I. Stage one - preparatory

Getting acquainted with the materials of colleagues on this site, I came across the fact that for many, reorganization procedures are interesting from a purely technical point of view. But, since in my reorganization project the goals were absolutely white and involved not only the separation of operating activities and main assets of the business, but also the corresponding tax-free transfer of real estate, I attached special importance to this stage.

- Analysis of information on the financial and economic activities of the Company.

- Development of the concept of the reorganization procedure. Making a business decision by the sole participant on the issue of distribution of assets of the reorganized company.

- Development of the Company's charter, created as a result of reorganization through spin-off.

In the context of massive refusals by registration authorities, I recommend finalizing this stage with some kind of conclusion in writing about the “business purpose” of this procedure. The signatures of a lawyer and an accountant on draft documents on their approval and signatures on a written opinion will greatly help you when communicating with the registration authority in the event of a suspension of the reorganization, due, again, to the directive working methods of our tax authorities and the formal approach to such procedures.

Reorganization in the form of transformation

Transformation is a change in the organizational and legal form of a company, while the previous organization ceases to exist and a new one is registered, to which all the rights and obligations of the previous company are transferred.

Conversion is the most common form of reorganization. It is in demand among companies participating in government procurement programs and contracts, where the form of a joint stock company gives an advantage in winning tenders. When a legal entity of one organizational and legal form is transformed into a legal entity of another organizational and legal form, the rights and obligations of the reorganized enterprise do not change, with the exception of the rights and obligations in relation to the founders (participants), the change of which is caused by the reorganization.

Important: during reorganization, there is a universal legal succession of one person from another, which consists in the transfer of the entire set of obligations and rights to the legal successor unchanged, unconditionally and free of charge. For example, in the case where a reorganized company has the right to carry out long-term lease of commercial real estate, this right will be preserved and transferred on the basis of the principle of universal succession to the legal successor.

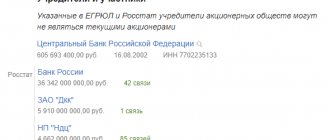

Important: when reorganizing joint stock companies, it is additionally necessary to register the issue of shares with the Office of the Central Bank of the Russian Federation or notify about their redemption.

II. Stage two - preparation of a corporate decision and notification of the registration authority

- Adoption by the sole participant (general meeting of participants) of the Company of a decision on the reorganization of the Company.

- Preparation and submission to the registration authority of a notification about the start of the Company's reorganization procedure in the form of a spin-off in the form P12003.

- Receiving a record sheet about the beginning of the reorganization procedure.

In my opinion, the most boring and uninteresting stage) But, nevertheless, fundamental.

At this stage, we are guided by clause 1 of Art. 13 of the Law on State Registration of Legal Entities and Individual Entrepreneurs , which states that a legal entity, within three working days after the date of the decision on its reorganization, is obliged to notify the registration authority in writing about the start of the reorganization procedure, including the form of reorganization, with the decision attached about reorganization.

The application in the above form is signed by the executive body of the company in respect of which the decision on reorganization was made.

Step-by-step instructions for the procedure

Like any other form of reorganization, the procedure for separating an LLC has its own algorithm of actions :

- The decision by the owners of the enterprise to carry out reorganization and the choice of its specific form.

- Carrying out inventory and forming a separation balance sheet.

- Collection and preparation of necessary documents that are needed to start the procedure (decision or minutes of the meeting and application).

- Notification of the upcoming procedure of registration authorities.

- Notifying creditors that the firm is undergoing a reorganization in the form of a spin-off.

This is done in two ways: by sending written notices to all known creditors about the upcoming allocation and by publishing a message in the media (in the Bulletin). Publications are made twice, once every month. - Formation of the necessary reporting : final, transitional and introductory.

- Preparation of documents for the procedure.

- Submission of registration documents to the tax authority .

- Entering information about a new enterprise into the state register.

Sample notice to creditors of reorganization.

At this point, the reorganization procedure is completed.

Next, the selected enterprise becomes a separate economic unit , independent from other organizations.

Typically, reorganization by spin-off, like its other forms, takes about 2-3 months.

Read more about dividing an LLC into two LLCs in this material.

IV. Stage four - reconciliation with the Federal Tax Service and languid waiting

- Conducting reconciliation with the Federal Tax Service.

