Simple and with examples about why VAT is not a business expense, why suddenly the tax is shown in the balance sheet as part of assets and how to calculate how much needs to be paid to the state.

Hi all! Alexey Ivanov is with you, the knowledge director of the online accounting “My Business” and the author of the telegram channel “Accounting Translator”. Every Friday on our blog at The Clerk I talk about accounting. I started with the basics, then I will move on to more complex matters. For those who are just preparing to become an accountant, this will help them get to know the profession better. Seasoned chief accountants should look at familiar categories from a different angle.

The procedure for calculating and paying value added tax is regulated by Chapter 21 of the Tax Code. The object of VAT taxation is the sale of goods, works or services in Russia. The obligation to pay tax for companies and entrepreneurs arises upon sale. It is equated with the gratuitous transfer of assets, the provision of work and services for one’s own consumption within the organization.

Sales of goods, performance of work, provision of services

When selling goods, works or services, the VAT base is revenue, that is, the value under the contract taking into account excise taxes (if any) and excluding VAT (clause 1 of Article 154 of the Tax Code of the Russian Federation). The same rules apply to gratuitous and barter transactions.

It is generally accepted that the contract sets prices that correspond to market prices. Sometimes the tax office checks transactions and charges additional taxes if it finds irregularities in prices.

Example . In January 2022, Lobster LLC shipped a batch of finished products to the buyer, subject to VAT at a rate of 20%. The cost of the batch is 50,000 rubles. The price under the contract and the tax base for VAT is 100,000 rubles (VAT not included). The amount of VAT is 20,000 rubles.

In accounting you need to reflect the implementation as follows:

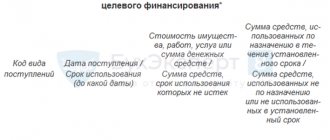

| Wiring | Sum | The essence of the operation |

| Dt 62 Kt 90-1 | 120 000 | Revenues from sales |

| Dt 90-3 Kt 68 | 20 000 | VAT charged on revenue |

| Dt 90-2 Kt 43 | 80 000 | The cost of finished products sold is written off |

The moment of determining the tax base, also known as the date of VAT calculation, is the date of shipment, completion of work, provision of services and/or day of payment. Depends on what happened before. If you received an advance payment, then the base must be determined twice.

How to determine the shipment date

- in the standard case - the date of the first goods or delivery note drawn up in the name of the buyer or carrier;

- shipment in parts - the date of the invoice drawn up when the last part was shipped;

- the goods are not shipped - date of transfer of ownership;

- sale of real estate - the day of transfer to the buyer according to the deed, etc.

How to determine the date of service provision

- in the standard case - the date on which you signed the certificate of services rendered;

- continuing services - the last day of the month or quarter in which the services were provided.

How to determine the date of completion of work

- in the standard case, the date on which the customer signed the work acceptance certificate.

Commentary to Art. 167 Tax Code of the Russian Federation

All organizations must determine the VAT tax base at the time of shipment of goods (transfer of works, services and property rights). This is established by subparagraph 1 of paragraph 1 of Article 167 of the Tax Code of the Russian Federation.

In a special procedure, VAT is charged on goods that are not shipped or transported. They are considered shipped at the moment when title to the goods passes to the buyer. This norm is stated in paragraph 3 of Article 167 of the Tax Code of the Russian Federation. A typical example of such goods is real estate. They are not shipped or transported, because according to Article 130 of the Civil Code of the Russian Federation, immovable things include land plots, subsoil plots, isolated water bodies and everything that is firmly connected to the land, that is, objects whose movement without disproportionate damage to their purpose is impossible, in including forests, perennial plantings, buildings, structures, unfinished construction projects. And in accordance with Article 131 of the Civil Code of the Russian Federation, ownership and other real rights to immovable things, restrictions on these rights, their emergence, transfer and termination are subject to state registration in the unified state register by bodies carrying out state registration of rights to real estate and transactions with it. Article 223 of the Civil Code of the Russian Federation states that in cases where the alienation of property is subject to state registration, the acquirer’s right of ownership arises from the moment of such registration, unless otherwise provided by law.

