculate and pay insurance premiums on a monthly basis. The deadline for paying insurance premiums is no later than the 15th day of the month following the month in which payments were made to individuals.

The amount of insurance premiums is determined in rubles and kopecks and is calculated separately in relation to insurance premiums for:

- compulsory pension insurance;

- compulsory social insurance in case of temporary disability and in connection with maternity;

- compulsory health insurance.

The billing period is the calendar year, the reporting periods are the first quarter, six months, and nine months of the calendar year.

ON A NOTE

The calculation form for insurance premiums (DAM) was approved by Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/470 @ (as amended on October 15, 2020) “On approval of the calculation form for insurance premiums, the procedure for filling it out, as well as the format [email protected] as invalid .”

Payers making payments to individuals submit the DAM to the tax authority quarterly no later than the 30th day of the month following the settlement (reporting) period.

An important point: payers who do not make payments and other remuneration to individuals (individual entrepreneurs, lawyers, mediators, notaries and other persons engaged in private practice) do not have the obligation to fill out and submit the DAM.

To avoid errors in the calculation of insurance premiums, payers need to check it using the Control ratios specified in the letter of the Federal Tax Service of Russia dated 02/07/2020 No. BS-4-11 / [email protected]

Basis and legal basis

Issues of insurance premiums were previously regulated by a number of federal laws. Fundamental among them was Federal Law No. 212-FZ of July 24, 2009, which became invalid due to amendments to the Tax Code.

Now the norms of the Tax Code of the Russian Federation apply to the calculation and payment of insurance premiums. New section 11 and chapter 34 of the Code are devoted to insurance premiums.

From 2022, tax authorities:

- control the completeness and timeliness of payment of insurance premiums accrued according to the new rules;

- accept and check reports starting with the calculation of insurance premiums for the first quarter of 2022;

- collect arrears, penalties and fines on insurance premiums, including for 2016 and previous periods.

With regard to insurance premiums for periods expired before 2022, the Pension Fund and the Social Insurance Fund continue to conduct inspections and identify the presence of arrears.

The Tax Code in Article 8 establishes the concept of insurance contributions - these are mandatory payments for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, for compulsory medical insurance, collected from organizations and individuals for the purpose of financial security for the implementation of the rights of insured persons to receive insurance coverage for the corresponding type of compulsory social insurance.

Insurance contributions are also recognized as contributions collected from organizations for the purpose of additional social security for certain categories of individuals.

The Tax Code of the Russian Federation in its latest edition establishes:

- general conditions for establishing insurance premiums (Article 18.2 of the Tax Code of the Russian Federation);

- circle of contribution payers (Article 419 of the Tax Code of the Russian Federation);

- obligations of payers (Article 23 of the Tax Code of the Russian Federation);

- the procedure for calculating insurance premiums (Article 52 of the Tax Code of the Russian Federation);

- taxable object and base (Articles 420 and 421 of the Tax Code of the Russian Federation);

- tariffs of insurance premiums (Articles 425-429 of the Tax Code of the Russian Federation);

- the procedure for paying insurance premiums (Article 431 of the Tax Code of the Russian Federation);

- liability for violation of legislation on insurance premiums and other issues.

WHAT IS ACCIDENT INSURANCE

Compulsory social insurance against industrial accidents and occupational diseases is a type of social insurance and provides for:

- ensuring social protection of the insured and economic interest of insurance subjects in reducing professional risk;

- compensation for harm caused to the life and health of the insured during the performance of his duties under an employment contract and in other cases established by law, by providing the insured in full with all necessary types of insurance coverage, including payment of expenses for medical, social and professional rehabilitation;

- application of preventive measures to reduce industrial injuries and occupational diseases.

The legislation of the Russian Federation on compulsory social insurance against industrial accidents and occupational diseases consists of:

- Federal Law No. 125-FZ dated July 24, 1998 (as amended on December 8, 2020) “On compulsory social insurance against industrial accidents and occupational diseases”;

- federal laws and other regulatory legal acts of the Russian Federation adopted in accordance with it.

NOTE

Insurance premiums for pension insurance, medical insurance and in case of temporary disability are paid to the tax authorities, insurance premiums for accidents are paid to the Social Insurance Fund of the Russian Federation.

Contribution rates for injuries are provided for by Federal Law No. 179-FZ dated December 22, 2005 (as amended on December 22, 2020) “On insurance rates for compulsory social insurance against industrial accidents and occupational diseases for 2006” (hereinafter referred to as Federal Law No. 179-FZ). They range from 0.2 to 8.5% depending on the type of activity.

The validity of this regulatory document is extended by separate regulatory acts. Thus, Federal Law No. 445-FZ dated December 27, 2019 “On insurance tariffs for compulsory social insurance against industrial accidents and occupational diseases for 2022 and for the planning period of 2022 and 2022” establishes that in 2022 and in the planned period 2022 and 2022 Insurance premiums for OSS against industrial accidents and occupational diseases are paid by the insured in the manner and at the rates approved by Federal Law No. 179-FZ for 2006.