Why do you need a certificate?

Despite the fact that the certificate is a fairly informative document and can describe in detail the financial picture of the company’s activities, it does not apply to the mandatory documents included in the financial statements.

Most often, it is required to conduct analytical work on the activities of the enterprise and maintain internal reports and records, as well as, in some cases, for interested structures “from the outside.”

The certificate is relevant, for example, when it is necessary to confirm the solvency and reliability of an organization in banking and credit institutions, insurance companies, in front of potential or existing investors, counterparties, etc.

Extract from the balance sheet

How to establish a useful life for fixed assets in accounting and tax accounting

That is why it is necessary in situations where the activities of an organization are directly related to determining the book value of assets (BSA).

Internal and external users of financial statements can request such a financial document, such as:

- founders - to familiarize themselves with the current financial situation of the enterprise;

- investors, insurance and credit organizations - to check the solvency and stability of the institution in order to make further decisions regarding the investment of funds.

For large organizations, a register may be needed to recognize the scale of the transaction (BSA is an indicator for determining a large transaction). Or to confirm the need to conclude a particular agreement.

Current and non-current assets

The assets of any company are divided into two types:

- Negotiable. These include:

- inventory, including products ready for sale;

- cash in the organization’s cash desk and in its current bank accounts;

- accounts receivable, i.e. everything that can be converted into monetary value in a short period of time.

- Non-negotiable . These are fixed assets and non-property assets, which are much more difficult to convert into monetary form (buildings, equipment, production, information systems, etc.).

Details about current assets.

Details about non-current assets.

A good indicator is if current assets are higher than non-current assets - in this case, the company is considered successful in terms of financial activities and solvent, which means that the likelihood of achieving its goals is much more serious.

Preparing data for extract

In order not to pay VAT legally, the company needs to collect a package of documents and submit it to the tax authorities (clause 6 of Article 145 of the Tax Code of the Russian Federation). This package also includes an extract from the balance sheet. But in fact, the information that should be given in it cannot be taken from the balance sheet. To do this, you need to collect data on revenue, and you can get it from accounting registers.

For more information about how revenue is related to the balance sheet, read the article “How is revenue reflected in the balance sheet?” .

To fill out the statement, you will need data on the volume of goods (work, services) sold. This should also include revenue from transactions taxed at a 0% rate.

NOTE! Officials insist on the mandatory inclusion in revenue of proceeds from transactions not subject to VAT, transactions that are not subject to VAT, as well as from the sale of goods (work, services), the place of sale of which is not the Russian Federation (letter of the Ministry of Finance dated January 29, 2013 No. 03- 07-11/1592, dated 10/15/2012 No. 03-07-07/107, Federal Tax Service of Russia for Moscow dated 04/23/2010 No. 16-15/43541), although the judges do not agree with them (clause 4 of the resolution of the Plenum of the Supreme Arbitration Court RF dated May 30, 2014 No. 33, resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 27, 2012 No. 10252/12, etc.).

There is no need to take into account the prepayment received (letter of the Federal Tax Service of the Russian Federation for Moscow dated April 23, 2010 No. 16-15/43541), revenue from activities on UTII (letter of the Federal Tax Service dated May 12, 2014 No. GD-4-3 / [email protected] ) or goods transferred free of charge (letter of the Ministry of Finance of the Russian Federation dated September 30, 2013 No. 03-07-15/40261).

When the information for the statement is prepared, you can begin filling it out.

Who draws up the document

The responsibility for drawing up the document is usually assigned to an employee of the accounting department, i.e. an employee who has access to the financial performance of the company.

After the certificate is generated, it must be submitted to the chief accountant for signature, then it must be endorsed by the director.

You need to be very careful when drawing up the certificate; the future of the enterprise sometimes depends on how correctly it is filled out. That is why no errors, inaccuracies, and especially unreliable or deliberately false information in the certificate are unacceptable. If a mistake does occur, you should not correct it; it is better to fill out a new form.

Why do you need a certificate about the cost of the apartment?

Proper documentation of the true value of housing may be required in cases where a certain type of activity is carried out with real estate and property. What does this mean? During a global change in housing layout, when real estate is alienated or when an apartment is being prepared for sale.

Therefore, such a certificate is extremely necessary to perform such tasks. More precisely, without this supporting paper, execution is simply impossible. All this completely depends on the main activity carried out with housing. Therefore, a cadastral or inventory valuation of the apartment is calculated.

As for the cadastral, the following function is performed:

- When the purchase and sale of an apartment is carried out by government agencies or municipal authorities:

- Or when the exact amount of taxation on a land plot or on a citizen’s real estate is revealed.

Important! After completing such an assessment of real estate, an accurate indicator of the price category of the resident’s real estate is revealed. All initial information is entered into the cadastral passport of the apartment

As for the inventory, we can say unequivocally that this type of apartment assessment is several times less than the previous assessment method. Why is this so?

In order to calculate an accurate inventory estimate, other factors are taken into account:

- size, or more precisely, the total area of the room;

- the location of the building in which the apartment in question is located;

- "age" of this apartment.

