Information about the place of work

The essence of the work certificate is the employee’s employment with the individual entrepreneur. This kind of paper can be of two types: about the period of work and about current employment. In the first case, the document should reflect how long the employee worked, in the second - from what date the person started working and is working at the time the certificate is issued.

Sample certificate of employment from an individual entrepreneur

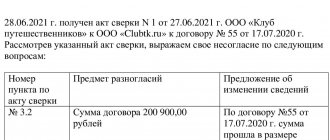

| IP "Petrov P.P." 456789, Russia, Subject of the Russian Federation, Remarkable Ave., 1, tel. 000-00-00 Ref. No. 15/01/21 of 01/15/2021 REFERENCE The subject of the Russian Federation With this certificate we confirm that Rodionov L.P., born 10/06/1984, works for the individual entrepreneur “Petrov P.P.” as an accountant from 08/16/2019 (hiring order dated 08/16/2019 No. 25/19) to the present. Issued for presentation at the place of request. Individual entrepreneur______________________ Petrov P.P. INN 1234567890, KPP 121001001, OGRN 2323454567001, OKPO 90100101 r/ account 000000000000000000000 in OJSC BANK NADHEZHNY in the RF SUBJECT, Subject of the Russian Federation, BIC 000000000, cor. account 00000000000000000000 |

How to obtain a certificate of income of an individual entrepreneur

Typically, working citizens submit a Form 2-NDFL certificate from their employer at the place of request. For an individual entrepreneur, this option is only possible if he works for someone under an employment contract, receiving earnings subject to personal income tax. An individual entrepreneur does not have the right to draw up such a document in relation to his business income, and there is no approved form of a certificate of income for an individual entrepreneur. So what can you do?

If a certificate of income of an individual entrepreneur is required for a bank

Most financial institutions are ready to consider other reliable sources containing the necessary information for a loan, instead of a certificate of income for an individual entrepreneur. It is advisable to first check with the bank whether it is possible to confirm the data with other documents.

What can be submitted instead of a certificate of income of an individual entrepreneur:

- For individual entrepreneurs on OSNO - a copy of the 3-NDFL declaration accepted by the Federal Tax Service. For information about the income of the current year - a copy of the “Book of accounting of income and expenses of individual entrepreneurs” (approved by Order of the Ministry of Finance No. 86n/BG-3-04/430, amended on June 19, 2017).

- “Simplers” submit for the past year a copy of the declaration under the simplified tax system, and for the current period - a copy of the KUDiR (approved by Order of the Ministry of Finance No. 135n).

- Individual entrepreneur on a patent - a copy of the patent and the “Income Accounting Book” (approved by Order of the Ministry of Finance 135n).

- It is more difficult for persons using UTII - the quarterly declaration does not confirm their real income, and there is no separate register in which to keep records. You can offer the bank for consideration an independently developed document that takes into account all revenues and expenses, with copies of primary documents attached. For example, for non-cash payments - bank statements, for cash - printouts of revenue data from the OFD personal account.

- Individual entrepreneurs who have switched to paying professional income tax (self-employed) can generate a certificate of income for the reporting year in the “My Tax” mobile application.

If the bank is not satisfied with the proposed options, you will have to issue a certificate on your behalf.

How to make a certificate of income for an individual entrepreneur yourself

Since the law does not have a mandatory form for use, a certificate of income of an individual entrepreneur is drawn up in free form. You can find out in advance about the requirements for such certificates from the organization where the completed document will be submitted. It is recommended to include in the certificate the details required for primary documentation (Clause 2, Article 9 of Law No. 402-FZ):

- document's name;

- date;

- surname, name, patronymic of the individual entrepreneur issuing the certificate;

- content of the fact (amount of income) indicating units of measurement (rubles);

- positions and signatures of the persons vising the document (the signature of the entrepreneur himself is sufficient).

The law talks about accounting documents, but these rules also apply to certificates of any form. To confirm income for the entire required period of time, one document is usually drawn up (for example, a certificate of income for the period 2017-2019); it is not worth issuing a certificate of income separately for each calendar year, unless required by the party requesting the document.

What a completed income certificate for an individual entrepreneur might look like, a sample of it is given below.

The certificate is signed by the individual entrepreneur himself. If an entrepreneur hires a person to perform the duties of an accountant (or chief accountant), then this employee can also sign the document.

Confirmation of information about the work of individual entrepreneurs

In his activities, an entrepreneur is his own employer and employee. To confirm your activities in financial and government agencies, it is usually sufficient to present an extract from the Unified State Register of Individual Entrepreneurs, a certificate of inclusion in the Unified State Register of Individual Entrepreneurs, and to confirm income - an income statement with a mark of acceptance by the tax authority. But if a need arises, a businessman has the right to issue the necessary certificate to himself. In this case, the document is issued in the name of the entrepreneur and signed by him. Most likely, the information will still need to be confirmed with documents from the tax office.

In various life situations, documents about professional employment and income are required. An individual entrepreneur has the right to provide various options for business confirmations, both in free and unified form.

What other documents confirm the income of an individual entrepreneur?

Additional proof of confirmation of income for entrepreneurs, in the case of a 2-NDFL requirement for individual entrepreneurs, is a book of income and expenses, including for PSN. The necessary pages indicating the amount of income can be copied and certified. Also supporting documents are primary documents: bank statements, cash receipts, contracts, etc.

Also, to confirm his income, an entrepreneur can provide existing primary documents and a cash book. Also, a way out for an individual entrepreneur may be to decide to keep a special register in which he will record and systematize all documents received. When maintaining such a register, one should take as a basis the details that, in accordance with clause 4 of Art. 10 of the accounting law must be in the document.

