In order for the company to operate as efficiently as possible, it is very important to correctly distribute responsibilities between employees and give them the correct amount of time to complete each task. For these calculations, economic indicators such as “man-hour” and “man-day” are used. They make it clear how quickly a particular employee is able to complete the task. Every entrepreneur should be able to calculate them correctly, because these indicators not only help to correctly distribute the load, but are also extremely necessary when production is expanding. With their help, they determine how profitable it will be to increase the staff, what positions more people can be hired for, etc. In addition, man-hours and man-days are needed to fill out various reports to the tax office. Therefore, you need to be able to calculate these indicators. How? We'll tell you below.

general information

Information on working hours is contained in Article 91 of the Labor Code of the Russian Federation.

This period refers to the period of time when a person performs labor functions. By law, the standard duration of this time is 40 hours per week. In practice, such working hours are rarely used. Firstly, in many enterprises the production process cannot be stopped, so the work schedule there is shifting. Secondly, some categories of employees cannot work for such an amount of time, since by law they are entitled to a reduction in labor standards. These are minors, people with disabilities, etc.

However, the rules for calculating working hours stipulate that a 40-hour working week should be taken as a basis.

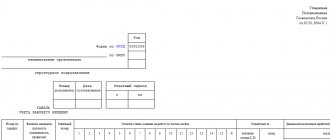

What are the forms for recording time worked?

Until 2013, organizations were required to follow government standards. Management now has the legal ability to develop their own templates. However, a large number of companies continue to use those offered by Goskomstat. The reasons for their popularity are convenience, structure and functionality. They are also easy to use and do not require specialists to develop additional skills. To create a report card, in particular, forms T-12 and T-13 are used. The latter is created using automated systems.

Documents are filled out in one copy by the responsible person. After closing, the signatures of the HR representative and the manager are affixed. Afterwards the paper is transferred to the accounting department. It is kept in the archive for the next 5 years. However, there are exceptions. If at least one employee worked in difficult conditions, the period is increased to 50.

Calculation for a month

Determining labor standards allows employers to correctly set work schedules, keep records of hours worked, pay wages and distribute vacations. Knowing how to correctly calculate the standard working time, you can easily determine how many hours an employee must work. One calendar month is often taken as the billing period.

Working hours are calculated as follows:

- First you need to find out how many working days there are in the selected accounting period, and how many weekends, holidays, etc.

- Next, the number of working hours per day is calculated. At the same time, do not forget that the normal length of a working week is 40 hours. This means you calculate the number of hours per working day. Example: 40/5=8.

- The number of days in a month when a subordinate works must be multiplied by 8 hours.

An example of such a calculation could be as follows:

- Let's say there are 21 working days in June.

- The authorized employee must determine the standards by which the personnel will work.

- For this, the time standard will be calculated using the following formula: 21*8=168 hours. This is exactly how much each subordinate must work on average.

To correctly calculate working hours, you need to check the production calendar. It contains all the information about the number of work shifts for each calendar month.

Services and methods of recording working hours

Digital technologies are actively used in organizing activities at enterprises. Now there is no need to do everything manually and independently supervise all personnel. There are services that allow management to carry out these procedures much faster and more conveniently. The software also reduces the likelihood of errors due to human factors.

The software is installed on the employee’s computer and automatically performs calculations. After a certain period, the person in charge only needs to look at the report generated by the application on the use of working time.

This section will discuss the most popular and effective solutions.

Crocotime

Among the advantages of this software is the ability to integrate it with IP telephony. Pairing with calendars and controllers – devices for recording inputs and outputs – is also available. Another advantage is that accounting is not only online, but also offline.

The program automatically generates time sheets for each employee and analyzes his productivity. For example, a manager can see moments when he was distracted and did not complete his tasks. Based on this data, it will be possible to determine the feasibility of issuing an award or further cooperation.

You can enter information manually or automate this process. The application is not free, but there is a trial period. It helps evaluate the quality of the software and ease of use. In the future, each employee will need to pay 250 rubles per month.

Kickidler

This is an alternative option. It features the ability to track activity on the monitor using live streaming. What happens on the screen can also be recorded.

Another advantage is the restrictions that are defined in the settings. For example, write down a list of sites prohibited from visiting. If a violation occurs, the system notifies the administrator.

