In order to receive material (financial) assistance from the state, as well as all kinds of social benefits issued to solve various everyday problems, a citizen - an applicant for such assistance - must be officially considered low-income.

One of the grounds for recognizing an individual as low-income is documentary evidence of the insufficiency of his or her earnings. The corresponding document - a certificate of income for the required period of time - is submitted by the citizen-applicant to the social protection service.

Where is a 3 month salary certificate required?

To be recognized as unemployed at the labor exchange, you will need to submit a package of documents, which includes a certificate of average earnings for the last three consecutive months of work. This is also stated in paragraph 2 of Art. 3 of the Law “On Employment...” of April 19, 1991 No. 1032-1.

A certificate of average earnings for the 2021-2022 sample for the employment service has not been approved at the federal level, but there is a form recommended by the Ministry of Labor of the Russian Federation. It is given in the department’s letter dated January 10, 2019 No. 16-5/B-5. In the same letter, the Ministry of Labor warned that if the certificate was drawn up by the employer in any form and contains information necessary to determine the amount and timing of payment of unemployment benefits, there are no grounds for refusing to accept it.

If you have access to ConsultantPlus, check whether you have correctly filled out the average earnings certificate to determine unemployment benefits. If you don’t have access, get trial online access to the K+ legal system for free.

In the certificate for the employment center, the average earnings are calculated according to the rules given in the resolution of the Ministry of Labor of the Russian Federation “On approval of the Procedure for calculating average earnings to determine the amount of unemployment benefits and scholarships paid to citizens during the period of professional training, retraining and advanced training in the direction of the employment service authorities” dated 12.08.2003 No. 62.

The employer must issue this certificate, like any other documents related to work, within 3 days after receiving a written request from the employee (Article 62 of the Labor Code of the Russian Federation).

How to apply for an apartment subsidy in special situations

The family of the owner or the tenant of the property can begin to apply for preferential accruals when the owner:

- is undergoing military service;

- is in prison;

- declared missing;

- declared dead;

- compulsorily treated in accordance with a court decision.

Their relatives may qualify for payments if they continue to live in this house or apartment. In addition to the general package of papers, in this case the following is attached:

- documentation confirming the position (for example, a court order);

- evidence that members of the family permanently lived with the owner on the premises before changing his location.

If more than just family members live in the apartment

Situations like this are rare, but you should find out all the necessary information about them. When other people are registered in the house with you and your loved ones, additional papers must be attached to the completed package:

- certificates confirming payment for repairs, maintenance of housing and utilities, which are transferred by persons not specified in the application for benefits;

- objective reasons why these citizens live in the house.

Where is a 6 month salary certificate required?

Typically, documents confirming the amount of salary for a specified period are required by banking institutions to issue loans.

Important! The certificate must indicate the name and contact details of the organization, the length of time the employee has been working in the position held (with its indication) at the given enterprise, as well as the monthly breakdown of the accrued wages.

The same certificate may be required to be submitted to the social security department when applying for a subsidy for utility bills.

There is no strict form for such a certificate. Usually banks and social agencies offer their own form to fill out.

Income level to qualify for compensation

The ability to receive benefits from the state largely depends on regional policy. The right to claim preferential accruals is determined not by the specific amount of family income, but by what share it spends on housing and communal services payments.

In Moscow, for example, it will be possible to obtain a subsidy if utility costs amount to more than 10% of total income. In St. Petersburg, you can enlist government help only when the cost of housing and communal services exceeds 14%. In Voronezh, subsidies are provided for payment for utility services in the amount of 10-18% of total income:

- 15 percent for large families, single pensioners, single mothers and people living in low-rise residential buildings, in which heating is provided by companies at inflated rates;

- 10% is relevant for those whose income does not reach the subsistence level.

To make the calculation, you need to add up the earnings/pension received (other documented accruals) for the last six months and compare the total amount with the amount of mandatory expenses for utility bills. If the result is more than 22%, citizens have the right to apply for government benefits. It is important to understand that only material wealth that is officially registered is taken into account.

Before preferential payments are accrued, government officials will once again carry out calculations, taking into account the average amount of a citizen’s income over the last 6 months and the percentage required to cover housing and communal services bills. If the amount equals or exceeds the established standards, submitting documents to receive a housing subsidy will become possible.

Salary certificate in form 182n: sample filling in 2021-2022

This certificate is issued to the employee so that he can receive social benefits at his new place of work. The information in it is provided for the two years preceding the dismissal.

Unlike the two previous types of certificates, this one has a normatively approved form, which is contained in the order of the Ministry of Labor and Social Protection dated April 30, 2013 No. 182n. Now it is applied as amended by Order of the Ministry of Labor dated 01/09/2017 No. 1n (valid from 02/06/2017). You can also find a sample of filling out a certificate in form 182n on our website using the link below:

ConsultantPlus experts spoke about the nuances of filling out a certificate in form 182n. Get trial access to the K+ system and upgrade to the ready-made solution for free.

In what cases may a certificate or 2-NDFL be required?

Most often, a salary certificate is required in the following situations:

- to the pension fund for the calculation and assignment of pensions;

- to the embassy if a person wants to get a visa;

- to banking organizations for the purpose of obtaining a mortgage, credit, loan;

- to the employment center for registration and calculation of unemployment benefits;

- to other organizations if necessary ( tax service, registration of guardianship, finding a new job and other situations where you need to confirm your income and financial situation );

- to the department of social protection to apply for benefits or allowances;

- to other organizations if necessary (tax service, registration of guardianship, applying for a new job and other situations where you need to confirm your income and financial situation).