According to Article 2 of the Federal Law of July 21, 1997 N 122-FZ “On state registration of rights to real estate and transactions with it,” state registration is the only evidence of the existence of a registered right. The registered right to real estate can only be challenged in court. State registration of rights is carried out throughout the Russian Federation according to a system of records of rights to each piece of real estate in the Unified State Register of Rights to Real Estate and Transactions with It. The date of state registration of rights is the day the corresponding records of rights are made in the Unified State Register of Rights.

Thus, VAT on the sale of real estate should be charged at the time of state registration of ownership of it by the buyer.

VAT on construction and installation work performed for own consumption should be charged at the end of each tax period. Let us remind you that the tax period for VAT is equal to a month. And for taxpayers (tax agents) with monthly quarterly amounts of revenue from the sale of goods (work, services) excluding VAT not exceeding RUB 2,000,000, the tax period from 2006 is established as a quarter.

Until January 1, 2006, taxpayers were required to increase the VAT tax base by the amount of advance payments received. From January 1, 2006, receipt of prepayment is recognized as the moment the tax base arises, along with the day of shipment. This is indicated in subparagraph 2 of paragraph 1 of Article 167 of the Tax Code of the Russian Federation. However, according to paragraph 13 of Article 167 of the Tax Code of the Russian Federation, if the taxpayer - manufacturer of goods (work, services) receives payment, partial payment on account of upcoming deliveries of goods (performance of work, provision of services), the duration of the production cycle of which is more than six months, the taxpayer - the manufacturer of the specified goods (work, services) has the right to determine the moment of determining the tax base as the day of shipment (transfer) of the specified goods (performance of work, provision of services). However, for this it is necessary to organize separate accounting of transactions carried out and VAT amounts on purchased goods (work, services), including fixed assets and intangible assets, property rights used to carry out operations for the production of goods (work, services) with a long production cycle and other operations. The list of goods (works, services), the duration of the production cycle of which is more than six months, and for which VAT is not required to be charged at the time of receipt of advance payment, is approved by the Government of the Russian Federation.

Having received an advance payment, the taxpayer - manufacturer of goods (works, services) with a production cycle exceeding six months must submit to the tax authorities simultaneously with the tax return:

— contract with the buyer (a copy of such a contract, certified by the signature of the manager and chief accountant);

- a document confirming the duration of the production cycle of goods (works, services), indicating their name, production time, name of the manufacturing organization, issued to the specified taxpayer-manufacturer by the federal executive body exercising the functions of developing state policy and legal regulation in the field industrial, defense-industrial and fuel-energy complexes, signed by an authorized person and certified by the seal of this body.

The accrual of VAT at the time of receipt of the prepayment does not relieve the taxpayer from the obligation to accrue this tax at the time of shipment of goods (transfer of work, services or property rights). This is the requirement of paragraph 14 of Article 167 of the Tax Code of the Russian Federation. At the same time, VAT accrued on the prepayment is accepted for deduction (clause 8 of Article 171 and clause 6 of Article 172 of the Tax Code of the Russian Federation).

Receiving an advance

Include in the database the entire amount of the prepayment, including VAT (clause 1 of Article 154 of the Tax Code of the Russian Federation). There is no need to determine the basis of the advance payment if the product (work, service):

- are not subject to VAT;

- VAT rate 0%;

- production cycle is more than 6 months (clause 1 of article 154 of the Tax Code of the Russian Federation).

If you do not know how many goods shipped as an advance payment will be subject to VAT, charge tax on the entire amount received.

The moment of determination is the day of advance payment and the day of shipment. VAT accrued on the advance payment can be deducted (Articles 171, 172 of the Tax Code of the Russian Federation).

VAT tax base when receiving an advance

If the organization received an advance from the buyer, it must be included in the tax base. The following articles will help you understand how to do this correctly, what documents to draw up and what postings to make:

- “What is the general procedure for accounting for VAT on advances received?”;

- “VAT on advance payments: examples, postings, complex situations.”

In business activities, a situation may arise when an organization has shipped products or completed work, and only then received payment. After some time, the selling organization, in agreement with the buyer, reduces the price and, accordingly, the cost of the product (work). Next, a correction invoice is issued.

What to do with VAT in this situation, read the article “The cost of paid shipment has decreased? You have an advance and VAT .

