Definition of terms

First of all, let us make a reservation that the terminology of civil and tax law differs. In the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation, the Code) there is no definition of the concept of a branch, as well as the concept of a representative office. At the same time, Article 11 of the Tax Code of the Russian Federation indicates that the institutions, concepts and terms of civil and other branches of legislation of the Russian Federation used in the Code are applied in the meaning in which they are used in these branches of legislation, unless otherwise provided by the Code. Therefore, we will use these terms for tax purposes exactly in the meaning in which they are used in civil legislation.

The concepts of “branch” and “representative office” are given in Article 55 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation). According to the provisions of this norm, a representative office is a separate division of a legal entity, located outside its location, which represents the interests of the legal entity and protects them.

A branch is a separate division of a legal entity, located outside its location, and performing all or part of its functions, including the functions of a representative office.

Based on the definitions, we can conclude that the main difference between a branch and a representative office from each other is their functional purpose: a representative office only represents the interests of a legal entity in its relations with participants in civil transactions, for example, it performs the functions of conducting negotiations and subsequent conclusion of transactions, as well as protecting the interests of the organization in the courts.

The branch also represents the interests of the legal entity, i.e. including performing the functions of representation. In addition, the branch carries out all or part of the functions of a legal entity. In other words, the branch not only negotiates and makes transactions on behalf of the legal entity, but also carries out actual actions aimed at fulfilling the concluded contracts, i.e. conducts production, trade or other activities, the implementation of which is carried out by the legal entity itself. At the same time, a branch can perform all types of activities of the organization, or some of them.

When can a branch independently enter into contracts?

Important! Branches of the company fully or partially perform the functions of the company, which means they can enter into transactions with different partners. But this is only possible if they act as representatives of the company.

There are some conditions, subject to which the branch has the right to independently enter into agreements:

- The manager must have a power of attorney to carry out certain types of transactions.

- The company's charter, or other internal documents of the company, must provide for the possibility of concluding transactions. This is due to the fact that the activities of the organization are regulated by the charter (other local documents), which means they must contain the possibility of concluding an agreement by the head of the branch.

Only if all the above conditions are met will the contracts concluded by the head of the unit have legal force.

General characteristics of a branch and representative office

Having considered both concepts, we can identify features that are similar for both the branch and the representative office. The first and, perhaps, most defining feature comes down to the fact that neither the branch nor the representative office are legal entities, i.e., independent participants in civil transactions, but enter into civil, labor, tax and other legal relations on behalf of the legal entity that created them . In practice, this feature is reflected in the following:

- transactions on behalf of a branch or representative office are concluded by the legal entity itself;

- it is also responsible for obligations arising in connection with their activities;

- branches and representative offices cannot act as plaintiffs and defendants in court, i.e. cannot independently participate in legal proceedings on their own behalf.

This is how the Presidium of the Supreme Arbitration Court of the Russian Federation (hereinafter referred to as the SAC RF) comments on this issue in Information Letter No. 34 dated May 14, 1998 “On the consideration of claims arising from the activities of separate divisions of legal entities”: “... a separate division that is not a legal entity , may bring a claim only on behalf of a legal entity... The statement of claim signed by the head of a separate division must be accompanied by a power of attorney (or a copy thereof) of the legal entity confirming his authority to sign the statement of claim on behalf of the legal entity.”

In the absence of such a power of attorney, the statement of claim is returned without consideration, on the basis of clause 2, part 1, art. 108 Arbitration Procedure Code of the Russian Federation.”

A similar conclusion is contained in the Resolution of the Plenum of the Supreme Court of the Russian Federation and the Plenum of the Supreme Arbitration Court of the Russian Federation dated June 11, 1999 N 41/9 “On some issues related to the implementation of part one of the Tax Code of the Russian Federation.” By virtue of clause 9 of this Resolution, branches and representative offices of Russian legal entities are not considered as participants in tax legal relations and do not have the status of taxpayers, tax agents and other obligated persons. Responsibility for failure to fulfill all obligations to pay taxes, fees, penalties and fines lies with the legal entity that includes the relevant branch (representative office).

Guided by this legal position, the FAS Moscow authority in its Resolution dated April 15, 2009 No. KA-A40/1708-09 noted that branches are not subjects of tax legal relations, therefore, cannot be brought to tax liability, since liability for actions (inaction) of branches only a legal entity can be involved.

