How to apply for benefits?

Registration procedure:

- You must submit an application and documents at your place of work. If a woman is registered as an individual entrepreneur or unemployed, then she needs to submit papers to the social protection authorities.

- The documents are reviewed by the employer within 10 working days, after which benefits are assigned.

- If payments were made through the employer, they will be credited to the card on the day the salary is issued. When registering compensation with the social security authorities, funds can be transferred to any account specified in the application or issued in cash via mail at the request of the applicant.

After the birth of a child, you can apply for compensation from the employer and maternity benefits with one application at once.

Termination of payments

There are situations in which payments are suspended for up to 3 years:

- the woman resigned of her own free will;

- receives unemployment benefits;

- early exit from vacation;

- a woman goes from maternity leave to maternity leave;

- the child was taken to a boarding school;

- the mother was deprived of parental rights.

The termination of child benefit payments occurs from the next month after the occurrence of these circumstances.

Monthly compensation in the amount of 50 rubles during parental leave

Mothers* who are in employment relationships with enterprises, institutions and organizations, regardless of organizational and legal forms, and female military personnel on parental leave until the child reaches 3 years of age are entitled to monthly compensation payments in the amount of 50 rubles

*Or other relatives actually caring for the child.

This norm was established by the Decree of the President of the Russian Federation dated May 30, 1994. No. 1110 “On the amount of compensation payments to certain categories of citizens” and is valid from January 1, 2001.

Of course, 50 rubles is not a very large amount; on the other hand, during parental leave for a child up to three years old, a little more than 1,500 rubles will come up. – the amount is also not huge, but it won’t be too much for many young mothers.

Despite the fact that payment of compensation is mandatory, many people currently do not receive it because... they do not comply with important conditions for receiving it: compensation is paid only upon the employee’s application. Accordingly, if the employee does not apply for payment of compensation, then the employer does not pay compensation and does not violate anything.

Our article will cover:

- The procedure for assigning and paying compensation in the amount of 50 rubles to mothers on parental leave before the child reaches 3 years of age,

- The source of payment of this compensation and the procedure for taxation of personal income tax.

According to clause 11 of the Decree of the Government of the Russian Federation of November 3, 1994. No. 1206 “On approval of the Procedure for the appointment and payment of monthly compensation payments to certain categories of citizens”, monthly compensation payments in the amount of 50 rubles are assigned and paid to those on parental leave until the child reaches the age of 3 years (hereinafter referred to as parental leave):

- mothers (father, adoptive parent, guardian, grandmother, grandfather, other relative actually caring for the child) who are in employment relationships with organizations regardless of their organizational and legal forms;

- mothers undergoing military service under contract, serving as privates and commanding officers in internal affairs bodies;

- mothers undergoing military service under a contract, and mothers from civilian personnel of military formations of the Russian Federation located on the territory of foreign states, in cases provided for by international treaties of the Russian Federation;

- unemployed women dismissed due to the liquidation of an organization, if they were on maternity leave at the time of dismissal and do not receive unemployment benefits.

It does not matter whether the employee applying for compensation works at his main place of work or is a part-time worker.

In accordance with the provisions of Article 287 of the Labor Code of the Russian Federation, part-time workers have the right to the same guarantees and compensation as main employees. And the legislative acts establishing the specifics of the purpose of this compensation do not establish corresponding restrictions (unlike child care benefits, which can be received only at one of the places of work).

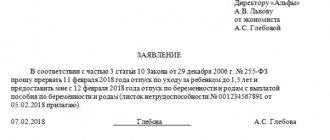

To assign (and subsequent payment) compensation, you must submit an application for the assignment of monthly compensation payments at the place of work (service). A copy of the order granting parental leave must be attached to the application.

The application is drawn up in any form and may look like this:

“To the General Director of Romashka LLC, M.M. Ivanov. from Petrova V.V.

Statement.

Based on the provisions of the Decree of the President of the Russian Federation dated May 30, 1994. No. 1110 “On the amount of compensation payments to certain categories of citizens,” I ask you to assign me a monthly compensation payment in the amount of 50 rubles. per month, as a mother on maternity leave until the child reaches 3 years of age.”

