Procedure for working with ELN

More and more medical institutions are switching to issuing electronic certificates of incapacity for work.

To handle them, special formats have been developed that use coding of many operations. Let's figure out how to set up an employer's work with electronic sick leave, what the status of electronic sick leave is 030, 010, 020 and others, and what to do if you receive a sick leave certificate with an error. IMPORTANT!

The Ministry of Labor proposed to abolish paper sick leave! Draft law 01/05/07-20/00106462 on a complete transition to electronic certificates of incapacity for work is being developed.

To start working with electronic certificates of incapacity for work, the employer must:

- Conclude an agreement on interaction with the regional branch of the Social Insurance Fund.

- Obtain an electronic digital signature and install the necessary software to work with it (cryptoprovider).

An organization has the right to exchange data with the fund:

- through the employer’s personal account on the Social Insurance Fund website;

- through an authorized telecommunications operator (“Tensor”, “Kontur”, etc.).

To request an electronic identification number, all you need is its number and full name. sick person, his SNILS. The FSS will send a sick leave certificate based on this data. But sometimes, instead of the requested document, the employer receives an error notification.

When will the sick leave money arrive?

Now we need to decide on the main question that worries all employees - when will the payments arrive if all the documents at work have been submitted? Here you should immediately turn to the regulated rules from Social Insurance:

- After submitting documents from the employee, the employer is obliged to send all data to the Social Insurance Fund within 5 calendar days .

- After receiving the data, Social Insurance is obliged to check the sick leave certificate within 10 calendar days and make the payment.

- Here I also recommend adding the terms of the money transfer, which very often depend on the banking organization. On average, you need to expect 1-3 business days after the final FSS status. If the money is paid through Russian Post, the period may be extended.

Here is a clear example of calculating review times:

An example of the timing of accrual of sick leave payments from the Social Insurance Fund

Above we described an example when everything goes perfectly. In reality, situations involving errors in submitted applications very often occur. Both employees and employers can make mistakes. If a specialist finds a discrepancy in the documents or an error, he will assign the status “Errors found during format check.” After this, additional verification will be carried out. If the error is serious, a notice with comments is sent to the employer (the notice is sent to the FSS account or by email). In turn, in the personal account the employee will see the status of the notification generated.

Status Notification generated indicates errors

Returning documents to the employer resets the previously set deadlines and the entire cycle is repeated again.

If you (an employee) receive a notification about errors or notices in your personal account, we recommend doing the following:

- call the accounting department at your place of work and explain the situation, perhaps you need to deliver some documents or provide additional data;

- call the FSS hotline and find out if you can find out the phone number in your region through this directory;

- Additionally, you can check the status of payments through your personal account on the State Services portal.

Possible error codes

The employer will receive information about the certificate of incapacity for work only with a certain status.

Otherwise, the protocol will be returned - sick leave is unavailable due to an error and its code. To understand the reason, refer to the list of statuses of the electronic certificate of incapacity for work. Decoding status codes

| Code | Explanation |

| 010 | Open |

| 020 | Extended |

| 030 | Closed |

| 040 | Sent to ITU |

| 050 | Supplemented with ITU results |

| 060 | This means that the sick leave is filled by the policyholder |

| 070 | The PVSO register has been transferred (this code is used in the regions of the pilot project for direct payment of benefits from the Social Insurance Fund) |

| 080 | Benefit paid |

| 090 | Canceled |

The electronic number that is still being processed at a medical institution has limited access, which means status 010 in the email. sick leave, as well as 020, 040 and 050. Neither the employee nor the employer will be able to see this sheet until the registration is completed by the medical institution.

When will funds be paid if an error is detected?

It is difficult to give a definite answer to the question of how long you will have to wait for payment of funds if an error is detected. If the status “Filled in by the Policyholder” appears in your personal account on the website fss.ru, after which a notification appears about an error detected, you should contact the accounting department (at your workplace). It is necessary to report any inaccuracies to the responsible persons and ask them to solve the problem. If an employer cooperates with the Social Insurance Fund through the 1C-Reporting system, you can view the list of identified errors using a special gateway for receiving documentation. It is located at the link docs.fss.ru (in the “Information about submitted documentation” section).

There is an alternative option that allows you to find out when the money will be paid - call the FSS hotline. The support phone number for residents of the Moscow region is 8-495-587-4384. The numbers of regional branches of the Social Insurance Fund are presented on the website fss.ru (in the “Contacts” section). You will need to dictate your ticket number to the support worker and receive information about the reasons for the error notification. You can send a request to the e-mail of the regional branch. To obtain the email address of the local FSS branch, you need to contact the hotline.

