The essence and classification of avoidable production costs

Ways to Identify Avoidable Manufacturing Costs

Ensuring optimal production costs is the most important task of the head of the financial and economic service of any manufacturing company. Practice shows that without systematic control on his part, production costs tend to increase, which is often economically unjustifiably high.

Therefore, work to reduce production costs must be carried out, firstly, constantly, and secondly. using various methods, since the composition of such expenses is also diverse. One such method is to identify and reduce avoidable manufacturing costs. This allows us to significantly reduce the cost of manufactured products and thereby increase their competitiveness in the sales market.

Basic and overhead costs

Based on the economic role in the production process, costs are divided into basic and overhead.

The main costs are those directly related to the production (technological) process of manufacturing products, performing work or providing services. In other words, the main costs include expended resources, the consumption of which is associated with the production of products (works, services), - for example, materials, wages of production workers, depreciation of fixed assets, etc.

Overheads are recognized as costs that arise in connection with the organization, maintenance and management of production.

For example, general production and general economic expenses - maintenance of the management apparatus, depreciation and repair of fixed assets for workshop or general plant purposes, taxes, costs of recruiting and training personnel, etc.

Accounting and distribution of costs to determine costs

Methods and solutions.

Cost data underlies strategic decisions for your company in pricing policy, product strategy, sales channel strategy, etc. A mistake in this area can lead to large material losses.

The correctness of the chosen method for obtaining information plays an important role here. It is important that the method remains correct and relevant. If suddenly your method lags behind changes in the external and internal environment, then it is quite capable of ruining the company.

Thanks to a competent management accounting system, you can obtain correct and timely data on the cost of manufactured products or services, orders and contracts. At the same time, by comparing the cost with the price, you can estimate the profitability of certain products, clients, etc.

Cost Allocation

Let's compare two methods for estimating the cost of cost objects: the traditional method and ABC analysis.

Traditional method

Costing involves three ways to distribute costs.

Path 1. Formation of an overhead pool.

Overheads are allocated and grouped together. In the best case, at this step these expenses will be grouped by cost centers (pools) or by departments (service, management). Further, in this case, it will be possible to apply different factors for allocating overhead costs to cost objects to different pools.

Path 2. Transferring the cost of direct costs to cost objects.

The transfer of direct cost costs is usually carried out in accordance with raw material consumption standards or labor standards.

Path 3: Allocate overhead costs to cost objects.

This step is the subject of criticism of the traditional method of costing. This distribution can be carried out:

- with the distribution of overhead costs among products in proportion to certain indicators (this includes direct labor costs, machine time, etc.);

- without allocating overhead costs to products. Overhead costs are paid from gross profit (manufacturing margin).

The occurrence of overhead costs is influenced by a certain set of characteristics of a cost object. The traditional method selects the factor with the highest weight and ignores other causes of overhead.

In turn, this results in selected cost objects with strong characteristics absorbing a large amount of overhead costs. In reality, on the contrary, cost objects with a lower value of the distribution factor will receive less overhead costs, although they may be the main reason for their occurrence.

As a result, it turns out that cost objects of the first type perform a kind of role as “profitability donors” for objects of the second type. That is, in practice, this system can hide the unprofitability of one product and underestimate the profitability of another.

According to the traditional method, even if the distribution of overhead costs to cost objects is carried out with serious errors, the cost information will not contain a significant error. Accordingly, management decisions will be quite effective. However, this method of calculation is not so popular in the modern world. Now companies are striving to obtain more accurate calculations while minimizing risks.

Cost distribution in ABC analysis

The method is called activity-based costing - ABC (activity-based costing).

Here, in addition to “costs” and “cost objects,” the concepts of “resources” and “operations” are used. To conduct ABC analysis, the following classification of operations is necessary:

- main operations

(supply, production, sales, etc.); - service operations

(providing information technology, personnel management operations, repair of production equipment, accounting); - Management operations

are operations that serve the purposes of managing basic and service operations.

There are six ways to distribute costs using the operation-oriented costing method.

First way

Allocation of overhead costs to resources.

Here the cost of overhead is transferred to the cost of resources. In this case, the full current cost of owning a unit of resource is determined: the cost of a position, the cost of equipment, etc.

In practice, one cost item is often transferred to several units of resources. For example, rent for office space must be allocated to the cost of the positions whose workplaces are located in the premises. Then, cost distribution coefficients are used here, which are called “cost drivers”. This is the main indicator of the level of costs: for rent, this is the area of the premises occupied by a given employee; for the cost of consumed electricity, this is the consumed electrical power of the employee’s personal equipment (adjusted for operating time), etc.

