Reason for amendments to the Procedure for applying KOSGU

The procedure for applying the classification of operations of the general government sector (KOSGU) is still approved by Order of the Ministry of Finance of Russia dated November 29, 2017 No. 209n (hereinafter referred to as Order No. 209n). However, Order No. 222n of the Ministry of Finance dated September 29, 2020 introduced many changes and amendments to it.

The Ministry of Finance clarified certain provisions of Order No. 209n in order to improve the legal regulation of the procedure for applying KOSGU in accordance with the provisions of Art. 18, , 23.1 and 165 of the Budget Code of the Russian Federation.

Let’s say right away that the Ministry of Finance has made changes to both the income and expense codes of KOSGU. In general, there are quite a lot of clarifying edits. Some of them must be applied as early as November 21, 2020.

The requirements for the approved structure of KOSGU codes have also been clarified. The provisions relating to the list of “income” items of KOSGU are set out in a new way, individual articles and the procedure for assigning certain income to sub-items are detailed.

In the new edition of Order No. 209n, the Ministry of Finance took into account its requirements, clarifications and comments on the use of KOSGU codes, which it gave earlier.

Main changes in the application of KOSGU 2020-2021

Compensation from the Social Insurance Fund

Since 2022, the Ministry of Finance has introduced a new subarticle 139 “Income from reimbursements of expenses by the Social Insurance Fund of the Russian Federation.” It must reflect income from reimbursement to the Social Insurance Fund for expenses for:

- measures to reduce industrial injuries and occupational diseases of employees;

- sanatorium-resort treatment for those who work in harmful or dangerous conditions.

Let us note that in 2022, these revenues were attributed to subarticle 134 of KOSGU “Income from compensation of costs.”

But benefits that employers pay at the expense of the Social Insurance Fund were removed from the cost structure under subarticle 213 of KOSGU “Accruals for wage payments.” This is due to the transition from 2022 of all regions of Russia to the principle of direct payments from the Social Insurance Fund (without offset).

Tax penalties

The list of costs that are reflected under subarticle 292 of the KOSGU “Fines for violation of the legislation on taxes and fees, legislation on insurance premiums” has been added. Now it also shows penalties for other violations of laws on taxes, fees and insurance premiums (i.e., in addition to late payment).

Note that until 2022, the Ministry of Finance required that these sanctions be reflected in code 295 of the KOSGU “Other economic sanctions.”

Purchasing licenses and software

The Ministry of Finance upheld the requirement to apply subarticle 226 of KOSGU “Other work, services” when accounting for the costs of purchasing non-exclusive rights to use programs, databases and other results of intellectual activity.

Previously, they wanted to replace the sub-article for accounting for such expenses with codes 352 “Increase in the cost of non-exclusive rights to the results of intellectual activity with an indefinite useful life” and 353 KOSGU for a certain period of use. According to the amendments to Order No. 209n, these codes must be used only when taking into account rights of use for the results of intellectual activity.

ATTENTION

The composition of transactions reflected in codes 352 and 353 of KOSGU has been swapped. Now subsection 352 of KOSGU is applied if the useful life can be determined in relation to the right to use the results of intellectual activity. Accordingly, objects with an indefinite period are taken into account under subsection 353 of KOSGU.

New expenses under code 226 KOSGU

And the Ministry of Finance made many more clarifications to subarticle 226 of KOSGU “Other work, services.” Now it reflects the following expenses:

- payment for dismantling work (demolition of buildings, relocation of communications, etc.) if they were not carried out for the purpose of capital investments in capital construction projects (reconstruction, including with elements of restoration, technical re-equipment) and were not included in the volume of capital investments, forming the cost of the operating system;

- material incentives for people's vigilantes for participating in the protection of public order;

- compensation payments for meals to sports judges, volunteers, controllers who are not full-time employees of the institution and involved in participation in sports events;

- payment for services for transportation, storage and dispensing through the pharmacy network to citizens of free and discounted medications under a single contract (agreement) concluded with a pharmaceutical company;

- payment for the services of a translator or specialist invited by the arbitration court to participate in the arbitration process;

- payment for the services of lawyers providing free legal assistance to citizens;

- remuneration to the bankruptcy trustee, as well as compensation for his expenses for conducting bankruptcy proceedings for the absent debtor.

Let us note that the Ministry of Finance has already given its explanations for most of these costs.

Salary payments

From November 21, 2020, the list of costs under subarticle 211 of KOSGU “Wages” has been supplemented with the following payments:

- additional payment for combining professions (positions), expanding service areas, increasing the volume of work or performing the duties of a temporarily absent employee without release from work specified in the employment contract;

- monthly salary of a judge in accordance with the qualification class assigned to him;

- a one-time payment when providing annual paid leave to state and municipal employees;

- compensation for unused vacation upon dismissal.

Note that the Ministry of Finance required these amounts to be reflected under code 211 KOSGU earlier.