How to respond to error messages

Having received a protocol with an error instead of an ELN, act depending on the error code. For example, what does status 020 mean in an electronic sick leave? This error indicates that the certificate of incapacity for work has not been closed by the medical institution, the illness has not ended, and the employee has not started work. Wait until the employee is discharged and submit your request again. Proceed in the same way if you receive an error with code 010; 040 or 050.

IMPORTANT!

Special situation - what does status 090 mean in email. sick leave is the cancellation of the ELN. Such sick leave is not subject to payment. In this case, inform the employee that his ELI has been canceled and the benefit will not be assigned or paid.

The ELN available for calculating benefits has the status “Closed”, which means status 030 in the electronic sick leave certificate. Only after receiving a document with such a code, the employer has the right to begin calculating benefits.

What does status mean?

Filled out by the Insured (PVSO register) - this means the technical status in the Social Insurance Fund, which indicates that the employer has already filled out the ELN register, but has not yet uploaded the data to the direct payment system. In the employer’s system register, this status is assigned the code “070”.

The ELN register (electronic certificate of incapacity for work) is filled out by the employer, who enters all the necessary data about the employee (full name, address, SNILS, INN, bank details, etc.) and his organization. After sending all the information to the FSS, the status should change to “Document uploaded.”

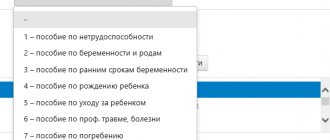

The concept of “register” refers more to employers who, through it, transmit information about employees to Social Security. Based on these data, the Fund calculates the amount of benefits. It is important to note that there is a separate register for each type of benefits:

- for temporary disability;

- for pregnancy and childbirth;

- child care;

- when registering in the early stages of pregnancy;

- at the birth of a child.

Not many people understand what the abbreviation “PVSO register” stands for and what it means. The literal translation is “Direct Social Security Payments.” Such an entry in the statuses indicates the region’s participation in a pilot program for calculating benefits directly from the Social Insurance Fund.

Amount of payment for sick leave during quarantine

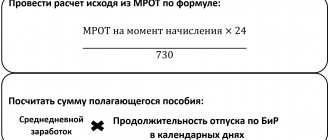

The amount of the quarantine benefit, as in the usual case, depends on the employee’s earnings for the previous 2 years and length of service on the day of sick leave. The calculation procedure is as follows:

- the total amount of income for the billing period (2019, 2022), taken into account when calculating contributions (within the limit), is divided by 730;

- the resulting average daily earnings are adjusted depending on the total length of service:

- 60% will be paid if you have worked for less than 5 years;

- 80% - with experience from 5 to 8 years;

- 100% - with more than 8 years of experience.

- the calculated average daily earnings are multiplied by the number of days of quarantine.

Employees who have worked for less than 6 months or have low earnings are paid for sick leave during coronavirus quarantine based on the minimum wage (RUB 12,130 per calendar month based on the number of days taken into account).

Sick leave payment limits

The benefit amount is limited. When calculating benefits, the established limits are taken into account:

- the maximum daily payment amount is RUB 2,301.37;

- The minimum benefit amount per day is RUB 398.79.

From 04/01/2020 to 12/31/2020, a new rule is in effect - benefits calculated for a full calendar month for full-time employment cannot be lower than the minimum wage level (Article 1 of Law No. 104-FZ dated 04/01/2020). For example, for 1 sick day in April, the amount should not be less than 404.33 rubles. (RUB 12,130/30 calendar days). When calculating the minimum wage, it increases by the amount of regional coefficients (if they exist in the region).

Calculation example

In April 2022, an employee returning from a trip abroad was quarantined for 14 days. He was issued an electronic sick leave with code “03”. The employer sent the following data to the Social Insurance Fund: the salary on which insurance contributions were calculated, for 2022 - 218,000 rubles, for 2022 - 220,000 rubles, the employee's total work experience - 4 years. The FSS calculated the payment as follows:

- First, the employee’s average daily earnings are determined:

(218,000 + 220,000) / 730 = 600 rubles;

- Earnings were compared with the limits: 398.79 <600.00 < 2301.37 – the obtained value is within the acceptable limits;

- calculated earnings are adjusted depending on length of service. Since less than 5 years have been worked, the average daily payment is equal to:

600 rub. x 60% = 360 rub.;

- the amount is checked for compliance with the minimum wage (12,130 rubles / 30 days of April = 404.33 rubles):

- 360 < 404.33; the resulting value is below the minimum threshold, so the payment is calculated from the minimum wage, i.e. average daily earnings 404.33 rubles:

404.33 x 14 days = 5660.62 rubles;

- 13% personal income tax will be withheld from the accrued amount:

5660.62 x 13% = 736 rubles;

5660.62 – 736 = 4924.62 rubles. – the amount received by the employee during the quarantine period.