First, find the cost of a cost driver unit: one square meter, kilowatt-hour, etc. To do this, you need to multiply the cost of a driver unit by the amount of driver consumed by a given resource.

Second way

Attribution of direct costs to the cost of cost objects.

This step in ABC analysis is identical to the distribution of direct costs in traditional costing and does not cause any methodological difficulties.

Third way

Primary transfer of resource costs to operations

This is a labor-intensive but very important procedure.

The total cost of resources calculated in the first path is transferred to the operations that are performed by the corresponding resource units.

The transfer of value from resources to operations is carried out in proportion to indicators reflecting the degree of use of a given resource in the corresponding operation. These indicators are called “resource drivers”.

The transferable value is calculated in several stages:

- the total number of driver units of a given resource is determined, for example, the working time fund in man-hours;

- by dividing the cost of a resource by the total number of resource driver units, the cost of a driver unit is determined: the cost of an hour of employee work, the cost of an hour of computer time;

- the number of resource driver units consumed by a particular operation is determined;

- By multiplying the number of consumed driver units by the cost of a driver unit, the amount of resource cost transferred to this operation is determined.

Fourth way

Redistribution of the cost of service operations to the resources they serve

A service operation can also transfer its cost to the resource (employee or equipment) that performs this operation. For example, a programmer himself works on a PC and is forced to maintain the computer as well. The service operation will transfer only part of its cost back to “its” resource, and the rest will be distributed to other resources.

The transfer of the cost of an operation is carried out in proportion to the drivers of operations, which are formed similarly to the cost drivers and resource drivers. First, the total number of driver units is calculated, then the cost of each unit is determined. Next, the number of driver units consumed is analyzed and the transferable cost is calculated.

Fifth way

Distribution of the cost of control operations into main and maintenance operations

This is the most complex procedure and in most cases is subjective. For the purposes of ABC analysis, management objects should be recognized not as resources managed by the management subject, but as actions (operations) of management objects.

The extremely difficult task of this stage is to select an adequate driver of operations, in proportion to which the redistribution would be carried out. The following approaches are proposed:

- the cost of the control operation is distributed equally among the controlled operations;

- the cost of a management operation is distributed in proportion to the working time spent by the subject of management (manager) on the corresponding operations;

- the cost of a control operation is distributed in proportion to the significance of the operations, determined by expert analysis.

Control operations are located at various levels of the company's business process model. This is associated with the difficulties of redistribution, since in this case there will be not only horizontal, but also vertical transfers of value.

Sixth way

Transferring the cost of main operations to cost objects

The drivers of operations at this step are usually the quantitative characteristics of cost objects (quantity in pieces, weight in kilograms, length in meters, etc.), in proportion to which the main operations transfer their cost to them.

Basic operations can be divided into groups similar to the classification of cost objects: “product-oriented” and “customer-oriented”. The first type of main operations is associated with the full cycle of creating a product, and the second is associated with the full cycle of sales to a given buyer.

However, in reality, it is not advisable to limit yourself to calculating only the cost of a manufactured product or the abstract cost of servicing a client. It is necessary to estimate the full cost of cost objects. For these purposes, “customers–products” or “products–customers” slices are created, in which the cost of objects of the “customer” type is added to the cost of objects of the “product” type and vice versa. The results of these calculations are used to evaluate the profitability of producing and selling individual products, as well as producing products and selling them to specific customers.

Cost distribution in 1C

Currently, the issues of distribution of indirect costs between types of products (works, services) are of particular relevance.

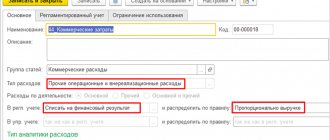

In 1C programs, expenses that are distributed to the cost of goods are recorded according to expense items with the option of distribution to the cost of goods.

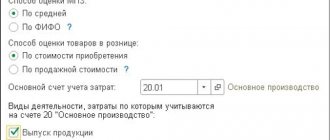

The 1C:ERP system supports a flexible mechanism for setting up cost accounting, which includes ranking of expenses associated with the production process. The classification of costs is fixed in the directory of expense items individually for each item. Setting up the posting of indirect expenses, with “For production costs”

, is similar to the distribution of straight lines.

This operation is carried out in the “Distribution of expenses to the cost of production”,

and the redistribution base depends on the setting of the expense item. This point significantly distinguishes the solution from “1C: Accounting 8 edition 3.0”, where you can configure the order of distribution of indirect expenses in the “Accounting Policy” information register.

Also in 1C:Accounting there are many documents for reflecting indirect costs, including:

- "Receipt of goods, ,

- "Payroll",

- "Advance report"

- "Decommissioning of materials"

- "Write-off of goods."