If the application is submitted late, it can be supplemented with the phrase “Including for the 6 months preceding this application.”

Please note: Unemployed persons submit an application to the social security authority at their place of residence.

The decision to assign monthly compensation payments is made by the administration of the organization within 10 days from the date of receipt of the documents. In case of refusal to assign monthly compensation payments, the applicant is notified in writing of this within 5 days after the relevant decision is made, indicating the reason for the refusal and the procedure for appealing it.

Monthly compensation payments are assigned:

- from the date of granting parental leave, if the application was made no later than 6 months from the date of granting the said leave.

When applying for the appointment of monthly compensation payments after 6 months from the date of granting parental leave, they are assigned and paid for the elapsed time, but not more than 6 months from the date of filing the application for the appointment of these payments (clause 15 of Resolution No. 1206) .

This means that if an employee, for example, went on maternity leave from 01/01/2012, and wrote an application for appointment and payment of compensation on 01/01/2013, then she will be paid compensation for the previous 6 months (from 01/07/2012 to 31/12 .2012) and will continue to be paid monthly until the child reaches the age of 3 years.

Payment of monthly compensation payments is carried out for the current month within the time limits established for the payment of monthly benefits for the period of parental leave until the child reaches the age of one and a half years*.

*In accordance with paragraph 51 of the Order of the Ministry of Health and Social Development of the Russian Federation dated December 23, 2009. No. 1012n “On approval of the Procedure and conditions for the appointment and payment of state benefits to citizens with children”, monthly child care benefits are assigned and paid within the time limits established for the payment of wages (other payments, remunerations).

In accordance with clause 4 of Article 136 of the Labor Code of the Russian Federation, wages are paid at least every half month on the day established by the internal labor regulations, collective agreement, and employment contract.

If circumstances arise that lead to the termination of monthly compensation payments, in particular:

- dismissal of an employee at his own request,

- assignment of unemployment benefits,

- the child is fully supported by the state,

- deprivation of the parent caring for the child of parental rights,

payment of monthly compensation payments ceases starting from the month following the month in which the relevant circumstances occurred (clause 17 of Resolution No. 1206).

Also, of course, the basis for termination of compensation payments is the end of parental leave (the child reaches 3 years of age, the mother goes to work, etc.).

Moreover, if the end date of parental leave for a child under 3 years of age falls, for example, on January 2, payment of compensation stops only in February. And for January it will be carried out in full.

In accordance with paragraph 18 of Resolution No. 1206, recipients of monthly compensation payments are required to notify the organization’s administration of all changes affecting their payment.

According to paragraph 19 of Resolution No. 1206, assigned monthly compensation payments that are not received on time are paid for the past in the amounts provided for by the legislation of the Russian Federation for each corresponding period, if the application for their receipt was made within three years from the date of granting parental leave child.

Thus, the mother can receive the entire amount of the assigned compensation at the end of maternity leave for a child up to 3 years old.

Monthly compensation payments that are not paid on time due to the fault of the employer who appoints and pays them are paid for the past without any time limit .

Monthly compensation payments are made from funds allocated for wages by organizations, regardless of their organizational and legal forms. That is, at the expense of the employer’s own funds.

At the same time, for persons working, serving, or living in areas where regional wage coefficients are established, the amount of monthly compensation payments is determined:

- using these coefficients regardless of the place of actual stay of the recipient during the period of parental leave.

Disputes regarding the appointment and payment of monthly compensation payments are resolved by a higher authority or court in the manner prescribed by the legislation of the Russian Federation.

Since, according to paragraph 20 of Resolution No. 1206, the payment of compensation is made from funds allocated for wages, then in accounting the costs of its payment will be classified as expenses for ordinary activities. In accordance with the provisions of clause 5 and clause 8 of PBU 10/99 “Expenses of the organization”, the costs of paying compensation in the amount of 50 rubles must be reflected:

- in the debit of the corresponding account for accounting for production costs or sales costs (for example, in accounts 20, 23, 25, 26, 44) and in the credit of account 70 “Settlements with personnel for wages”.

