From the beginning of the year, new rules always come into force. This year, legislators also worked hard, and by the beginning of 2022, many changes had accumulated that need to be taken into account in their work. We prepared a detailed overview of changes in taxes and accounting.

At the end of the article there is a video from the webinar by Alexey Ivanov and Lyudmila Arkhipkina on changes 2022.

General changes

New list of KBK. In general, the BCC did not change compared to last year. Only a new BCC was introduced for personal income tax from a base of over 5 million rubles. and excluded one BCC for the payment of mineral extraction tax.

Confirmation: Order of the Ministry of Finance of Russia No. 75n dated June 8, 2022.

New opportunities to offset overpayments. Overpayment of taxes can now be offset against the payment of insurance premiums. Conversely, overpaid contributions can be offset against taxes.

Confirmation: clauses 6-7 art. 1 of Federal Law No. 379-FZ of November 29, 2022.

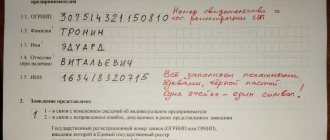

Single tax payment for individual entrepreneurs. Entrepreneurs who switch to this regime will pay taxes and fees in one payment order without specifying the type of payment, payment deadline and budget level. The Federal Tax Service will independently offset the amounts against upcoming payments or arrears.

It will be possible to switch to this payment procedure only from July 1, 2022 and apply it until December 31, 2022 inclusive. To do this, you will need to reconcile your payments with the Federal Tax Service and submit an electronic application.

Confirmation: clause 3 of Art. 1 of Federal Law No. 379-FZ of November 29, 2022.

New procedure for obtaining and using an electronic signature. From January 1, 2022, only the Federal Tax Service of Russia and its authorized representatives can issue qualified electronic signatures to individual entrepreneurs and heads of commercial organizations.

Confirmation: Federal Law No. 476-FZ of December 27, 2019.

New tax regime - AUST. From July 1, 2022, a new regime should be launched - an automated simplified taxation system. So far, only as an experiment in four regions: Moscow, Moscow region, Kaluga region and Tatarstan. It will be valid for small businesses with up to 5 employees and income up to 60 million rubles. The tax rate will be 8% for the Income object and 20% for the Income minus expenses object, with a minimum tax of 3%. At the same time, insurance premiums for employees and fixed contributions for individual entrepreneurs will be zero.

Confirmation: Bill No. 20281-8.

Besides:

- in 2022, there is a moratorium on supervisory inspections of businesses, extended to 2022 by Government Decree No. 1520 of September 8, 2021;

- a new unified Commodity Nomenclature for Foreign Economic Activity and the Unified Customs Tariff of the Eurasian Economic Union come into force (Decision of the Council of the Eurasian Economic Commission No. 80 of September 14, 2021).

Changes in tax legislation from 2021 on personal income tax

Personal income tax will be charged at a rate of 13% on interest on deposits in excess of the amount calculated as:

1 million rub. × key rate of the Central Bank at the beginning of the year (law dated April 1, 2020 No. 102-FZ).

Interest on deposits below 1% and on escrow accounts are not subject to taxation.

A “tax for the rich” is being introduced: on annual incomes over 5 million rubles. the tax will be charged at a higher rate of 15% (Law No. 372-FZ of November 23, 2020).

Individuals, when receiving a deduction for treatment starting from 2022, must be guided by the updated lists of medical services and expensive treatment (approved by Government Decree No. 458 dated 04/08/2020).

Changes in accounting

Restrictions on the method of transmitting reports electronically have been lifted. The Accounting Law now provides for the possibility of submitting financial statements and audit reports in the form of an electronic document not only through the TKS operator, but also in other ways. An alternative way is to report in the “Presentation of tax and accounting reporting in electronic form” service on the website of the Federal Tax Service of the Russian Federation.

Confirmation: Order of the Federal Tax Service of Russia No. ED-7-1/843 dated September 28, 2021.

The obligation to duplicate reporting to authorities has been abolished. If the reporting is contained in the State Information Resource for Accounting Reports (GIRBO), there is no need to duplicate it to other bodies.

Confirmation: Federal Law dated July 2, 2021 No. 352-FZ.

