Operating principle of the Plato system

According to clause 3 of the Rules, toll collection is carried out using a toll collection system (TCS), which is understood as a set of technically and technologically related objects that ensure, for the purposes of toll collection, collection, processing, storage and automatic transmission of data on the movement of a vehicle on roads public use of federal significance (hereinafter referred to as highways).

The toll collection system acquired the name “Plato”. According to its developers, this is a derivative of the phrase “payment per ton”.

Let's consider accounting and tax accounting of transactions related to payments to the Platon system.

Main points of the scheme

Any company that has trucks at its disposal and is in the general taxation system must pay duties to the Platon system. However, after changing Article 270 of the Tax Code of the Russian Federation, this fee was included in the transport tax. This caused difficulties for organizations in paying advances on transport tax for the first quarter of 2022.

It's quite simple. Now the fee charged for damage to public roads caused by vehicles with a maximum permissible weight of more than 12 tons is included in other taxes. With the exception of the amount by which the transport tax was reduced, and which must be paid directly to the budget.

Article 270. Expenses not taken into account for tax purposes

Legal grounds

The rationale for this form of calculation and reflection of Plato’s fee is several articles and their points from the Federal Law and the Tax Code. Thus, Federal Law No. 257 provides for the admission of heavy trucks with a maximum permitted weight exceeding 12 tons only if their owners pay a tax fee that compensates for the damage caused by vehicles to public roads.

Federal Law No. 249, adopted in 2022, introduced several provisions into the tax legislation that provide for the specifics of calculating taxes, both on profit and transport tax, due to the fact that vehicle owners make additional payments. However, these features apply to those legal relations that were concluded starting from 01/01/2016, and expire no later than December 31 of the next year.

It is worth paying attention to paragraph 48.21 of Article No. 270 of the Tax Code. By virtue of it, when determining the tax base, expenses are not taken into account for income tax, including the fee by which the transport tax was reduced, which was calculated for heavy cargo for the reporting period.

Shape Features

As already indicated, in connection with Plato, in 2022 a new form of declaration came into force, fixing the amount of transport tax. You can fill out the document either electronically or in writing. The new form of the form, according to the letter of the Federal Tax Service dated December 29, 2016, can be used for reporting both for 2020 and for last year.

The main change was the appearance of a deduction for Plato in the transport tax return for 2022. The new form allows companies that paid into the Plato system last year to reduce the amount of transport tax. When filling out the form, you must indicate both the amount of the deduction and its code. Payments in the Platon system have code 40200.

It is also worth noting that for heavy loads you no longer need to make advance payments, which means that zeros must be entered in the fields corresponding to the quarters. Before completing and submitting a transport tax return, you need to make sure that Plato has been paid, and also prepare documentary evidence of this fact.

Full Features

First of all, it is worth noting that owners of those vehicles whose mass is more than 12 tons received the opportunity to reduce transport tax for 2020. But it is worth noting that this benefit is valid when paying tax only on a specific heavy vehicle, and not on the entire amount of transport tax accrued for a certain period. Deductions are provided for returns for periods from 2022 to 2022.

Do not forget that Plato for 2022 in the transport tax return is not included in tax expenses in its entirety.

You can only deduct the part by which the amount exceeded the transport tax for a car weighing more than 12 tons for which it was paid. At the same time, there are cases when the amount of deductions is greater than the transport tax, which means that its payment is not required at all.

Also, owners of heavy trucks registered in the registry no longer need to make quarterly advance payments. However, the fields in the declaration remain for them. They must be filled out, but instead of indicating the amounts, you must put one zero in each line.

Filling details

In order to be able to deduct part of the fee paid for Plato from the transport tax return, you need to find the 2020 form. The old option is not suitable because it does not contain lines related to the reflection of payments made to the Plato system. In order to correctly fill out the declaration, you must enter in line code 290 all the fees that were paid into the Plato system account last year.

Next, in line 280 you need to enter the code “40200”, which will mean that deductions are made in connection with the payment of Plato. When calculating liabilities, the amount indicated in line 290 is subtracted from that written in line 300. Lines 023 to 027 do not need to be filled in with anything other than zeros, since they relate to advance payments, the payment for which was withdrawn from the cars - heavy trucks.

You can reduce the transport tax of an LLC on the simplified tax system by transferring the transport tax to the company's expenses. Read the article on how to find out the transport tax debt using your TIN.

