Legislative framework

The concept of paying money as part of the social protection of compatriots who have small children in the Russian Federation is reflected in the Federal Law of May 19, 1995 No. 81-FZ “On state benefits for citizens with children.”

The procedure for calculating, determining the amount and making financial payments is contained in the Order of the Ministry of Health and Social Development of the Russian Federation dated December 23, 2009 No. 1012n “On approval of the Procedure and conditions for the appointment and payment of state benefits to citizens with children.”

If the deadline for obtaining benefits is missed, you should be guided by the provisions of Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2007 No. 74 “On approval of the List of valid reasons for missing the deadline for applying for temporary disability benefits, maternity benefits, and monthly child care benefits.”

How exactly average earnings are calculated to establish the amount of child benefit is set out in Decree of the Government of the Russian Federation of December 29, 2009 No. 1100.

To determine the amount of “children’s” payments, legislative documents relating to taxation and contributions to social funds are also used.

What benefit is given to a family with two or more children under 1.5 years of age?

If a family is raising two or more children under the age of 1.5 years, child care benefits up to one and a half years of age are assigned to each such child.

The amount for each baby depends on its birth order.

If a family is entitled to minimum benefits, then:

- for the first child - will receive 4852.00 rubles;

- for the second and subsequent children - 6751.54 rubles each.

That is, benefits are assigned to each child and added up. The benefit for each subsequent child does not cancel the payment for the previous child.

If the applicant was officially employed and received a high salary, then the amount of accrued benefits is much higher than the minimum benefit amount established by the state.

If a woman is on maternity leave and becomes pregnant with her second child, she must choose between sick pay for her second pregnancy and maternity leave and benefits for caring for her first child. It will not be possible to receive both payments .

The minimum monthly child care benefit for individuals is 6,752 rubles , regardless of the number of children. For a number of persons, the maximum amount of child care benefits for a full calendar month is 13,504 rubles. (Law dated 06/08/2020 No. 166-FZ).

Caring for a baby: vacation and allowance

Upon the birth of a child, the state provides the mother or another person with the opportunity to care for the new citizen by providing appropriate leave. While on this leave, which can last up to 3 years, for the first year and a half, the caregiver has the right to receive social financial support guaranteed by the state - a child care allowance for up to 1.5 years. It is provided through the finances of the Citizens Social Insurance Fund, which consists of transferred insurance contributions.

NOTE ! Even if the vacation after your child turns 1.5 years old lasts up to 3 years, the payment of state benefits will be stopped, instead only monthly compensation from the employer is due (50 rubles)

Who is entitled to child benefits up to the age of 1.5 years?

According to the provisions of Federal Law No. 81-FZ of May 19, 1995, children under the age of one and a half years are paid monetary compensation for income lost due to care. The law specifies who is entitled to child care benefits:

- one of the parents who is on parental leave (mother or father of the child);

- guardian or adoptive parent;

- grandma or grandpa;

- other relatives caring for the child in the event of deprivation of the mother and (or) father of parental rights or in the event of the death of the mother and (or) father.

IMPORTANT!

The fact that the second parent or both of them do not receive payments for a child under 1.5 years old should be confirmed by a certificate (certificates) issued by employers or social security authorities at their place of residence, if the parents do not work (Part 1, 4, Article 11.1 Law No. 255-FZ).

The help looks like this:

The main condition is formalized parental leave. That is, the appointment of a monthly child care benefit is provided only for employed citizens or those who are studying full-time. Officially unemployed citizens have the right to claim payment if they are registered in the social insurance system.

The right to benefits remains subject to part-time work (6 hours or less) or when working from home.

Persons who may qualify for child welfare benefits

Family nuances associated with a new addition to the family can be very diverse, and it is not necessarily the mother who will have to care for the child. It happens that a parent goes to work, and one of her relatives takes her place next to the baby. If this relative, in turn, who has a registered place of work, takes leave of the same name, he will not be able to receive an official salary or any other income. Therefore, the state has given a choice of who receives this benefit until the child turns 1.5 years old: either the mother or another actual caregiver, and it does not matter whether this person is employed or has a side income, etc.

