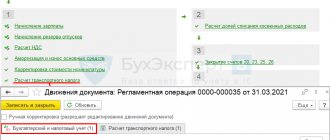

Transport tax in 1C Accounting 8.3 is calculated and accrued automatically at the end of the year (Fig. 1) when performing the routine operation “Month Closing”.

Fig.1

What actions must be taken to correctly calculate transport tax?

There are several main points:

- Capitalization and registration of a vehicle

- Registration of a vehicle in 1C

- Setting up calculations, charges and payment terms

- Direct tax calculation

Let's take a closer look at all the points using a step-by-step example in the 1C program.

Vehicle registration

The hyperlink “Registration of vehicles” provides information about the registration and deregistration of vehicles.

When registering a vehicle, the following data is indicated:

- Fixed asset is an element of the Fixed Assets directory from the “Vehicles” accounting group.

- Date – according to documents on state registration of the vehicle.

- Organization – the field is present if the database contains records for several organizations.

- Information about registration – by default, the vehicle is registered in the program with the same tax authority that is indicated in the organization’s card. In accordance with filling out this field, KPP and OKTMO will be entered into the Transport Tax Declaration. If the vehicle is registered in another tax authority, then you should change the setting to “In another tax authority” and indicate it from the “Registration with a tax authority” directory.

- Vehicle type code – filled in from the drop-down list. If there is no suitable code in the list, then select “Other codes for vehicle types...” and after that a full list will open for selection.

- Identification number (VIN) – from the vehicle registration document. For land vehicles VIN, for water vehicles IMO, for air vehicles serial serial number.

- Brand - from the vehicle registration document.

- Registration plate - from the vehicle registration document.

- Tax base - depending on the type of vehicle (power, nameplate static thrust, gross tonnage or vehicle unit)

- Ecological class - from the vehicle registration document.

- Share in the right to a vehicle - by default, the organization is the sole owner; if this is not the case, then set the flag “The vehicle is in common shared (joint) ownership” and indicate the size of the organization’s share.

- The tax rate is entered automatically depending on the Vehicle Type Code and the date the asset was accepted for accounting. Rates are stored in the “Transport Tax Rates” register and are updated automatically.

- An increasing coefficient is established if the vehicle is included in the List of the Ministry of Industry and Trade of Russia.

- Tax benefit – not applied by default. If the benefit consists of tax exemption, then we indicate “Exemption from taxation”, and in the Tax Benefit Code detail we indicate 20210 and the basis for the benefit.

- Registered in the register of the Platon system - set the flag if the vehicle is registered in the Platon system.

- Comment – additional information on the vehicle. Does not appear in reports.

When there are changes in the vehicle data, a new registration record is entered and the effective date of these changes is indicated.

Buying a car

The first step is to reflect the purchase of our car in the program. This is done by the receipt document, which is located in the “OS and intangible assets” section. Our car is a fixed asset, worth 800,000 thousand rubles. In our example, we bought it on August 28, 2017 from.

The receipt document has created the necessary transactions, but for further accounting of expenses for it, commissioning is required.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

To put the car into operation, we created the document “Acceptance for accounting of fixed assets” dated 08/29/2017. It will be registered with the organization LLC Confetprom.

On the “Fixed Assets” tab, you need to add an element of the directory of the same name to the tabular part.

In our case, we take into account the KIA RIO passenger car and accordingly indicate that it is a motor vehicle. We will also choose to belong to the OS accounting group “Vehicles”.

After filling out all the data, the document can be processed. Now our car is listed on account 01.01 for the main division.

Watch also the video on capitalizing the OS:

Deregistration of a vehicle

A deregistration record is created.

The following fields are filled in:

- A vehicle being deregistered is an element of the Fixed Assets directory from the “Vehicles” accounting group.

- Date of deregistration.

- The organization is the one on whose balance sheet this vehicle was listed.

- Comment – additional information on the vehicle. Does not appear in reports.