Four federal accounting standards have become mandatory for application:

- FSBU 25/2018 “Accounting for leases”;

- FSBU 26/2020 “Capital Investments”;

- FSBU 6/2020 “Fixed assets”;

- FSBU 27/2021 “Documents and document flow in accounting.”

In addition, a law has been adopted that significantly reforms auditing activities (Article 6 of Federal Law No. 359-FZ of July 2, 2021).

Changes in communication with the Federal Tax Service from 2022

Tax authorities will send you SMS

Tax officials will be allowed to send you SMS messages about unpaid taxes, debts on penalties, fines, and interest. The Federal Tax Service will send such messages to you by email or other means. It is unclear what exactly “others” are.

However, you must give your written consent to receive such messages. And the tax authorities will have a restriction: to send you “chain letters” no more than once a quarter.

The change in the Tax Code of the Russian Federation on sending SMS to taxpayers comes into force on April 1, 2022.

Federal Law of September 29, 2019 No. 325-FZ.

Decisions on interim measures will be made public

From April 1, 2022, decisions on interim measures will appear on the Internet.

Decisions on the adoption and cancellation of interim measures in the form of a ban on the alienation of property will be published on the website of the tax service. Indicating the property that is subject to the ban. The list of information that will be posted on the website will be approved by the tax service later.

Information about decisions will be published on the tax website within three days from the date the decision is made, but not before the decision to bring (refusal to bring) to justice comes into force.

The amendment to the Tax Code of the Russian Federation comes into force on April 1, 2022.

Federal Law of September 29, 2019 No. 325-FZ.

Changes in value added tax

Catering will not pay VAT. From 2022, public catering enterprises will be able not to pay VAT if the total income for the previous year, according to tax accounting data, is no more than 2 billion rubles, and the share of income from public catering is at least 70%. New organizations and individual entrepreneurs created in 2022-2023 will be able to immediately apply this benefit in the year of creation.

From 2024, in order to be exempt from VAT for operating organizations, the average monthly salary for the previous year must be no lower than the industry average. For newly created organizations and individual entrepreneurs in the year of creation, the salary for the quarter that precedes the use of the benefit should not be lower than the industry average.

Confirmation: clause 2 of Art. 2 of Federal Law No. 305-FZ of July 2, 2021.

When reselling goods purchased from citizens, VAT must be calculated on the difference between prices. From January 1, 2022, when selling certain types of electronic and household appliances purchased from citizens without individual entrepreneur status for resale, VAT will need to be calculated on the difference between the sale price and the purchase price. Previously, this procedure was applied only to the resale of cars purchased from citizens.

The list of types of electronic and household appliances for which this taxation procedure applies was approved by Decree of the Government of the Russian Federation No. 1544 of September 13, 2022. The list includes household vacuum cleaners, washing machines, refrigerators, freezers, phones for cellular and wireless networks and some computers.

Confirmation: Federal Law No. 103-FZ of April 30, 2022.

The taxation of fish farming products has been changed. The sale (transfer for one's own needs) of breeding fish, their embryos and juveniles has been exempted from VAT. For the sale of any type of trout, a single VAT rate of 10% has been established. Previously, the sale of sea trout was taxed at a rate of 10%, and freshwater trout - 20%.

Confirmation: Federal Law No. 308-FZ of July 2, 2022.

Changes in income tax

New declaration form. It must be applied starting from the 2022 report.

Confirmation: Order of the Federal Tax Service of Russia No. ED-7-3/869 dated October 5, 2021.

The rules for accounting for expenses for sanatorium and resort treatment have been relaxed. Expenses for sanatorium and resort treatment in Russia for employees and members of their families can be taken into account even if:

- the contract was concluded directly with the sanatorium, and not through a tour operator or travel agent;

- Initially, the costs are borne by the employee himself or his family members, and the employer then compensates them in full or in part.

Previously, to account for such costs, the employer had to enter into an agreement strictly with a tour operator or travel agent.

Confirmation: clause 5 of Art. 1 of Federal Law No. 8-FZ of February 17, 2022.

The rules for property depreciation have been clarified. The initial cost of a fixed asset after completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation changes regardless of the size of the residual value, even if the fixed asset has been fully depreciated.

If, after reconstruction, modernization or technical re-equipment, the useful life of a fixed asset item has not increased, it is necessary to apply the depreciation rate determined by the originally established useful life.

