Changes in payments from 2022

In 2022 and earlier, in regions not participating in the Direct Payments project, the following scheme was in effect.

First, the employer transferred his funds to the employee, and then the Social Insurance Fund reimbursed him the entire amount. Starting from 2022, in all regions of the Russian Federation, payments to women are made directly by the FSS (see “Starting from 2022, in all regions of Russia, benefits will be paid directly from the FSS”).

The new algorithm for interaction between the employer and the fund is set out in the regulation approved by Decree of the Government of the Russian Federation dated December 30, 2020 No. 2375. It says that having received supporting documents from the employee, the accounting department must transfer to the Social Insurance Fund the information (in particular, sick leave registers) necessary for assignment and payment benefits. This must be done no later than 5 calendar days from the moment the woman brought the papers.

The method of transferring information (sick leave registers) depends on the average number of individuals to whom payments were made in the previous billing period (for newly created companies - on the current number of personnel). If this figure exceeds 25 people, the information is submitted electronically. If the number is equal to or less than 25 people, you can submit information on paper (for information on how to calculate the average number of employees, see “Crib sheet for calculating the average number of employees”).

Create and submit sick leave registers for free using the “FSS Benefits” service

Who is paid maternity benefits?

According to Article 6 of Federal Law No. 81-FZ dated May 19, 1995, maternity benefits (B&R) are awarded to women (including those who have adopted a child under three months of age):

- working;

- unemployed if they were fired due to the liquidation of the employer company (loss of individual entrepreneur status, termination of lawyer status, etc.) within 12 months preceding the day they were recognized as unemployed;

- full-time students in professional and other educational organizations;

- undergoing military service under a contract, as well as service in law enforcement and customs authorities.

Calculate your salary and benefits taking into account the increase in the minimum wage in 2022 Calculate for free

What is the amount of maternity benefits in 2022?

The calculation algorithm is given in the Regulations on the specifics of the procedure for calculating benefits for temporary disability and pregnancy and childbirth (approved by Decree of the Government of the Russian Federation dated June 15, 2007 No. 375). First you need to find the average earnings, compare it with the limits, and then calculate the amount of the B&R benefit.

Calculation of average daily earnings

Total earnings

It includes payments to the employee from whom contributions were paid for compulsory social insurance in case of temporary disability and in connection with maternity.

In general, it is counted for two calendar years preceding the year in which the maternity leave began. If a woman goes on leave for employment and labor in 2022, the total earnings are determined for 2020 and 2022.

ATTENTION. If in the two previous calendar years a woman was on another maternity leave or on maternity leave for at least one day, one or two years can be transferred to an earlier period. The basis must be a written statement. Let's give an example. Let's say maternity leave starts in March 2022. Moreover, in 2022 the employee was on maternity leave, and in 2022 she was on maternity leave. She wrote a statement, and her total earnings were calculated for 2022 and 2018.

Total earnings are taken into account in the part that does not exceed the maximum value of the base for contributions in case of temporary disability and in connection with maternity. This value is approved annually by the Government of the Russian Federation. Earnings for each of the two years separately should be compared with the maximum values of the base (for an example, see Table 1).

Calculate maternity benefits taking into account current indicators

Table 1

An example of comparing total earnings with the maximum values of the base when calculating benefits for the BiR

| Indicators | The period for which total earnings are calculated | |

| 2019 | 2020 | |

| Limit value of the base for the corresponding year | 865,000 rub. | 912,000 rub. |

| Total earnings | 870,000 rub. (exceeds) | 890,000 rub. (does not exceed) |

| Amount taken into account when calculating maternity benefits | 865,000 rub. | 890,000 rub. |

| Total total earnings for two years | RUB 1,755,000 (865,000 + 890,000) | |

Number of days in the billing period

To find it, you need to take two quantities:

- The number of calendar days in the period for which total earnings are calculated.

- The number of calendar days of the excluded period. It includes time of illness, maternity leave, and parental leave for up to 1.5 years. Also included in the excluded period are days when the woman was released from work according to the laws of the Russian Federation with full or partial retention of her salary (if contributions were not transferred from payments in case of temporary disability and in connection with maternity).

Then the second value should be subtracted from the first value.

Average daily earnings

It is equal to the total earnings divided by the number of days of the billing period.