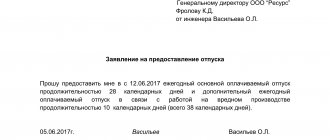

How to issue a certificate of average monthly salary

To obtain a certificate of average earnings for 3 or 6 months, sample 2021-2022, the employee must contact the employer with a corresponding application. He can do this both immediately upon dismissal and at any time after. The certificate is issued within 3 days after receiving a written request from the employee (Article 62 of the Labor Code of the Russian Federation).

A certificate of earnings for the last 2 years of work is issued to the employee upon dismissal, even if the employee did not request it. By written agreement with the dismissed employee, the certificate can be sent by mail or provided at another time.

You may also find information related to the dismissal of an employee useful, which can be found in the article “Deduction for unworked vacation days upon dismissal .

Instructions for filling out a salary certificate

The certificate is often filled out by the company's payroll accountant. Therefore, the responsible executive is responsible for how to correctly write a salary certificate.

A sample salary certificate is filled out in the following order.

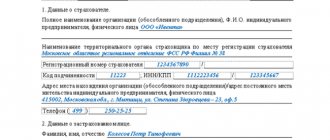

Indication of company details and taxpayer number. Information about the employer is written down in the header of the certificate; often the full name, organizational and legal form, and code of economic activity (without decoding) are enough.

Indication of the full name of the employee for whom the certificate is being drawn up. If this is provided for in the certificate form or requirements, passport data and citizenship information are also recorded.

The period of work of the employee and the date from which the employment agreement or contract was signed with him must be specified. So, in the recommendation form of a certificate from the Ministry of Labor, which indicates the salary for the last 3 months, you also need to indicate how many full weeks the employee worked over the last year.

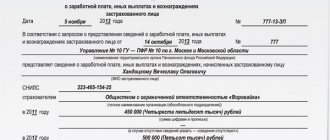

In the salary information block, information about the employee’s income is recorded: one amount if the current average earnings are used for the calculation, 3 or 6 amounts if you need to indicate income for the last 3-6 months.

If a salary certificate is drawn up according to the recommendation form of the Ministry of Labor for the Labor Center, periods that are not included in the calculation are indicated at the end of the certificate.

The document is endorsed by the manager and chief accountant. A telephone number is provided for inquiries. If an accountant has questions, he can use a sample for filling out a salary certificate.

Results

Salary certificate is a generalized name for certificates that may be required by various authorities. Its form and design rules depend on the situation in which it is needed.

Sources:

- Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n

- Law of the Russian Federation of April 19, 1991 No. 1032-1 “On employment in the Russian Federation”

- Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Key points to fill out

The document (in paragraph 3) reflects the amount of earnings for the two calendar years preceding the year of termination of work or the year of application for work, and the current calendar year for which insurance premiums were calculated.

The number of calendar days falling within the periods is also indicated (in paragraph 4):

- temporary disability;

- maternity leave;

- maternity leave;

- releasing an employee from work with full or partial retention of wages in accordance with the law, if insurance premiums were not accrued on the retained wages (clause 3, part 2, article 4.1 of Law No. 255-FZ).

The filling out requirements are established by the procedure for issuing a certificate of the amount of average earnings (approved by Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n (as amended on January 9, 2017)), according to which:

- the document is filled out based on the employer’s accounting and reporting data;

- it must be filled out by hand with black or blue ink (ballpoint pen) or using technical means (computer or typewriter);

- Erasures and corrections are not allowed.

The seal of the employer's organization (if any) should not cover the signature. If the employer does not have a seal, copies of the following documents must be attached:

- document(s) confirming the authority of the person who signed the document to act on behalf of the legal entity without a power of attorney;

- power of attorney for signing with attached documents confirming the authority of the person who issued the power of attorney;

- identification document of an individual;

- certificate of state registration of an individual as an individual entrepreneur.

Why do you need a certificate?

salary

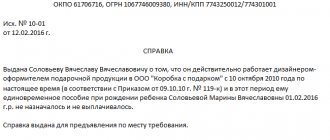

certificate is an official document of an organization confirming an employee’s income for a specific period, necessary for calculating various benefits and payments, applying for loans, etc.

According to the Labor Code of the Russian Federation, upon a written application from an employee, an enterprise is obliged to draw up and issue this document within 3 days. At the same time, the application must reflect what type of information should be and where it is being submitted.

Currently, many competent authorities request a standard document in form 2-NDFL, or provide a blank sample certificate of employment that needs to be filled out. This saves time and costs for both the employee and responsible persons at the enterprise.

However, there are situations when it is necessary to provide information in free form. In this case, the company must have a developed form that the accountant uses as the need arises. Many specialized accounting programs allow you to automatically generate this document; to do this, you need to select a billing period and an employee.

Samples of forms and templates for issuing certificates

You can download ready-made templates in Word or use the forms below to fill out the certificates yourself.

Protocol of disagreements to the Agreement, sample (ready-made example) Characteristics in the traffic police, traffic police (samples and ready-made examples) Characteristics of the head of the enterprise (sample from the place of work) How to write a negative (bad) characteristic? Characteristics for rewarding an employee (sample, ready-made example) Samples (examples) of positive characteristics for an employee from the main place of work