The minimum wage is a legally established minimum that must be paid to an employee working full time, including those living in Novosibirsk. The norm is enshrined in Art. 133 of the Labor Code of the Russian Federation.

In cases where an employee works only half the time or part-time, payment below the established minimum wage is permitted. This value is indexed annually in accordance with changes in prices for the consumer basket.

Minimum wage from January 1, 2022

Within the framework of the current law (Federal Law No. 82 of June 19, 2000), from January 1, 2020, the minimum wage must be at least 12,130 rubles.

- Region Size

- Adygea (republic) - Not less than 12,130 for employees of regional organizations

- Altai (republic) - 12130

- Altai Territory - 13000

- Amur region - 12130

- Arkhangelsk region - Not less than 12,130 for employees of regional organizations

- Astrakhan region - Not less than 12,130 for employees of regional organizations

- Bashkortostan (republic) - 12130

- Belgorod region - Not lower than 12,130 for employees of regional organizations

- Bryansk region - Not lower than 12,130 for employees of regional organizations

- Buryatia (republic) - 12130 This amount is used to calculate regional coefficients and percentage bonuses for work experience in the Far North and equivalent areas (11,280)

- Vladimir region - Not less than 12,130 for employees of regional organizations

- Volgograd region - Not less than 12,130 for employees of regional organizations

- Vologda region - Not less than 12,130 for employees of regional organizations

- Voronezh region - Not less than 12,130 for employees of regional organizations

- Dagestan (republic) - 12130

- Jewish Autonomous Region - 12130

- Trans-Baikal Territory - 12130

- Ivanovo region - Not less than 12,130 for employees of regional organizations

- Ingushetia (republic) - 12130

- Irkutsk region - 12130

- Kabardino-Balkaria (republic) - 13079

- Kaliningrad region - Not less than 12,130 for employees of regional organizations

- Kalmykia (republic) - Not lower than 12,130 for employees of regional organizations

- Kaluga region - Not lower than 12,130 for employees of regional organizations

- Kamchatka Territory - 12130

- Karachay-Cherkessia (republic) - 12130

- Karelia (republic) - Not less than 12,130 for employees of regional organizations

- Kemerovo region - 19134

- Kirov region - 12130

- Komi (republic) - Not less than 12,130 for employees of regional organizations. This amount is calculated by regional coefficients and percentage bonuses for work experience in the regions of the Far North and equivalent areas

- Kostroma region - Not less than 12,130 for employees of regional organizations

- Krasnodar Territory - Not lower than 12,130 for employees of regional organizations

- Krasnoyarsk Territory - 12130

- Crimea (republic) - Not lower than 12,130 for employees of regional organizations

- Kurgan region - 12130

- Kursk region - Not lower than 12,130 for employees of regional organizations

- Leningrad region - Not less than 12,130 for employees of regional organizations

- Lipetsk region - Not less than 12,130 for employees of regional organizations

- Magadan region - 12130 Regional coefficients and percentage bonuses for work experience in the Far North regions are calculated on this amount

- Mari El (republic) - 12130

- Mordovia (republic) - 12130

- Moscow — 20 195

- Moscow region - for public sector organizations: 15,000 rubles; for extra-budgetary organizations (commercial organizations) and individual private entrepreneurs: 19,500 rubles

- Murmansk region - Not lower than 12,130 for employees of regional organizations

- Nenets Autonomous Okrug - Not lower than 12,130 for employees of regional organizations

- Nizhny Novgorod region - 12130

- Novgorod region - Not less than 12,130 for employees of regional organizations

- Novosibirsk region - 12130

- Omsk region - 12130 This amount is charged with the regional coefficient established in the region

- Orenburg region - 12130

- Oryol region - Not lower than 12,130 for employees of regional organizations

- Penza region - 12130

- Perm region - 12130

- Primorsky Krai - 12130

- Pskov region - Not lower than 12,130 for employees of regional organizations

- Rostov region - Not less than 12,130 for employees of regional organizations

- Ryazan region - Not less than 12,130 for employees of regional organizations

- Samara region - 12130

- St. Petersburg - 18,000

- Saratov region - 12130

- Sakha (republic) - 12130 Regional coefficients and percentage bonuses for work experience in the Far North regions are calculated on this amount