IMPORTANT! Care allowances should be distinguished from money paid for pregnancy and childbirth: the first can be redirected, the second is due exclusively to the mother.

Federal legislation allows payment of “children’s” money up to 1.5 years for:

- any relative of the child insured by social authorities;

- relatives who are contract military personnel;

- close persons or guardians of the newborn, if they are full-time students;

- socially uninsured persons if one and/or both parents are no longer alive or the court has deprived them of parental rights.

If the organization is liquidated

Pregnancy, childbirth and a year and a half after the birth of an heir is a fairly long period of time during which anything can happen to the enterprises where parents work, including liquidation. If such an event took place, this does not mean the loss of the employer’s obligations to issue the benefit in question. The mother or father of a newborn child who has been released from office due to the liquidation of an enterprise has the right to apply for the primary purpose of this payment or continue to receive money for the child in the same manner if:

- liquidation and dismissal as a result of this event coincided with the pregnancy or postpartum leave of the baby’s mother;

- another relative was already on leave to care for the baby in place of the mother during the liquidation.

FOR YOUR INFORMATION! The amount of the benefit assigned in such a situation cannot exceed the maximum established by the state. Usually it is 40% of the average wage for the 2 years preceding maternity leave.

The nuances of payments under special working conditions

If a relative who belongs to categories of employees with a special labor organization takes parental leave, certain points stipulated in Russian legislation should be taken into account regarding the right to this benefit.

- Part-time workers have the right to choose which employer to apply for child benefits if their work experience for both employers is at least 2 years old.

- Those working part-time are not deprived of the right to accrue the analyzed benefit.

- Working from home also entitles you to this type of social security.

Features of providing payments to the unemployed

Almost all legislative aspects of calculating “children’s” money are designed for officially employed persons, since they are the main payers to the Social Insurance Fund, which pays these funds. Nevertheless, state financial support is also provided to citizens who are not employed for various reasons, as well as to parents who are students, but it is provided in a minimal amount.

FOR YOUR INFORMATION! Even the minimum amount of benefits provided by social security in the first year and a half of a child’s life is subject to state indexation.

Unemployed relatives who have children under 1.5 years of age in their care have the right to ask for benefits from the territorial social security agency (social security) if they do not receive payments for their own unemployment.

Full-time students who decide to have a child do not always use the right to official maternity leave. If a student mother studied until she gave birth, she will receive benefits for up to 1.5 years from the day the baby is born. If the student mother nevertheless went on “pregnant” leave, then the 1.5-year allowance will begin to accrue to her from the day it ends.

Documents required for unemployed people to receive benefits:

- information from the employment record about the last employer, position and time of official employment;

- a copied dismissal order from the last employer;

- certificate of family composition;

- previously made calculation of maternity benefits, if they were paid;

- statement on behalf of the person who will look after the child.

Step-by-step instructions for applying for a “children’s” allowance

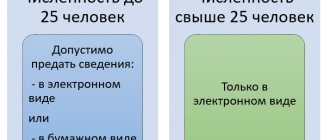

Officially working relatives of the child, as a rule, arrange for the payment of benefits at their enterprise. The law allows you to apply for an accrual directly to social insurance (to your regional branch) - this project is valid for certain regions of the Russian Federation, namely the Karachay-Cherkess Republic, Nizhny Novgorod, Astrakhan, Kurgan, Novgorod, Novosibirsk, Tambov regions and Khabarovsk Territory.

Step 1 – preparing a package of documents. Along with the application for payment of benefits, you will need to provide a number of supporting documentation to the personnel department of your enterprise or the Social Insurance Fund:

- baby’s birth certificate (copy and original);

- if the applicant has other children, their birth (adoption) certificates are needed;

- a certificate from the official place of work of the second parent stating that he was not given the required leave to care for his child;

- if necessary - a certificate from the previous place of employment about the amount of average earnings (if the applicant changed jobs during the two years preceding the birth of the child);

- if necessary, an application requesting the replacement of years to calculate the payment base to earlier ones;

- for part-time workers - a certificate from the employer who does not provide benefits stating that the employee was not actually provided with benefits for this place of work.