Procedure for paying taxes locally (from 2022 Payment of advance payments)

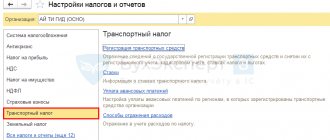

Using this hyperlink in the Transport Tax settings, tax rates and tax payment deadlines are indicated.

From 2022, this form can be used to indicate whether advances on transport tax are paid.

Transport tax declaration

All transport tax data will be included in the corresponding declaration. You can find it in the “Reports” - “Regulated Reports” section.

If the transport tax declaration is not added to your favorites, then you can find it on the “All” tab.

After filling out, on page 1 of section 2 of this declaration, we reflected all the data on calculating the amount of tax on our KIA RIO car.

Ways to reflect expenses

By default, this register contains an entry that assigns the amount of transport tax to account 26 and the cost item “Property taxes”. If this setting suits you, then you need to supplement it by indicating the department to which the expenses relate.

If necessary, you can make changes to this register and create your own settings.

Calculation and accrual of transport tax

The calculation and accrual of transport tax in the program is carried out when performing the regulatory operation “Calculation of transport tax” for December.

Transport tax is calculated based on the data contained in the information registers “Registration of vehicles” and “Calculation of transport tax”. The calculation results are recorded in the information register “Calculation of transport tax”.

Transactions for accrual of transport tax are generated in accordance with the methods of reflecting transport tax expenses specified in the register “Methods of reflecting tax expenses”.

To document the calculations performed, it is necessary to generate a “Certificate for transport tax calculation”.

Section 1. Amount of tax to be paid to the budget

Section 1 is filled out based on the data from section 2. All indicators in this section, with the exception of indicators on lines 023, 025, 027, are filled in automatically.

When filling out section 1 of the declaration, the organization’s tax identification number and checkpoint, as well as the serial number of the page, are indicated automatically.

On line 010 , the budget classification code (BCC) is automatically indicated, according to which the amount of transport tax indicated in line 030 .

In line 020, the OKTMO code is automatically entered at the place of registration of each vehicle, which was previously selected from the corresponding directory and indicated in line 020 of section 2.

If vehicles are located on the territory of several municipalities, in section 1 the required number of blocks with lines 020-040 in for each code according to OKTMO.

Lines 021 automatically indicate the total tax amount for all vehicles with the same OKTMO from lines 020 of section 2.

Lines 023, 025, 027 indicate the amounts of advance payments for transport tax. In this case, the amount of payment after the 1st, 2nd and 3rd quarters of the current tax period is calculated as one-fourth of the product of the corresponding tax base and the tax rate, taking into account the coefficient defined as the ratio of the number of full months during which the vehicle was registered to the organization to the number calendar months in the tax (report) period.

The amounts of advance payments are indicated:

- on line 023 – for the first quarter of the current year,

- on line 025 – for the second quarter of the current year,

- on line 027 – for the third quarter of the current year.

They can be taken from payment orders for the transfer of advance payments for transport tax.

Lines 030 and 040 are calculated automatically. Line 030 indicates the amount of transport tax calculated for payment to the budget according to the relevant OKTMO. It is defined as the difference between the total tax amount ( line 021 ) and the amount of advance payments (sum of lines 023, 025, 027 ). If the resulting value is positive, it is automatically entered in line 030 . If the amount of advance payments (sum of lines 023, 025, 027 ) exceeds the total amount of tax reflected on line 021 , then the amount of overpaid tax is automatically indicated on line 040 .

Attention! In accordance with paragraph 3 of Art. 360 of the Tax Code of the Russian Federation, the legislative (representative) bodies of the region are given the right not to establish reporting periods for transport tax in the corresponding constituent entity of the Russian Federation. If reporting periods are not established, then the organization does not pay advance payments and the amount of calculated tax for the tax period is entirely subject to transfer to the budget within the period established by the law of the constituent entity of the Russian Federation. In this case, the tax amount indicated on line 021 will automatically be transferred to line 030 .

Also in section 1, in the field “I confirm the accuracy and completeness of the information specified on this page,” the date is automatically indicated.