When receiving advances for products (work, services) with a long production cycle, VAT may not be calculated on advances, but provided that these products (work, services) are included in the list approved by the Government of the Russian Federation.

Read about changes to this list in the material “The government has updated the list of goods with a long production cycle .

When receiving the deposit, do not forget to charge VAT. Details in the material “The deposit is included in the VAT base upon receipt.”

Sale of property accounted for with “input” VAT

If you bought equipment to use in your work, but then decided to sell, then you did not deduct VAT and accounted for the property at cost with “input” VAT.

In this and similar cases, determine the base using the formula (clause 3 of Article 154 of the Tax Code of the Russian Federation):

NB = Sales price with VAT and excise taxes - Purchase cost of property or residual value on the balance sheet (with VAT)

The moment of determination is the day of receipt of the advance payment and the day of shipment.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Tax deductions for VAT

The VAT presented by the supplier is accepted for deduction. True, after a desk tax audit. To do this, three conditions must be met.

- Valuables were purchased or services were provided in order for you to use them in activities that are subject to VAT. That is, in order to sell something. For example, if you buy spare parts to assemble a refrigerator, VAT is deductible. But if it’s to repair refrigerators for free under warranty, then no.

- There is a special supplier document in which the VAT amount is highlighted. This is usually an invoice. The requirements for its registration are established in Art. 169 of the Tax Code of the Russian Federation. Forms - Decree of the Government of the Russian Federation dated December 26, 2011 N1137.

- There is a primary document on the basis of which the purchase is accepted for accounting. For example, an invoice.

The validity of deductions is an issue that has long been troubling the state. Back in the early 2010s, recovering VAT by purchasing documents from a supplier without actual delivery was a normal business practice. “Paper” VAT still exists, but it has become much more difficult for those involved in this business to work. And the volume of the market itself has decreased several times. It was the breaks in the VAT chains that prompted the Federal Tax Service to create the most automated tax administration system in the world. But this is a topic for another discussion.

Transfer of goods (works, services) for own needs

The tax base must be determined only if expenses for goods (work, services) cannot be taken into account when calculating income tax (clause 1 of Article 159 of the Tax Code of the Russian Federation). For example, for goods for corporate events.

The base depends on whether you sold identical or similar goods (work, services) in the previous quarter:

- if yes, the tax base is equal to the sales price in the last quarter, taking into account excise taxes and excluding VAT;

- if not, the tax base is equal to the market price with excise taxes and excluding VAT.

The moment the base is determined is the day of transfer for one’s own needs.

Tax base for VAT when performing construction and installation work for your own needs

The general rule for the formation of the tax base in this situation is set out in paragraph 2 of Art. 159 of the Tax Code of the Russian Federation. But, despite the apparent simplicity of this operation, practicing accountants often have questions about determining the tax base when performing construction and installation work for their own needs.

The answers to them can be found in the article “What is the procedure for accounting and deducting VAT during the construction of fixed assets?” .

The most difficult thing when calculating the amount of VAT to be charged is to correctly determine the tax base. In addition to the above, there are many other articles on our website that will help you correctly calculate this indicator.

In order not to get confused in the rules relating to VAT, and to keep abreast of the latest changes in legislation, often look into the “VAT” and the “VAT Tax Base” .

Transfer of property rights

Include in the tax base all income received from the transfer of property rights (clause 2 of Article 153 of the Tax Code of the Russian Federation).

Exceptions are listed in Art. 155 Tax Code of the Russian Federation. For example, transfer of rights to residential buildings, garages, parking spaces, etc. The tax base should be determined using the formula:

NB = Sale price of property right including VAT - Costs for purchasing the right

The moment of determination is the day of assignment of rights under the contract or the day of state registration (if the contract must undergo it).

Transportation

Include in the database the cost of transportation without VAT (clause 1 of Article 157 of the Tax Code of the Russian Federation). Transactions that are exempt from taxation under Art. 149 of the Tax Code of the Russian Federation, do not include it in the database.

We remind you that shipments may be subject to VAT at different rates. In this case, determine the base for each rate separately.