- Sakhalin region - 12130

- Sverdlovsk region - 12130

- Sevastopol - Not lower than 12,130 for employees of regional organizations

- North Ossetia (republic) - 12130

- Smolensk region - Not less than 12,130 for employees of regional organizations

- Stavropol Territory - 12130

- Tambov region - Not lower than 12,130 for employees of regional organizations

- Tatarstan (republic) - 12130

- Tver region - Not lower than 12,130 for employees of regional organizations

- Tomsk region - 12130

- Tula region - 14,100

- Tyva (republic) - 12130

- Tyumen region - 12130 This amount is subject to a regional coefficient and a percentage bonus for work experience in areas with special climatic conditions

- Udmurtia (republic) - 12130

- Ulyanovsk region - 12130

- Khabarovsk Territory - 12130

- Khakassia (republic) - 18048

- Khanty-Mansiysk Autonomous Okrug - 12130 This amount is used to accrue regional coefficients and percentage bonuses for work experience in the regions of the Far North and equivalent areas. The total amount must not be lower than the subsistence level of the working-age population established in the district (11,280)

- Chelyabinsk region - 12130

- Chechnya (republic) - 12130

- Chuvashia (republic) - 12130

- Chukotka Autonomous Okrug - 12130

- Yamalo-Nenets Autonomous Okrug - 12130 This amount is used to accrue regional coefficients and percentage bonuses for work experience in the regions of the Far North and equivalent areas. The total amount of minimum wage must not be lower than the subsistence level of the working-age population in the Yamalo-Nenets Autonomous Okrug for the second quarter of the previous year (11,280)

- Yaroslavl region - Not lower than 12,130 for employees of regional organizations

They pay “black wages” and what this means for an employee – how to protect your rights in Novosibirsk in 2022

What do minimum wages and PM affect?

The minimum wage in Russia is equal to the minimum wage for the working population, determined by the Ministry of Labor for the 2nd quarter of the previous year. The indicators have important social significance: a family in which the income per member is less than the subsistence minimum is considered low-income.

The Novosibirsk region has its own regulations establishing regional benefits, payments, benefits for the poor. These are local laws dated December 15, 1995 No. 29-OZ, dated October 6, 2010 No. 533-OZ.

Recognition of a low-income family in Novosibirsk and the region is the basis for:

- to register for housing under social rent;

- to pay monthly child benefit;

- to assign benefits to the poor;

- for an annual payment for the purchase of school and writing supplies for large families;

- to conclude a social contract to provide targeted assistance.

The minimum wage is important for establishing the minimum wage, as well as for calculating disability benefits for those workers who did not have labor income in the billing period.

How is the minimum wage set?

The indicator is established by federal legislation and applies to all Russian regions, including Novosibirsk. Subjects of the Russian Federation, in accordance with regional laws, can establish a regional minimum wage for all areas of labor activity, except for organizations financed from the state budget. The minimum wage must be reviewed every year.

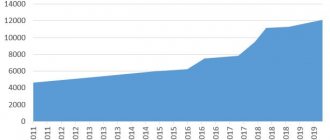

After amendments to the law, which came into force on January 1, 2022, the minimum wage is calculated based on the indicators of the second quarter of last year.

Minimum wage from January 1, 2022 in Russia

The government decree dated June 30, 2021 states that the cost of living next year will be 11,950 rubles. The corresponding document was published on July 1, 2021 on the official Internet portal of legal information.

The document states that from January 1, 2022, the cost of living per capita in the Russian Federation as a whole will be 11,950 rubles. Moreover, for the working population it will be equal to 13,026 rubles, for pensioners – 10,277 rubles, for children – 11,592 rubles. The resolution will come into force on January 1, 2022 and will be valid until the end of the year.

As you know, now the minimum wage and the cost of living are set in relation to the median wage and median per capita income. Thus, the minimum wage is equal to 42% of the median salary, which is calculated by Rosstat. And the cost of living is 44.2% of the median per capita income.

