Normative base

Federal Law of December 25, 2018 N 481-FZ “On Amendments to Article 1 of the Federal Law on the Minimum Wage”

Regional agreement on the minimum wage in St. Petersburg for 2019

A time-based remuneration system is a form in which an employee’s salary is calculated from a salary or tariff rate, taking into account the time actually worked.

Salary is the established amount of remuneration for the performance of labor duties, accrued for a fully worked month.

Daily or hourly rate is a fixed amount paid per day or hour worked.

Features of calculating time wages

The starting point for calculating wages can be :

- hourly rate,

- daily tariff rate,

- official salary.

Their sizes are determined in accordance with the Regulations on remuneration and are reflected in the organization’s staffing table . The latter is drawn up in form T-3 (approved by Decree of the State Statistics Committee of January 5, 2004 No. 1) and is approved by order of the head of the organization.

In this case, the name of the employee’s position, specified in the staffing table, must be identical to the name specified in the employment contract. An employee will not be hired for a position that is not included in the staffing table (in accordance with letter from Rostrud dated January 21, 2014 No. PG/13229-6-1).

The actual time worked by the employee is calculated using a special time sheet compiled by a human resources employee, accountant or other employee who is granted the appropriate authority by the head of the organization.

In particular, it states:

- reasons for the employee’s absence from work (determined according to the relevant documentation),

- working time in part-time mode,

- overtime work time.

Such a report card is filled out monthly and in one copy, either taking into account all appearances and absences at the workplace, or taking into account only violations of the organization’s operating hours (no-shows, lateness, etc.).

At the end of the calendar month, they proceed directly to payment calculations taking into account the total quantity:

- days or hours worked,

- lateness and no-shows,

- weekends and holidays.

However, if a separate document is used to calculate wages, for example, a payroll sheet, it is enough to only reflect the accounting of the use of working time .

Depending on the form of recording working hours, the time sheet form T-12 is used - when recording manually, or T-13 - when recording on a computer. Both were approved by Decree of the State Statistics Committee of January 5, 2004 No. 1.

The finished timesheet is signed by the employee who filled it out, then by the head of the organization, and finally transferred to the accounting department, where wages are directly calculated in accordance with the system adopted in the organization.

Areas of use

As a rule, a time-based form of remuneration is used when wages are set for management staff, office employees, and employees serving the main production of departments. But this is not a complete list of areas of application of PSOT.

This mode of settlements with personnel is used precisely in those areas of activity that are focused on the quality of the work performed, and not on the quantity of products produced or services provided. This approach to the labor remuneration system encourages employees to constantly improve, raise their level of qualifications, and systematically take educational courses and trainings. After all, the higher the level of knowledge, the more earnings.

PSOT is mainly used in the following areas of activity:

- The work of a specialist is regulated by a certain rhythm or cycle.

- The work is carried out on production conveyor lines.

- Activities for repair and maintenance of equipment, machines, units.

- These types of work in which quality is more valuable than the volume of work performed.

- The type and areas of activity in which it is impossible to determine the quantitative factor of the work performed or the implementation of this procedure is irrational is difficult.

- A type of work, the result of which is not the main indicator of his work activity.

For example, PSOT is established in relation to medical workers, teachers and teaching staff, accountants, and personnel officers. In most cases, the salary of state and municipal employees is also determined according to this regime.

In simple words, it is quite difficult to calculate the quality of work of an accountant or personnel officer in the reporting month. After all, no one will count how many orders for the organization were prepared, how many reports were drawn up, how many documents were drawn up and how many transactions were recorded in accounting. Moreover, it is irrational to evaluate the quality of operations performed. This will take an incredible amount of time. In addition, it turns out that if in the reporting month there were fewer of the same orders, then earnings should be lower.

What is a time wage?

Each enterprise has its own specific form of remuneration. This is due to the specifics of production. For example, in one company employees are paid for the quantity of products they produce, and in another - for the time actually worked.

The manager himself determines what kind of salary he will have in production. But nevertheless, this issue is coordinated with the trade union organization. Every employee who gets a job can find out about his salary in advance. The type and form of monthly payments is prescribed in the employment contract.

In the Russian Federation, only 30% of enterprises have time-based wages, although, for example, in the USA this figure has exceeded 70%. Now let’s decipher the concept itself.