As for income tax, for tax accounting purposes, compensation payments in the monthly amount of 50 rubles are included in labor costs in accordance with the provisions of Article 255 of the Tax Code of the Russian Federation and clause 4 of Article 272 of the Tax Code of the Russian Federation.

The Ministry of Finance expressed a similar position in its Letter dated September 15, 2009. No. 03-03-06/4/78:

“In accordance with clause 1 of Decree of the President of the Russian Federation dated May 30, 1994 N 1110 “On the amount of compensation payments to certain categories of citizens” to mothers (or other relatives actually caring for the child) who are in employment relationships with enterprises, institutions and organizations, regardless of organizational and legal forms, and female military personnel on maternity leave before reaching 3 years of age, monthly compensation payments in the amount of 50 rubles are established.

Decree of the Government of the Russian Federation dated November 3, 1994 N 1206 approved the Procedure for assigning and paying monthly compensation payments to certain categories of citizens.

Thus, clause 15 of the Procedure provides that monthly compensation payments are assigned from the date of provision of parental leave, if the application for them follows no later than 6 months from the date of provision of the specified leave.

Based on clause 20 of the Procedure, monthly compensation payments are made from funds allocated for wages by organizations, regardless of their organizational and legal forms.

In accordance with the provisions of Article 255 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), the taxpayer’s expenses for wages include any accruals to employees in cash and (or) in kind, incentive accruals and allowances, compensation accruals related to work hours or working conditions , bonuses and one-time incentive accruals, expenses associated with the maintenance of these employees, provided for by the legislation of the Russian Federation, labor agreements (contracts) and (or) collective agreements.

Paragraph 7 of Article 255 of the Code establishes that in addition to labor costs for the purposes of Ch. 25 of the Code includes expenses for wages retained by employees during the period of vacation provided for by the legislation of the Russian Federation.

Taking into account the above, monthly compensation payments to women on parental leave until the child reaches the age of three, who are in an employment relationship with the organization, are assigned from the date of provision of child care leave, are made from funds allocated for wages, and are taken into account as part of the tax base for income tax in accordance with Article 255 of the Code.”

The Ministry of Finance adhered to a similar position earlier. For example, in his Letter dated May 16, 2006. No. 03-03-04/1/451.

Since monthly compensation in the amount of 50 rubles is fixed at the legislative level and is mandatory, this payment

is not subject to personal income tax in accordance with the provisions of paragraph 1 of Article 217 of the Tax Code of the Russian Federation:

- The following types of income of individuals are not subject to taxation (exempt from taxation):

- State benefits (except for temporary disability benefits, including benefits for caring for a sick child), as well as other payments and compensation paid in accordance with current legislation.

Compensation payments are not subject to insurance contributions :

- for compulsory pension insurance,

- for compulsory social insurance in case of temporary disability and in connection with maternity,

- for compulsory health insurance,

since, according to paragraph 1 of Article 7 of the Federal Law of July 24, 2009. No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund”, the object of taxation of insurance contributions is payments and other remuneration accrued by payers of insurance contributions in favor of individuals within the framework of civil labor relations -legal agreements, the subject of which is:

- execution of work,

- provision of services,

- and so on.

This conclusion is set out in the Letter of the Ministry of Health and Social Development of the Russian Federation dated 05.08.2010 No. 2519-19:

“Based on Decree of the President of the Russian Federation dated 30.05.1994 No. 1110 “On the amount of compensation payments to certain categories of citizens” (hereinafter referred to as Decree No. 1110) to mothers (or other relatives , who is actually caring for the child) who is in an employment relationship with organizations who are on parental leave until the child reaches the age of three, a monthly compensation payment is made in the amount of 50 rubles.

The employer makes the specified payment by virtue of a mandatory requirement enshrined in Decree No. 1110, regardless of the presence or absence of relevant provisions in the employment contract, collective agreement or agreement, that is, such payment is made outside the framework of any agreements between the employee and the employer regarding the implementation of labor activities and social security.