At the beginning of the summer, the Ministry of Labor presented preliminary calculations according to which the minimum wage next year will be 13,617 rubles. According to Rosstat, in 2022 the median income increased to 27,036 rubles (+2.5% compared to 2022), and the median salary reached 32,422 rubles (+6.4% compared to 2022).

Let us remind you that the subsistence minimum is used to assess the need of Russians to receive state social assistance and other support measures. In turn, the minimum wage determines the minimum salary that a full-time employee can expect to earn.

One of the key tasks of the state is to ensure a decent level of income for public sector workers, since it is difficult to attract a qualified specialist to a low-paid position.

To achieve this, the government uses certain support measures:

- Increasing the minimum wage. In 2022, it was possible to bring the minimum wage to the national average subsistence level - its size reached 12,792 rubles. In 2022, the minimum wage will increase by 1,108 rubles. (8.6%) and will amount to 13,890 rubles.

- Indexation carried out every year (Article 130 of the Labor Code of the Russian Federation). Depending on the level of inflation, the indexation coefficient changes annually.

- The May presidential decrees provide for bringing the wages of public sector employees to the average wage in the region.

In addition to taking the above measures, budgetary organizations are gradually moving to a new remuneration system, uniform for all sectors of the national economy.

According to the current regulations, the salaries of employees of budgetary organizations depend on the level of the regional budget. For state employees at the federal level, salaries are set centrally. These include employees of scientific and medical centers, university, theater, and museum workers. Remuneration for doctors, teachers, and employees in similar positions is under the control of local authorities and may depend on the specific institution.

It turns out that in the same industry, earnings in a subsidized and less wealthy region are less than in a “richer” region. The goal of the ongoing reform is to equalize incomes, introduce a system that takes into account the regional coefficient, the minimum regional subsistence level.

Initially, the State Duma considered a draft law to increase the minimum wage in 2022 to 13,617 rubles. But the President of the Russian Federation said that adjustments would be made in the near future to increase the minimum wage and the cost of living, and therefore asked to hold this bill in the second reading.

According to the Constitution of the Russian Federation, the minimum wage should not be less than the subsistence level. Both this and the minimum wage are planned to be increased in 2022 by 8.6%, which will be approximately 1,100 rubles. It turns out that the minimum wage next year is 13,890 rubles.

The federal minimum wage in 2022 will be 13,890 rubles. The minimum wage by region and industry may have different values, but it must be no less than the federal minimum wage.

Subjects of the Russian Federation have the right to set their own minimum wage through special regional agreements. Usually the regional minimum wage is higher than the federal minimum (Article 133.1 of the Labor Code).

In some areas of the economy, regional authorities set separate minimum wages, which are specified in industry agreements. Their texts are published on the website of the Ministry of Labor, as well as in the journals “Social and Labor Studies”, “Business of Russia” and in the newspaper “Solidarity”.

Important! The regional minimum wage cannot be less than the federal one. A regional coefficient and a percentage premium are calculated on this amount (Resolution of the Constitutional Court of December 7, 2017 No. 38-P). Also, when checking the minimum wage, additional payments for overtime hours, for work on holidays and weekends are not taken into account if the employee worked outside the normal working hours. Additional payments for combining, expanding the service area, increasing the volume of work are also not included in the calculation (Resolution of the Constitutional Court dated April 11, 2019 No. 17-p, Letter of the Ministry of Labor dated September 4, 2018 No. 14-1 / OOG-7353).