Therefore, the price varies and the exact amount depends on these criteria.

Nowadays, in all government agencies that are involved in the calculation of taxes and taxation, as well as accounting for citizens’ real estate, the basis is the inventory value.

Good to know! This indicator is the leading and main value for calculating tax payments for any real estate. In any case, no matter what type of calculation the citizen-owner chooses, the estimated value of his home will be reliable and performed properly, in accordance with the law of the Russian Federation.

Rules for drawing up a certificate

Today there is no unified form for a certificate of the book value of assets, so employees of enterprises and organizations can write a document in any form or, if the enterprise has a developed and approved document template, based on its sample.

Sometimes a document is drawn up based on the requirements of the institution for which information about the company’s financial activities is collected.

The only thing is that in any case you need to take into account that the certificate must indicate a number of mandatory information:

- Title of the document;

- name of the enterprise;

- place and date of drawing up the form;

- if the certificate is of an outgoing nature, you can indicate which organization it is intended for;

- information on the book value of assets for the period of time for which it is required (it must be indicated). Here their total value is indicated, broken down into current and non-current assets.

If necessary, this data can be described in more detail in the form of a table.

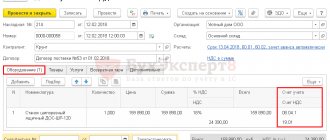

Sample on how to draw up an accounting statement

There is nothing complicated in compiling this paper. Let's consider, for example, a sample accounting certificate about the correction of an error, or, as it is called, reversal. In it, the accountant must outline the essence of the transaction, as well as the circumstances under which the error occurred. It is also necessary to write entries with corrections and indicate how this affected taxes. If there have been changes in their calculation, you need to indicate which updated reports need to be submitted. The chief accountant certifies the accounting certificate with his signature.

Only on the basis of such paper can an accountant make corrections in the General Ledger of the organization, where no corrections are allowed.

Registration of a certificate

The certificate can be written by hand or typed on a computer, on an ordinary A4 sheet or on the company’s letterhead (the latter option is preferable because it a priori includes the company’s details).

It is important to strictly observe only one condition - the document must be signed by the head of the organization (or a person who is his official representative), as well as the chief accountant. In this case, the signatures must be “live” - the use of facsimile autographs, i.e. printed in any way is unacceptable.

Today it is not necessary to certify a certificate using various types of stamps - this should be done only when the norm for the use of seals and stamps for endorsing papers is enshrined in the internal local legal acts of the company.

The certificate is usually made in one original copy, but if there is any need, additional certified copies can be made.

Information about the certificate is entered in a special accounting journal, and if it is intended for a third-party institution, also in the outgoing documentation journal.

In what form is the document drawn up?

Because The law does not establish mandatory requirements for either the form or content of the certificate; it can also be issued in any form:

- in writing by hand;

- in typewritten (typed on a computer) version.

The certificate can be submitted:

- on a standard sheet of A4 office paper;

- on the organization's letterhead.

The main thing is that the document contains the necessary details to identify the organization, period, total value of the property and signatories. You should also make sure that the signatures on the certificate are “live” - the use of facsimiles is not allowed.

If the certificate is intended for a third-party recipient, it must be registered in the outgoing documentation journal and assigned an outgoing number.

For sale

There are two ways to evaluate an apartment for its further sale: by contacting a specialized appraisal bureau or a real estate agency. Both options have their advantages and disadvantages, as well as a list of required documents.

What documents are needed to evaluate an apartment for sale?:

- Official. The assessment is carried out by the BTI or authorized organizations. The Appraisal Bureau provides its services upon provision by the customer of the following documents:

- documents confirming ownership of the inspected housing;

certificate from the BTI on the type of walls and interfloor ceilings (for houses built before 1960), floor plan of the building, explication.

- Determining the cost of an apartment by realtors . It is also called “mass-realistic”. It is good because the real value of the apartment at the moment is determined and this is done quickly, without any documents, often during a telephone conversation. The disadvantage is obvious - the customer will not receive documents of the established form that have legal force.

In fact, the list of documents is identical to the list of papers required for inspecting a home when applying for a mortgage. The only difference is that determining the value of the premises upon sale does not require the owner to have a technical passport for it.

IMPORTANT! Calculating the cost of a residential property for its further sale is aimed at determining its market price (not liquid, as is the case with a mortgage) and is carried out at the request of the owner! This procedure is not necessary!

Calculating net asset value

To date, there is no unified form of this document. It is drawn up in the form of an accounting certificate and approved by order of the head of the enterprise (Part 4 of Article 9 of the Law “On Accounting” dated December 6, 2021 No. 402-FZ).

_____________________________________ (name of organization) Certificate of balance sheet (residual) value Name of the object _______________________________________________________ Location of the object ___________________________________________________ Date of commissioning.