Accounting for payments in the Platon system when calculating transport tax

To calculate transport tax for a truck for which payments are made to the Platon system (to compensate for damage caused to roads by trucks with a maximum permissible weight over 12 tons), you must proceed in the following order:

- calculate the tax for the year for the truck in the usual manner;

- calculate the tax payable using the formula (clause 2 of Article 362 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated 08/12/2016 No. GD-4-11/ [email protected] , Ministry of Finance dated 08/25/2016 No. 03-05-06-04/ 49670, dated 08/11/2016 No. 03-05-05-04/47021):

Amount of transport tax per truck payable per year

=

The amount of transport tax per truck calculated for the year

—

Payment to the Platon system paid for this truck, but not more than the accrued amounts

If the result is zero or negative, the tax amount is assumed to be zero.

At the same time, the lessor cannot reduce the transport tax for the truck registered to him by the fee to Plato paid for this truck by the lessee (Letter of the Ministry of Finance dated July 18, 2016 No. 03-05-04-04/41940).

Payment to “Platon” reduces the transport tax payable only on a specific truck and does not affect the amount of tax for other vehicles (Letter of the Ministry of Finance dated August 11, 2016 No. 03-05-05-04/47021).

If the law of the subject of the Russian Federation in which the truck is registered establishes reporting periods for transport tax, then you calculate advance payments for the truck in the usual manner (without reducing the fee to Platon), but do not pay it to the budget (clause 2 of Article 363 of the Tax Code RF, Letter of the Federal Tax Service dated August 12, 2016 No. GD-4-11/ [email protected] ).

How to set up invoice and cost analytics for Plato board

How to set up an invoice and cost analytics for a fee to compensate for damage caused to roads (Plato fee) in “1C: Accounting 8” edition 3.0?

The video was made in the program “1C: Accounting 8” version 3.0.49.27.

The concept of payment for compensation for damage caused to highways was introduced by paragraph 5 of Article 3 of Federal Law No. 257-FZ dated November 8, 2007 (hereinafter referred to as the “Platon” fee). The procedure for collecting the “Platon” fee is determined by Decree of the Government of the Russian Federation dated June 14, 2013 No. 504. According to paragraph 2 of Article 362 of the Tax Code of the Russian Federation, the taxpayer can reduce the amount of transport tax calculated at the end of the tax period in relation to each vehicle (vehicle) by the amount of the “Platon” fee. , calculated in the current period in relation to this fund, that is, apply a deduction.

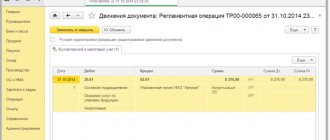

In the 1C:Accounting 8 program (rev. 3.0), a special document is intended for accounting for the Platon fee: Report of the operator of the Platon system

.

Using this document, the user reflects data on the operator’s transfer to the federal budget of funds from the owner (possessor) of the vehicle as a fee depending on the route traveled by each vehicle. The calculation of the amount of transport tax is carried out by a regulatory document with the type of operation Calculation of transport tax

.

The account and cost analytics for the Platon board correspond to the method of reflecting transport tax expenses, which is configured in the Methods of reflecting tax expenses

.

The register is accessed from the Main

(

Settings – Taxes and reports – Transport tax – Methods for reflecting expenses

) or from

the Directories

(

Transport tax – Methods for reflecting expenses

)

.

By default, an entry is entered into this register to assign tax amounts (advance tax payments) for all vehicles to the debit of account 26 “General business expenses” under the expense item Property taxes

.

If this method of reflection corresponds to the method enshrined in the accounting policy of the organization, then to use it it is enough to indicate the division to which the expenses relate.

If the accounting policy provides for a different account for accounting for transport tax expenses, then you can make changes to the existing entry, or enter a new entry into the register with a later validity date.

If for individual vehicles the method of reflecting tax expenses differs from the others, then you need to enter a separate entry in the register where you fill in the details:

- the date from which the reflection method is effective;

- set the switch to the For fixed assets

and indicate the vehicle (

fixed assets

) to which this entry relates; - invoice and analytics of cost accounting for transport tax.

To reduce the transport tax on the Plato fee in the 1C: Accounting 8 version 3.0 program, if the transport tax is greater and less than the fee, see the Directory of Business Transactions. 1C:Accounting 8" in the "Accounting and Tax Accounting" section in 1C:ITS.