The timesheet with the procedure for recording working hours is filled out automatically. This allows you to quickly generate a document for transmission to the accounting department.

A manager can gain remote access to a subordinate’s computer at any time.

The trial period lasts for the first 7 days. Potential users can carefully study the OP and identify strengths and weaknesses. The price of further use depends on the timing. For example, if you sign up for a paid subscription for 3 years at once, the cost per employee will be 183 rubles per month.

Time Doctor

This program allows you to take screenshots from screens. They can be used to monitor the quality of performance of duties. One of the features is the ability to control an employee’s actions on the Internet. There is a version of the application for both personal computers and smartphones. This expands the functionality of the software and helps companies with different profiles use it. As in the case of analogues, automatic creation of a time sheet is provided. You can also generate a single report on working time tracking from several.

Another strong point is the long trial period. Its duration is two weeks. One of the disadvantages is the high price – $10 per user. But the developer guarantees good discounts when connecting a large number of computers.

Quarterly calculation

It is also important to know how to calculate the standard working hours for a quarter, that is, for three months. The standard working day is 8 hours. All calculations are carried out very simply. First you need to determine what the labor norm is in each month.

Calculation example:

- Let's assume that there are 168 work hours in July. It remains to calculate the amount of time only for the next 2 months.

- There are also 168 working hours in August, and 160 in September.

- This means that the norm for the quarter is as follows: 168+160+168=496 hours.

If necessary, a similar calculation can be carried out for each quarter. Most often, company management uses the definition of the norm on a quarterly basis.

Holidays in Russia in 2022

The Labor Code of the Russian Federation in Article 112 establishes holidays that are considered non-working days throughout Russia:

- New Year holidays - from January 1 to January 8;

- Christmas - January 7;

- Defender of the Fatherland Day – February 23 and 24 (falls on Sunday);

- International Women's Day - March 8 and 9;

- Vesta and Labor Day - May 1, May 4-5;

- Victory Day – May 9, 11;

- Russia Day – June 12;

- National Unity Day – November 4th.

Subjects of the Russian Federation are allowed by Article 6 of the Labor Code to establish by their regulations additional holidays, including religious ones, when residents of a given territory are exempt from work.

Calculation for a year

Labor rationing is an important procedure that allows you to determine the number of hours that employees are required to work. When making calculations, the calendar year is often used as the accounting period. Hours are calculated in two ways. You can use the method that is used to calculate the quarter. You just need to determine the amount of the working period for all 12 months.

Another procedure for determining the norm was established by order of the Ministry of Health and Social Development of the Russian Federation No. 588n. The calculation is carried out using the formula: 40/5*number of working days per year. After this, from the resulting number you should subtract the number of hours that the employees did not work. We are talking about reductions before the holidays.

When determining the norm for 2022 according to the billing period, the following nuances should be taken into account:

- Sunday must be counted as a day off. And it doesn’t matter how many days of rest a subordinate actually has per week - 2 or 1. For some categories of subordinates, it is possible to transfer the day of rest to another date.

- Don't forget about official holidays, which are not used in calculations.

- When a holiday falls on a day of rest, the day off is postponed. These rules do not need to be used only when calculating labor standards for January.

- The length of the working day before a holiday is always reduced by 1 hour.

When making calculations, you must follow these rules, otherwise the final number of hours will be incorrect.

Why do you need to track employee working hours?

Proper monitoring makes it possible to solve several problems at once. First of all, it is monitoring compliance with the established routine. In addition, the data in the time sheet is used to calculate salaries for employees. Depending on the number of hours, the accounting department generates payments.

The information also allows you to evaluate the effectiveness of specialists.

Another reason is economic. Using the information obtained, managers can calculate labor costs and optimize the system in the future.

Types of charts

The length of the working day most often depends on production needs. Therefore, it is rare that employers can provide their staff with a standard 5-day period. The most commonly used modes are:

- 24 hour shift with several days off.

- Work shift with 10 or 12 hours of work. Then the staff has more days off than planned.

- Shift is 12 hours, with alternating day and night shifts.