In addition, you can use routine operations: “Write-off of deferred expenses”, “Depreciation and depreciation of fixed assets”.

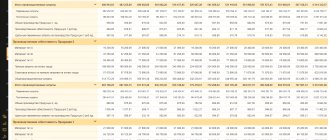

How indirect costs were distributed in “1C: Accounting 8 edition 3.0” can be found out when generating the balance sheet for the required account. The closure of indirect expenses will also be reflected there.

Using the application solution "1C: Integrated Automation 2" you can reflect material, labor and financial costs.

In the program you can:

- take into account and distribute item costs,

- register and distribute itemized expenses,

- write off production costs without production orders,

- create assets and liabilities,

- calculate the cost of production of goods,

- take into account other expenses and income,

- distribute expenses to financial results.

The system conveniently records and distributes costs that form:

- Cost of manufactured products

; - Cost of current assets

; - Cost of non-current assets

; - Financial results

.

In addition, the company's expenses include:

- Nomenclature costs

, which reflect the direct costs of production activities with quantitative measurement; - Itemized costs

, which take into account direct and indirect costs in total terms; - Formation of assets and liabilities

, which reflects operations related to the formation of assets or registration of liabilities, the management of which is carried out, as a rule, manually or the very fact of registration of which is determined by accounting requirements.

Neglecting the implementation of effective systems for the distribution of indirect costs can lead to serious imbalances in the production circuit, sales structure and pricing policy of the enterprise, and this will affect the financial results of the company. If you are looking for a solution or need to customize your system, call one of our offices. Experts will advise and help solve your problem.

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

13 popular questions regarding the transition to 20% VAT in 1C Payroll calculation taking into account the bonus system

No time to read? We'll send it to you by email!

Order help from a 1C specialist

Log in to leave a comment

Use your social media account to leave a comment or review!

Direct and indirect costs

Classification of costs according to the method of their inclusion in the cost of products, works and services into direct and indirect. It is this classification that determines the order in which costs are reflected in certain synthetic accounts, subaccounts and analytical accounts.

Direct costs are those that can be directly, directly and economically attributed to a specific type of product or to a specific batch of products (work performed or services provided). In practice, this category includes:

- direct materials costs (that is, raw materials and basic materials used in the production of products);

- direct labor costs (payment of personnel involved in the production of specific types of products).

However, if an enterprise produces only one type of product or provides only one type of service, all production costs will automatically be direct.

Indirect costs are those that cannot be directly, directly and economically attributed to a specific product, so they should first be collected separately (on a separate account), and then - at the end of the month - distributed by type of product (work performed, services provided) based on the chosen techniques.

Among production costs, indirect costs include auxiliary materials and components, expenses for wages of auxiliary workers, adjusters, repairmen, vacation pay, extra pay for overtime, payment for downtime, costs for maintaining workshop equipment and buildings, property insurance, etc. d.

Let us emphasize that indirect costs are associated simultaneously with the manufacture of several types of products, and they either cannot be “attributed” to a specific type of product, or in principle this is possible, but it is impractical due to the insignificance of the amount of this type of costs and the difficulty of accurately determining the part of them that accounts for for each type of product.

In practice, the separation of direct and indirect costs is very important for organizing the work of accounting in terms of cost accounting. Direct costs should be based on primary documents plus possibly additional calculations, as, for example, if the same type of raw material is used to produce several types of products in one division and it is impossible to provide accurate primary accounting of exactly how much of this raw material is spent on each from types of products, be included directly in the cost price of each type of product, formed by the debit of account 20 “Main production”. But indirect costs are collected on separate accounts - for example, shop expenses during the month are debited to account 25 “General production expenses”.

If we talk about the relationship between the two classifications considered, we can note the following:

- all direct costs are basic (after all, they are necessary for the production of specific types of products);

- overhead costs are always indirect;

- Some types of basic expenses, from the point of view of the order of their inclusion in the cost price, are not direct, but indirect - such as, for example, the amount of depreciation of fixed assets used in the production of several types of products.

What is overhead

Not all costs in production go directly into the product and can be directly planned and taken into account in its cost. Nevertheless, the funds spent turn out to be absolutely necessary for the manufacture of products, their sale, promotion on the market, as well as the management of the organization itself.

The most accurate definition of overhead would be “everything else.” This type of costs is not highlighted in a separate article in the Tax Code of the Russian Federation; naturally, their structure is not spelled out there either. In accounting, it is also impossible to clearly differentiate them.