Time wages are a type of salary where the amount of employee payments directly depends on the hours, days or months actually worked. This takes into account special working conditions and qualifications of specialists.

Simply put, a time-based form of remuneration is when wages are paid not for the quantity (volume) of work performed, but for the time it is performed. That is, the hours of work that were spent on completing a particular task are paid.

Salaries are calculated based on the completed working time sheet. There, the standard keeper indicates how many hours or days the employee worked.

Time-based wages: registration of labor relations

The conditions for accrual and payment of remuneration must be established when an employee is hired. They are prescribed in the employment contract, drawn up in two copies. The employment contract must stipulate the amount of salary or tariff rate, allowances and bonuses.

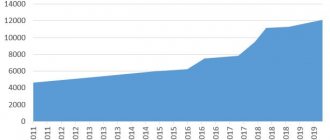

If a time-based wage system is used, the amount of remuneration for a fully worked month should not be less than the established minimum wage. The federal minimum wage as of January 1, 2019 is 11,280 rubles.

If in the subject of the Federation in which the company operates, a regional minimum wage has been established, then when establishing the minimum remuneration for an employee, it is necessary to focus on it. For example, in St. Petersburg, the Regional Agreement on Minimum Wages dated November 28, 2018 No. 332/18-C established the minimum remuneration for performing labor duties in a fully worked month in the amount of 18,000 rubles, while the tariff rate (salary) of a worker is 1- 1st category should not be less than 13,500 rubles, which is significantly higher than the federal value.

Definition and varieties

The name of the system actually explains its essence, which lies in the proportion between remuneration and time spent on the labor process. A time-based wage system is a scheme that establishes the relationship between the cost of labor and hours worked.

In practice, types of time-based wage systems are used, established individually for each member of the team, group, sector or company:

- A simple time-based form of payment is the calculation of wages for the total number of hours of work at an established “tax” (tariff). The tariff set for a monthly interval is called a salary.

- A time-based individual remuneration system is the formation of remuneration for an established individual task for a specific period of time, conditionally dividing salary calculation into two components:

- for man-hours worked;

- for completing a specific task.

- The time-based bonus form is the calculation of a salary component according to a time sheet and a bonus component accrued when certain indicators are met. If the indicators that serve as the basis for bonuses are not met, then the remuneration is equal to the standard one, calculated on the basis of the tariff.

- Time-based piecework wages are the quintessence of fundamental systems, including:

- a fixed constant in accordance with the time spent;

- remuneration in a variable amount, determined by the volume of production and sales.

Types of time-based wages are relevant when the time factor is dominant, the impossibility of highlighting personal contribution in the final aggregate result, and the lack of linkage of the volume of work with the financial indicators of the business entity.

The system is used in cases of economic incomparability of the result and the labor process, which is advisable when forming remuneration for administrative staff, since there is often an inversely proportional relationship between the volume of work and financial indicators. For example, if an enterprise is unprofitable, an accountant must calculate the amount of losses down to the penny (standard work), come up with an explanation to the fiscal authority and make proposals for overcoming the financial crisis.

Time-based form of remuneration: varieties

Time-based payment is not always payment based only on a fixed salary. The following varieties are distinguished:

- simple time-based;

- time-bonus.

In a simple form, time-based wages depend on the established tariff rate (salary) and on the actual time worked. It is rational to establish such a payment regime in relation to specialists whose work is not focused on the final result. Also, PSOT in a simple form is mainly established in relation to workers whose work is aimed at maintaining the main production.

If a simple PSOT is established for an employee, then you should not count on additional types of additional payments. For example, no bonuses or incentive payments are provided.

With a simple PSOT, there is a simple and understandable dependence on the actual time worked and the norm of the general work schedule. For example, an employee who has worked the full working time can count on a full salary. And having worked only part of the established norm, a specialist can only claim a proportional amount of the official salary.

A similar calculation procedure is provided if a tariff rate is established for the employee, and daily or hourly does not matter. The number of days or hours worked is calculated, and then the result is multiplied by the approved rate. This is the distinctive feature.

The main advantage of a simple PSOT is its stability. That is, the employee is confident that he will receive his salary regardless of the quality of work. But this calculation mode has a significant drawback. The hired specialist completely lacks any motivation. In simple words, you can work carelessly and not take any active action - the salary will be the same.

