What benefits can small businesses apply? What preferences can businessmen operating in priority sectors of the economy receive?

In accordance with the Tax Code of the Russian Federation, small enterprises can apply the following special tax regimes:

- taxation system for agricultural producers (unified agricultural tax) (Chapter 26.1 of the Tax Code of the Russian Federation);

- simplified taxation system (Chapter 26.2 of the Tax Code of the Russian Federation);

- taxation system in the form of a single tax on imputed income for certain types of activities (Chapter 26.3 of the Tax Code of the Russian Federation);

- patent taxation system (was introduced by Federal Law No. 94-FZ of June 25, 2012 on January 1, 2013) in relation to certain types of activities carried out by entrepreneurs.

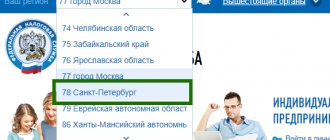

In addition, for the property tax of organizations and transport tax classified as regional taxes, the laws of the constituent entities of the Russian Federation may provide for tax benefits and grounds for their use (Article 372, Article 356 of the Tax Code of the Russian Federation). And regulatory legal acts of representative bodies of municipalities (laws of federal cities of Moscow, St. Petersburg and Sevastopol) can establish tax benefits, the grounds and procedure for their application for land tax (Article 387 of the Tax Code of the Russian Federation, Letters of the Federal Tax Service of the Russian Federation dated February 17, 2017. No. BS-4-21/ [email protected] , Ministry of Finance of the Russian Federation dated May 25, 2016 No. 03-01-11/29777).

Benefits for payers on the simplified tax system

Small enterprises have the right to switch to the simplified tax system from January 1, 2019, if based on the results of nine months of 2022, income did not exceed 112.5 million rubles (Article 346.12 of the Tax Code of the Russian Federation).

If the object of taxation is income, the tax rate is 6%.

At the same time, the laws of the constituent entities of the Russian Federation can establish tax rates ranging from 1 to 6% depending on the categories of taxpayers.

If the object of taxation is income reduced by the amount of expenses, the tax rate is 15%. At the same time, the laws of the constituent entities of the Russian Federation may establish differentiated tax rates ranging from 5 to 15% depending on the categories of taxpayers.

Important!

In most constituent entities of the Russian Federation, there are reduced rates of “simplified” tax for the taxable object “income reduced by the amount of expenses.”

In order to take advantage of the reduced “simplified” tax rate, an organization must register in this preferential region and create a separate division at the place where the organization actually operates.

A common condition for applying a preferential rate of “simplified” tax is that the taxpayer conducts a priority type of activity for the region.

For example, the Law of the Moscow Region dated February 12, 2009 No. 9/2009-OZ “On the tax rate levied in connection with the application of the simplified tax system” (hereinafter referred to as Law No. 9/2009-OZ) for some metropolitan businessmen using the simplified tax system with the object of taxation is “Income minus expenses”, the tax rate is set at 10%, provided that companies and individual entrepreneurs carry out certain types of activities (Article 2 of Law No. 9/2009-OZ).

Among them, for example: growing annual and perennial crops, growing seedlings, livestock raising, mixed agriculture, auxiliary activities in the field of production of agricultural crops and post-harvest processing of agricultural products, collection and procurement of wild mushrooms, fruits, berries, nuts, production of medicines and materials, used for medical purposes, production of rubber products, glass and glass products, cast iron, steel and ferroalloys, building metal structures and products, watches, optical instruments, photographic and film equipment, general purpose machinery and equipment, furniture, repair of machinery and equipment, electronic and optical equipment, activities of road freight transport, rental of inland water transport vessels for the transport of passengers with crew, management of real estate for a fee or on a contract basis, activities in the field of sports.

The condition for applying the preferential rate of 10% is the ratio of revenue, which must be at least 70% of the total amount for the specified types of activities for the reporting (tax) period.

Personal income tax when combining simplified taxation system and UTII

An individual entrepreneur who has employees performs the duties of tax agents for personal income tax on a general basis. If he combines the simplified tax system and UTII, he transfers personal income tax from the wages of employees on the simplified tax system to the place of residence, and on UTII - to the place of responsibility. A report on form 6-NDFL and income certificate 2-NDFL are submitted in a similar manner.