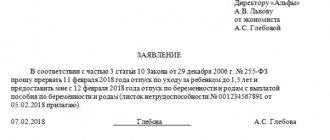

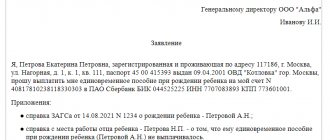

Step 2 – writing an application. The text of the application is drawn up in a relatively free form (without contradicting the general rules of office work). It is addressed to the management of the organization. You can combine a request to provide benefits for up to 1.5 years of age for a child and to pay a monthly “employer” compensation of 50 rubles. up to 3 years.

Sample application for payment of benefits for child care up to 1.5 years

To the General Director of Metafora LLC, Anton Aleksandrovich Skaznitsky, Sales Manager Irina Petrovna Talanovskaya

statement.

I ask you to grant me leave from February 15, 2022 to care for my child Platon Igorevich Talanovsky, born on December 28, 2016, until he reaches the age of three. My son is my first child.

I ask you to assign me a monthly allowance for caring for a child up to 1.5 years old and a monthly compensation payment.

I am attaching to the application:

- a copy of P.I. Talanovsky’s birth certificate;

- a copy of the passport of I.P. Talanovskaya’s mother;

- a certificate from the place of work of his father, Igor Mikhailovich Talanovsky, stating that he was not provided with parental leave and that no benefits were assigned.

February 10, 2022 / Talanovskaya / I.P. Talanovskaya

Another sample application with detailed preparation can be found on this page.

Sample certificate for the second parent

It is issued on the organization’s letterhead or its basic details must be indicated. This certificate is issued as outgoing documentation.

Limited Liability Company "Inspiration" LLC "Inspiration" 127546, Moscow, st. Zabelina, 36, office 2 Tel./fax +, e-mail OKPO xxxxxxxxxx, OGRN xxxxxxxxxxxxxxxx, INN/KPP xxxxxxxxxxxx/xxxxxxxxxx

REFERENCE

Data given to Igor Mikhailovich Talanovsky is that he actually works at Inspiration LLC, holding the position of economist from July 18, 2014 to the present (hiring order No. 117-k dated June 18, 2014). During this period, child care leave for Platon Igorevich Talanovsky, born on December 28, 2016, was not provided until he reached the age of three, and no monthly child care allowance was assigned.

The certificate was issued for presentation at the place of request.

General Director of LLC "Inspiration" /Sedykh/ R.L. Sedykh Chief Accountant /Antiokhina/ S.P. Antiokhina

Step 3 – submit an application. The application, along with copies of the attached documents, must be submitted to the personnel department (or directly to the Social Insurance Fund).

Step 4 – receive a copy of the order. Based on the documentation received, the HR department initiates the execution of the corresponding order from the manager to grant the requested leave and assign legally required benefits. The order is signed by the general director; it must be familiarized with the signature of the chief accountant and the applicant himself. The period for drawing up an order and assigning payment to the employer is a maximum of 10 days.

Monthly allowance for child care up to 1.5 years

From 01/01/2022 , the procedure for calculating monthly child care benefits will take place in three stages .

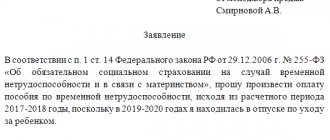

- One of the parents or another person caring for the child submits two applications to the employer at the same time . In the first, the applicant requests leave to care for a child up to 3 years old . In the second - about the assignment of monthly benefits . In the case when the insured person works part-time, it is necessary to select the one for whom the Social Insurance Fund will pay benefits, and then confirm your choice (new editions of Parts 2, 3 and 10 of Article 13 of Law No. 255-FZ).