- Providing reports to the Pension Fund.

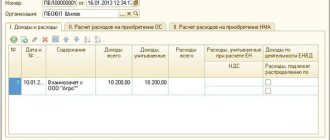

- Preparation of the transfer deed.

- Obtaining a certificate from the Pension Fund of Russia (optional).

Although we approved the deed of transfer by decision, at the time the decision was made there was no understanding of the composition of the property being transferred, so instead of the second stage, I attributed it to the fourth stage.

Subject to para. 2 p. 3 art. 11 of the Federal Law of 01.04.1996 N 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system”, when reorganizing the insured - a legal entity, he submits the information provided for in paragraphs 2 - 2.3 of this article within one month from the date of approval transfer act (separation balance sheet), but no later than the day of submission to the federal executive body that carries out state registration of legal entities and individual entrepreneurs, documents for state registration of the legal entity created through reorganization. The norm is scary, but in reality it’s not all that scary. pp. g) clause 1 of Art. 14 of the Law on State Registration of Legal Entities and Individual Entrepreneurs provides that, in the manner of interdepartmental exchange, the Pension Fund of the Russian Federation independently submits such a certificate to the registration authority. We went the classic route and, to be on the safe side, decided to obtain such a certificate to make sure that there were no possible obstacles to completing the reorganization.

Reorganization in the form of merger

A merger is the combination of two or more companies with their subsequent liquidation and the emergence of one new one. This reorganization is carried out with the aim of legal consolidation of the business. During this procedure, two or more legal entities combine their assets and create a new organization. At the same time, the companies themselves individually cease to exist. Basically, this approach is used to consolidate efforts in competition by increasing its presence in the market.

The created company (this may be an LLC or another legal form) is subject to mandatory state registration in the manner prescribed by law. As a result, the rights and obligations of all companies participating in the merger are transferred to the new company in accordance with transfer acts.

In some cases, reorganization in the form of a merger requires the consent of the FAS (Federal Antimonopoly Service). It will first be needed if the assets of each reorganized legal entity exceed 100 thousand minimum wages, according to their latest balance sheets.

In the case when assets exceed 50 thousand minimum wages, the antimonopoly authority is simply required to notify about the reorganization in the form of a merger. This is done within 15 days from the date of making changes to the Unified State Register of Legal Entities.

V. Stage five - “finish line”

- Submission to the registration authority of an application for state registration of a newly emerging legal entity created through reorganization, in form P12001.

- Obtaining a record on the creation of a legal entity through reorganization in the form of separation.

And finally, a month has passed since the second publication in the journal “Bulletin of State Registration”, and we successfully submitted an application in form P12001 with the attachment of the charter of the legal entity being created, the transfer deed, a receipt for payment of the state duty and a certificate from the Pension Fund of the Russian Federation to the registration authority. After five working days, we received the registration sheet.

Registration actions

Notifying the registration authority by submitting the appropriate documents is the most important action in the entire reorganization procedure.

This stage is divided into two parts:

1. Actions that are taken at the beginning of the reorganization procedure of a legal entity. These include:

- submitting an application and decision on reorganization to the registration authority;

- notification of the territorial tax authority (the composition of the necessary documents in this case is specified in the specific branch of the Federal Tax Service).

2. Actions that are performed at the end of the procedure. After the second publication in the Bulletin, you can prepare a package of documents:

- statements (forms P12001, P13001 and P14001), which must be notarized;

- charter of the new enterprise (in two copies);

- updated version of the charter of the reorganized enterprise;

- a letter of guarantee to the legal address of the organization that is being created;

- minutes of the meeting or decision to carry out the reorganization procedure;

- receipt of payment of the state fee for registering a new organization;

- separation balance ;

- copies of the Bulletin pages with published notices about the upcoming procedure;

- a certificate from the Pension Fund confirming the absence of debt;

- evidence of notice to creditors (for example, postal receipts).

All these documents are submitted by the general director of the reorganized company to the registration authority. Within five days after this, all documents must be ready - both for the new enterprise and for the main one. They can be collected personally or with the help of a trusted person.

If no one comes to the registration authority to pick up the documents on the appointed day, they are sent by mail to the legal address of the organization . The moment of completion of the reorganization procedure is the entry into the Unified State Register of Legal Entities of a new enterprise.