Personal income tax when working in special modes

The procedure for transferring personal income tax from employees when working in special modes is regulated by the Tax Code of the Russian Federation. Thus, paragraph 7 of Article 226 of the Tax Code of the Russian Federation states that personal income tax in the calculated and withheld amount is transferred to the budget at the place of residence and is registered with the inspectorate of the individual entrepreneur - tax agent, unless a different procedure is established.

A different procedure has been established for agents on UTII (and PSN): personal income tax from employees is transferred to the place of business under the specified regimes.

Thus, an entrepreneur who combines the simplified tax system and UTII must transfer personal income tax amounts withheld from the income of employees engaged in activities taxable under the simplified tax system to the budget at the place of residence, and personal income tax amounts withheld from the income of employees engaged in activities taxable under UTII. – to the budget at the place of registration in connection with the implementation of such activities.

Personal income tax when combining special regimes

Difficulties arise with personal income tax deductions from employees if the individual entrepreneur combines the simplified tax system and UTII and is registered with two different Federal Tax Service Inspectors. Where to transfer the personal income tax of employees who are simultaneously engaged in both types of activities?

In order to correctly calculate the tax, you need to keep separate records, that is, distribute their earnings in proportion to the share of income from the corresponding type of activity in the total income of the individual entrepreneur.

Example. Distribution of income by type of activity

The individual entrepreneur is engaged in two types of activities - wholesale and retail trade.

The first type of activity has been transferred to “simplified”, the second to UTII.

An individual entrepreneur as a tax payer under the simplified tax system is registered in the city of Moscow, and UTII is registered in the city of Khimki, Moscow region.

During the first quarter, the individual entrepreneur received 2,300,000 rubles from wholesale trade.

During the same period, income from retail trade amounted to 550,000 rubles. The total amount of income for the first quarter is RUB 2,850,000. (RUB 2,300,000 + RUB 550,000).

The share of income from simplified taxation system activities in total revenue is 80.7% ((2,300,000 rubles: 2,850,000 rubles) × 100%).

The share of income from UTII activities in total revenue is 19.3% ((550,000 rubles: 2,850,000 rubles) × 100%).

A salesperson in a store sells retail goods (“imputed” activity) and at the same time releases goods from a wholesale warehouse (“simplified” activity).

His monthly salary is 40,000 rubles. The total amount of personal income tax is 5,200 rubles. (RUB 40,000 x 13%).

Personal income tax on the income that an employee receives for participating in simplified taxation system activities is equal to 4196.40 rubles. (RUB 5,200 x 80.7%). It must be transferred to the budget of the city of Moscow.

And personal income tax on income received by an employee for participation in “imputed” activities in the amount of 1003.6 rubles. (RUB 5,200 x 19.3%) - to the budget at the place of registration of the individual entrepreneur in connection with running a business subject to payment of UTII - the city of Khimki, Moscow Region.

The procedure for submitting personal income tax reporting

All individual entrepreneurs with employees are required to report personal income tax withheld from their income. Like all tax agents for this tax.

An individual entrepreneur who combines two types of activities provides reporting on personal income tax for employees, guided by the same rules by which he transfers the withheld tax. He submits 2-NDFL certificates and 6-NDFL calculations:

- for employees of “simplified” business - to the Federal Tax Service at their place of residence;

- for workers who work in “imputed” activities - at the place where such activities are carried out.

As for workers engaged in both types of activities, the individual entrepreneur must submit two 2-NDFL income certificates for each of them and distribute data about them across two 6-NDFL reports - for each type of activity.

Tax holidays

Individual entrepreneurs applying the simplified tax system with the taxable object “income” from January 1, 2015, have the right to apply a 0 rate, provided that the relevant law is adopted by the constituent entities of the Russian Federation.

In order to take advantage of the benefit, an individual entrepreneur must fulfill a number of conditions:

- entrepreneurial activity must be carried out in the production, social and (or) scientific spheres, as well as in the field of consumer services;

- The individual entrepreneur was registered for the first time and registered with the Federal Tax Service after the relevant law of the constituent entity of the Russian Federation came into force.