The procedure for assigning child care benefits to a part-time employee: if we are dealing with a part-time employee, then it is fundamentally important to know which insurers he worked for in the previous 2 years before the onset of child care leave. If these were the same employers as at the time of the leave, then the part-time employee has the right to apply for benefits to any of the policyholders. If these were different employers, then the application can and should be submitted to the policyholder for whom the employee works at the time the vacation begins.

In order to calculate the amount of social benefits, employees of the social insurance fund determine the average monthly earnings for the two previous calendar years. In this case, for a part-time employee, only those incomes that he received from the employer to whom he subsequently submitted an application for payment of cash benefits are taken into account. Earnings paid by other employers can also be taken into account. But only for the period when the insured person was not yet working for the policyholder chosen to assign the benefit (new edition of Part 1 of Article 14 of Law No. 255-FZ).

- The information necessary to assign monthly payments of child care benefits is sent by the employer to the territorial body of the Social Insurance Fund in which the employer is registered. In this case, the deadline for submitting information should not exceed 3 working days from the date of receipt of the application for granting benefits (Part 11, Article 13 of Law No. 255-FZ).

IMPORTANT! If, before the end of child care leave, a mother or other relative who previously received child care benefits goes full-time, he will lose the right to receive benefits. In this case, the employer is obliged to send a corresponding notification to the Social Insurance Fund also no later than three working days (Part 12, Article 13 of Law No. 255-FZ).

- The FSS bodies make a decision on the appointment or refusal of monthly child care benefits. This decision is made within a period not exceeding 10 working days from the date of receipt of information from the employer. If a positive decision is made, the funds will be received by the insured person no later than 10 days later (Part 1, Article 15 of Law No. 255-FZ).

In 2022, the rule will remain in force according to which it will be possible to replace one or both calendar years of the billing period with earlier ones . However, as before, there are exceptions to this rule. It should be borne in mind that replacing one or two calendar years is only possible if the billing period or even part of it does not fall during maternity leave or during the previous period of parental leave.

ATTENTION! Updated version of Part 1 of Art. 14 of Law No. 255-FZ has now been supplemented with another paragraph containing a new rule regarding the calculation of benefits. If an employee submitted an application in which he asked to replace the calendar years of the calculation period after he received a positive answer regarding the assignment of benefits to him or after he was paid the entire amount of this benefit, the Social Insurance Fund is still obliged to recalculate. However, timing must be taken into account. The recalculation is made for a period not exceeding three years preceding the day of filing the application to replace the calendar calculation period.

About registration deadlines

The law allocates a sufficient period of time for collecting the necessary documents and completing the process of registering this social financial guarantee. It will be appropriate to begin the relevant efforts whenever and wherever it is convenient, starting from the first day of the granted leave to care for the baby. It will not be too late to apply for benefits within six months after the offspring’s 1.5 birthday.

NOTE! Whenever an application is submitted (during the agreed period of time), the benefit will be paid for the entire period of 1.5 years (or the duration of childcare if the official leave is shorter).

Are you late submitting documents and applying for benefits?

The period provided by the state is long, but it is not endless. The start of the process of applying for benefits is the date indicated by the applicant in his written request for payment. Failure to provide the remaining necessary documents on time also delays the legal deadline provided by the state for registration - not in favor of the applicant.

IMPORTANT INFORMATION! If timely completed documents, as confirmed by the date on the application, were transferred to the Social Insurance Fund later, regardless of the reasons for the delay, including the possible fault of the employer, the deadline will not be considered missed.

If the delay occurred for an unexcusable reason (respect must be proven with appropriate documentary evidence), then the employer will not be able to send such an application to the Social Insurance Fund: even if he does this, the social insurance authorities will refuse to consider such papers, which they will notify in writing within ten days.

If the reason for the excessively delayed registration is valid , you can try to recover the lost time. This is done through the court, for which a corresponding application is submitted outlining and written confirmation of the reasons for the omission. If the proven reason is included in the list approved by law, the period can be restored.

IMPORTANT! Restoring the deadline for submitting documents for benefits up to 1.5 years is not provided for by law, but in practice the court often makes a positive decision if the reasons for absence are proven.