Multifunctional center - Novosibirsk

Organization

| Name of institution | Multifunctional center - Novosibirsk |

| Area | Dzerzhinsky |

| What is the address | Novosibirsk region, Novosibirsk, Dzerzhinsky Avenue, 16 |

| [email protected] | |

| Region | Novosibirsk region |

| Operating mode | Monday-Friday: 09:00 to 18:00 |

| Phones | 052 |

| Website | https://www.mfc-nso.ru |

Multifunctional center - Novosibirsk

Where to get it

| Establishment | Multifunctional center - Novosibirsk |

| What area is it located in? | Leninist |

| In what region of the Russian Federation is it located? | Novosibirsk region |

| Operating mode | Monday, Wednesday-Friday: from 08:00 to 18:00 Tuesday: from 08:00 to 20:00 Saturday: from 09:00 to 14:00 |

| Address | Novosibirsk region, Novosibirsk, Gorsky microdistrict, 8a |

| [email protected] | |

| Organization website | https://www.mfc-nso.ru |

| Phone number | 052 |

Combination of positions - how to register in Novosibirsk in 2022

Multifunctional center - Novosibirsk

Where to apply

| Name | Multifunctional center - Novosibirsk |

| Area | Kalininsky |

| Address | Novosibirsk region, Novosibirsk, Krasnykh Zori street, 1/2 |

| In what region of the Russian Federation is it located? | Novosibirsk region |

| Website | https://www.mfc-nso.ru |

| Operating mode | Monday, Wednesday-Friday: from 08:00 to 18:00 Tuesday: from 08:00 to 20:00 Saturday: from 09:00 to 14:00 |

| [email protected] | |

| Phone numbers | 052 |

How to properly increase wages to the new minimum wage in the regions

If an employee’s salary for full working hours is less than the new minimum wage or the regional or industry minimum, then it must be increased from January 1, 2022. Here are the options:

Option No. 1: salary increase

This option is not very convenient. After all, every time the minimum wage changes, you will have to issue not only an order to increase wages, but also change employment contracts, staffing schedules and other documents that mention the size of salaries. But if this option suits you, then we offer sample documents for downloading:

ALSO .

Multifunctional center - Novosibirsk

Establishment

| Name of institution | Multifunctional center - Novosibirsk |

| In what area | Pervomaisky |

| Telephone | 052 |

| [email protected] | |

| Institution website | https://www.mfc-nso.ru |

| Organization address | Novosibirsk region, Novosibirsk, Marata street, 2 |

| Region of the Russian Federation | Novosibirsk region |

| Working hours | Monday, Wednesday-Friday: from 08:00 to 18:00 Tuesday: from 08:00 to 20:00 Saturday: from 09:00 to 14:00 |

How to apply for compensation after dismissal in Novosibirsk in 2022

Multifunctional business center - Novosibirsk

Where to go

| Name | Multifunctional business center - Novosibirsk |

| In what area | Zaeltsovsky |

| Phones | 052 |

| What is the address | Novosibirsk region, Novosibirsk, Dusi Kovalchuk street, 177 |

| [email protected] | |

| Region | Novosibirsk region |

| Website | https://www.mfc-nso.ru |

| Operating mode | Monday-Thursday: from 09:00 to 18:00 Friday: from 09:00 to 17:00, break: from 13:00 to 14:00 |

Multifunctional center - Novosibirsk

Organization

| Name | Multifunctional center - Novosibirsk |

| What area is it located in? | Leninist |

| Site | https://www.mfc-nso.ru |

| Region | Novosibirsk region |

| When it works | Monday, Wednesday, Friday: from 08:00 to 18:00 Tuesday, Thursday: from 08:00 to 20:00 Saturday: from 08:00 to 17:00 |

| What is the address | Novosibirsk region, Novosibirsk, Truda Square, 1 |

| [email protected] | |

| Phones | 052 |

Combination of positions - how to register in Novosibirsk in 2022

New federal minimum wage from 2022: new amount

According to Article 1 of the law on the minimum wage (dated June 19, 2000 No. 82-FZ), from January 1, 2022, the minimum wage is fixed by federal law in the amount of the subsistence level of the working population in Russia as a whole for the second quarter of the previous year.

Order No. 550n of the Ministry of Labor and Social Protection of the Russian Federation dated August 24, 2018 determined the living wage for Russia as a whole for the second quarter of 2022. The order sets the cost of living for the second quarter of 2018 on average per capita at 10,444 rubles. Living wage:

- for the working population is determined in the amount of 11,280 rubles;

- for pensioners – 8,583 rubles;

- for children – 10,390 rubles.