The moment of determination for rates of 20% and 10% is the day of receipt of the advance payment and the day of provision of the service. If a service has a 0% rate, determine it for the last day of the quarter in which you collected documents to confirm this rate.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

In the letter, the Ministry of Finance spoke about the moment of determining the tax base for VAT.

As a general rule, at the time of determining the tax base for VAT, a company must charge value added tax on a business transaction.

The moment of determining the tax base is the earliest of the following dates (clause 1 of Article 167 of the Tax Code of the Russian Federation):

— day of shipment (transfer) of goods (works, services), property rights;

- or the day of payment, partial payment on account of upcoming deliveries of goods (performance of work, provision of services).

In other words, if there was no prepayment, then, as a general rule, VAT should be charged on the day of shipment. If there was an advance payment, then the VAT tax base will have to be determined twice: on the day the advance payment was received and on the date of shipment (Clause 1, 14, Article 167 of the Tax Code of the Russian Federation).

In the commentary letter, the Ministry of Finance confirmed its long-standing position - the date of shipment (transfer) of goods is the date of the first drawing up of the primary document in the name of the buyer or carrier for the delivery of goods to the buyer. A similar point of view is expressed in letters of the Ministry of Finance of Russia dated December 30, 2014 No. 03-07-11/68585, dated March 23, 2012 No. 03-07-11/80, dated November 9, 2011 No. 03-07-09/40, dated June 22. 2010 No. 03-07-09/37, Federal Tax Service of Russia dated December 13, 2012 No. ED-4-3/ [email protected]

The Ministry of Finance also says that the date of shipment is the date of drawing up the first primary document, drawn up, among other things, using an electronic digital signature. Moreover, this rule applies not only to VAT, but also to income tax (letter dated March 23, 2012 No. 03-07-11/80).

Source documents

Each fact of economic life is documented in primary documents (Clause 1, Article 9 of the Federal Law of December 6, 2011 No. 402 “On Accounting”).

The Ministry of Finance emphasized that the date of shipment for VAT purposes is the drawing up of the first primary document drawn up:

- either in the name of the buyer;

- or in the name of the carrier for delivery of goods to the buyer.

Let's consider two situations.

Situation 1.

There are three companies: supplier, seller and buyer. The goods are shipped from the supplier's warehouse and delivered to the buyer by the supplier.

In this case, the date of shipment of goods, according to the Ministry of Finance, is the date of the primary document drawn up by the seller in the name of the supplier for delivery of the goods to the buyer. In this regard, invoices for goods shipped from the supplier’s warehouse and delivered by this supplier to the buyer are issued by the seller no later than five calendar days, counting from the date of preparation of the specified document (letter of the Ministry of Finance of Russia dated November 9, 2011 No. 03-07-09/40 ).

Situation 2.

The goods are sent by rail. It is delivered to the railway by car by the carrier company. In this case, the date of shipment will be the day the goods are transferred to the carrier company, that is, the date indicated on the documents issued for this carrier (resolution of the Federal Antimonopoly Service of the Ural District dated October 21, 2008 No. F09-7599/08-S2 in case No. A76-4251/ 08, by Decision of the Supreme Arbitration Court of the Russian Federation dated February 17, 2009 No. 1437/09, the transfer of this case to the Presidium of the Supreme Arbitration Court of the Russian Federation was refused).

The product is delivered in parts

In practice, there are situations when any complex technological equipment is supplied not immediately as a single complex, but in parts. In this case, the date of its shipment is considered to be the date of drawing up the primary document issued to the buyer or carrier when shipping the last part of the goods, regardless of the transfer of ownership of the goods (letter of the Ministry of Finance of Russia dated January 13, 2012 No. 03-07-11/08). That is, the moment of determining the tax base for VAT will be the day the primary document is drawn up when the last part of the goods is shipped.

In letter dated June 21, 2007 No. 03-07-11/177, the Ministry of Finance also indicates that in the case when the goods are delivered to the buyer not entirely, but by commodity payment nodes, the date of its shipment for VAT purposes is recognized as the day of drawing up the primary document when the latter is shipped -payment node.

