For whom is registration of a cash book mandatory?

The main legal act regulating the maintenance of cash books by Russian organizations is Bank of Russia Directive No. 3210-U dated March 11, 2014 (hereinafter referred to as the Directive).

NOTE! As of November 30, 2020, changes have been made to the cash register procedure. For example, separate divisions that deposit cash into the organization’s main cash desk were relieved of the obligation to maintain a cash book.

What else has changed in the procedure for conducting cash transactions since November 30, 2020, find out from the explanations of experts given in the ConsultantPlus system. If you don't have access to K+, get a free online trial.

And about the changes effective from 2022, read the articles:

- “Changes in the procedure for conducting cash transactions”;

- "New rules for working with accountables."

The main part of its provisions (including those directly related to the maintenance of cash books) came into force on 06/01/2014. In accordance with them, registration of cash books is mandatory for all enterprises carrying out certain transactions with cash, regardless of the form of taxation applied.

The use of online cash registers does not relieve the obligation to maintain a cash book.

What it is and why online cash registers were introduced, read here.

Yes, with the transition to online cash registers, the need to maintain some primary cash register has disappeared. It is now being replaced by fiscal documents that are generated and stored electronically. But this does not apply to the cash book. It is conducted through the so-called “main cash register”, in which not only settlements with customers take place, but also other cash turnover. Therefore, you need to maintain a cash book as before.

Read more about this in the article “Do I need a cash book to maintain an online cash register?”

The cash book may not be legally filled out by individual entrepreneurs who, in accordance with the established procedure, keep records of income, expenses, physical indicators and other taxable items that characterize a particular type of commercial activity (clause 4.1. Instructions). Since individual entrepreneurs are almost always required to keep records of income and expenses (both under OSN, and under Unified Agricultural Tax, Simplified Tax System, PSN) or physical indicators (with UTII), this norm can be legitimately interpreted as applying to all individual entrepreneurs.

For more information about keeping records of income and expenses by individual entrepreneurs, read the article “How to keep a book of income and expenses under the simplified tax system (sample)?” .

ConsultantPlus experts explained the rules for working with the cash book in various situations. If you don't have access to the system, get a free trial online.

Our task in this article is to explore how to fill out a cash book, consider a sample algorithm for entering data into it, and the procedure for handling the corresponding document.

How to maintain a cash book?

The cash book must be maintained by the organization in the KO-4 form, approved by Decree of the State Statistics Committee No. 88 of August 18, 1998 and corresponding to number 0310004 in OKUD (clause 2 of the Directive). You can download it on our website:

You only need to fill out the cash book on those days when the organization actually received (issued) funds.

About the procedure that should be followed when conducting cash transactions, read the material “Procedure for conducting cash transactions in 2022 - 2022.”

NOTE! From August 19, 2017, the cashier does not have to make entries in the cash book. This can be any authorized employee of the organization, for example, an accountant. The corresponding change to the cash procedure was made by the Bank of Russia’s instruction dated June 19, 2017 No. 4416-U ( what else has changed, see here ). But later in the article we will continue to habitually call such an employee a cashier.

There are 3 ways to fill out cash books:

- manually on prepared forms;

- on a computer (with subsequent printing);

- on a computer with saving the cash book file in the software registers.

Next, we will look at the nuances of using each method in more detail. For now, let’s study the structure of the cash book and how the fields are filled in.

A completed sample cash book can be downloaded from our website.

Cash book structure (rules for filling out fields)

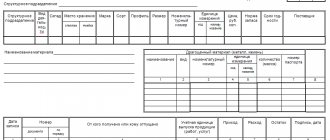

The cash book corresponding to form No. KO-4 contains 3 types of pages:

- front (sample cover or title);

- internal (pages 3 to 10);

- final (located at the end of the document).

The front pages contain information about the company, as well as the year for which the cash book reflects cash transactions. The internal pages of the document contain the following columns:

- “Cash for” (it records the dates of certain transactions with funds);

- “Sheet” (the serial number of a specific sheet of the cash book is indicated here);

- “Document number” (this column records the order number - incoming or outgoing);

- “From whom received or issued to” (initials of the person or company that deposits or receives cash);

- “Number of the corresponding account, sub-account” (this column records the account that corresponds in the prescribed manner with account 50, individual entrepreneurs do not fill out this area of the cash book);

- “Receipt” (the amount of funds on receipt orders is recorded);

- “Expenses” (indicate the amount of funds for settlement orders);

- “Total for the day” (receipts are summed up, as well as cash payments for the cashier’s work shift);

- “Cash balance at the end of the day” (the amount of the cash balance is indicated).

In the “Transfer” column of the cash book, the total amount of funds for orders of both types can be recorded, reflected in a specific table, so that the cashier has the opportunity to continue entering information on the next page.

The following signatures must appear at the end of each internal page of the cash book:

- the cashier of the organization, who fills out basic information in the cash book;

- an accountant (who simultaneously indicates the number of PKOs and RKOs, and also certifies the fact that he received and checked the orders).

On the last (final) page of the document, it is indicated how many sheets are stitched and numbered, the date of compilation of the cash book, and also the signatures are affixed:

- chief accountant;

- head of the company.

Rules for drawing up a DDS report

Remember that a DDS report is essentially an analogue of a bank statement, which reveals information about the movement of all the company’s money. You also need to understand that the DDS report reveals line 1250 of the balance sheet.