Sample charter of a new enterprise.

Sample resolution on approval of the charter and appointment of the general director.

A sample letter of guarantee for the organization being created.

Sample deed of transfer for reorganization by spin-off.

You can also find on our website a sample deed of transfer for reorganization by merger, transformation of a closed joint stock company into an LLC and division, read here.

VI. Stage six - technical

- Preparation and submission of a package of documents when registering the transfer of ownership of the transferred real estate

- Obtaining an extract from the Unified State Register of Real Estate on registration of the transfer of ownership of real estate

- Organization of document flow in the established Company.

- Organization of accounting and tax accounting in the established Company.

Society has been created.

Assets transferred. By the way, in a tax-free way. That's all. Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

Voluntary procedure

There are various factors under the influence of which the reorganization of an LLC in the form of a spin-off may become necessary. For example, one of the owners participating in the labor process decided to conduct business independently. The need for transformation may arise in order to optimize management in several structures. Often, to prevent liquidation, a reorganization of the company is carried out. The form of allocation is characterized by the provision of not only rights, but also responsibilities. Moreover, the latter may also be in debt. After this, the subsidiary can be declared bankrupt. In this case, the main enterprise will pay off small debts, thus continuing its functioning.

It is also worth saying that the newly formed company is not obliged under the Tax Code to pay duties, taxes and fees for the old enterprise. Reorganizing an LLC in the form of a spin-off can thus be used as a way to prevent debt from accumulating. Of course, there is a possibility that the court will oblige the company to pay it. However, this is only possible if it is proven that the purpose of its creation was precisely to evade payment.

Tax obligations upon allocation

The tax obligations of a company that is subject to reorganization are determined by Art. 50 of the Tax Code of the Russian Federation. This rule states that these obligations are assigned to legal successors, regardless of whether they knew or not about the existence of unfulfilled obligations, fines or penalties.

It is noteworthy that the process of reorganization of the enterprise does not have any impact on the time period within which the successor is obliged to fulfill these obligations.

Important! The above conditions of succession are a general rule and do not apply to reorganization carried out by way of separation, which is a kind of exception within the framework of tax law.

Thus, according to tax legislation, when a new legal entity is separated, it does not become the legal successor of the reorganized one. The latter, in turn, continues to bear the responsibility for paying taxes. However, if as a result of this procedure the reorganized company is unable to fulfill its obligations to the tax service and if it is proven that the reorganization was carried out with the aim of avoiding such fulfillment, then the court may oblige the spun-off companies to fulfill the obligation jointly and severally with the original organization.

The process of reorganization of legal entities through separation

Process: reorganization of legal entities by separation begins with the adoption of a decision on reorganization. The decision to reorganize in the form of separation of legal entities can be made on three grounds:

- reorganization through spin-off on a voluntary basis - the decision on the reorganization of persons in the form of spin-off is made by the general meeting of founders or by the decision of the sole participant of the legal entity;

- reorganization through judicial separation - reorganization at the request of the antimonopoly authority in order to increase the level of competition in a certain segment of economic activity;

- Making a decision on reorganization through spin-off on a voluntary basis implies that all participants in the organization have given their consent to the reorganization of the company in the form of spin-off.

The issuance of a court decision on forced reorganization in the form of separation is carried out in the form and within the time limits specified in the judicial act. The reorganization procedure in the form of separation in this case is carried out by the owner of legal entities or another body that has received these powers.

Each of the newly formed legal entities, after reorganization in the form of a spin-off, receives a certain amount of rights and obligations of the original legal entity. Article 58 of the Civil Code of the Russian Federation provides that during reorganization in the form of separation from legal entities of one or more legal entities, the rights and obligations of the reorganized entity are transferred to each of them in accordance with the transfer act.

The requirements and mandatory conditions of the transfer deed for reorganization in the form of a spin-off are defined in Article 59 of the Civil Code: the transfer deed for reorganization in the form of a spin-off must contain provisions on the succession of all obligations of the reorganized entity in relation to all its creditors and debtors, including obligations disputed by the parties, and also the procedure for determining succession during reorganization through separation in connection with a change in the type, composition, value of property, the emergence, change, termination of the rights and obligations of the reorganized person, which may occur after the date on which the reorganization transfer act was drawn up.