Social Security

Quite a few additions to subarticle 260 of KOSGU on social security costs. We present them below in the table.

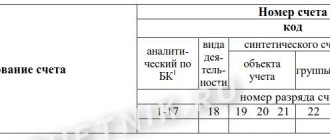

| SUBSTATIONS KOSGU | COSTS THAT ADDED |

| 262 “Benefits for social assistance to the population in cash” | Payment of material support to the unemployed and citizens aged 14 to 18 years during the period of participation in public works and temporary employment Payment of one-time financial assistance to promote self-employment of unemployed citizens Payment of a one-time benefit upon the release of orphans, children without parental care, and persons from among them Payment of maternity benefits to women studying full-time in professional educational organizations, educational organizations of higher education, educational organizations of additional vocational education and scientific organizations Payment by government bodies (municipal bodies) to individuals, including employees of these bodies, of social benefits that are public regulatory obligations |

| 263 “Benefits for social assistance to the population in kind” | Purchase of goods and services to provide free food, a set of clothing, shoes and soft equipment for orphans and persons from among them, as well as compensation for these expenses Payment for travel for children in difficult life situations to their holiday destination and back Compensation for the cost of travel and rental accommodation for citizens sent for vocational training or additional vocational education as directed by the employment service authorities Compensation for the cost of travel and luggage for unemployed people when moving to another area for employment in the direction of the employment service authorities |

| 264 “Pensions, benefits paid by employers, employers to former employees” | Lump sum benefit in connection with the death of a judge Monthly compensation to the judge in the event of injury or other damage to health, excluding further opportunity to engage in professional activities Monthly compensation to disabled family members of a judge who were dependent on him in the event of his death (death) Financial assistance to close relatives, family members, the spouse of an employee (employee) in connection with his death during the period of service if the payment is provided for by the employee’s status or the terms of employment relations Payment of sick leave for the first 3 days of incapacity for work for former employees |

| 265 “Social assistance benefits paid by employers and employers to former employees in kind” | Reimbursement of expenses for family members of a former employee related to his funeral |

| 266 “Social benefits and compensation to personnel in cash” | Payment of 4 additional days off per month to a parent (guardian, trustee) to care for disabled children One-time cash incentive (benefits) upon dismissal due to retirement for long service |

General provisions for the use of account 209 00

According to the new edition of clause 220 of Instruction No. 157n, account 209 00 is called “Calculations for damage to property and other income.”

It was previously called “Property Damage Settlement.” The purpose of this account has expanded significantly. Now account 209 00 is intended not only for accounting for calculations of the amounts of identified shortages, thefts of funds, other valuables, the amounts of losses from damage to material assets, other amounts of damage caused to the property of the institution, subject to compensation by the perpetrators in the manner established by the legislation of the Russian Federation, but also for accounting:

- amounts of advance payment not returned by the counterparty in the event of termination of contracts (other agreements), including by court decision;

- amounts of debt of accountable persons that were not returned in a timely manner (not withheld from wages);

- amounts of debt for unworked vacation days when an employee is dismissed before the end of the working year for which he has already received annual paid leave;

- amounts of excessive payments made;

- amounts of forced seizure, including compensation for damage in accordance with the legislation of the Russian Federation, in the event of insured events;

- amounts of damage caused as a result of the actions (inaction) of officials of the organization.

Another innovation in the use of account 209 00 is that the amount of damage caused by shortages and theft reflected on it is determined based on the current replacement cost of material assets on the day the damage was discovered. In this case, the current replacement cost is understood as the amount of money that is necessary to restore the specified assets ( clause 220 of Instruction No. 157n ).

Let us recall that before the changes were made, damage was assessed at the market value of material assets on the day of its discovery, which recognized the amount of money received as a result of the sale of the designated assets.

As before, for the amounts of shortages, thefts, losses from spoilage, and other damage not recognized by the guilty parties for compensation, materials drawn up in the prescribed manner are transferred for filing a civil claim or initiating a criminal case in the prescribed manner. Upon receipt of a court decision, the amount of damage claimed for compensation is specified in accordance with the court decision, writ of execution or on other grounds in accordance with the legislation of the Russian Federation.

It is also worth noting the introduction in paragraph 220 of Instruction No. 157n of provisions related to the peculiarities of accounting for damage settlements in foreign currency:

- Accounting for debtors' debts for damage and other income in foreign currencies is simultaneously carried out in the corresponding foreign currency and in the ruble equivalent on the date of accrual of debt (revenue recognition).

- Revaluation of payers' settlements for damage and other income in foreign currencies is carried out on the date of transactions for payment (return) of settlements in the corresponding foreign currency.

- Positive (negative) exchange rate differences that arose when calculating the ruble equivalent are attributed to the increase (decrease) in calculations of income in foreign currency, with exchange rate differences attributed to the financial result of the current financial year from the revaluation of assets.