Help and calculation from the accounting department on depreciation of fixed assets in 2008

| OS type | Balance at the beginning of the year | Balance at the end of the year |

| Buildings and constructions | 650 120 | 746 470 |

| Machines, equipment | 920 810 | 1 149 530 |

| Vehicles | 110 000 | 160 000 |

| Other | 349 140 | 387 420 |

| Total | 2 030 070 | 2 443 420 |

Calculation of the organization's property tax for 2008. (accounting certificate)

- Calculation of the average annual (average) value of property

during the reporting period

| As of: | Initial cost of fixed assets (account 01) | Amount of accrued depreciation (account 02) | Residual value of property |

| January 1, 2008 | 3 561 620 | 2 030 070 | 1 531 550 |

| February 1, 2008 | 3 657 120 | 2 185 962 | 1 471 158 |

| March 1, 2008 | 3 848 120 | 2 344 370 | 1 503 750 |

| April 1, 2008 | 3 848 120 | 2 373 752 | 1 474 368 |

| May 1, 2008 | 3 943 620 | 2 420 180 | 1 523 440 |

| June 1, 2008 | 4 039 120 | 2 445 585 | 1 593 535 |

| July 1, 2008 | 4 134 620 | 2 475 709 | 1 658 911 |

| August 1, 2008 | 4 325 620 | 2 574 423 | 1 751 197 |

| September 1, 2008 | 4 325 620 | 2 677 340 | 1 648 280 |

| October 1, 2008 | 4 516 620 | 2 874 613 | 1 642 007 |

| November 1, 2008 | 4 516 620 | 2 894 170 | 1 622 450 |

| December 1, 2008 | 4 039 650 | 2 419 170 | 1 620 480 |

| December 31, 2008 | 3 986 650 | 2 441 420 | 1 545 230 |

| Total: | 52 743 120 | 32 156 764 | 20 586 356 |

| № p/p | Indicators | Amount, rub. |

| 1 | Average annual property value for 2008 (residual value of fixed assets at the beginning of the reporting year + residual value of fixed assets at the beginning of each month within the reporting period + residual value of fixed assets as of December 31 of the reporting year): 13 | 1 583 566 |

| 2 | Tax rate, % | 2,2 |

| 3 | Tax amount for the year | 34 838 |

| 4 | Tax amount calculated for 9 months | 25 364 |

| 5 | Amount of tax due for payment at the end of the reporting period (operation 59) | 9 474 |

We determine and write down at the end of the month (December) and for the year as a whole the balance of other income and expenses by filling out analytical data for account 91 “Other income and expenses.”

Analytical data for account 91 “Other income and expenses” (for January-December 2008)

| Analytical accounting article | Turnover, rub. | |||||

| From the beginning of the year to the reporting month | For the reporting month | Total for the year | ||||

| Debit | Credit | Debit | Credit | Debit | Credit | |

| Revenue from sales of securities | 80 000 | 80 000 | ||||

| Book value of shares | 60 000 | 60 000 | ||||

| Revenue from OS sales | 49 200 | 49 200 | ||||

| VAT on sold OS | 7 505 | 7 505 | ||||

| Residual value of disposed fixed assets | 1 970 | 40 000 | 41 970 | |||

| Materials from OS liquidation | 69 700 | 12 300 | 82 000 | |||

| Equipment dismantling costs | 20 000 | 2 981 | 22 981 | |||

| Difference between purchase and face value of bonds | 2 500 | 2 500 | ||||

| Interest on bonds | 12 000 | 12 000 | ||||

| For the use of funds in a current account | 4 950 | 1 100 | 1 100 | 4 950 | ||

| Fines, penalties, penalties | 47 710 | 176 110 | 13 700 | 1 520 | 61 410 | 177 630 |

| VAT on fines | 26 864 | 274 | 27 138 | |||

| Interest on bank loans | 52 210 | 32 000 | 84 210 | |||

| Property tax | 25 364 | 9 474 | 34 838 | |||

| Excess materials identified during inventory were capitalized | 700 | 700 | ||||

| The cost of a trip to a sanatorium was written off; the excess portion was included in other expenses. | 7 000 | 7 000 | ||||

| Write-off of the balance of other income and expenses | 76 642 | 20 814 | 55 828 | |||

| Total | 250 760 | 250 760 | 176 534 | 176 534 | 406 480 | 406 480 |

We calculate the amount of conditional income tax expense for December in the accounting certificate.

Adjacent files in an item

Real estate valuation agreement

A contract is the only basis for the emergence of a certain kind of legal relationship between the customer and the contractor. A real estate valuation agreement is a mandatory condition, drawn up in writing and certified by a notary.

This document must contain the following information:

- grounds for conclusion;

- type of residential premises being assessed;

- the type of value that must be determined during the assessment;

- cost of services provided and method of payment;

- information on civil liability insurance of the performer.

In addition, the contract must contain detailed information about the contractor, including information about the availability of a license for this activity, its validity period and the name of the issuing authority.

As a rule, appraisal bureaus use a standard document form, which is understandable given the growing popularity of mortgage loans and the development of the real estate market .

However, thoughtlessly signing a contract is a common mistake of many customers. Remember, an agreement is the only tool for protecting your interests in court if the contractor did his work in bad faith or completely neglected it!

Real estate appraisal agreement, sample.