NOTE! The law establishes a list of overhead costs only in the construction and medical industries. All other enterprises must determine overhead costs themselves, fixing this in their accounting policies.

overhead costs, accepted in business, implies expenses that cannot be attributed directly to technological production processes, accompanying the production process, but not included in the cost of work and raw materials. Another name for overhead costs is indirect costs . They are indicated when planning and drawing up estimates for both the company as a whole and individual structural divisions.

How to calculate the cost of production taking into account overhead costs ?

Product costs, period costs

This classification is very important from the point of view of management accounting, since it is the only one used in Western countries, where many of the management accounting methods used today were developed, and such a classification is usually required in both management and financial accounting.

Figure 2. Classification of costs in management accounting

Product costs (production costs) are considered only those costs that should be included in the cost of production, at which it should be accounted for in workshops and warehouses, and if it remains unsold, reflected in the balance sheet. These are “inventory-intensive” costs directly related to the manufacture of products and, therefore, subject to accounting as part of its cost.

In practice, this category of costs includes:

- raw materials and basic materials;

- remuneration of personnel involved in the production of specific types of products;

- general production costs (production overhead), including: auxiliary materials and components; indirect labor costs (salaries of support workers and repairmen, additional payments for overtime, vacation pay, etc.); other expenses - maintenance of workshop buildings, depreciation and insurance of workshop property, etc.

Period costs (periodic expenses) include those types of costs, the size of which does not depend on production volumes, but rather on the duration of the period. In practice, they are presented in two articles:

- commercial expenses – expenses associated with sales and deliveries of products (goods, works, services);

- general and administrative expenses are the costs of managing the enterprise as a whole (in Russian practice they are called “general business expenses”).

Such costs are not included in the cost of finished products, because they are not directly related to the production process, therefore they are always attributed to the period during which they were produced, and are never attributed to the balances of finished products.

When applying this classification, the full cost of products sold is formed in the following order.

Figure 3. Formation of cost in classical management accounting

If we apply this classification to domestic practice, guided by the Russian Chart of Accounts, it is necessary to organize cost accounting as follows:

1) in terms of product costs:

- direct material and labor costs are collected directly on account 20 “Main production” (according to subaccounts and analytical accounts for each type of product, work, service);

- General production expenses during the reporting period are collected in a separate account (according to the Russian Chart of Accounts, account 25 “General production expenses” is used for these purposes), and at the end of the period they are distributed and written off to account 20 “Main production” (by type of product, work, service );

- as a result, all costs recorded on the debit of account 20 “Main production” for a certain period represent total production costs, which may relate to manufactured products, forming the production cost of finished products (or to work performed, services provided, forming their cost accordingly), or may relate to work in progress balances, if any;

2) in terms of period costs:

- one must proceed from the postulate that periodic expenses are always attributed to the month, quarter or year during which they were incurred, that is, at the end of the period they are completely written off to reduce the financial result (profit), and they are never attributed to the balance of finished products on warehouse and work in progress;

- This means that they must be collected in accounts designated for these purposes (in Russia these are accounts 26 “General business expenses” and 44 “Sales expenses”), and at the end of each month the entire amount of expenses collected for the month must be written off from the credit of these accounts to the debit of the account 90 "Sales".

Please note that this option is permitted by current Russian legislation (in particular, PBU 10/99 “Organizational Expenses” and the Instructions for the Application of the Chart of Accounts). So every manager and accountant can implement this methodology into the practice of their organization.

However, in Russia, unlike IFRS and the accounting requirements of many foreign countries, this is not the only permitted option.

Thus, account 44 “Sales expenses” in Russian practice may not be closed completely “month to month”; depending on the accounting policy of the organization, a carryover debit balance may be formed on this account - for example, in terms of costs for packaging and transportation of shipped products, if it has not yet become the property of the buyer, or in terms of transportation costs in trade organizations (if part of the goods remained unsold at the end of the month).

And we can close account 26 “General business expenses” not to account 90 “Sales”, but to account 20 “Main production” (as well as 23 “Auxiliary production” and 29 “Service production and farms”, if their products, work and services are sold externally). It was this option that was used until the early nineties, and it was not canceled or completely replaced by a new option using account 90 “Sales”.

The logic of this application of the 26th account, which involves the inclusion of general business expenses in the cost of specific types of manufactured products, works, services (including for the purpose of estimating the balances of unsold products), is based on the traditional approach, according to which in domestic practice, production costs and Today, in addition to material costs, labor costs and general production expenses, many also include general business expenses (and, accordingly, non-production costs include the costs of selling products, as well as maintaining social facilities).

