Determination of the tax base

The rules for determining the tax base when transferring goods (work, services) for one’s own needs are established in paragraph 1 of Article 159 of the Tax Code of the Russian Federation. In this case, two options are possible:

- in the previous quarter, the organization sold identical (or, in their absence, homogeneous) material assets (similar work, services);

- in the previous quarter, the organization did not sell identical and homogeneous material assets (similar work, services).

If in the previous quarter the organization sold identical (homogeneous) material assets (similar work, services), then VAT must be calculated based on their price (clause 1 of Article 159 of the Tax Code of the Russian Federation).

An example of calculating and reflecting VAT in accounting when transferring goods for one’s own needs. In the previous quarter, the organization sold identical material assets

Alpha LLC (confectionery factory) sells both its own products (confectionery) and purchased goods (food). Goods are accounted for at purchase prices.

In the second quarter, for a corporate holiday - the anniversary of the organization - the following were transferred to the factory canteen:

- from the finished product warehouse - a batch of confectionery products with a cost of 6,000 rubles, subject to VAT at a rate of 18 percent;

- from a warehouse of purchased goods - a batch of food products (pasta, cereals, vegetable oil) with a cost of 2,000 rubles, subject to VAT at a rate of 10 percent (subclause 1, clause 2, article 164 of the Tax Code of the Russian Federation).

In the first quarter, the selling price (excluding VAT) of the same batches of confectionery and food products sold externally by the factory was:

- for confectionery products – 15,000 rubles;

- for food – 3000 rub.

The organization's accountant determined the VAT tax base for the transfer of finished products and goods for their own needs, based on the selling prices of the same batches of confectionery and food products sold by the factory externally in the previous quarter.

On transactions of transfer of finished products and goods for own needs, VAT was charged in the amount of 3,000 rubles, including:

- for confectionery products – 2700 rubles. (RUB 15,000 × 18%);

- for food – 300 rub. (RUB 3,000 × 10%).

In the second quarter, the factory accountant made the following accounting entries:

Debit 29 Credit 43 – 6000 rub. – a batch of own-produced products was transferred to the canteen;

Debit 29 Credit 41 – 2000 rub. – a batch of purchased goods was transferred to the canteen;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 3000 rubles. – VAT payable to the budget has been accrued;

Debit 91-2 Credit 29 – 8000 rub. (6,000 rubles + 2,000 rubles) – the cost of food and confectionery products used for own needs is taken into account as part of other expenses.

If in the previous quarter the organization did not sell identical (homogeneous) material assets (similar work, services), then VAT must be calculated based on the market prices of such goods (work, services) without including tax (clause 1 of Article 159 of the Tax Code of the Russian Federation) .

An example of calculating and reflecting VAT in accounting when transferring goods for one’s own needs. In the previous quarter, the organization did not sell identical (homogeneous) material assets

Alpha LLC (confectionery factory) sells both its own products (confectionery) and purchased goods (food). Goods are accounted for at purchase prices.

In the second quarter, for a corporate holiday - the anniversary of the confectionery factory - the following were handed over to the factory canteen:

- from the finished product warehouse - a batch of confectionery products with a cost of 6,000 rubles, subject to VAT at a rate of 18 percent;

- from a warehouse of purchased goods - a batch of food products (pasta, cereals, vegetable oil) with a cost of 2,000 rubles, subject to VAT at a rate of 10 percent (subclause 1, clause 2, article 164 of the Tax Code of the Russian Federation).

In the first quarter, the factory did not sell identical (homogeneous) confectionery products and food products. According to the financial service of the factory in the first quarter, the market value (excluding VAT) of the same batches of identical confectionery and food products sold by other manufacturers was:

- confectionery products – 15,000 rubles;

- food – 3000 rub.

Alpha's accountant determined the tax base for VAT when transferring finished products and goods for their own needs, based on market prices.

The total amount of VAT payable to the budget for this operation will be 3,000 rubles, including:

- for confectionery products – 2700 rubles. (RUB 15,000 × 18%);

- for food – 300 rub. (RUB 3,000 × 10%).

In the second quarter, the factory accountant made the following accounting entries:

Debit 29 Credit 43 – 6000 rub. – a batch of own-produced products was transferred to the canteen;

Debit 29 Credit 41 – 2000 rub. – a batch of food products was transferred to the canteen;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 3000 rubles. – VAT payable to the budget has been accrued;

Debit 91-2 Credit 29 – 8000 rub. (6,000 rubles + 2,000 rubles) – the cost of food and confectionery products used for own needs is taken into account as part of other expenses.

Write-off of goods

Since there will be no sale of goods, their cost will be reflected in expenses when written off for production.