When drawing up a DDS, follow the following rules:

- in the report, do not take into account cash flows that change the composition, but not the amount of funds: for example, do not record the transfer of money from an account to an organization’s account in the DDS report;

- reflect receipts and payments without VAT;

- Indicate VAT and excise taxes separately as part of current cash flows: we count all submitted VAT and compare it with incoming; if the tax presented is greater than the input tax, then the difference is entered in “Other receipts”, otherwise - in “Other payments”;

- employee salaries are taken into account with personal income tax and insurance contributions;

- income tax is shown separately in flows from current activities.

Filling out the cash book manually (sample algorithm for working with a document)

The procedure for manually maintaining a cash book requires stitching and numbering it before entering data. The main feature of the paper version of the cash book is that the document is divided into 2 parts - the main and detachable ones.

When starting a shift, the cashier must place the tear-off part of the cash book under the main one, and place carbon paper between them. Then you need to record the cash balance as of the beginning of the day. During the shift, data on PKO and RKO should be recorded in the cash book - according to the columns that we discussed above.

At the end of the shift, the cashier must count all the turnover for PKO and RKO for the day and record them in the cash book, put his signature on the document, and then take it along with the orders to the accountant.

Read about sanctions for violating the rules for conducting cash transactions in the article “Cash discipline and responsibility for its violation.”

How to Use a Cash Flow Statement

To answer this question, you need to understand who is using the report. And there are two user groups.

External users are the Federal Tax Service. It is not for nothing that the DDS report is included in the group of financial statements. However, not everyone submits the DDS: small businesses are exempt from submitting it if they believe that it does not contain important information. Such a report is made once a year along with the balance sheet.

Internal users are top managers and owners of the company who want to understand the state of the main asset - money. For them, the DDS report is often even more interesting than the financial results report. The reason is that the DDS is based on actual data, that is, it allows you to really judge how much money came and went from the company.

But the financial results report is based on accounting data, which largely depends on the accounting methods.

Example . The head of My Defense LLC makes a decision to open a new business line. In the financial result report, he sees a profit of 300 million rubles. The number is not small. But then he looks at the DDS report and sees that the balance of money is three times less - 100 million rubles. The reasons are different, for example, the remaining 200 million rubles are receivables that are unknown when they will return. Since the business actually only has 100 million, the manager is holding back the opening of a new direction.

For internal use, the report is prepared at different intervals. Some once a month, some once a quarter.

How to fill out the KO-4 cash book on a computer?

Filling out form No. KO-4 on a computer can be done using an accounting program or an office application (for example, Excel). After entering the necessary information into the cash book on the PC in accordance with the algorithm we discussed above, the cashier needs to:

- print all pages of the cash book;

- sign 2 copies of the document and take it to the accountant, taking with you the PKO and RKO, issued for the day.

Every year, all printed sheets of the cash book should be stitched and numbered (in the case of filling out the form manually, as we noted above, they must be stitched and numbered initially), and then a scheme for filling out the cash book should be sent to the chief accountant and manager for signature

Firms have the right to fill out and maintain a cash book without printing it out (clause 4.7 of the Instructions), generating the corresponding document entirely in electronic form. This feature can be used if the cash book compiler has at his disposal technical means that guarantee:

- protection against unauthorized access;

- no errors when entering data into the cash book;

- protection against information loss.

Electronic samples of cash books must be signed with an electronic signature that meets the requirements of Federal Law No. 63 of 04/06/2011. A virtual sample of a cash book may differ from form No. KO-4 in appearance, but the columns in it will be the same.

See also “Procedure for making corrections to the cash book (nuances)” .

Results

A cash book is a mandatory document when working with cash, be it revenue or other payments. Its form and procedure are strictly regulated, and violations when working with it may result in liability. Therefore, it is very important to maintain this cash register accurately and without errors.

Sources: Directive of the Bank of Russia dated March 11, 2014 N 3210-U

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Related documents

- Sample. Limit fence card. Form No. m-8

- Sample. Limit fence card. Form No. M-9

- Sample. Local estimates. Form No. 4-в

- Sample. Invoice is a requirement for release (internal movement) of materials. Form No. m-11

- Sample. Inventory of cash tickets sent for examination (instruction of the Central Bank of the Russian Federation dated 10/04/93 No. 18 (as amended on 02/26/96))

- Sample. Determining Average Percentage of Gross Income

- Sample. List of rented premises

- Sample. List of debtors of a liquidated credit institution included in the liquidation balance sheet (Regulation of the Central Bank of the Russian Federation dated April 2, 1996 No. 264)

- Sample. List of creditors of a liquidated credit organization included in the liquidation balance sheet (Regulation of the Central Bank of the Russian Federation dated April 2, 1996 No. 264)

- Sample. List of creditors of a liquidated credit institution included in the interim balance sheet indicators (Regulation of the Central Bank of the Russian Federation dated April 2, 1996 No. 264)

- Sample. List of objects of social, cultural and public utility purposes (appendix to the agreement on the procedure for using federal property assigned to a state educational institution with the right of operational management

- Sample. List of creditor organizations

- Sample. List of creditor organizations

- Sample. Payment statement. Form No. 253

- Sample. Regulations on the organization of reporting in a joint-stock company (standard form)

- Sample. Transmittal sheet for the bag with cash proceeds

- Sample. Order on conducting an inventory of property and financial obligations (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. Order on accounting policies for a budgetary institution

- Sample. Order on accounting policies for a non-profit organization

- Sample. Approximate list of technical and economic indicators for public buildings and structures