With this approach, the meaning put into the concept of “production cost” also changes:

- a Western accountant or manager views this type of cost as the sum of “product costs”, and in his view management costs cannot be included in production costs;

- In domestic practice, to this day, there are often not two (production and full), but three types of cost - shop, production and full, while:

- shop cost is considered to be precisely the amount of “product costs” (that is, in our country shop cost is what Western experts call production cost);

- Production cost in Russia is often understood as the sum of shop cost and general business expenses, that is, in addition to “product costs” (direct and general production expenses), it also includes management expenses, which Western experts clearly classify as “period costs”, subject to accounting only in full cost and never included in production costs;

- the concept of the full cost of goods sold is conceptually the same in both systems, although its value, other things being equal, may not coincide (if there are balances of unsold products, because then for a Russian accountant, part of the management costs may “settle” in the balance sheet in the value of the balances of finished products, and For a Western accountant, the entire amount of management expenses will be attributed month to month to the reduction of profits).

Why consider overhead costs?

The most obvious goal is planning future profits, which are affected by all the costs incurred by the entrepreneur. But in terms of overhead costs, this poses certain difficulties. If potential direct costs can be fairly accurately calculated for specific types of products, then it is quite difficult to determine how many indirect costs will result and how they will be distributed when, for example, expanding production or signing a certain contract.

IMPORTANT! To adequately determine the cost of a product, it is necessary to take into account and distribute overhead costs in proportion to direct expenses - calculate production costs .

Total and specific costs

First of all, we note that costs can be cumulative and specific - depending on the volume they are calculated for (for the entire set of products, for the entire batch of products or per unit of production).

Cumulative expenses are expenses calculated for the entire output of an enterprise or for a separate batch of products. In other words, these are the total, total costs for a certain amount of products of the same type or even for a certain volume of products of different assortments.

Specific costs are costs calculated per unit of production.

Accordingly, the cost can be calculated per unit of product or for the entire batch, or we can talk about a general cost indicator for all types of products, works, and services for a certain period.

Depending on the specific management problem to be solved, in some cases it is important to know the amount of total costs, and in others it is important to have detailed information about specific costs (for example, when making decisions in the field of pricing and assortment policy).

Definition

Conditionally fixed costs are expenses that do not depend on the scale of production and sales, or sales of services. But you need to take into account that fixed costs can turn into variable ones. Fixed costs are contrasted with variable ones. Collectively, total expenses are formed.

Simply put, these are expenses that do not change throughout the budget period. In this case, the sales volume does not matter. But you need to take into account that these are conditionally fixed costs. That is, they are not permanent in the full sense of the word. The size of these expenses changes under the influence of changes in the scale of the enterprise's activities. For example, there are these factors that influence semi-fixed costs:

- Introduction to sale of new products.

- The emergence of new branches.

The scale of the enterprise's activities changes extremely slowly. That is why costs are called conditionally constant, and not just constant.

In connection with cost calculations based on technical and economic factors, costs are grouped into conditionally constant, conditionally variable and identifying the connection of the latter with certain production conditions or changes in its technique, technology and organization, i.e. technical and economic factors. What are the differences between them? View answer

Variable and fixed costs

Depending on how costs react to changes in the organization’s business activity - to an increase or decrease in production volumes - they can be divided into variable and constant.

Variable costs increase or decrease in proportion to changes in production volume, that is, they depend on the business activity of the organization. They, in turn, can be divided into:

- production variable costs: direct materials, direct labor, as well as part of overhead costs, such as the cost of auxiliary materials;

- non-production variable costs (costs of packaging and transportation of finished products, commissions to intermediaries for the sale of goods, etc.).

Fixed costs in total do not depend on the volume of production and remain unchanged during the reporting period. Examples of fixed costs are rent, depreciation of fixed assets, advertising costs, security costs, etc.

The point is that the total amount of fixed expenses usually does not depend on exactly how much and what kind of products the company produces in a given month. For example, if a company rented premises for a production workshop or retail outlet, it will have to pay the agreed rent every month, even if nothing is produced or sold at all in one of the months, but, on the other hand, if this premises will be operated around the clock, and not eight hours a day, the rent will not be higher. The situation is similar when advertising is given - of course, the goal is to sell more products, but the amount of advertising costs (for example, the cost of advertising agency services, the cost of advertising on television or in a newspaper, etc.) directly depends on the quantity products sold in the current month will not be affected.

But variable costs clearly respond to changes in production and sales volumes. We didn’t produce products – we didn’t have to purchase materials, pay wages to workers, etc. If the intermediary did not sell the goods, there is no need to pay him a commission (if it is set depending on the number of goods sold, as is usually done). And vice versa, if production volumes increase, it is necessary to purchase more raw materials, attract more workers, etc.