Example 1

Ksenia Ivanova goes on vacation in April 2022. Her total earnings for 2022 and 2022 amounted to 500,000 rubles. (base limits are not exceeded). There are 731 calendar days in 2020-2019. Of these, Ivanova was on sick leave for 15 calendar days. The number of days in the billing period is 716 days. (731 - 15). Average daily earnings amounted to 698.32 rubles. (RUB 500,000: 716 days).

Comparison of average daily earnings with limits

Minimum maternity payments in 2022

The amount of the B&R benefit cannot be as small as desired. If a woman’s average earnings are below the minimum wage established on the start date of maternity leave, the benefit should be considered based on the minimum wage.

It is necessary to compare two values of average daily earnings: actual and based on the minimum wage. To do this you need to do the following:

- Divide the actual total earnings by the number of days in the billing period.

- Multiply the minimum wage as of the start date of maternity leave by 24 months and divide by 730 days.

- Compare the figures obtained. If the first is greater than or equal to the second, the benefit must be calculated based on the first value. If the first is less than the second, the benefit should be determined based on the second value (example in Table 2).

table 2

An example of comparing two values of average daily earnings: actual and based on the minimum wage

| Start date of maternity leave | April 1, 2022 |

| Total earnings for 2022 and 2022 | 100,000 rub. |

| Minimum wage for 2022 | RUB 12,792 |

| Number of calendar days in 2022 and 2022 | 731 days |

| Number of days of the excluded period (sick leave) | 45 days |

| Number of days in the billing period | 686 days (731 - 45) |

| Actual average daily earnings | RUB 145.77 (RUB 100,000: 686 days) |

| Average daily earnings based on the minimum wage | RUB 420.56 (RUB 12,792 x 24 months: 730 days) |

| Conclusion | The actual average daily earnings are less than this figure calculated based on the minimum wage. Therefore, benefits should be calculated according to the minimum wage |

The amount of maternity benefit is equal to the average daily earnings multiplied by the number of vacation days according to the BiR.

The amount of maternity benefits, calculated based on the minimum wage, in 2022 is:

- RUB 58,878.4 - if the duration of leave under the BiR is 140 days;

- RUB 65,607.36 - if the duration of leave under the BiR is 156 days;

- RUB 81,588.64 - if the duration of leave under the BiR is 194 days.

Calculate wages and benefits according to labor accounting at an enterprise with different remuneration systems, coefficients and allowances

Maximum amount of maternity payments in 2022

If the employee did not write an application to transfer the payroll period to earlier years, the total earnings for maternity leave are considered for 2022 and 2022.

Taking into account the maximum base values, the maximum average daily earnings will be 2,434.25 rubles ((865,000 rubles + 912,000 rubles): 730 days).

The amount of maternity benefit cannot exceed the following values:

- RUB 340,795 - if the duration of leave under the BiR is 140 days;

- RUB 379,743 - if the duration of leave under the BiR is 156 days;

- RUB 472,244.5 - if the duration of leave under the BiR is 194 days.

Calculation of the benefit amount according to BIR

You need to take the average daily earnings and multiply by the number of calendar days of vacation according to the BiR according to the certificate of incapacity for work (140, 156 or 194 days).

IMPORTANT. When paying benefits under the BiR, the average daily earnings are multiplied by 100%, regardless of length of service. Personal income tax is not charged or withheld from this payment.

Example 2

In May 2022, Daria Petrova brought a maternity bulletin to the accounting department, according to which the duration of leave is 140 calendar days. Petrova did not submit an application to postpone the billing period.

The employee’s total earnings in 2022 amounted to 750,000 rubles, and in 2022 - 730,000 rubles. (base limits are not exceeded).

During 2019-2020, Petrova was on the ballot for 14 calendar days.

The accountant determined that the actual average daily earnings are equal to 2,064.16 rubles ((750,000 rubles + 730,000 rubles): (731 days - 14 days)).

Next, I compared the resulting figure with the limits and made sure that:

- actual average daily earnings do not exceed the maximum permissible value (RUB 2,064.16 < RUB 2,434.25);

- the actual average daily earnings are greater than the average daily earnings calculated based on the minimum wage (RUB 2,064.16 > RUB 420.56).

As a result, the maternity benefit amounted to 288,982.4 rubles (2,064.16 rubles × 100% × 140 days). Petrova received this amount in her hands.