Accounting

Postings for accounting payments to the Platon system will be as follows:

| Wiring | Operation |

| On the date of transfer of money to the Platon system | |

| D 76 - K 51 | Money was transferred to the Platon system |

| On the last day of the month | |

| D 20 (23, 25, 26, 29, 44) - K 76 | Expenses reflect fees accrued for trucks in the Platon system. |

Advance payments for transport tax for trucks for which payment is made to the Platon system are not reflected in accounting, since the organization does not have to pay them.

The entry for the calculation of transport tax at the end of the year is made only for the amount of tax payable:

| Wiring | Operation |

| D 20 (23, 25, 26, 29, 44) - K 68 | Transport tax has been charged for the truck (to the extent that it exceeds the amount of payments accrued in the Platon system for this truck for the year) |

If the vehicle is not subject to taxation

All economically justified and documented expenses are taken into account when calculating income tax, except for those specified in Art. 270 of the Tax Code of the Russian Federation (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Consequently, if the transport tax is not paid due to the absence of a taxable object, then the amount of the “Platon” fee is taken into account in expenses that reduce the tax base for income tax in full on the date of accrual of the “Platon” fee (clause 7 of Article 272 of the Tax Code of the Russian Federation) .

If the vehicle is not subject to transport tax, then there is no need to wait for the transport tax to be calculated.

Therefore, in 1C it is necessary:

- do not register the vehicle in the register of information Registration of vehicles , because Calculation of transport tax for this vehicle is not necessary;

- reflect the costs of the “Platon” fee in the document Receipt (act, invoice) transaction type Services (act) similar to the services of third-party organizations.

1C: Franchisee Consultant Accountant

When purchasing a vehicle and registering it with the traffic police, the organization becomes a payer of transport tax (Article 357, paragraph 1 of Article 358 of the Tax Code of the Russian Federation). Transport tax rates are determined by regional legislation; you can find them out at the tax office where the vehicle is registered. At the same time, the base rates for transport tax are determined in Art.

361 Tax Code of the Russian Federation. According to paragraph 1 of Art. 359 of the Tax Code of the Russian Federation, the determination of the tax base depends on the type of vehicle. When purchasing a truck, an organization pays tax based on the formula: Tax base * Tax rate * Reduction factor determined in accordance with clause 3 of Art. 362 Tax Code of the Russian Federation. In addition, this formula includes another indicator that reduces the amount of accrued transport tax - a payment for compensation for damage caused to roads, it is established by Part.

5 tbsp. 3 of Federal Law No. 257-FZ of November 8, 2007 (hereinafter referred to as the “Platon” board).

The procedure for collecting the Platon fee is determined by Decree of the Government of the Russian Federation dated June 14, 2013 No. 504 (hereinafter referred to as the Rules). Owners and owners of vehicles whose maximum permitted weight exceeds 12 tons register them in a special register (clause 5, 38-55 of the Rules). The fee, which is paid through the operator, is indicated in the route map (clause

10(1) of the Rules) or is calculated by the operator automatically using data received from a device installed on the vehicle (clause 7 of the Rules). Every day, the operator transfers to the federal budget an amount that is defined as the amount of payments made by the owners for the routes traveled by vehicles (clause

16 Rules). Upon request, the payer can clarify:

- balance of funds (clause “b” of clause 83 of the Rules);

- the amount of debt to pay the fee (clause “a” of clause 83 of the Rules);

- on operations for the operator to transfer to the federal budget the funds of the owner (possessor) of the vehicle as payment depending on the route traveled by each vehicle (clause 84 of the Rules).

Accounting Calculations for transport tax are reflected in accounting on account 68 “Calculations for taxes and fees”. To do this, a subaccount “Calculations for transport tax” is opened to account 68. As a rule, transport tax relates to expenses for ordinary activities (clause

5 PBU 10/99). The procedure for its reflection in accounting depends on the production or division of the organization in which the vehicle on which the tax is calculated is used. The accrual of the Platon fee is reflected in the following transactions:

- Dt 20 (44) - Kt 76 - the fee calculated for travel is charged to expenses in the Platon system (based on information from the operator upon special request).

- Dt 76 - Kt 51 - advance payment is transferred to the operator (basis - payment slip or other document confirming the transfer).

If this is provided for by the organization’s accounting policy, you can additionally reflect the amount of the fee,