These rules were applied before according to the explanations of the Ministry of Finance, now they are “registered” in the Tax Code.

When applying the straight-line method, in established cases, depreciation is terminated regardless of whether the useful life of the depreciated property has expired.

Confirmation: clauses 33-35 art. 2 of Federal Law No. 305-FZ of July 2, 2022.

The rules for the formation of R&D expenses have been clarified. A separate type of R&D expenses includes expenses for the acquisition of rights to inventions, utility models, industrial designs, breeding achievements, computer programs and databases, topologies of integrated circuits:

- under an agreement on the alienation of exclusive rights;

- under a license agreement.

Acquired rights must be used exclusively for R&D.

Confirmation: clause 36 of Art. 2 of Federal Law No. 305-FZ of July 2, 2022.

The list of expenses that cannot be taken into account when calculating income tax has been added . These are payments for compensation of damage transferred to the budget and state extra-budgetary funds.

Confirmation: clause 39 of Art. 2 of Federal Law No. 305-FZ of July 2, 2022.

Other changes to income tax:

- the rules for forming intervals of maximum interest rates for debts arising from controlled transactions have been changed (clause 38, article 2 of Federal Law No. 305-FZ of July 2, 2022, clause 25 of article 2 of Federal Law No. 374-FZ of November 23, 2020) ;

- the procedure for calculating income tax by a tax agent when paying dividends to Russian organizations has been adjusted (paragraph 4, paragraph “a”, paragraph 6, article 1 of Federal Law No. 8-FZ of February 17, 2021);

- the validity period of the restriction on transferring losses of past years to the future has been extended (clause 40 of Article 2 of Federal Law No. 305-FZ of July 2, 2021);

- the list of income of a foreign organization taxed at sources of payment in Russia has been expanded (clause 48 of Article 2 of Federal Law No. 305-FZ of July 2, 2021);

- the list of SONPOs has been clarified, the value of property transferred free of charge to which can be taken into account as part of tax expenses (Federal Law No. 104-FZ of April 30, 2021);

- a limitation has been introduced on the total volume of benefits for participants in regional investment projects (RIPs) included in the relevant register (clause “b”, clause 42, article 2 of Federal Law No. 305-FZ of July 2, 2021).

Tax changes from September 29, 2022

Most of the amendments affected those organizations that operate under special regimes.

Accounting for expenses for objects requiring state registration

Companies using the simplified tax system can now take into account the costs of purchasing real estate for tax purposes as expenses, without waiting for the moment of submitting documents for state registration of this property. Moreover, the change applies to all fixed assets acquired in 2022. Amendments have been made to Art. 346.16 Tax Code of the Russian Federation.

Previously, the fact of submitting documents for state registration was very important. And from September 29, 2022, he plays no role in this case.

Reflection in accounting of income in the form of subsidies

Amendments to Art. 346.17 of the Tax Code of the Russian Federation clarified the controversial issue of when “simplified” people need to reflect receipt of state support in their income.

Now such income must be recognized not at once, but in proportion to expenses, in the period when the corresponding expenses are reflected in tax expenses.

The exception is cases when the subsidy was not received in advance for expenses, but later, after expenses had already been incurred in the previous period (that is, they are reimbursed to you).

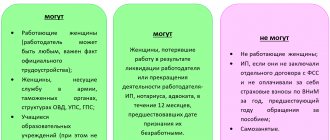

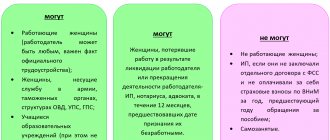

Tax holidays for individual entrepreneurs on the simplified tax system who own hotels

The list of activities that newly registered individual entrepreneurs can engage in without paying tax has been added. The list includes such a type of activity as the provision of premises for temporary use, that is, hotels (clause 4 of Article 346.20 of the Tax Code of the Russian Federation).

However, it is important to remember that you can take advantage of this benefit locally if appropriate regional laws have been adopted.

Additional restrictions for those who use PSN

Amendments made to Art. 346.43 of the Tax Code of the Russian Federation (a new clause 2.1 clause 8 has appeared), allows regional authorities to introduce additional restrictions on the use of the patent tax system. Such “limiters” may include the size of the area, the number of vehicles, the number of stationary and non-stationary retail chain facilities and public catering facilities.