For example, the Law of the Sverdlovsk Region dated March 20, 2015 No. 21-OZ established a tax rate of 0% for first-time registered taxpayers - individual entrepreneurs carrying out one or more of the following types of business activities included in the class “Food production”, “ Production of textiles”, “Production of clothing”, into the group “Production of soft drinks; production of mineral waters and other bottled drinking waters” in accordance with federal legislation establishing the classification of types of economic activities, etc.

Property tax for organizations on UTII

In accordance with paragraph 4 of Art.

346.26 of the Tax Code (hereinafter referred to as the Code), legal entities on UTII pay property tax in 2022 only in relation to those real estate objects for which the tax base is determined as their value in the State Cadastre. IMPORTANT! Starting from 2022, UTII will cease to be valid throughout Russia. Some regions abandoned the special regime already in 2020. Read more here.

The need to pay property tax under UTII arises when a number of conditions are met (clause 2, subclause 1, clause 7, article 378.2 of the Tax Code of the Russian Federation):

- the results of the cadastral valuation of property at the beginning of the year were approved in the region;

- a regional law on the payment of tax on such objects has been adopted;

- the object of taxation based on the cadastral value is included in the list of objects in the region on which such a tax must be paid.

Note! If you combine UTII and OSNO, then for real estate used on OSNO, but for which the cadastral value has not been determined, you need to calculate the tax based on the average annual value of the asset.

ConsultantPlus experts explained in detail how to correctly calculate property tax:

Learn the material by getting trial access to the system for free.

Benefits for UTII payers

For UTII payers, the single tax rate is set at 15% of the amount of imputed income (clause 1 of Article 246.31 of the Tax Code of the Russian Federation). At the same time, the regions are given the opportunity to reduce the single tax rate from 15 to 7.5% (clause 2 of Article 346.31 of the Tax Code of the Russian Federation).

The amount of UTII can be reduced by the amount of transferred insurance premiums, payment of sick leave benefits for the first 3 days and payments based on voluntary personal insurance contracts in favor of employees.

The right of taxpayers to reduce the amount of UTII by the amount of paid insurance premiums for compulsory insurance is limited only to the tax period in which they were paid (clause 1, clause 2, article 346.32 of the Tax Code of the Russian Federation). Accordingly, the amount of UTII for the quarter is reduced by the amount of insurance premiums that were actually paid in a given quarter. In this case, it does not matter for what period the contributions were accrued (Letters of the Ministry of Finance of the Russian Federation dated October 24, 2018 No. 03-11-11/76242, dated October 24, 2018 No. 03-11-06/3/76236).

Property tax for individual entrepreneurs on imputation

As for individual entrepreneurs, in accordance with paragraph. 2 clause 4 art. 346.26 of the Code, they also become payers of property tax under UTII on real estate, taxed based on the cadastral value and used by individual entrepreneurs in business activities.

But individual entrepreneurs do not submit property tax reports to UTII. The responsibility for calculating tax for them falls on the tax authorities, which must send the entrepreneur a tax notice for payment.

Benefits for payers working on a patent

The patent taxation system (hereinafter referred to as PSN) is applied by individual entrepreneurs along with other taxation regimes in relation to the types of activities provided for in paragraph 2 of Art. 346.43 Tax Code of the Russian Federation. For example, in relation to:

- public catering services provided through public catering facilities that do not have a customer service area;

- services for slaughter, transportation, distillation, grazing;

- production of leather and leather products;

- production of dairy products;

- production of bakery and flour confectionery products;

- services (performance of work) for the development of computer programs and databases (software and information products of computer technology), their adaptation and modification;

- repair of computers and communications equipment.

The laws of the constituent entities of the Russian Federation may establish a tax rate of 0% for taxpayers - individual entrepreneurs registered for the first time after the preferential laws of the constituent entities of the Russian Federation came into force (clause 3 of Article 346.50 of the Tax Code of the Russian Federation). At the same time, the activities of the individual entrepreneur must be carried out in a certain area: production, scientific, social, and the share of profit received from the implementation of this activity must be at least 70% of the total total income.