The goods have not been shipped, but title has transferred

If the goods are not shipped or transported, but there is a transfer of ownership of this product, then in accordance with paragraph 3 of Article 167 of the Tax Code, such a transfer of ownership for the purpose of applying VAT is equivalent to its shipment. In this case, the date of shipment of such goods is recognized as the date of transfer of ownership specified in the document confirming the transfer of ownership. The Russian Ministry of Finance came to this conclusion in letter No. 03-07-11/473 dated November 1, 2012. The explanation dealt with the property transferred to the claimant by the bailiff.

The goods have been shipped, but title has not been transferred

In one of the clarifications, the Ministry of Finance considered the following situation. According to the terms of the agreement concluded between the supplier and the buyer, the supplier is obliged to supply, install and commission complex technological equipment. Ownership of this equipment, as well as the risk of its accidental loss or damage, passes to the buyer only after the supplier has installed it, commissioned it and transferred it to the buyer according to the acceptance certificate, which is drawn up after the completion of commissioning work. The period for installation and commissioning works is 51 working days from the date of delivery of the equipment to the buyer’s site. The single price of the contract includes the cost of the equipment itself, its delivery, unloading and movement to the installation area on the buyer’s territory, the cost of installation and commissioning.

The taxpayer had a question: when to determine the tax base for VAT.

The Ministry of Finance indicated that if, under an agreement for the supply of equipment, the equipment was shipped in one tax period, and the ownership of this equipment passes to the buyer in another tax period (after the supplier completes installation and commissioning), VAT should be charged in that tax period in which in which the equipment was shipped, regardless of the moment of transfer of ownership (letter dated March 11, 2013 No. 03-07-11/7135). In other words, it is necessary to charge VAT without waiting for installation and transfer of ownership.

The courts also note that the date of shipment of products does not depend on the moment of transfer of ownership determined by contracts for the supply of these products (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated January 16, 2003 No. F03-A51/02-2/2813).

Shipment date for completed work

The moment of determining the tax base for VAT is also important in relation to the work performed. In this case, the day of shipment is considered to be the date of completion of the work.

According to the Ministry of Finance, the document confirming the delivery of the results of work and, accordingly, the fact of their completion, is the work acceptance certificate. In this regard, in order to determine the moment of determining the tax base for value added tax, the day of completion of the work should be recognized as the date of signing the work acceptance certificate by the customer.

If the customer has not signed the work acceptance certificate, but there is a court decision, from which it follows that the terms of the contract for the performance of work by the contractor have been fulfilled, the day the work was performed for VAT purposes should be considered the date the court decision entered into legal force (letter from the Ministry of Finance Russia dated 02.02.2015 No. 03-07-10/3962).

Provision of intermediary services

Intermediaries include in the base only their remuneration and other income received for the execution of the mediation agreement (clause 1 of Article 156 of the Tax Code of the Russian Federation). Do not include money or goods that you received from the customer or transferred to him in the database.

The intermediary does not include his remuneration in the base if he participates in the following transactions (clause 2 of article 156 of the Tax Code of the Russian Federation):

- rents out premises to foreign companies and citizens accredited in the Russian Federation;

- sells medical products from the list of the Government of the Russian Federation;

- provides funeral services;

- sells folk arts and crafts goods.

The moment of determination is the day of receipt of the advance payment and the day of provision of the service.

Import

The tax base for imports into the Russian Federation (except for imports from the EAEU) is equal to the sum of customs value, duties and excise taxes (clause 1 of Article 160 of the Tax Code of the Russian Federation).

Determine the tax base for each group of goods of the same name, type and brand. If there are excisable goods within the group, divide the groups into excisable and non-excisable (clause 3 of Article 160 of the Tax Code of the Russian Federation).

The VAT base for imports from the EAEU is equal to the price of goods under the contract, taking into account excise taxes. Determine it on the date the goods are accepted for accounting.

If under the agreement all payments are made in foreign currency, then recalculate the proceeds into rubles to determine the VAT base. Conduct a recalculation at the rate of the Central Bank of the Russian Federation in force at the time of determining the base (clause 3 of Article 153 of the Tax Code of the Russian Federation).

Keep records of transactions subject to VAT in Kontur.Accounting. Add documents to the service, keep records and determine the tax base. The service will automatically fill out a VAT return based on the generated transactions. All new users can use Accounting for free for 14 days.