Clarifications on the average headcount limit for PSN

In the new edition of paragraph 5 of Art. 346.43 of the Tax Code of the Russian Federation clarifies the issue of how individual entrepreneurs on PSN determine the average number of employees. Only those who are engaged in the type of activity under the patent need to be taken into account.

Subjects of the Russian Federation have the right to set the cost of a patent

It is worth paying attention to the new edition of paragraphs. 3 clause 8 art. 346.43 Tax Code of the Russian Federation.

The cost of a patent can be set:

- per unit of average number of employees;

- per unit of vehicles, water transport vessels;

- per 1 ton of vehicle carrying capacity, per passenger seat;

- per 1 sq. meter of area of residential and non-residential premises and land plots for rent;

- for 1 stationary (non-stationary) retail chain facility, catering facility and (or) 1 sq. meter of area of such an object.

Changes in corporate property tax

New declaration form. It must be applied starting with reporting for 2022.

Confirmation: clause 4 of Order of the Federal Tax Service of Russia No. ED-7-21/574 dated June 18, 2021.

Uniform deadlines for payment of corporate property tax and advance payments have been introduced. From 2022, all organizations must pay tax no later than March 1, and advance payments within a month after the reporting period. Previously, the deadline was set by regional authorities.

Confirmation: clause 82 of Art. 2 of Federal Law No. 305-FZ of July 2, 2022.

The obligation to include in the declaration information about objects taxed at cadastral value has been cancelled. The rule is effective starting with the 2022 tax year. If the organization has only such objects, there is no need to submit a declaration.

Confirmation: pp. "b" clause 83 art. 2 of Federal Law No. 305-FZ of July 2, 2022.

A procedure has been introduced for providing benefits for objects taxed at cadastral value. Previously, benefits were declared on the property tax return. But since the obligation to indicate such objects in the declaration has been abolished, starting from the tax period of 2022, taxpayers will need to submit an application for the benefit. Without such an application, the benefit will be provided based on information available to the tax office.

Confirmation: clause 81 of Art. 2 of Federal Law No. 305-FZ of July 2, 2022.

The procedure for calculating tax on destroyed (lost) property has been determined. From 2022, the tax on such property is not calculated from the 1st day of the month of its death or destruction. To do this, you need to submit an application to the Federal Tax Service.

Confirmation: clause 81 of Art. 2 of Federal Law No. 305-FZ of July 2, 2022.

Other changes:

- changes in the list of objects taxed at cadastral value must be posted on the Internet within five days by the authorities of the constituent entity of the Russian Federation (clause 79 of Article 2 of Federal Law No. 305-FZ of July 2, 2021);

- the procedure for calculating tax on objects of common shared property taxed at cadastral value was approved (subclause “b”, paragraph 79, article 2 of Federal Law No. 305-FZ of July 2, 2021);

- property leased, including under a leasing agreement, is subject to property tax from the lessor (clause 49, article 1, clause 3, article 3 of Federal Law No. 382-FZ of November 29, 2021).

What has changed in the calculation of personal income tax?

From January 2022, a progressive personal income tax rate will be established. A tax of 15% will be withheld from the income of individuals when the threshold of 5 million rubles is exceeded[1].

There are exceptions that are not included in the limit of 5 million rubles. Thus, income from the sale of property (except for securities) and shares in it, income in the form of donations of property, as well as insurance payments received by individuals under insurance contracts and pension agreements are not taken into account when determining the threshold of 5 million rubles and are taxed at a rate of 13%. . A rate of 35% is valid for any winnings and prizes received in competitions, games and other events for the purpose of advertising goods, works and services, to the extent that they exceed 4,000 rubles (Clause 28 of Article 217 of the Tax Code of the Russian Federation). The same amount of personal income tax - 35% - will remain on interest on mortgage-backed bonds for income on securities of Russian organizations.

Most people throughout the Russian Federation will not be affected by the change in the tax rate for 2022, since our income for the tax period is less than 5 million rubles. The only advantage is that the 15% rate does not apply to income from the sale of property in excess of 5 million rubles. When tax rates increase, there is always a risk of gray schemes and tax evasion.