This means that in 2022 the minimum wage for the working population will be 11,280 rubles.

Note that from May 1, 2022, the minimum wage was 11,163 rubles per month. It turns out that from January 1, 2022 it will increase by only 1%. (up to RUB 11,280). Only 117 rubles.

Also see “What is affected by the new minimum wage from January 1, 2022“.

Multifunctional center - Novosibirsk

Establishment

| Name of institution | Multifunctional center - Novosibirsk |

| What area is it located in? | Railway |

| In which region of the Russian Federation | Novosibirsk region |

| [email protected] | |

| Telephone | 052 |

| Site | https://www.mfc-nso.ru |

| What is the address | Novosibirsk region, Novosibirsk, Lenin street, 57 |

| When it works | Monday-Friday: 09:00 to 18:00 |

Multifunctional business center - Novosibirsk

Where to contact

| Establishment | Multifunctional business center - Novosibirsk |

| In what area | October |

| Operating mode | Monday, Wednesday, Friday: from 08:00 to 18:00 Tuesday, Thursday: from 08:00 to 20:00 Saturday: from 08:00 to 17:00 |

| Region of the Russian Federation | Novosibirsk region |

| Site | https://www.mfc-nso.ru |

| What is the address | Novosibirsk region, Novosibirsk, Zyryanovskaya street, 63 |

| [email protected] | |

| Phone number | 052 |

They pay “black wages” and what this means for an employee – how to protect your rights in Novosibirsk in 2022

New minimum wage from January 1, 2022 in Russia: table by region

The minimum wage in the Russian Federation, or abbreviated as the minimum wage, is the minimum threshold of material remuneration for a worker (employee), which, according to our legislation, a worker must receive for the work he has performed and for one month.

At the same time, the legislation says the following - the minimum wage (minimum wage) means the amount before taxes.

If, after all the mandatory deductions of personal income tax and others, the employee receives a salary less than the minimum wage, this cannot be considered a violation of the law.

A worker’s salary cannot be less than the minimum wage if:

- he worked a full month;

— conscientiously fulfilled all the duties required in the employment contract;

If, according to the employment contract, the employee did not work the entire month, but only part of it, the salary, and this is natural, may be less than the minimum wage.

Why else is a minimum wage needed? It is used not only to calculate wages for the working population, but also to pay all kinds of social benefits, the same unemployment benefits or benefits for children, disability, maternity leave, etc.

The size of the minimum wage (minimum wage) is reviewed annually and quarterly, and it is influenced by several factors at once and we will deal with them, first of all these are:

— the price level in Russia (increased over the past year), and the cost of living is recalculated accordingly;

— the unemployment rate is also taken into account;

— inflation for the previous year is taken into account;

The key factor in setting the minimum wage is the subsistence level, that is, the required minimum level of income that is necessary to satisfy the basic needs of one person.

The minimum subsistence level usually includes a consumer basket, which consists of a set of goods and food products, as well as mandatory services (utilities), payments and fees.

The regional cost of living may differ from the federal one, be both lower and higher, because in our country and in its different places of residence, prices can differ significantly for the same services and food products.

The amount of the minimum wage at the federal level can be changed more than once a year, but revised quarterly, focusing primarily on the changed prices of the past quarter.

The minimum subsistence level for the working population of Russia most directly affects the establishment of the federal minimum wage.

In many regions of Russia, local authorities set their own minimum wage depending on their own economic capabilities, the characteristics of the living conditions of the local population, price nuances, and also taking into account the geographical location, for example, taking into account the difficult climatic factor.

All employers without exception in the region to which it applies are required to focus on the regional minimum wage (minimum wage).

from 15,350.40 ₽ to 15,990 ₽

It is best to check with your employer, the local Ministry of Labor or a trade union to determine which coefficient is used in your organization.

If an employee has a percentage increase in wages for work experience in the Far North and equivalent areas, then the minimum wage of such an employee will be even higher.