Reports on personal income tax and insurance premiums

If there are employees, the issue of submitting reports and paying taxes by a separate division is determined in a different manner.

| According to personal income tax | For insurance premiums |

| If the employment contract with the employee states that his workplace is located within the OP, then personal income tax will have to be paid at the location of the OP. Therefore, you will have to report separately - submit 6-NDFL and 2-NDFL separately for GI and OP | The OP’s obligation to pay and report arises only if the following conditions are met:

For example, the DAM for a separate division without a separate balance sheet, which does not pay salaries to employees, is submitted through the head office. The norm is enshrined in clause 11 of Art. 431 Tax Code of the Russian Federation |

IMPORTANT!

Reports are also submitted to the Social Insurance Fund in the same way: if the organization pays wages and insurance premiums, it reports to the department as an independent unit. If a separate division does not have a current account, it cannot be registered with the territorial branch of the Social Insurance Fund (letter of the Ministry of Finance No. 03-15-06/92133 dated December 18, 2018).

The problem of territorial isolation

Territorial isolation, or location outside the location of the organization, is also an important defining feature of both a branch and a representative office. In accordance with paragraphs 2 and 3 of Art. 54 of the Civil Code of the Russian Federation, the location of a legal entity is determined by the place of its state registration and is indicated in its constituent documents.

In the 90s and 2000s, there were fierce disputes between lawyers about what was the “location” of a legal entity? Some believed that this was a specific address, i.e. settlement, street, house, office where the permanent executive body of a legal entity is located, or in its absence - another body or person authorized to act on behalf of the legal entity without a power of attorney, information about which is contained in the Unified State Register of Legal Entities (hereinafter referred to as the Unified State Register of Legal Entities). In accordance with this assumption, territorial isolation means that if an additional office of a company is located in the same locality, on the same street and even in the same house as the legal entity that created them, but in a different premises from it, they can safely be classified as branch or representative office.

Other lawyers believed that the location of a legal entity should not be considered a specific postal address contained in the Unified State Register of Legal Entities, but rather affiliation with a specific subject of the Russian Federation (for example, St. Petersburg, Moscow, Saratov, and so on).

This dispute was resolved only in 2015, when the legislator adopted Law No. 209-FZ of June 29, 2015. This regulatory act amended the Civil Code of the Russian Federation and established that the location of a legal entity is a specific locality (municipal entity) on the territory of the Russian Federation. In turn, the Unified State Register of Legal Entities indicates the address of the legal entity within its location.

Thus, territorial isolation, as a sign of a branch or representative office, means that a legal entity can create them only outside its location, i.e. outside the locality (municipal entity) where the parent company is registered.

Features of separate parts of the company

The specific features of the organization include the following:

- separate parts do not take part in legal relations related to a change in organizational structure or other similar actions;

- even if the division has property, it does not have the right to dispose of it, since the owner of the property is the parent company and only it has the right to dispose of it;

- the division is managed by an employee appointed by the head of the company;

- the company's activities occur in accordance with the rules established by the head (all powers of the head of the department are prescribed in the power of attorney, and actions that are not contained in it will be illegal);

- the division does not have the capabilities of a legal entity, but it performs the functions of the founder, or part of these functions.

Issues of property isolation

The property isolation of branches and representative offices, as their next important feature, means that, firstly, they have the right to own and use property allocated by a legal entity to a separate balance sheet, and secondly, they have the right to have a separate current account.

However, regarding the “separate balance sheet of a separate division”, not everything is so simple. The legislation does not know such a term at all. In practice, it is understood as a document with reporting information on the activities of an economic entity, as well as a method of recording indicators that allows them to be correlated with each other. Paragraph 8 of PBU 4/99 “Accounting statements of an organization” states that such statements must contain performance indicators of all branches. And hence the conclusion - branches do not prepare separate reports and do not draw up a separate balance sheet. Consequently, when regulations talk about a “separate balance sheet,” they simply mean a list of indicators that a legal entity has established for its divisions allocated to a “separate balance sheet.”

In addition, branches and representative offices only actually own and use the property (and funds) allocated to them by the organization. They do not have the right of disposal, operational management or economic management - real and obligatory rights to them.

Heads of branches and representative offices

Branches and representative offices are organizationally separate from the legal entity that created them. This means that their managers are appointed by a legal entity and act on the basis of a power of attorney issued to them. The Supreme Arbitration Court, and later the Supreme Court, have repeatedly emphasized this point. Thus, on June 23, 2015, the Plenum of the Supreme Court of the Russian Federation adopted Resolution No. 25, in which it once again clarified that the main powers of the head of a branch (or representative office) are confirmed only by his power of attorney, and not by the regulations or constituent documents of the legal entity.