It is to increase the motivation and interest of employees in work that the employer adds a bonus surcharge to the salary or tariff rate. This approach forms a separate type of PSOT.

Bonus-time wages are the calculation of remuneration based on the tariff rate, as well as a bonus set as a percentage of the official salary. The size of the bonus is established in the bonus regulations, the collective agreement of the organization or the order of the manager. Sometimes this procedure for calculating remuneration is called piece-time wages. This is not entirely correct, since the piecework system assumes a salary depending on the result of work, and not on the amount of time worked.

Type of time salary

There are several types of time wages.

Simple time wages - paid to employees whose responsibilities include maintaining the functioning of production. The employee does not in any way influence the final result of the product produced or service provided. The employee receives a fixed salary for the time worked in production. However, he cannot count on any additional payments.

Salaries can be calculated by period. Hours, days or months can be taken into account.

Example. The employee has a tariff rate of 60 rubles/hour, he worked 50 hours, therefore his salary will be 60 * 50 = 3000 rubles.

If an employee works for a month (works out a monthly standard of hours) and has a fixed salary, then his salary will correspond to the size of his salary.

The advantage of a simple time-based salary is its stability, but the disadvantage is the lack of motivation for the employee (everyone receives the same salary, regardless of work results). A simple time wage is very rare.

A time-based bonus salary is when an employee, in addition to his salary, receives additional payments in the form of bonuses for fulfilling certain conditions. For example, the absence of disruptions in work, no emergency situations were allowed, exceeding the plan, manufacturing products without defects, saving raw materials and energy resources, etc.

When calculating this type of remuneration, not only qualitative indicators are taken into account, but also quantitative ones.

The conditions for payment of bonuses and their amount are specified in the employment contract. Bonuses include the following payments: 13th salary, additional payments for length of service, holiday bonuses, etc.

Calculated as follows:

Basic salary + Bonus = Time-based bonus salary

The basic salary means the salary or tariff rate multiplied by the number of hours actually worked per month.

The bonus amount is a percentage of the basic salary.

Example. The employee has worked out the standard hours and his salary is 10 thousand rubles. For a job well done, he is entitled to a 10% bonus. We make calculations:

10,000 + 10,000*0.1 = 11,000 rubles.

With time-based bonus wages, the employee is interested in quickly and efficiently completing the task. Awards are a great way to stimulate and motivate the team.

Time-based bonus with a specific task - at enterprises where this form of wages is in effect, monthly payments to employees consist of payment for hours actually worked and additional payments (in the form of bonuses) for completing assigned tasks.

This is a type of time-based bonus salary. With this type of remuneration, the manager can count on a guaranteed result in completing the task, because the amount of the employee’s salary depends on this. And this is the main motivator for fast and high-quality work.

Piece-time wages - sometimes it is called mixed, because it combines piece-rate and time-based wages.

This salary is most often received by people whose activities are related to trade. For example, sellers, in addition to payment for actually being at the workplace, are accrued interest on products sold.

This condition interests employees, and they strive to increase the level of sales.

Time-based wages: examples

Example 1.

The employee is given a salary of 30,000 rubles. He has a standard schedule of a five-day workweek with an eight-hour workday. In May 2022, the employee worked 15 days. According to the schedule - 20 working days. Let's determine the salary to be paid:

Example 2.

Let’s use the conditions of example 1 with the change that the employee is not given a salary, but a daily tariff rate of 1,500 rubles.

Example 3.

Let's add a condition. In addition to the salary, the employee was given a bonus in the amount of 10% of the salary for May by order of the manager.

Piecework and time-based forms of remuneration

Unlike the system we are considering, piecework wages provide for the payment of remuneration for the final result of work:

- production of a certain number of products;

- number of operations performed;

- achieved amount of work.

With this form of payroll, the employee is interested in producing a larger volume of final products, so the employer does not need to analyze how effectively working time is used. As a rule, this form of payroll is used to calculate remuneration for employees of the main production.

Types of time-based wages

It is worth noting that it will not be possible to find time-based wages in a “pure” form anywhere in an enterprise, since many employers use only its variations. According to the Labor Code of the Russian Federation, the following types of time-based wages exist in the state:

- time-based simple;

- time-bonus;

- time-based with the standard task;

- other types (in particular, time-based piecework and salary).

In order to distinguish one type from another, to understand how this or that salary is calculated, it is necessary to study each of them separately.