Of course, in practice, especially in the long term, all costs tend to increase (for example, rent may increase, depreciation amount may increase due to the acquisition of additional fixed assets, etc.). Therefore, expenses are sometimes called semi-variable and semi-fixed. But the growth of fixed expenses, as a rule, occurs spasmodically (stepwise), that is, after an increase in the amount of expenses, they remain at the achieved level for some time - and the reason for their growth is either an increase in prices, tariffs, etc., or a change in production volumes and sales above the “relevant level”, leading to an increase or decrease in production space and equipment.

Overhead distribution options

IMPORTANT! Recommendations for the distribution of overhead costs from ConsultantPlus are available here

Despite the difficulties of planning indirect costs, this is a necessary procedure that can be carried out in several ways:

- The "working wage" method. If the main production employs a large number of workers, especially if manual labor predominates, overhead costs can be calculated in proportion to the wage fund for their labor.

- The “sales volume” method is advisable to use if automated processes predominate in the company. You can distribute income in proportion to machine hours.

- The unit of production method is applicable when direct costs significantly exceed indirect costs. Then we can take as a basis the ratio of direct costs per unit of goods to the total amount of direct costs.

- Direct counting method. Indirect expenses are summed up separately for each expense item.

- Combined methods are applicable in large companies with a complex structure, where several types of products are produced. For example, you can account for manufacturing overhead on the payroll basis, and general business overhead on the basis of unit cost.

EXAMPLE OF CALCULATION. Avtokoleso LLC is engaged in the transportation of goods. The staff wage fund is 8 million rubles per year. The overhead cost ratio in 2016 was 80%, that is, 6 million 400 thousand rubles. The company decided to reduce overhead costs, for which it fired several people. At the same time, the wage fund decreased by 20%, which means that the overhead costs of Avtokoleso LLC for 2022 can be planned in the amount of 5 million 120 thousand rubles.

Is there any provision for rationing of overhead costs ?

Standard and actual expenses

From the point of view of efficiency of accounting and cost control, a distinction is made between standard and actual expenses.

Actual expenses, as their name suggests, are expenses actually incurred by an enterprise in the production of products (works, services), reflected in primary accounting documents and accounting accounts. It is these that accountants take into account, and based on them the cost of production is formed. And then they are analyzed, compared with planned indicators or indicators of previous periods and conclusions are drawn.

Standard costs are predetermined realistic costs per unit of finished product. In other words, these are expenses (most often per unit of production) calculated on the basis of certain norms and standards.

Where is the composition of expenses determined?

For each type of product manufactured, the organization independently develops its planned calculation, which determines the quantitative composition of the main material and labor costs for its creation. This calculation forms the basis for the list of direct production costs and allows you to control the actual volumes of resources invested in the production of specific types of products.

Also, the organization itself will have to create specific lists of costs (directories) for each of the overhead expense accounts, detailing them to the required extent and assigning a specific digital code to each selected item. The presence of a code greatly facilitates the indication of a cost item in the primary documents used to document the attribution to expenses. Such a directory can be multi-level, which will make it possible to obtain accounting data both for individual cost elements included in an item, and for each item, as well as for cost groups. For example, as part of the article “Repair of fixed assets”, one can distinguish the subarticles “Major repairs” and “Current repairs”. Each sub-item can contain elements that reflect the type of fixed asset (real estate, equipment, transport, other fixed assets) and who carried out the repairs (its own department or a third-party organization). Directories should be detailed in such a way that they make it possible to obtain the information necessary for drawing up various types of reports with a minimum number of additional actions with it.

In addition, the organization needs to determine:

- lists of cost calculation objects for each type of product manufactured;

- algorithms for accounting and distribution of costs of auxiliary and service production;

- a basis for the distribution of production overhead costs;

- the procedure for writing off general business expenses, and if they are included in the cost price, the basis for distribution.

All of the above points are recorded in the accounting policy order. In this case, all directories of cost items and lists of costing objects will be appendices to this order.

Alternative (imputed) costs

Unlike financial accounting, which operates only with accomplished facts and actually incurred costs, in management accounting great importance is attached to alternative options, because, by making one management decision, the manager automatically refuses other options for the development of events, and therefore, in addition to real income and expenses, which will be received and implemented during the implementation of the decision made, alternative (imputed) costs inevitably arise, including in the form of lost profits due to the fact that the decision made excluded the possibility of alternative use of resources.

The concept of opportunity costs can also simplify decision making in some situations.

Let's look at a small example. The bakery was approached by a new potential client - the director of a restaurant that had recently opened nearby. He would like the bakery to supply his restaurant with buns every day that need to be baked according to a specific recipe. Of course, he is interested in the price - how much the bakery would like to receive for fulfilling such an order.