It is interesting that back in 1996, paragraph 20 of the Resolution of the Plenum of the Supreme Court of the Russian Federation and the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 1, 1996 N 6/8 “On some issues related to the application of part one of the Civil Code of the Russian Federation” indicated that: “When resolving a dispute, arising from an agreement signed by the head of a branch (representative office) on behalf of the branch and without reference to the fact that the agreement was concluded on behalf of a legal entity and under its power of attorney, it should be clarified whether the head of the branch (representative office) had the appropriate powers expressed at the time of signing the agreement in the regulations on the branch and power of attorney. Transactions made by the head of a branch (representative office) with such authority should be considered completed on behalf of the legal entity.”

A little less than 20 years have passed and the Supreme Court, clarifying this point, considered it necessary to remove the phrase “in the regulations on the branch.” Thus, he additionally emphasized that the authority of the manager is confirmed only by a power of attorney.

How to conclude an agreement with a branch

A company branch has only those rights that the parent company has given it. In this case, it is possible to conclude a deal only if the head of the branch has a power of attorney to conclude contracts.

| The branch has the right to enter into contracts independently | The rights, as well as obligations, that a branch of the company has are contained in the company's charter. At the same time, when concluding a separate agreement, the document must indicate a reference to the manager having the appropriate power of attorney. |

| The branch does not have the right to enter into contracts on its own behalf | The transaction will be concluded on behalf of the parent company. Both the branch itself and its management will not be indicated in this agreement. The signing of the contract will take place at the parent body. |

Important! Even if a branch independently enters into an agreement, this does not mean that it is a party to the transaction. Its conclusion occurs with the organization, which, according to the signed agreement, acquires certain rights and obligations.

Mandatory reflection of information about branches and representative offices in the Unified State Register of Legal Entities

Until 2015, business entities were required to indicate information about branches and representative offices in the Charter. As a result, 1/3 of the constituent document of a large federal company consisted of a long list of branches and their addresses, and changes to the Charter were made every six months.

Taking this fact into account, the state changed this procedure. Currently, legislation requires that information about branches and representative offices be contained only in the Unified State Register of Legal Entities. Information about them may not be included in the Charter (Article 55 of the Civil Code of the Russian Federation).

Creation of branches and representative offices

We examined the main features that characterize branches and representative offices and distinguish them from legal entities. Now let's turn to the issue of consolidating the legal status of a branch and representative office - let's talk about registering their creation. As we said above, information about branches must now be indicated only in the Unified State Register of Legal Entities. But this does not mean that this information should be immediately excluded from the existing statutes. The new rules apply only to branches and representative offices created after 09/01/2014.

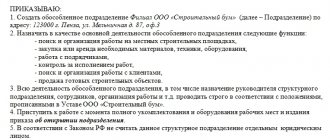

Today, to open a branch or representative office, you need to go through the following steps:

- make a decision on the creation of a branch/representative office by the competent authority determined by law and charter;

- appoint in a decision (minutes, or order) the head of a branch or representative office;

- fill out an application in form P13001 or P14001 and have it certified by a notary. (We spoke in some detail about the problem associated with the use of one form or another in a separate article. Those interested can familiarize themselves with it on our website;

- submit documents to the registration authority at your location.

Registration, accounting of changes in information, deregistration of an organization with the tax authority at the location of the branch and representative office are carried out on the basis of information from the Unified State Register of Legal Entities. This means that after making changes to the Unified State Register of Legal Entities, in connection with the creation of a branch or representative office, the registering authority transmits via electronic communication channels a file containing the relevant information to the tax authority at the location of the organization, and that, in turn, to the tax authority at the location creating a branch or representative office. The latter is given five days to register the organization for tax purposes at the location of its branch or representative office.

From what moment should a branch or representative office be considered established? The answer to this question can be found in the Letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of the Russian Federation dated December 16, 2009 No. 03-02-07/1-541: the date of creation of a branch (representative office) of the organization is the date of entering information about it into the Unified State Register of Legal Entities.

Separate division in tax law

We examined the similarities between a branch and a representative office and the differences between them, and determined the procedure for registering them. Now it’s worth talking about another concept used in law and in practice, namely a separate division of a legal entity.

The semantic content of the concept of “separate division” used in tax legislation is broader than in civil law. In accordance with Article 11 of the Tax Code of the Russian Federation, a separate division of an organization is any territorially separate division from it, at the location of which stationary workplaces are equipped. Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division. In this case, a workplace is considered stationary if it is created for a period of more than one month.

Thus, the Tax Code of the Russian Federation distinguishes another type of separate division of a legal entity, different from a branch and representative office.