Compensation and wages

The Labor Code of the Russian Federation in Article 129 synonymizes the concepts of “remuneration” and “wages” and defines them as a set of three elements:

| 1. remuneration for work | main (mandatory) part |

| 2. compensation | |

| 3. incentive payments | additional part |

Are compensation and incentive payments taken into account when paying for work on days off and non-working holidays ?

However, it is worth considering that not all components are required to be paid to the employee.

Monthly earnings cannot be lower than the minimum wage level established by the Government, and includes allowances for the complexity of the work and special conditions (work on weekends, etc.). But incentives remain at the discretion of the employer and are awarded only if the employee has done his job well, in the opinion of the employer.

As a result, it turns out that the concept of remuneration is broader than the concept of wages, because is a list of all the elements from which the wages of a particular employee are subsequently collected.

Each employer decides independently how to pay wages, taking into account the minimum provisions of the Labor Code.

Is labor legislation violated if employees are paid less than the minimum wage and are also paid a monthly bonus ?

Art. Art. 23 and 132 of the Labor Code establish the impossibility of discrimination against workers with equal qualifications, output and quality of work. This means that you cannot set different pay for the same work.

Accordingly, the employer must apply uniform parameters when setting wages. A variation of such parameters represents a remuneration system. It must be based on legal norms and not worsen the employee’s position in comparison with them.

Forms of remuneration

Do not confuse the concepts of “payment system” and “form of payment” - they are not identical, although in the literature they replace each other.

A system is a set of rules for remuneration. Form is one of these rules.

Art. 131 of the Labor Code of the Russian Federation establishes two forms in which labor can be paid:

- Cash – made in rubles.

- Non-monetary - in kind - paid in any material or immaterial form not prohibited by law. The size of the natural part is no more than 20% of the person’s entire salary.

How to reflect in accounting the remuneration of an employee in kind (with the organization’s own products)?

Pay systems

The remuneration system is a documented “instruction” on how to calculate an employee’s salary for a specific period worked, containing a complete list of parameters for the accrual and deduction of funds.

The employer, depending on the nature of the business activity, can use wages to increase output and/or reduce costs. To do this, you need to choose rational remuneration systems.

How can an organization switch to a new remuneration system ?

There are 3 main systems, divided into many types. For clarity, they are all presented in the table below.

| 1. Tariff system | Time-based |

|

| Piecework |

| |

| 2. Tariff-free | ||

| 3. Mixed |

| |

Types of wages

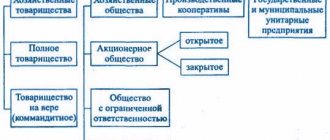

The legislation of our country determines what kind of remuneration system (types of monetary motivation for employees) can be established by employers.

The concepts in question seem familiar to everyone, but not everyone knows how they differ. The head of each specific organization has the right, in accordance with Art. 135 of the Labor Code of the Russian Federation, a collective agreement, a local administrative act, establish in an institution an optimal system for it, including the amount of salaries, compensation, incentives and compensation payments. Depending on the specific type of activity, the most effective remuneration system can be chosen, for example, when in order to receive the agreed remuneration it is necessary not to work the required number of hours, but to produce a specific amount of work: it is not always beneficial for the employer for the employee to be at the enterprise simply from “call to call” ", the results of his activities are more important.

Tariff system of remuneration

Tariff SOT is the most common, used by both government agencies and commercial organizations. It is based on the ranking of employee salaries depending on their qualifications, work experience, acquired skills, output, conditions and nature of work. In government agencies, the Unified Tariff Schedule is used. In commercial ones - documents similar to it, approved taking into account the opinion of the trade union body.

Tariffing is regulated by law for many industries. For example, for employees in the education sector, an individual tariff SOT has been established in accordance with Government Decree No. 583 dated 05.08.2008.

There are two types of tariff systems: piecework and time-based.

Material motivation of employees

Well, okay, we agreed on the salary with the applicant, and he was hired. Now the worst thing you can do is pay him the agreed amount without any adjustments. Even if this amount is quite large, it very soon ceases to motivate. They quickly get used to any money, and even more so to big ones. Sooner or later there will come a time when the employee declares that he will not work for the same pay. Therefore, salary is not as important as its direct dependence on labor results. To put it simply: if you worked well, you got more. I worked so-so - less. No one will rush if it does not affect the salary.

Therefore, we need a system of material motivation - both positive and negative:

- awards for good work. Can be linked to a sales plan. If the manager fulfills the plan, he receives a bonus. Exceeded it several times - its size adequately increases. You can also award bonuses based on the performance of the department as a whole. If a department excels, all its employees, including the manager, receive bonuses. There is no need to indulge - it is enough to do it once a quarter;

- percentage of sales. The holy of holies (and at the same time, the pain) of all sales managers. The idea is as simple as a Christmas tree: a person receives a fixed salary (usually small) and a certain share of the amount of closed transactions. This percentage varies depending on the specifics of the activity and can range from 5 to 50%. There is a direct motivation here: sold more, earned more;

- profit bonuses. They are successfully used everywhere: from Soviet-style industrial enterprises to small online stores. The idea is this: if the company makes a profit at the end of the month, then the money is distributed among all employees. Also, as in the previous paragraph, employees have fixed salaries. And at the end of the month a bonus is added to them, for example, 50% of this same salary. If the salary is 30 thousand rubles, then with a bonus of 50 percent the calculation will be 45 thousand. Minus 13% income tax;

- fines, where would we be without them? Negative motivation is also necessary. Just remember: direct fines are prohibited by law. They can punish you for this if the employee complains to the right place. Especially if the salary after the fine falls below the minimum wage. Therefore, you need to punish skillfully. A reason is required: violation of labor discipline, mistakes in work, and so on. It is necessary to take an explanatory note from the person and prepare an order for deprivation of the bonus. And before that, draw up a violation report with the signatures of witnesses (at least 2 people). Only a fine issued in this way will be considered legal. Everything else is from the evil one and can be challenged in court.