Starting from 2022, Form 2-NDFL has been abolished, which greatly simplifies the life of an accountant. Starting from reporting for the first quarter of 2022, 2-NDFL is included in 6-NDFL. For 2022, 6-NDFL is submitted using the old form. Submit 2-NDFL for 2022 no later than 03/01/2021.

In accordance with Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected] , 2-NDFL will be included in the calculation of 6-NDFL as an appendix. The calculation itself has also been changed, and several amendments have been made to it. It follows from this that form 6-NDFL will consist of such sections as:

- title page;

- Section 1 “Data on tax agent obligations”;

- Section 2 “Calculation of calculated, withheld and transferred amounts of personal income tax”;

- Appendix 1 “Certificate of income and tax amounts of an individual.”

It is important to clarify that Appendix 1 “Certificate of income and tax amounts of an individual” will need to be filled out and submitted as part of 6-NDFL only in annual reporting.

We believe that due to the adopted changes that have been made to 6-NDFL, a lot of questions will initially arise as part of filling out sections 1 and 2 of the report, since there will be a small number of explanations for filling out.

The Federal Tax Service approved a new form 3-NDFL, as well as the procedure for filling out and the electronic procedure for filling out the form[2]. The updated declaration applies from 2022 when declaring income for 2020. Mandatory sheets to fill out are the title page, section 1, section 2.

The declaration has been amended:

- an application for offset (refund) of the amount of overpaid personal income tax is now presented as an appendix to section 1;

- information on the amounts of tax (advance tax payment), as well as calculation of advance payments paid by individual entrepreneurs and persons engaged in private practice, in the form of paragraph 2 of section 1 and calculation to Appendix 3;

- added lines 020 and 040 to Appendix 1, which are necessary to reflect the cadastral value of real estate to calculate income from its sale.

The changes that were made to the 3-NDFL declaration, especially the inclusion of a statement about the offset (refund) of the amount of overpaid personal income tax, will prove to be quite useful for taxpayers.

New income tax benefits

From 2022, for some Russian organizations in the field of information technology, the income tax rate will be 3%. The tax is credited only to the federal budget, and to the regional budget in the amount of 0%.

To apply the income tax benefit, IT companies must simultaneously comply with certain conditions.

- An organization operating in the field of information technology must obtain a document on state accreditation.

- The share of income received from IT activities should not be less than 90%.

- The average number of employees must be at least 7 people for the reporting period.

In 2022, all IT companies pay income tax at a rate of 20%, contributing 3% to the federal budget and 17% to the regional budget.

Of course, a reduction in the tax rate for companies is a plus, and this is an incentive to work in the development of information technology in the country. But there is still a certain disadvantage: regional budgets will lose part of the income that, until 2022, was credited to the budgets of the constituent entities of the Russian Federation.

From January 1, 2022, the procedure for determining the share of profit of separate divisions will change. Thus, organizations that maintain separate accounting and pay taxes not at general rates will, from 2022, calculate the share of profit for each separate division separately according to the bases formed for each special rate[3].

The form of the income tax return has changed[4]. New taxpayer characteristics must be added to the new declaration:

- 15 – an organization that applies a reduced rate in accordance with paragraph 8-1 of Article 284 of the Tax Code of the Russian Federation;

- 16 – an organization that applies a reduced rate in accordance with paragraph 8-2 of Article 284 of the Tax Code of the Russian Federation;

- 17 – an organization that operates in the field of information technology;

- 18 – resident of the Arctic zone of the Russian Federation;

- 19 – an organization that carries out activities in the design and development of electronic component base products and electronic (radio-electronic) products.

Also, the barcodes in the form were updated, fields were added to sheet 02, which are provided, among other things, for participants in investment contracts and residents of priority development areas; for sheet 04, a code for the type of income was added - 9, which must be filled out when the declaration needs to reflect the shareholder’s income from the distribution of property of the liquidated organization; in sheet 08 an adjustment code appeared based on the results of the mutual agreement procedure.

Innovations in the declaration are applied from the submission of reports for 2020, but not earlier than 01/01/2021.

Reduced tariffs and new reporting on contributions

As part of the tax maneuver, reduced insurance premiums from 2021 can be used by IT companies that have received accreditation, as well as electronics developers, subject to certain conditions specified in the Tax Code of the Russian Federation (clause 3, clause 1, clause 18, clause 1, clause 5 , clause 14 of article 427 of the Tax Code of the Russian Federation).