ATTENTION. If the employee’s insurance experience is less than 6 months, then an additional condition is introduced. The BiR benefit for a full month cannot exceed the minimum wage multiplied by the regional coefficient (if it is introduced in a given area). The amount of payment for an incomplete month is calculated as follows. The minimum wage (taking into account the regional coefficient) is divided by the number of calendar days in a given month and multiplied by the number of days of maternity leave in a given month.

Calculate your salary and benefits taking into account the increase in the minimum wage in 2022 Calculate for free

How are maternity benefits calculated: two indicators

Some of the payments listed in the law are the same in size for everyone. This applies to benefits for early registration and to payments to the wives of conscripts. The amount is fixed, but is indexed once a year.

But the allowance for labor and child care depends on the income of the mother (or father). Federal Law No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 provides clear instructions on how to calculate maternity benefits. The calculation algorithm here is almost the same as for regular sick leave.

Two indicators are important. First, the mother's income for the previous 2 years. That is, if she goes on maternity leave in 2022, then the billing period is 2017–2018. The month doesn't matter.

Secondly, the number of calendar days is 730 or 731 if the year is a leap year. But it is important to take into account that this period does not include sick leave, maternity leave and additional days off with pay, if insurance premiums are charged on it.

So, maternity benefits need to be calculated this way:

- Determine the billing period.

- Calculate average daily earnings.

- Calculate the maximum amount of average daily earnings.

- Multiply average daily earnings by the number of vacation days.

Some of these points require clarification. Let's consider them separately, and then show the calculation using specific examples.

Features of determining the billing period

We already know that to calculate maternity benefits, we need to find out how much a woman earned in the 2 years preceding going on maternity leave. Subtracting from this period those days when the employee did not receive a salary and, accordingly, did not contribute funds to the Social Insurance Fund (FSS RF) is not so difficult. But in practice there are pitfalls.

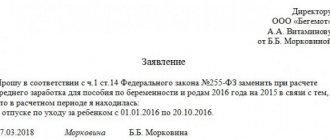

For example, this is not the employee’s first maternity leave, and the previous one fell within the billing period. That is, she was on vacation in 2017–2018, so they cannot be used for calculations in 2022. The only option is to choose other years, say 2015-2016.

But there are two important points. Another period can be taken only if the benefit eventually increases. In addition, such a replacement is possible only upon a written application from the maternity leaver. This is stated in Part 1 of Art. 14 of Law No. 255-FZ.

There is another case. A woman could have recently gotten a job at a company and not work there for another 2 years. However, her experience at her previous place of work is also taken into account. On the day of dismissal, the employee receives a certificate in the form established by order of the Ministry of Labor of Russia No. 182n dated April 30, 2013.

If the employee has lost it, she can send a request to her former employer, and within 3 days he must issue a duplicate. Based on this certificate, the employee’s income in her previous position is determined.

Of course, sometimes for young mothers, their current job may be their first. For example, if she recently graduated from an educational institution and did not have time to work for 2 years. But then all benefits are calculated not according to average earnings, but according to the minimum wage (minimum wage).

Average daily earnings and its maximum value

The formula for calculating average daily earnings is simple: you need to sum up all payments (for which contributions to the Social Insurance Fund of the Russian Federation were calculated) for the billing period and divide by the number of calendar days. Minus those we talked about above. This is exactly the instruction given in Part 3.1 of Art. 14 of Law No. 255-FZ.

However, there are limitations. The law establishes the maximum amount of income for calculating maternity benefits. If the mother's (father's) income for 2 years exceeds this limit, then the “surplus” is deducted. We discussed this issue in detail in the article on the procedure for calculating sick leave, so we will not dwell on this in detail.

But what to do when the income for the billing period is less than the minimum wage, or there was none at all? In both cases, the average daily earnings are calculated according to the currently approved minimum wage. Moreover, in some parts of the country there are regional coefficients, so be sure to include them in the calculation.

The formula looks like this: minimum wage * 24:730.

Finally, if she is underemployed, a woman also has the right to benefits. And the calculation is carried out in proportion to the duration of her working hours. Simply put, we multiply 24 months by 0.5 (if working part-time) or by 0.25 (for a quarter of the salary).