Time-based form of remuneration

Time-based SOT is used at those enterprises where there is no need or opportunity to normalize production. Employees' job functions do not include the production of goods or services, so it is optimal to pay wages for time, and not for the amount of work. Almost all administrative and economic personnel “sit” on this COT. Payment will be made based on the employee’s qualifications and actual time worked in the accounting period.

Peculiarities of salary calculation for different types of time-based wages

With a simple time-based wage, the time worked in the period is paid. Periods can be recognized as: hours, days, months and variations of these periods.

With a bonus , a bonus for the quality of work is added to the salary for time, calculated as a percentage of the salary at the rate. The bonus may be one-time or applied on an ongoing basis.

With a salary , the employee has the right to count on a monthly salary in the amount as established in the employment contract. Upon achieving a certain qualification (determined subjectively by the employer), the salary may be increased.

What is included in the main (net) part of the salary?

The main part of the salary includes only the salary (tariff rate). This is a fixed part of the salary. It is reflected in the employment contract and the employer’s staffing table. The introduction of other payments to the salary (based on the law or at the will of the parties to the employment agreement) is additional, but in some cases the salary can only be a fixed salary. The opposite situation, when the salary consists only of additional payments without a salary (tariff rate), is not provided for by law.

Consequently, salary refers to the minimum amount of money that an employee has the right to claim when performing a certain job function for a specified period of time.

To set the salary level, the most important indicator is the qualifications of the employee. Its concept includes:

- having a certain level of education;

- previous practice of carrying out the relevant work;

- qualification category (if available).

Two other indicators - complexity and volume of work - are no less important, since qualifications are closely related to them. It is this that presupposes the possibility of performing a labor function with a certain level of complexity and volume. It is important not to confuse this level with personal indicators (for example, resistance to stress, independent decision-making). As a rule, personal indicators have a greater influence on the level of the position held than on the salary.

Piece wage system

Piece work is used by organizations that provide services, perform work, or produce goods. Their profit directly depends on the speed of their employees’ work, so it is profitable to pay not per unit of time, but per unit of output. The payment formula is as follows: as much as you did, you received as much. The quantity of the product is multiplied by the unit price (piece rate). Such SOT encourages employees to constantly improve their output and quality of work. The second indicator is no less important, because Salaries are calculated based on the results of the period strictly after analyzing the work. Those. if Petrov produces 200 parts, of which 100 are unusable, only 100 will be paid for.

The basis for calculating wages will be documents confirming that employees have fulfilled their personal production plan. In order to facilitate calculations and minimize errors, it is necessary to carefully consider the system for recording employee performance.

How labor is paid for different types of piecework wages

With direct payment, payment is made for the number of units of output at the same price for each.

With progressive - the piece rate increases for each unit above the plan.

With a bonus , a bonus is added to the salary calculated according to the direct piece-rate system for fulfilling the plan, compressing deadlines, absence of defects, economical material consumption, etc.

With indirect payment, the work of support staff is paid, the amount of payment is set as a percentage of the salary of the main employee.

With a lump sum salary, the salary is accrued for the comprehensive implementation of the plan in general; the unit of output in this case does not play a role. There are:

- individual piecework SOT - salary for achieving one’s own indicators;

- collective - the salary of one person depends on the successful achievement of goals by the entire team. This system develops team spirit in the team.

Tariff-free wage system

The tariff-free SOP is similar to the option system in startups. There is a payroll and employees. Let’s assume 100 thousand rubles and 10 people. The employer establishes that:

- The payroll can be increased if the company’s profits rise,

- The share of each employee’s salary is 10%.

The share can rank employees by the amount of participation in work or be the same for everyone.

In the employment contract, of course, they will write down 10 thousand rubles - salary per month. It is impossible to mention % according to the Labor Code, and it is not very profitable for the company.

After the announcement of working conditions, there is no need to establish additional incentives; employees themselves will strive to increase the company’s income. This model is applicable to small, start-up companies that will not go public, but want to interest employees without having money for bonuses.

Mixed remuneration system

A mixed SOT combines tariff and non-tariff SOT - the employee has a certain salary, but in this case it directly depends on the success of his work: on the number of sales, on the quality of developments, on time worked, etc.

The more output, the higher the salary. And vice versa. The difference from the tariff is that the entire salary is reduced down to the minimum wage.

How are salaries calculated for different types of mixed labor protection?

The floating salary system involves recalculating salaries on a monthly basis based on the results of work for the previous period.

In commission calculations, an employee can count on a percentage of the company’s profit in general, or from each unit of output. This COT is very often used in insurance companies.

Payment for labor in a dealer network is very close to payment under a civil contract, but it also occurs in labor law. An employee is obliged to sell a certain amount of company goods, which he purchases at his own expense. The difference between the purchase price and the selling price to third parties is the person’s wages.

Salary or tariff is not yet a salary

The salary established in the company's staffing table, or the tariff according to the tariff schedule, is a component of the salary, its minimum base without taking into account additional payments and deductions.

The salary will consist of this “skeleton”, to which are attached:

- allowances;

- additional payments;

- compensation;

- coefficients;

- social payments, etc.

From the received amount the following are deducted:

- personal income tax;

- statutory deductions (for example, for material losses caused, etc.).