Section "General information"

In this section, information about the employee, the employing organization and the method of payment of benefits is filled out. The completed data is saved within the employee; when creating a new sheet, this section will be filled in automatically.

1. «Applicant” - it should be noted who is the recipient of the benefit:

- “Benefit recipient” - the benefit is received by the applicant himself.

- “Authorized representative” - the benefit is received by the applicant’s representative.

When you select the latter, a block opens in which you should enter information about the authorized representative - full name and passport details.

2. “Information about the benefit recipient” - you must fill in the details of the benefit recipient, such as full name, SNILS, date of birth, address, gender, registration status and identification document.

Information about employees is available simultaneously both in the “FSS Benefits” service and in the PF Contour-Report. If you change information about an employee in one service, it will change or be deleted in the other.

3. “Information about the employer (organization)” This section is filled in automatically from the payer’s details. All lines except the TIN can be changed manually. If you change the details of the employing organization here, they will also change in the details.

4. “Benefit payment method” - you must choose one of two payment methods:

- Transfer through a bank;

- To the “WORLD” card;

- Postal transfer;

- Through another organization.

5. The “General Information” section is completed, you need to move on to the next section. The “Save changes to the document?” window will appear, click the “Save” button and proceed to filling out the next section.

How does an electronic sick leave work?

The transition to an electronic form of interaction between the employer and the medical institution with the Social Insurance Fund was preceded by large-scale informatization of the healthcare system, without which it would not have been possible to establish electronic document flow.

For details, see the material “Electronic sick leave for transfer to the Social Insurance Fund online.”

For a medical institution employee registering an electronic sick leave, the action plan is as follows:

- Information about the patient and the diagnosis made is entered into a special program on the computer (in the “Electronic Medical Record” module).

- Part of the necessary data on the sick leave certificate comes from the electronic medical record, and the rest of the information is supplemented by the health worker when filling out an electronic image of the certificate of incapacity for work (in the module “Certificate of Incapacity for Work”).

- The sick leave is signed with an electronic signature and sent to the Uniform State Health Information System (Unified State Information System in the field of healthcare).

In fact, the only action provided for an employee (patient) within the framework of the procedure for registering an electronic sick leave is to communicate the sick leave number to the employer if necessary. The law formally stipulates a period of 6 months from the date of restoration of working capacity, during which the employee has the right to apply for benefits (Clause 1, Article 12 of Law No. 255-FZ of December 29, 2006). However, in the general case, the application of this norm in practice is not intended, since information interaction between the employer, the Social Insurance Fund and the medical institution at which the electronic sick leave is issued is carried out without the participation of the employee.

Thus, there is no need to require the employee to present an electronic sick leave number.

In some cases, a sick leave certificate cannot be issued to a citizen. Find out more in special material prepared by ConsultantPlus experts by getting free trial access.

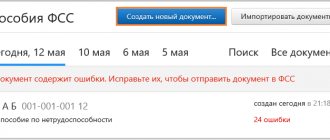

Checking and sending

1. To send, you must first open the document, then click the “Check and Send” button.

If you need to send several documents at the same time, you should open the “Details and Settings” menu and click the “Enable bulk sending mode” button.

After this, you will be able to send several documents.

2. The scan will begin.

- If the verification is successful, you should select a certificate to sign the document and click “Send document to the FSS.”

The list will display only qualified certificates whose TIN matches the organization’s TIN from the document.

The registration number of the policyholder in the certificate must match the registration number of the organization indicated in the document.

If the document is sent for a separate unit (in this case, the subordination code ends with 2), then the registration number of the policyholder in the certificate must match the additional FSS code specified in the document.

After sending, the document will appear first in the list with the status “Queue for sending”.

- If errors are found during the check, you should click the “Close and proceed to correct errors” button. Fields with errors will be highlighted in red; you should correct them and resend.

Creating documents in Extern

You must click on the “Create a new document” button.

In the window that opens, select the type of benefit, mark the desired employee in the list and click “Create document”.

The list of employees in the “FSS Benefits” service is common with the service for preparing reports to the pension fund Kontur-Otchet PF.

If the required employee is not in the list, then click the “Add new employee” button.

In the window that appears, fill in your full name and SNILS and click “Add employee.” The added employee will appear in the list and will be selected by default, and will also appear in the PF Contour-Report service.