For IT companies, as well as Russian organizations that design and develop electronic components, electronic (radio-electronic) products, the amounts of insurance premiums from January 1, 2021 will be:

- 6% - for OPS;

- 1.5% - according to VNiM;

- 0.1% - compulsory medical insurance.

In total, insurance premiums are 7.6%, which is almost two times less than in 2022. At the moment, in 2022, IT companies also apply benefits on insurance premiums and apply reduced rates. The amount of reduced insurance premiums for IT companies until December 31, 2020 inclusive is 14%[5]. Namely:

- 8% - on OPS;

- 4% - for compulsory medical insurance;

- 2% - according to VNiM.

Of course, it is important for companies working in the field of information technology to understand that the state does not forget them as a separate industry and provides them with benefits on taxes and contributions, which will allow these companies to develop more efficiently in the future.

The Federal Tax Service has approved changes in the calculation of insurance premiums starting from 2022. The form will now include information about the average headcount. Information on the average number of employees will not need to be submitted in a separate form until January 20, 2022. Data on the number will need to be indicated on the title page of the DAM. The changes occurred in connection with the publication of Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected]

Barcodes and the format for providing electronic payments will change.

Additional payer rate codes have been established:

- 20 - for payers of contributions recognized as small or medium-sized businesses;

- 21 - for those who received a zero tariff for the second quarter of 2020;

- 22 - for payers of insurance premiums carrying out activities in the design and development of electronic component base products and electronic (radio-electronic) products[6].

New category codes for the insured person will appear, specified in Appendix 7 “Category Codes for the Insured Person”[7]. The new codes will be:

- MS - individuals who receive income in excess of the minimum wage from SMEs;

- KV - individuals from whose income insurance premiums are calculated at a zero rate in accordance with Federal Law dated 06.2020 No. 172-FZ “On Amendments to Part Two of the Tax Code of the Russian Federation.”

- EKB - individuals, from whose payments and remunerations insurance premiums are calculated by organizations carrying out activities in the design and development of electronic component base products and electronic (radio-electronic) products; applies starting from the reporting period first quarter of 2021.

For the first quarter of 2022, it will be necessary to fill out a new Appendix 5.1 “Calculation of compliance with the conditions for the application of a reduced tariff of insurance premiums by payers specified in subparagraph 3 (subparagraph 18) of paragraph 1 of Article 427 of the Tax Code of the Russian Federation.” Appendix 5.1 will have to be filled out by Russian organizations carrying out activities in the design and development of electronic components and electronic (radio-electronic) products.

Program and database developers will need to submit Appendix 5.1 in their reporting for 2022.

Changes in insurance premiums, both in tariffs and in reporting, are for the better. Especially for IT companies. As for the calculation of insurance premiums, in our opinion, the changes made will simplify the submission of reports.

What not to forget when calculating transport and land taxes?

General deadlines have been established for the payment of transport and land taxes. The tax payment deadline for the year is 03/01/2021, advance payments are 04/30/2021, 08/02/2021, 11/01/2021. In 2022 and earlier, tax payment deadlines were set by regional laws.

For example, in Moscow, the deadline for paying transport tax for the year was no later than February 5 following the expired tax period, and advance tax payments were not paid by organizations in this region at all. From 2022, regional regulations governing the payment of tax will no longer be in force.

There is no need to submit returns for these taxes for 2022[8]. The tax is calculated by organizations independently, and at the end of the year, the Federal Tax Service sends a message to organizations about the tax amounts calculated by the tax authorities[9]. If the organization does not receive a message from the tax authority, it has the right to notify the tax authority.

If an organization does not agree with the INFS calculation, then in response it can submit an explanation with its data.

Changes in personal income tax

New form of declaration 3-NDFL. It must be applied starting with reporting for 2022.

Confirmation: Order of the Federal Tax Service of Russia No. ED-7-11/903 dated October 15, 2021.

Changes in form 6-NDFL. The updated form must be used starting with reporting for 2022.

Confirmation: Order of the Federal Tax Service of Russia No. ED-7-11/845 dated September 28, 2021.

The conditions for exemption from personal income tax for compensation of the cost of vouchers for employees have been changed. Now such compensations are not subject to personal income tax if:

- vouchers are purchased for children under 18 years of age, as well as children under 24 years of age, full-time students whose parents do not have an employment relationship with the employer;

- the employer pays compensation at his own expense and for the first time in a year.