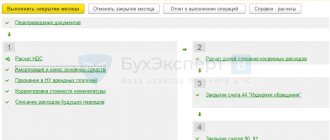

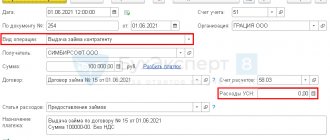

Reflect the write-off of goods that are used as materials using the Request invoice in the Warehouse - Warehouse - Requirement invoice - Create button. You can also issue it on the basis of the document Receipt (act, invoice) , and then the data in it will be filled in automatically.

Check that the fields are filled in:

- Warehouse —the warehouse from which inventory items are written off;

Materials tab :

- Nomenclature - the name of the inventory items being written off;

- Accounting account - the account in which inventory items are recorded, in our example - 41.01 “Goods in warehouses”;

- Quantity - the number of inventory items written off;

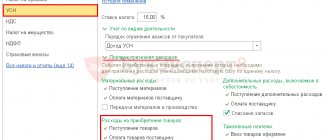

- Expenses (NU) - Accepted .

Cost Account tab :

- Cost account - an account for writing off materials, in our example - “General business expenses”;

- Cost items - an article from the directory Cost items: Type of expense - Material costs .

Postings according to the document

The document generates the posting:

- Dt Kt 41.01 - the cost of materials is written off as general business expenses.

The document generates movements according to the Expenses register under the simplified tax system :

- a registration record with the type Expense and the status Not written off for the amount of expenses on account 41.01.

The document generates movements according to the register Book of Income and Expenses (Section I) :

- registration record for expenses of the simplified tax system for the amount of written-off materials and VAT.

Product Traceability: New Questions Answered (Part 1)

Product traceability

is a system for recording and storing information about imported goods from other countries. She started acting relatively recently. Imported goods are now also traceable according to a government-approved list. Products are assigned a batch registration number. Transactions with goods in accordance with RNPT are entered into the traceability system using electronic document management. New details have appeared in invoices, and the use of EDI has become mandatory.

In this article we have collected the most important, common and popular questions about product traceability.

What to do when purchasing a traceable product for your own needs?

Goods are subject to traceability if they meet certain conditions. This rule also applies to goods from the list purchased for own needs before 07/08/2021.

If, after the specified date, any operations (for example, sales or disposal) are carried out with a traceable product previously purchased for its own needs, then the organization must obtain a RNPT. This must be done before the transaction is completed by submitting a notification of balances to the Federal Tax Service of Russia.

Subsequently, information about transactions with traceable goods is reflected in the appropriate reporting - in a VAT return or a report on transactions with traceable goods, indicating the received RNPT. In this case, such reports are submitted no later than the 25th day of the month following the reporting period.

When providing services, how to reflect the transfer of traceable goods if the contract does not provide for the preparation of a separate invoice for it?

The issuance of an electronic invoice for the sale of traceable goods is provided for by the norms of the Tax Code of the Russian Federation. This procedure does not depend on the presence or absence of relevant provisions in the contract with the customer.

If, as part of the provision of services to a customer who is a participant in the circulation of traceable goods, traceable goods are transferred without them losing their original properties, then such goods do not leave the traceability system. Accordingly, the customer must separately account for such goods, together with the RNPT belonging to them, for traceability purposes until their actual disposal or subsequent sale.

The transfer of traceable goods during the provision of services must be reflected in the electronic invoice by filling out the traceability details.

Let's look at an example: when installing a video surveillance system, three monitors are given to the customer. The following procedure for filling out an invoice is legal:

1) in line 1 in column 1a - “Installation of a video surveillance system.”

Next in subline 1 to line 1:

- in column 11 - RNPT1

- in column 12 – 796

- in column 12a – pcs.

- in column 13 – 1

in subline 2 to line 1:

- in column 11 – RNPT2

- in column 12 – 796

- in column 12a – pcs.

- in column 13 – 2

2) separating monitors into independent product items in line 2 with further indication of traceability details, as indicated in option “1”.

What should I do if the seller, when selling a traceable item, issued a paper invoice and not an electronic one?

When selling goods according to the List, approved. By decree of the Government of the Russian Federation, the seller is obliged to issue an invoice in electronic form. An exception is provided for the following cases:

- sales of traceable goods to individuals for personal, family, household and other needs not related to business activities, as well as to payers of professional income tax;

- sales and movement of traceable goods from the territory of the Russian Federation in accordance with the customs procedure for export (re-export);

- sale and movement of traceable goods from the territory of the Russian Federation to the territory of another state - a member of the EAEU.

In this case, the buyer of traceable goods is obliged to ensure receipt of invoices in electronic form via telecommunication channels through an electronic document management operator.

There is a transition period until July 1, 2022, during which liability for violations in the field of traceability legislation is not provided.

In the absence of an electronic invoice, there will be no negative consequences for the parties to the transaction. The buyer has the right to claim input VAT for deduction based on a paper invoice with completed traceability details. Moreover, even if issued on paper, such an invoice can provide the buyer with information about traceability details, which is very important for the full functioning of the traceability system and reporting. However, it is advisable to request an electronic invoice from the seller in accordance with legal requirements.