Determination of the tax base Rules for determining the tax base when transferring goods (works, services) for one’s own

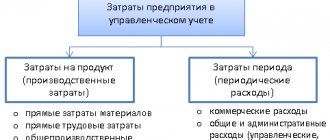

The essence and classification of avoidable production costs. Methods for identifying avoidable production costs. Ensure optimal costs.

08/11/2019 0 20211 8 min. According to the current law, any employer when dismissing an employee is obliged

As a general rule, in Russia all payments must be made in rubles (Article 317

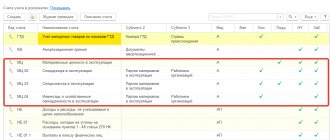

How to write off materials from an off-balance sheet account? Postings for capitalization and write-off from the account. 002

What does this code mean? Tax identification number is a unique code consisting of 12

Home Tax lawyer More than 20 years of general legal experience I will help you defend your rights and

The invoice journal is necessary to record both issued and received documents. This register confirms

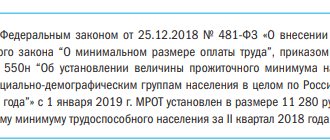

Fines for wages below the minimum wage Violation is punishable by a fine under clause 6 of Art. 5.27 Code of Administrative Offenses

How to fill in the payment basis and other details in the transport tax payment All payment details