For example, the Law of the Republic of Bashkortostan dated April 28, 2015 No. 221-z provides for tax holidays for individual entrepreneurs on a patent for the period from May 11, 2015 to December 31, 2020. Tax holidays are also provided for individual entrepreneurs registered in Moscow and carrying out certain types of activities in the period from March 25, 2015 to December 31, 2020 (Moscow Law of March 18, 2015 No. 10).

The reduction factor for UTII is applied individually

If the organization has concluded agreements with the mayor’s office for regular passenger transportation on several routes. This gives it the right to apply a reducing UTII coefficient to all passenger transportation carried out. This decision was reached by the Arbitration Court of the Northwestern District.

The essence of the dispute

The tax inspectorate conducted a desk audit of the updated UTII tax return submitted by the organization, based on the results of which it drew up an act and made a decision on additional assessment of the UTII amount and the application of a fine to the organization under paragraph 1 of Article 122 of the Tax Code of the Russian Federation. The basis for this decision was the conclusion of the inspectors about the organization’s unlawful use of the reduction factor K2, equal to 0.3, when providing services for the transportation of passengers by road.

Such transportation was carried out by the organization on regular public routes. While the carrier did not have any contracts for the provision of services for the transportation of passengers on public urban transport routes, concluded with local governments. However, the organization itself indicated that agreements were concluded between it and the mayor’s office of the city of Arkhangelsk for the implementation of regular passenger transportation in the territory of the municipal formation “City of Arkhangelsk” on routes No. 6 and 62, that is, on two of the six routes. Therefore, the organization filed a claim with the arbitration court to invalidate the decision of the Federal Tax Service.

The court's decision

The court of first instance granted the organization's claim. The judges came to the conclusion that the taxpayer lawfully applied the basic profitability coefficient K2 equal to 0.3. Therefore, the decision of the Federal Tax Service to accrue additional UTII to the organization, accrual of penalties and a fine under paragraph 1 of Article 122 of the Tax Code of the Russian Federation was recognized as unfounded. However, the appellate court did not agree with such conclusions and overturned the decision of the trial court, considering the position of the Federal Tax Service on the controversial issue correct. The Arbitration Court of the North-Western District, in a ruling dated July 24, 2015 in case No. A05-7402/2014, pointed out the errors made by the appeal and overturned the decision of the appellate court, leaving the decision of the trial court in force.

The judges noted that, in accordance with the provisions of Article 346.26 of the Tax Code of the Russian Federation, the taxation system in the form of a single tax on imputed income is established by the tax legislation of the Russian Federation and is put into effect by regulatory legal acts of representative bodies of local authorities. UTII can be used together with the general taxation system and other taxation regimes provided for by the legislation of the Russian Federation on taxes and fees.

At the same time, the object of taxation for the application of a single tax is the imputed income of the taxpayer. The tax base for calculating the amount of a single tax is the amount of imputed income, calculated as the product of the basic profitability for a certain type of business activity, calculated for the tax period, and the value of the physical indicator characterizing this type of activity. By virtue of Article 346.29 of the Tax Code of the Russian Federation, the basic profitability is adjusted by coefficients K1 and K2.

On the territory of the municipal formation "City of Arkhangelsk" UTII is applied on the basis of the decision of the Arkhangelsk City Council of Deputies dated November 29, 2005 N 67 and in the annex to this decision a reduced K2 coefficient of 0.3 is established for passenger road transport services on public routes. For other passenger transportation, the coefficient K2 is 1.0. In accordance with the requirements of local legislation, the basis for carrying out passenger transportation on a public bus route is the simultaneous presence of the carrier with an appropriate agreement, license and an approved and agreed upon route passport. In a controversial situation, the organization carried out passenger transportation on routes No. 6, 62, 75b, 75m, 11k and 76.

At the same time, the agreements with the mayor’s office were only for transportation on routes No. 6 and 62. Thus, there is evidence that the organization carried passengers by road on regular routes No. 6 and 62, which in itself is the basis for the use of a reduced K2 coefficient .