Suppose that at the moment the bakery is already working at the limit of its capacity and cannot simply bake buns for the restaurant in addition to the products that it already produces and sells to current customers, in order to begin cooperation with this restaurant, it will be necessary to reduce the production of some of the current types of products and, accordingly, reduce supplies to current customers or retail sales volumes.

Using the concept of opportunity cost, there is an elegant and simple way to solve this problem:

- of course, the price must cover the actual costs of the bakery - this means that you need to calculate the production cost of the buns that the restaurant director would like to receive; in addition, of course, the goal of the bakery is to make as much profit as possible, but this does not mean that you can set any level of profitability and ask for any price, although some amount of profit must be included in the price that will ultimately be set;

- Since in order to fulfill the restaurant's order, it will be necessary to reduce the current production of other types of products, there are alternative (opportunity) costs - in this case, this is the amount of profit that the bakery will lose if it accepts this order and reduces the supply and sales of previous products, that is this is the “lost” profit that the bakery would continue to receive if it refused to cooperate with the restaurant director and worked according to the previous program;

- This means that in order to set the price for buns for a restaurant, you need to add up the sum of the costs of producing these buns (their projected cost) and the “lost” profit from the sale of those products, the production of which will be reduced due to the acceptance of an order from the restaurant.

Let's illustrate with numbers. Let's say that a restaurant wants to receive 1000 buns. To be able to bake them, you will have to reduce the production and sale of French baguettes by 400 units. Let’s assume that the production cost of a baguette is 10 rubles, and its selling price is 19 rubles. In accordance with the calculation based on the recipe for making buns, their production cost should be 4 rubles.

We make the following calculations:

- profit from the sale of one baguette is: 19 - 10 = 9 rubles;

- opportunity cost - the profit that could have been received from selling 400 baguettes if the restaurant's order had been rejected - is 9 rubles. x 400 pcs. = 3600 rub.;

- the minimum price level for buns, at which it generally makes sense to talk about the possibility of accepting this order (replacing part of the baguettes with buns), consists of the sum of the cost of the buns and this lost profit from the baguettes, that is, for a batch of 1000 buns, the restaurant must pay at least : 4 rub. x 1000 pcs. + 3600 rub. = 7600 rub.;

- the minimum price of one bun must be no lower than: 7600 rubles. / 1000 pcs. = 7.60 rub.

It's minimum. If the restaurant director is not ready to pay that amount (for example, a neighboring bakery will offer him more favorable conditions), it is better to refuse cooperation and continue to produce the products that you are already producing at the moment. After all, if you agree to a lower price, it turns out that in the end the bakery will receive less profit than it received before.

Plus, other factors must be taken into account. For example, weigh whether it makes sense to spoil or break off relations with your current clients, because reducing the production of baguettes by 400 pcs. means that someone to whom the bakery sold them before will no longer receive these baguettes! Therefore, setting the price for buns at exactly 7.60 rubles, in fact, does not make sense - this price only makes up for the same profit that you are already making with the current production program, but for this you should not sacrifice already established relationships with customers .

What are the production overhead costs?

Manufacturing overhead costs for each production unit will include:

- remuneration of the division's management and general shop personnel, calculation of insurance premiums for this payment;

- costs for the current support of the department (stationery and household supplies, inventory, tools, depreciation of equipment, rental costs, insurance, information services, employee business trips);

- costs of maintaining property located in the department, highlighting work carried out by the organization’s own resources (auxiliary or maintenance production) and third-party organizations (technical and transport maintenance, verification, repairs, replacement parts and consumables necessary for the operation of equipment, consumption energy resources);

- costs of ensuring the quality of products (licensing, certification, pilot tests, warranty service, personnel training);

- labor safety costs (workplace certification, special clothing, special food, sanitation).

In particular, production overhead costs will include those costs that could be included in direct costs, but organizing their distribution among costing objects is either impossible or requires unreasonably high labor costs:

- depreciation of equipment used in production;

- energy costs;

- services of third parties.

Accounting for overhead expenses of a production nature is carried out on account 25, which can be opened:

- To all direct cost accounts.

- For the accounts of the main and auxiliary production, if there is no servicing production or it was decided to account for the costs of it due to their small volume using the boiler method (i.e., with both direct and overhead costs for the department assigned directly to account 29).

- Only to the account of the main production, if there are no auxiliary and service production or it is decided to record costs for them using the boiler method. The use of the boiler method for auxiliary production is justified for the purpose of simplifying accounting. Account 23 in such a situation is usually closed monthly, including the costs collected on it both in direct production costs (for example, ensuring the process of creating products with self-generated electricity or self-extracted water) and in the overhead costs of the main production.