Taking into account the above, the amounts of monthly compensation payments in accordance with Decree No. 1110 are not recognized as subject to insurance premiums on the basis of the provisions of Article 7 of Federal Law No. 212-FZ.”

At the same time, at present there is no clear answer to the question of whether compensation payments in the amount of 50 rubles should be taxed. insurance premiums for compulsory social insurance against accidents at work and occupational diseases.

According to the provisions of Article 20.1 of the Federal Law of July 24, 1998. No. 125-FZ “On compulsory social insurance against accidents at work and occupational diseases”, the objects of taxation of insurance contributions are:

- payments and other remunerations paid by policyholders in favor of the insured within the framework of labor relations and civil contracts, if, in accordance with the civil contract, the policyholder is obliged to pay insurance premiums to the insurer.

At the same time, Law No. 125-FZ does not contain a definition of “payments and other remuneration paid by policyholders in favor of the insured within the framework of labor relations.”

Accordingly, this norm can be interpreted in different ways. If we consider only those payments that are directly related to the employee’s performance of his labor function as payments subject to insurance contributions, then compensation payments for child care up to 3 years old certainly do not apply to such payments. Accordingly, compensation is not an object for calculating insurance premiums for accident insurance.

The same conclusion can be drawn by drawing an analogy with insurance premiums for compulsory pension insurance, compulsory social insurance in case of temporary disability and maternity, and compulsory health insurance.

However, another position is quite possible (on the part of FSS representatives):

- All payments must be subject to insurance premiums , except those directly specified in Article 20.2 of Law No. 125-FZ.

Indeed, according to clause 2 of Article 20.1 of Law No. 125-FZ, the base for calculating insurance premiums is determined as the amount of payments and other remunerations accrued by policyholders in favor of the insured, with the exception of the amounts specified in Article 20.2 of this Federal Law.

The difficulty lies in the fact that the compensation in the amount of 50 rubles paid to mothers on parental leave to care for a child under 3 years of age is not mentioned in Article 20.2 of Law No. 125-FZ.

Accordingly, if we exclude this compensation from the base for calculating insurance premiums for accident insurance, then there are certain tax risks (not too significant due to the size of the compensation payment).

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

Other benefits and benefits for children

What, in addition to benefits, can families with children under three years old count on:

- utility benefits;

- the right to a free plot of land;

- housing subsidies;

- survivor's pension;

- caring for a disabled child;

- for families with many children: tax benefits, housing, utilities, free food according to a doctor’s conclusion, free medicines, purchase of children’s goods.

Receipt of benefits is not automatic after childbirth. Funds are paid only on the basis of the application and provided papers.

What affects the type and amount of child benefit?

From the moment a child is born until he reaches the age of 3 years (and in some cases for a longer period), the state assumes the responsibility to support citizens with children.

During these 3 years, various benefits and compensations are paid to parents (relatives, guardians and other persons) for the maintenance of the child. They can be regular or one-time. They can be provided under both federal, regional, and local legislation. The type of benefits and payments for a child under 3 years of age is largely determined by his age (see the figure below):

IMPORTANT! From 01/01/2020, compensation payments up to 3 years in the amount of 50 rubles are no longer prescribed. Previously assigned compensation is paid until the child reaches 3 years of age.

But not only age determines the type and amount of payment. The assignment of individual benefits is made upon fulfillment of certain conditions related to the level of family income and/or the date of birth of the baby. For example, monthly payments from maternity capital until a child reaches the age of 3 are not available to everyone. The figure below shows the conditions under which such a payment is possible:

Benefits for up to three years in 2022 may also be assigned depending on the fulfillment of other conditions. For example, for large families, regional special payments for the third child are available, introduced in areas with low fertility rates.

Next, we will tell you in more detail about the amounts and types of benefits for a child under 3 years of age.

And you will find the amounts of all benefits provided by law for children (of any age), as well as links to resources that will help you apply for these benefits, in ConsultantPlus. Get trial access to the system for free and go to the Directory.