Confirmation: clause 3 of Art. 1 of Federal Law No. 8-FZ of February 17, 2022.

A new fitness deduction has been introduced. The deduction is provided in the amount of actual expenses, but taking into account the limit for the entire group of social deductions of 120 thousand rubles. You can receive a deduction only if the types of services paid for and the organizations providing them are included in the approved lists. The deduction applies to income received from January 1, 2022.

Confirmation: Federal Law No. 88-FZ of April 5, 2022.

The rules for providing social and property deductions by the employer have been changed. Now the tax office will send a notification about the employee’s right to a deduction to employers after the employee contacts it. Previously, the employee received a notice from the tax office and brought it to the employer.

Confirmation: clause 1, pp. "c" clause 3 of Art. 2 of Federal Law No. 100-FZ of April 20, 2022.

Platform for transfer of administrative data

In addition, according to the Federal Tax Service Action Plan for 2022, the department intends to develop the concept of the fourth generation automated information system of the Federal Tax Service “Tax-4”, as well as create a digital analytical platform for the transfer of administrative data to government bodies.

The press service of the Federal Tax Service reports that the digital analytical platform for electronic data exchange with government authorities and other data consumers is currently at the design stage. “The composition of the information participating in the information exchange will be determined based on the existing requirements for the provision of data, within the framework of current regulatory legal acts and the needs of executive authorities (information contained in tax returns, debts, cash register data and others),” the press service said .

It is assumed that the supply of data will be carried out in an automated mode, taking into account the restrictions provided for by regulations, to the extent required to ensure the activities of government bodies.

Changes in transport tax

The procedure for stopping the calculation of transport tax on seized vehicles has been determined. From 2022, upon withdrawal, the calculation of tax stops from the 1st day of the month in which this occurred. The taxpayer will be able to report this to the Federal Tax Service with a statement.

Confirmation: pp. "b" clause 76 art. 2 of Federal Law No. 305-FZ of July 2, 2022.

The rules for calculating transport tax on water or air transport in common, shared or joint ownership have been established. The tax must be calculated for each participant based on his share. For shared ownership - in proportion to the share, for joint ownership - in equal shares.

Confirmation: pp. "b" clause 76 art. 2 of Federal Law No. 305-FZ of July 2, 2022.

It is prescribed how to calculate the tax if the right to a benefit appears or ceases during the year. In such cases, the tax must be calculated taking into account the coefficient: the number of full months without a benefit, divided by 12. The month of the emergence or termination of the right to a benefit is taken as a full month.

Confirmation: pp. "b" clause 76 art. 2 of Federal Law No. 305-FZ of July 2, 2022.

Forms for notifying tax authorities about the availability of taxable objects and benefits have been changed:

- notification of the availability of real estate or transport for citizens;

- notification of the availability of vehicles and (or) land plots recognized as objects of taxation for organizations;

- application for a tax benefit for transport tax and (or) land tax.

Confirmation: Order of the Federal Tax Service of Russia No. ED-7-21/574 dated June 18, 2021.

Changes in mandatory insurance contributions

New amount of individual entrepreneur contributions for himself. For 2022 you will need to pay 34,445 rubles. for compulsory pension insurance and 8,766 rubles. - for compulsory medical. Total 43,211 rub.

Confirmation: clause 1 of Art. 430 of the Tax Code.

New form of RSV. Applicable from reporting for the first quarter of 2022.

Confirmation: Order of the Federal Tax Service of Russia No. ED-7-11/875 dated October 6, 2021.

Reduced fees for catering. SMEs in this area with more than 250 employees, but not more than 1,500, are now also entitled to reduced tariffs: 15% instead of 30% for wages exceeding the minimum wage.

Confirmation: pp. "b" clause 88 art. 2 of Federal Law No. 305-FZ of July 2, 2022.

The grounds for submitting SZV-STAZH in a shortened time frame have been supplemented. Now, within three days, you need to report when an employee applies for an urgent pension payment and a lump sum payment of pension savings.

Confirmation: clause 1 of Art. 2 of Federal Law No. 153-FZ of May 26, 2021.