Expenses collected on account 25 are distributed monthly between costing units, in respect of which direct production costs are collected on the direct cost accounts. The distribution base is either one of the types of direct expenses (materials, wages) or their total amount.

Find out what is included in fixed costs and how they relate to the cost of finished products in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Sunk costs

The next important type of costs that managers and accountants who prepare information for making management decisions must take into account are sunk costs. From their name it is clear that this refers to expenses that have already been incurred in the past (as a result of the execution of one or more earlier management decisions) and which now cannot be returned or compensated. You can only come to terms with them.

It is extremely important to learn how to identify such sunk costs and mercilessly “cut off” information about them when making decisions. This approach can also simplify the procedure for analyzing alternatives and make calculations more concise and elegant.

Accounting for business expenses

Another type of overhead costs is one that, according to the rules in force in the Russian Federation, is never included in the cost of production. These are expenses associated with the sale of products (goods, works, services): commercial. They are collected on account 44, dividing them in analytics according to the same principles as other overhead costs: by department and by type of expense.

The list of business expenses for a production-type organization will be closer to the list developed for account 25. The difference may lie in the addition of items to this list that reflect expenses:

- on transportation to the buyer;

- loading and unloading operations;

- cargo storage;

- customs clearance;

- marketing research.

For a trading organization that does not need to use production cost accounts and collects all its overhead costs on account 44, the list of cost items for this account will be similar to the one that is developed in production for account 26, taking into account the addition of its items, paragraph above indicated as being added to the account 25.

You also need to close account 44 on a monthly basis, writing off the numbers collected on it to the account for accounting for financial results from sales. However, there may be a balance due to the presence of packaging and transportation costs included in the costs, which are subject to distribution between sold and unsold products (goods).

For a method of cost accounting in which business expenses can be included in the cost price, read the material “ABC cost accounting method - how to apply?” .

Relevant and irrelevant costs

The concepts of alternative (opportunity) and sunk costs, as well as the behavior of various types of costs, lead us to the need to distinguish between relevant and irrelevant costs and introduce the concept of the relevance of information used to justify decisions.

Relevant information is information that distinguishes one alternative from another and, therefore, is subject to analysis and consideration when making decisions. Accordingly, relevant costs are those costs whose value will change depending on which of the alternatives is chosen as a result of the decision.

In other words, if any income, expenses or other indicators remain unchanged in any of the possible decisions, they are irrelevant and should not be taken into account when considering such a decision.

Of course, a significant part of irrelevant expenses consists of the sunk costs we have already discussed, that is, expenses that were made in the past and which no decision can change (such as, for example, the cost of geological exploration in the event that minerals are never found). have been discovered or the development of the deposit is unpromising).

Fixed costs are also often irrelevant - but here, of course, everything depends on the nature of the problem and the decision being made. For example, if the question is about what is more profitable to sew for the winter season - leather jackets or leather coats - information on the amount of depreciation of equipment, rent for production premises or the cost of electricity consumed to illuminate the workshop and ensure the operation of sewing machines has no values, because these amounts will be the same regardless of what you ultimately decide to sew. But if a more global question is being resolved about whether it is worth stopping tailoring and switching to trading fabrics, threads and accessories, information about fixed costs may become relevant - if, for example, a decision may ultimately be made to terminate the lease agreement for production premises and sell sewing machines.

The concept of relevance is perhaps the most important, fundamental principle of preparing information for analysis and management decisions.

Overhead expenses included in cost

The cost of products manufactured by an enterprise includes 2 types of expenses: direct and overhead.

Direct ones include those that can be unconditionally linked to a specific type of product being created. It is either difficult or impossible to relate overhead costs directly to manufactured products. Based on their connection with the production process, they are divided into:

- for production - ensuring the functioning of production units producing products;

- general economic - not directly related to the creation of products, but necessary to ensure the operation of the enterprise as a whole.

Existing rules (Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) do not prevent the possibility of forming accounting costs at 2 levels:

- its incomplete value, including, in addition to direct costs, only those overhead costs that are related to production;

- its full size, which combines, in addition to direct costs, overhead costs generated both in production departments and in general business structures.

What are overhead costs, read in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Results

To collect overhead expenses, accounting provides special accounts from which the accumulated amounts are written off monthly.

Manufacturing costs are always included in the cost of production. General business expenses can either be taken into account in the cost price or not be included in it, but be attributed to the accounting of financial results from sales. Selling expenses are not taken into account in the cost of production, they are always immediately attributed to the financial result and may have amounts remaining at the end of the month. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.