Examples of calculating maternity benefits

Let us show with an example how to calculate maternity benefits based on average daily earnings. Accountant Ivanova A.A. I worked for the company for 7 years. She has a sick leave certificate for 194 days, as she is expecting the birth of twins.

Vacation start date: 02/01/2019, billing period: 2017–2018. There are no excluded periods during this time. In 2022 she earned 350,000 rubles, in 2022 - 400,000 rubles. Now we count:

- 350 000+400 000=750 000 rubles earned in 2 years.

- 750 000:730=1,027 rubles is the average daily earnings.

The minimum average daily earnings in 2022 is 370.85 rubles, the maximum is 2,150.68 rubles. Therefore, the income of Ivanova A.A. per day fits into the norm.

- 1,027*194=199,315 The accountant will receive rubles as a benefit for accounting.

Now let's see how to calculate maternity benefits according to the minimum wage. Secretary K.K. Golubtsova worked for the company for 5 months. This is her first job. Sick leave is open from 03/01/2019 for 140 days. The minimum wage for 2019 is 11,280 rubles.

- 11 280*24:730=370,85 rubles average daily earnings according to the minimum wage.

- 370,85*140=51 919 Secretary Golubtsov will receive rubles as a benefit for accounting and accounting.

Finally, let's look at an example of calculating maternity pay for women working part-time. Student A.I. Emelyanova works part-time as a cleaner in a cosmetics store. Her monthly salary is 5,500 rubles. At the time of opening a sick leave for 140 days, she had worked for 2 years.

5 500*24*0,5:730=90,41 rubles is the average daily earnings of a student.

However, it is below the minimum wage, and according to the law, the benefit cannot be less than the established minimum. Therefore, the benefit is calculated based on the average daily earnings of 370.85 rubles. Consequently, the student will receive 51,919 rubles.

Amounts of “children’s” benefits in 2022

| Type of benefit | Size |

| Monthly allowance for child care up to 1.5 years | Paid every month. Amount for a full month = average daily earnings * 30.4 * 40%. The amount for an incomplete month is proportional to the number of calendar days of the month in which the woman was on maternity leave. The maximum possible payment amount per month is RUB 29,600.48. If the average monthly earnings are not more than the minimum wage, the amount of benefits for a full month is: in January 2022, 6,752 rubles; from February 2021 - 7,082.85 rubles. (if working part-time, it must be multiplied by a coefficient reflecting the length of working time; if there is a regional coefficient, by this coefficient). The monthly benefit amount cannot be lower than: - in January 2022: when caring for the first, second and subsequent children - 6,752 rubles. (multiplied by the regional coefficient if available); - from February 2022: when caring for the first, second and subsequent children - RUB 7,082.85. (multiplied by the regional coefficient if available). |

| One-time benefit for the birth of a child | Paid once. In January 2022 - 18,004.12 rubles. From February 2022 - RUB 18,886.32. |

| One-time benefit for women registered in the early stages of pregnancy | Paid once. In January 2022 - 675.15 rubles. From February 2022 - 708.23 rubles. |

How an employer prepares information for benefits to the Social Insurance Fund

Documents for the assignment of maternity benefits must be submitted to the Social Insurance Fund within 5 calendar days from the date of their receipt. Depending on the number of employees, the employer can submit them in paper or electronic form.

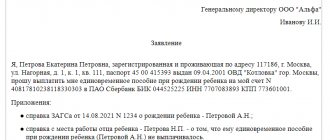

If documents are provided in paper form, the employer must prepare:

- inventory of transferred documents;

- application of the insured person (Appendix No. 1 to the order of the Social Insurance Fund dated November 24, 2017 No. 578);

- sick leave;

- certificate of registration in the early stages of pregnancy (if necessary);

- certificate of earnings from previous places of work (if necessary);

- application to replace the years of the billing period (in cases established by law);

- a certificate calculating the amount of the benefit (required by some branches of the Social Insurance Fund, without inclusion in the inventory).

When transferring documents electronically from the employer, you only need to fill out the register in the approved form (Appendix No. 1 to the FSS order No. 579 dated November 24, 2017). At the same time, all original documents are kept by the employer and there is no need to transfer them to the FSS branch.

Payment for maternity benefits is transferred to the employees' account without a card or only using a MIR plastic card.