By the way, according to Article 133_1 of the Labor Code of the Russian Federation, the minimum wage for employees of organizations financed from the federal budget is always equal to the federal minimum wage, i.e. 12,792 ₽. Regional increasing coefficients are also applied for this size.

This means that from January 1, 2022, the minimum payment for sick leave will increase to 13,890 rubles. According to the minimum wage, temporary disability benefits are considered for those whose work experience is less than 6 months, who have had no income for the last 2 years, or whose average monthly salary is less than the minimum wage. Sick leave benefits are reduced to the minimum for those who violate the regime prescribed by the doctor.

Workers whose income is below this figure will need to add. Of course, we are talking about accrued wages, that is, before withholding income tax, provided that the monthly working hours are fully worked.

Maternity benefits for pregnancy and childbirth and children's benefits for caring for a child up to 1.5 years depend on the minimum wage.

In addition to the federal minimum wage, which is valid throughout Russia, some regions determine their own minimum wage or regional minimum wage. If the authorities of your region have established their own minimum wage, be guided by it when issuing wages. It doesn't affect anything anymore.

If the regional minimum wage exceeds the minimum wage, then it should be used.

We found the minimum wage for some regions. If yours is not on the list, write in the comments, we will try to help.

To make sure that the minimum wage is up to date, follow the link in the table.

In 2022, individual entrepreneurs pay 40,874 rubles in fixed insurance premiums + 1% of income over 300 thousand rubles - this amount does not depend on the minimum wage.

From 2022, insurance premiums do not depend on the minimum wage. In 2022 and earlier, the fixed part was calculated using the formula:

Contributions for the year = minimum wage x 12 x 31.1%

For the calculation, we used the federal minimum wage, which was in effect at the beginning of the year. On January 1, 2022, the minimum wage was 7,500 rubles, so for 2022, individual entrepreneurs paid 27,990 rubles + 1% of income over 300 thousand.

The size of the minimum wage in 2022 for employers means the need to control payments to employees. If they have worked the entire time limit and fulfilled all obligations in full, then they must receive a salary not lower than a certain level. And this level has several meanings.

The minimum wage is directly determined at the federal level. And first of all, we need to focus on these indicators. The 2022 federal minimum wage is a general indicator. However, there are values by region and even by industry. All this must be taken into account as a whole.

In particular, the minimum wage in Russia from January 1, 2022 will be 12 thousand 792 rubles. Moreover, in the regions a separate minimum wage is established. It is fixed at the level of constituent entities of the Russian Federation by special agreements. According to Article 133 of the Labor Code of the Russian Federation, the minimum wage is traditionally higher than the federal one.

Individual industries have their own payment standards. They are indicated in the corresponding agreement. The texts of the latter are published on the website of the Ministry of Labor of the Russian Federation and in a number of official publications. It is advisable to keep track of all this.

If the employee’s payment is less than the regional minimum wage in 2021, then the employer is obliged to establish an additional payment. You can do this in 2 ways:

- Enlarge report.

This means that with any change in the minimum wage, a corresponding order will need to be issued, the texts of employment contracts will need to be changed, and the staffing table will need to be redone. It is also necessary to understand the remaining documents in which the salary is indicated.

- Indicate the additional payment in a separate act.

The fact is that the entire salary is compared with the minimum wage, not the bare salary. That is, other payments and allowances are taken into account. This option is simpler because it eliminates the need to redo a huge number of documents.

The second option is preferable, because it is enough to fix the compensatory additional payment only once. Accrual will occur automatically. That is, the employer will only need to look at the table of minimum wages by region of Russia, find the required indicator, and calculate the amount.

Important: it is worth considering that additional payment to the regional minimum wage is not required if the employee did not work all the days as scheduled for various reasons. However, the shortcoming in this case must have good reasons. And they need to be identified.

The increase in the minimum wage in 2022 affected all employers in one way or another. If they charge their employees less than the required amount, they may face fines and other troubles. That’s why it’s so important to follow the Government’s resolution on the minimum wage.

But if problems arise with the calculations, you can always turn to professionals on a specific issue. You can also completely delegate all issues related to accounting to specialists.

Photo 2109

2320