Systematic maintenance of such a register reflecting all incoming documents will help individual entrepreneurs to easily confirm their income to both banks and government agencies. If a certificate of income is required due to the “bureaucratic whim” of state or municipal authorities, then it should be drawn up in any form.

It is usually not possible for an entrepreneur to receive a certificate of income drawn up from the Federal Tax Service, since neither the Tax Code nor the methodological recommendations of the fiscal service contain rules on confirming the income of individual entrepreneurs. Until now, the issue of official confirmation of individual entrepreneurs’ income has not been resolved at the legislative level.

How to confirm income

If an individual entrepreneur works under an employment contract, he can obtain a certificate from the employer. And if not? What to do then? The answers to these questions depend on the individual entrepreneur’s tax system.

Individual entrepreneur on the general taxation system

Entrepreneurs on the general taxation system (GTS) can confirm their income by submitting a certified copy of the income tax return (form 3-NDFL) for the past year (Article 229 of the Tax Code of the Russian Federation). This is their most important income document. For example, in 2019, a declaration for 2022 (if submitted) is suitable.

Individual entrepreneur in the special mode of the simplified tax system or unified agricultural tax

Entrepreneurs on the simplified tax system (STS) or on a special regime that provides for the payment of the unified agricultural tax (UST), to confirm their income, can submit a certified copy of the tax return for the past year (Article 346.10, Article 346.23 of the Tax Code of the Russian Federation).

IP on a patent

Individual entrepreneurs in the patent taxation system will not be able to confirm their income with a tax return, since when applying a patent, a declaration is not submitted (Article 346.52 of the Tax Code of the Russian Federation). An entrepreneur with a patent reflects his income in the individual entrepreneur's income book (clause 1 of Article 346.53 of the Tax Code of the Russian Federation).

IP on UTII

Also, entrepreneurs in the taxation system in the form of a single tax on imputed income (UTII) will not be able to confirm their income with a tax return, since they declare imputed income (that is, potential income) quarterly, and not real (Article 346.27, paragraph 1 Article 346.29, paragraph 3 of Article 346.32 of the Tax Code of the Russian Federation).

Individual entrepreneur certificate for an employee

According to the law, an individual entrepreneur has a number of functions as an employer - he maintains work books, makes social insurance contributions, submits reports to the tax office, the Pension Fund and the Social Insurance Fund. If an individual entrepreneur uses the labor of hired employees, then he is obliged to provide them with information about their work activities. It is required for various departments:

- to social protection authorities - when applying for benefits and compensation;

- to the employment center - to calculate benefits;

- to embassies - for visas;

- banking institutions - when lending;

- to educational institutions - when purchasing vouchers to a children's camp;

- to courts, etc.

IMPORTANT!

Employees have the right to apply orally for information about their work activities, but it is preferable to write an application addressed to management. Such an official request will become the basis for issuing paper within 3 working days (Article 62 of the Labor Code of the Russian Federation).

Depending on the purpose, the content is also adjusted. Requirements are voiced by those departments that request information. Depending on this, there are several types of such documents:

- on confirmation of the individual entrepreneur’s work activities and work schedule;

- about the amount of salary;

- about the income received for the previous period - for 3, 6, 12 months.

Please note how to write a certificate to an employee stating that he worked for an individual entrepreneur - be sure to reflect the basic information:

- registration number and date when the document was issued;

- personal data of the applicant - full name, passport details;

- job title;

- employment date;

- wage level;

- IP signature and seal (if any).

Usually they compose paper in any form. There is no unified form established by law. It is advisable to draw up an individual entrepreneur on letterhead listing the basic data of the enterprise - name, OKPO, INN, KPP, OGRNIP, address, telephone. At the bottom, the place of destination is usually indicated, most often: “for presentation at the place of requirement” (if the exact place is not known to the employer).

IMPORTANT!

Remember: the employee is not required to explain the reasons and purpose of the document. And the employer does not have the right to refuse to issue it.

ConsultantPlus experts discussed how to draw up a certificate of employment for obtaining a visa. Use these instructions for free.

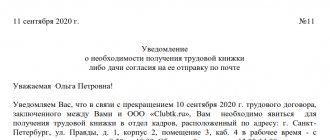

Sample work certificate

To confirm the position, length of service and type of activity, a document confirming the employee’s employment with the individual entrepreneur is issued. Here's how to write a certificate of employment: a sample from an individual entrepreneur for an employee.

| IP "Voronov A.V." 123456, St. Petersburg, Pravdy street, building 1 tel./fax (812) 7121212, e-mail: | Voronov A.V. |

Sample salary certificate

Typically, such official paper is required for filing with various departments. And different forms of filing income documents are required. Banks, for example, often request information about wages in the form of 2-NDFL; to recalculate sick leave, employers need paper in form 182N. If an employee needs such a certificate from an individual entrepreneur about income when purchasing a ticket to a children's camp, then it is enough to indicate the monthly salary.

Social protection departments ask for proof of income for 3–6 months or a year (depending on the type of benefit). It is compiled in a free style and presented in the form of a table.

Contents of the certificate

A certificate of employment issued by an individual entrepreneur must contain the following mandatory details:

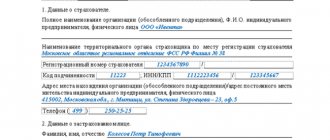

- information about the registration data of the individual entrepreneur (it is usually contained in the header of the letterhead);

- number and date of compilation;

- Full name of the employee to whom the certificate is issued, and the necessary information about him (position, length of work, amount of earnings, etc.);

- place of presentation of the certificate (or indicated: “At the place of request”);

- Full name of the entrepreneur, signature and seal (if available).