Next, you should start filling out the form in the window that opens.

Decoding

Calculation of compensation on a general basis has the following algorithm: average daily earnings (ADE) is multiplied by the length of service coefficient, and then by the number of days of illness. The length of service coefficient means that if an employee has been working at the company for more than 8 years, his compensation according to the bulletin is 100% of the SDZ. With 5 to 8 years of experience, he will receive 80% of earnings; from 1 year to 5 years - 50%, and if the length of service is less than 1 year, sick leave payment will be 30% of the average daily earnings.

Disease codes on sick leave certificates affect the calculation of compensation: in one case, instead of SDZ, the minimum wage (minimum wage) is taken as the basis for the calculation, in another, length of service is not taken into account, in the third, the number of paid days is limited.

Table

| Code | Decoding | How is it paid? |

| Main code (2 characters) | ||

| 01 | General malaise | Compensation on a general basis. The duration of one insured event is 15 days, the paid period is no more than 10 months. |

| 02 | Domestic injury | |

| 03 | Quarantine of an employee or his child under 7 years of age | Payment on a general basis is entirely from the Social Insurance Fund. |

| 06 | Inpatient surgery to install prostheses | |

| 08 | Treatment in a sanatorium | |

| 04 | Work injury | 100% of SDZ is paid for the entire period of incapacity. Length of service and violation of treatment regimen are not taken into account. Payment is entirely at the expense of the employer. |

| 07 | Occupational Illness | |

| 05 | Maternity leave | 100% of the average daily earnings for a period of 140 days are paid from the Social Insurance Fund. |

| 09 | Caring for a sick relative | To care for a child under 7 years of age, no more than 60 days are allowed; up to 15 years – 45 days; up to 18 years – 30 calendar days per year. You can take no more than 30 days to care for an adult relative. The duration of one insured event is 7 calendar days. |

| 10 | Other (poisoning, medical procedures) | On a universal basis. At the expense of the employer - 3 days, the rest - from the Social Insurance Fund. |

| 11 | Socially significant or dangerous disease (RF Decree No. 715 of December 1, 2004) | Compensation on a general basis. The maximum paid period is 12 months. |

| 12 | Particularly serious illness of a child (Order of the Ministry of Health No. 84N of February 20, 2008). | Payment for sick leave is extended to 90 days a year without time limits for each insured event. |

| 13 | Caring for a disabled child | Paid for 120 days a year, the time period for each case of illness is not limited. |

| 14 | Caring for a child with complications after vaccination or cancer | An employee has the right to take out a certificate of incapacity for work at any time of the year without restrictions on the number of days. |

| 15 | Caring for a child with HIV infection | |

| Additional code (3 characters) | ||

| 017 | Referral for treatment to a specialist. sanatorium | Payment by main code |

| 018 | Sanatorium treatment for work-related injuries | |

| 019 | Treatment in research institute clinics | |

| 020 | Additional leave for complicated births | |

| 021 | Incapacity for work due to alcohol intoxication, drug addiction or substance abuse. | Sick leave payments are calculated based on the minimum wage, and not on the employee’s average salary. |

| Code "Violation of regime" | ||

| 23 | Unauthorized violation of the treatment regimen | Until the date of violation, sick leave is paid according to the main code. After noting a violation of the regime, compensation is calculated according to the minimum wage. |

| 24 | Showing up for an appointment with your doctor unscheduled | |

| 25 | The employee started work without covering his sick leave | |

| 26 | Refusal of medical and social examination (MSE) | |

| 27 | No-show at ITU | |

| 28 | Other violations | |

| Code "Calculation conditions" | ||

| 43 | Person exposed to radiation | Compensation is 100% of SDZ, regardless of length of service. |

| 44 | A person who worked in regions with difficult natural conditions (Far North, etc.) | |

| 45 | Having a disability | One insured event for a disabled person can last 4 months. In total, disability payments are payable for 5 months per year. |

| 46 | Work experience less than six months | The amount of disability benefits is calculated according to the minimum wage |

| 47 | The illness occurred within a month after dismissal | Compensation is calculated based on 60% of the employee’s SDZ. |

| 48 | There is a good reason for violating the treatment regimen | Compensation is paid according to the main cause of disability code. |

| 49 | The disease lasts more than 4 months | Filled out for disabled employees who have the right to sick pay for 5 months a year. |

| 50 | Disability lasts more than 5 months | |

| 51 | The employee is employed part-time in production | Calculation of sick leave payments is done according to SDZ in proportion to the time worked. |