Note: these are not all the regimes that able-bodied citizens have to face. But, based on the specifics of some professions, a regular 8-hour shift may be disadvantageous for both management and the subordinates themselves.

https://www.youtube.com/watch?v=YtMOJEFrytA

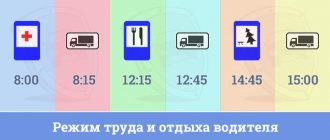

Shift mode

This work schedule raises many questions. It is somewhat more difficult to analyze. However, there are situations when there is no alternative way out. For example, if the length of a weekday exceeds the norm prescribed in the Labor Code. This is how restaurants and many other establishments operate. This routine is also necessary when the equipment is used around the clock.

When hiring a new employee, this type of employment is already indicated in the contract. It is more difficult if you need to switch the entire enterprise or individual workers to shift mode. Then the algorithm of actions is as follows:

- the manager issues the appropriate order;

- changes are reflected in the collective agreement;

- shift schedules are developed;

- execution of additional agreements, personnel are notified and give consent at least two weeks in advance;

- familiarization with the schedule is carried out.

When creating a schedule, you need to take into account legal restrictions on pre-holiday days and the length of shifts for certain categories of citizens.

Production calendar

In order for managers to correctly calculate labor standards, there is a special document. This is the so-called production calendar, which takes into account all working days, as well as rest days, including holidays. This document is not a normative act and therefore has no legal force.

However, it is very useful for accountants or HR employees whose responsibilities include keeping time records and calculating earnings. The production calendar can be found online and used at your discretion. Also, the law does not prohibit organizations from independently developing such documents. To do this, you can take a regular calendar and indicate working days and weekends in it in accordance with established rules.

Methods for keeping track of employee working hours

There are many options for how to carry out the procedure described in the article. The most common ones will be discussed in this section.

The first is a paper journal. This is the "classic" approach that has been used for many decades. Its essence lies in the fact that information is stored on paper. Although many organizations still use them, this type has become obsolete.

Another option is video surveillance. It can be automated or have an employee at the control panel. The second option makes the system more efficient. The employee will monitor compliance with internal regulations and record violations by staff. The advantage of this approach is the ability to assess the productivity of each specialist in performing tasks. The downside is the need to purchase additional equipment.

Another way is to use tables in Excel or Google services. The main advantage is ease of use. It is enough to create a template, and then enter the numbers in each accounting period. Also, the company does not incur additional costs. But this approach only works in small companies. When the staff consists of several dozen people, it is necessary to introduce automation.

This is a complex process, so you should entrust it to professionals. It is best to contact. We specialize in ready-made solutions for business. You can purchase the necessary software and equipment on our website.

Accounting programs have proven themselves. Most of them provide a function that allows specialists to keep track of working hours. This makes it possible to save time resources and reduce the risk of errors.

A method that large organizations resort to is the installation of controllers. Each employee is given a magnetic card. To enter the territory of the enterprise, it must be attached to the scanner. The equipment serves to carefully monitor the hours and minutes that a person spent at the workplace. But this approach also has weaknesses. First of all, this is the high cost of the equipment. Therefore, small firms cannot afford it. Repairing devices is also expensive, which entails additional costs. In addition, during the maintenance period, personnel will not be able to reach their workplaces. Another drawback is the rather high probability of losing the card.

Another solution is the use of CRM systems. They have a built-in automatic timer. It starts when a worker starts the application. When turned off, the counter stops. Pros: simplicity and reliability. The weak point is the possible confusion at first. Many will forget to start or turn off the program.

Calculation of the maximum possible fund

The maximum possible working time is another one of the most informative indicators. This takes into account not only rest periods and holidays, during which the working population of the country does not legally attend work, but also vacations. According to the Labor Code of the Russian Federation, the latter period is 28 days. Every officially employed citizen can count on this amount. And it is this parameter that is required to calculate the maximum possible fund.

You will need to perform the following steps for calculation:

- the number of days attributable to the vacation of one employee is multiplied by the number of people enrolled in the company's staff;

- subtract the resulting value from the amount of the nominal fund.

Expert commentary

Gorbunova Olga

Lawyer

The maximum FRF more accurately indicates the number of working hours (or days) an employee is potentially available for work. If, after calculating the actual time worked, a large difference is revealed, this will indicate that labor time is being allocated ineffectively.