These requirements must be present in the transfer act when reorganizing persons in the form of separation, otherwise the registering authority will make a decision to refuse state registration of the reorganization in the form of separation.

Features of reorganization by separation

Currently, in Russian business circles, spin-off has become the most popular form of reorganization. The fact is that its use is a consequence of very common circumstances.

The following main reasons for such a reorganization are noted:

- The parent company has a large debt. In this case, when creating a new enterprise, along with part of the property and other rights, the debts are also transferred in whole or in part. As a result, the parent company continues to operate quietly and make a profit.

- The emergence of highly specialized workshops or branches in the process of company growth. The separation of these divisions as independent legal entities contributes to their further development, speeds up business transactions and simplifies accounting. In this case, cooperation between legal entities becomes more profitable than cooperation between branches within one legal entity.

- Expansion of the company, leading to more complex management and complicating its further growth.

- The emergence of acute disagreements between owners.

Reorganization by separation, as opposed to other methods (except for division), is carried out not only according to the wishes of the owners of the LLC, but also according to a decision made by the tax service, the antimonopoly committee or a judicial authority. All such decisions are made solely on the basis of existing legislation.

And also the fundamental difference of this method of reorganization is that during the separation, only legal entities belonging to the same organizational and legal form to which the parent company belongs can be created.

Video: features of reorganization in the form of separation

https://youtube.com/watch?v=NDmWx3egn0E

Positive and negative aspects of reorganization through spin-off

The main advantage of carrying out a reorganization in the form of a spin-off is, of course, the solution to the problems that gave rise to the idea of carrying out such a reorganization. Among them:

- optimization of incurred debts;

- the emergence of new areas of activity requiring specialization;

- expansion of activities, leading to cumbersomeness and difficulties in managing an expanded enterprise;

- disputes between owners.

However, the separation process also entails certain risks. The main risk arises from the fact that, by carrying out a reorganization, the company thereby attracts the close attention of both tax authorities and creditors. The latter can, based on the provisions of Art. 60 of the Civil Code of the Russian Federation, demand early payment of debts. At the same time, creditors have the right to be jointly and severally liable to get their money back:

- reorganized (parent) enterprise;

- newly created company;

- responsible executors of the reorganization.

In case of delay in repayment of loans, not only the reorganized and newly established enterprises, but also the founders of these organizations will be found guilty.

After the reorganization, creditors may also demand repayment of debt obligations in court. The reason for such an appeal may arise if the size of the net assets of the reorganized company becomes less than the amount of the authorized capital. Creditors may then claim that the reorganization was deliberately designed to harm their financial interests. And in this case, not only the reorganized company, but also the newly created enterprise can be held liable.

Such actions of creditors both at the stage of reorganization and after it are carried out will certainly attract the attention of the tax authorities. And although tax audits during reorganization by spin-off are not mandatory, claims by creditors will provide a legal reason for conducting audits. Therefore, a careful analysis of the positive aspects and risks that may arise during reorganization through spin-off is required.

Video: how to choose the appropriate reorganization option by highlighting

Reorganization in the form of a spin-off requires a complex and lengthy procedure involving experts in the field of economics, finance, accounting and jurisprudence. A thorough and professional approach to all stages of this process is required: from preparing an extraordinary general meeting to amending the constituent documents of the reorganized company and registering a new enterprise.

Decision-making

The issue of reorganization is discussed at a meeting of participants. The shareholders make a decision to carry out the transformation, and approve the procedure and conditions for the reorganization. Meanwhile, it is worth saying that this process must be preceded by the development of a plan. During the preparatory stage, the company's management must evaluate its assets and property and prepare documentation for examination. The plan will allow you to structure operations and reduce discussion time. The decision must be unanimous. This means that all meeting participants (if there are several of them) must vote for the reorganization. Problems usually do not arise if the company has only one founder. Minutes must be taken during the meeting.

Reorganization of the separation form: separation balance sheet (sample)

Drawing up this document is the responsibility of the enterprise carrying out the transformation. Its approval is carried out at the general meeting of participants. It contains information about the obligations and property of both the existing and the newly created company. The separation balance sheet is considered as a set of documentation reflecting data on the past, current and future work of the enterprise. In particular, it contains annual reporting, inventories, lists of obligations and material assets, and the procedure for their distribution.