New maximum base values for calculating insurance premiums. RUB 1,032,000 for compulsory social insurance and 1,565,000 rubles. - for mandatory pension.

Confirmation: Decree of the Government of the Russian Federation No. 1951 of November 16, 2022.

Limits have been established for financing preventive measures to reduce injuries and occupational diseases. It remained at the 2022 level: 20% of the amount of contributions accrued over the past year. For workers of pre-retirement age, when sending them to sanatorium-resort treatment, this figure can be increased to 30%.

Confirmation: pp. 2 p. 1 art. 5 of Federal Law No. 393-FZ of December 6, 2022.

Changes in labor legislation and settlements with personnel

New minimum wage for 2022. The new value was 13,890 rubles.

Confirmation: Federal Law No. 406-FZ of December 6, 2022.

We adjusted the rules for calculating the length of insurance to determine the amount of benefits for illness, pregnancy and childbirth. Now the length of service includes periods of work in a foreign country before obtaining citizenship in Russia, if there are international agreements providing for the summation of length of service.

Confirmation: Order of the Ministry of Labor of Russia No. 388n dated June 9, 2022.

Paper sick leave has been abolished. Benefits will now be assigned only on the basis of electronic sick leave. They will be issued according to the new rules. Paper sick leave is no longer used.

Confirmation: Federal Law No. 126-FZ of April 30, 2022.

Rules for reimbursement of expenses for additional days off when caring for a disabled child were approved. Temporary rules have been established for the 2022 transition year. Now they are approved on a permanent basis and are essentially no different from the previous ones.

Confirmation: Decree of the Government of the Russian Federation No. 1320 of August 9, 2022.

We established new rules for calculating benefits for temporary disability and pregnancy and childbirth. They differ from the previous ones in that now, when calculating benefits for voluntary contributors, the regional coefficient is taken into account.

Confirmation: Decree of the Government of the Russian Federation No. 1540 of September 11, 2022.

We updated the procedure for providing and paying leave to those injured at work. The rules were brought into line with the mechanism of direct payments.

Confirmation: Decree of the Government of the Russian Federation No. 1584 of September 21, 2022.

A new list of regions of the Far North and equivalent areas was approved. But the list of districts remained the same; only the structure of the document was updated due to changes in the municipal-territorial structure of the country.

Confirmation: Decree of the Government of the Russian Federation No. 1946 of November 16, 2022.

We determined a list of documents for payment of benefits and the procedure for receiving them. This is due to the fact that the direct payment mechanism and the transition to electronic sick leave are starting to operate on an ongoing basis. The Social Insurance Fund, the policyholder and the employee will interact and exchange documents according to a simplified procedure.

Confirmation: Decree of the Government of the Russian Federation No. 2010 of November 23, 2022.

The “My Business” team keeps its finger on the pulse and is always aware of changes. We take into account all innovations in the work of online accounting and our users can be sure that they fill out reports and calculate taxes strictly according to current rules.

PSN: increase in the number of types of activities on a patent from 63 to 80.

The conditions for the patent tax system are also becoming more interesting. However, you need to remember that a patent is only available to individual entrepreneurs. The following key changes have been made to the patent tax system:

- The list of activities in respect of which PSN can be applied has been expanded, including those that were used within the framework of UTII: parking lots, repairs, maintenance and washing of vehicles, etc. If previously there were 63 types of activities in the final list, then (with the adoption Federal Law No. 373-FZ) there were 80 of them.

- PSN payers, just like previously UTII payers, received the right to reduce the amount of calculated tax by the amount of insurance contributions paid to extra-budgetary funds, by the employer's expenses for the payment of benefits for temporary disability, and by payments to the organization for voluntary insurance of the employee in case of temporary disability.

- For trade and catering, the maximum area limits for the sales and service areas have been increased. The indicators were “pulled up” to those that were on UTII – from 50 square meters. m. up to 150 sq. m.

Changes 2022 in detail

A gift for our readers - a recording of a webinar on upcoming changes in taxes and accounting. An hour and a half of detailed analysis of innovations, specific examples and answers to questions! Speakers are well-known experts in accounting and participants in the development of new FSBUs:

- Alexey Ivanov is the director of knowledge and development of the online accounting system “My Business”.

- Lyudmila Arkhipkina is a leading methodologist for accounting and taxation of Internet accounting “My Business”.