Do I have to pay personal income tax and compulsory insurance contributions?

If the head of an organization decides to provide monetary compensation to an employee under various life circumstances, the accountant asks what taxes are imposed on financial assistance in 2022 and whether there are any restrictions on amounts and terms.

To do this, please refer to Art. 217 and Art. 422 of the Tax Code of the Russian Federation. The calculation period for personal income tax and insurance premiums is one calendar year. This period is taken into account when determining the limits on amounts exempt from taxation. The amounts of financial assistance that are tax-free in 2022 in Russia include those discussed below.

ConsultantPlus experts discussed how to correctly reflect financial aid in accounting. Use these instructions for free.

to read.

Financial assistance to a former employee

According to Article 217 of the Tax Code of the Russian Federation, a number of payments to former employees are exempt from personal income tax. Article 422 of the Tax Code of the Russian Federation on payments not subject to insurance contributions does not mention former employees at all.

The employment relationship with the former employee has been terminated, that is, they no longer exist. Therefore, there is no object of taxation with insurance premiums. And this is not only financial assistance. Any payment to a former employee with insurance premiums, unlike personal income tax, is not taxed due to the absence of the main condition for the emergence of an object of taxation - labor relations.

Let us remind you: the amount of material assistance provided by employers to their former employees who quit due to retirement due to disability or age is not subject to personal income tax up to 4,000 rubles.

Personal income tax must be withheld from the amount of such financial assistance to former employees exceeding 4,000 rubles.

But such excesses are not subject to insurance premiums. This conclusion is based on the provisions of Article 420 of the Tax Code of the Russian Federation. This article is about the object of taxation of insurance premiums.

Read in the berator “Practical Encyclopedia of an Accountant”

Payers of contributions, object of taxation of insurance premiums

Let us recall that the object of taxation of insurance premiums are payments and benefits to employees paid within the framework of labor relations. No labor relations - no subject to contributions.

In the amount of 4000 rubles

Any payments not related to labor income are regulated by the company’s internal regulations. Thus, the list of those who are entitled to financial assistance at work once a year is determined by order. The amount of incentives and reasons for providing monetary compensation are not limited by law. Only tax-exempt amounts are subject to limitations. So, for each employee, taxation and insurance contributions on financial assistance are 4,000 rubles. in 2022 there are no payments, regardless of the reason for the payments. In other words, 4000 rubles. — a limit valid for each employee during one pay period.

Tax-free financial assistance 2022

Who can receive financial assistance at work? To give financial assistance or not to give is the right of the employer. Financial assistance may also be paid selectively. During a calendar year, an employee has a non-taxable limit of financial assistance of 4,000 rubles for various purposes. The limit of 4,000 rubles does not depend on the connection in which the money was issued. It could be:

- wedding;

- birthday;

- financial assistance for the anniversary (taxation 2020);

- acquisitions;

- treatment, etc.

Taxation of financial assistance in 2022 and insurance premiums from it vary depending on whether payments exceed 4,000 rubles.

The only exceptions are:

- death of an employee or his relative;

- birth of a child;

- natural disasters and terrorist attacks.

When a subordinate becomes a parent, he can be paid up to 50,000 rubles without calculating insurance premiums. Financial assistance in connection with the death of a family member, compensation for damage due to injury, terrorist attack, emergency or accident are not included in the base for calculating insurance premiums and personal income tax. Thus, income taxes and the 2022 cap remain unchanged for now.

Please note that one-time financial assistance is considered a payment for certain purposes, accrued no more than once a year on one basis, that is, on one order (Letter of the Federal Tax Service of Russia No. AS-4-3/13508). How a person receives the money - all at once or in parts throughout the year - does not matter (Letter of the Ministry of Finance of Russia No. 03-04-05/6-1006).

At the birth of a child

In this case, a limit of RUB 50,000 applies. in year. Each parent has the right to receive funds in connection with the birth or adoption of a child (letter of the Ministry of Finance No. 03-15-06/29546 dated May 16, 2017). If the income was paid in the first year after the occurrence of the event, then personal income tax and insurance contributions for financial assistance at the birth of a child in 2022 are not charged in the amount of 50,000 rubles. (clause 8 of article 217, subclause 3 of clause 1 of article 422 of the Tax Code of the Russian Federation). Amounts above this limit are taxed in accordance with the generally established procedure.

Due to the death of a relative

If the payment is a one-time payment, then, in accordance with the above norms of the Tax Code of the Russian Federation, personal income tax and insurance premiums for financial assistance in connection with the death of a close relative in 2022 are not charged. In accordance with the letter of the Ministry of Labor No. 17-3/B-538 dated November 09, 2015), close relatives include:

- spouses;

- parents;

- children, including adopted children.

If an organization provides monetary compensation in connection with the death of other relatives (sister, brother, grandmother, grandfather, etc.), amounts exceeding 4,000 rubles are subject to taxes.

Who is the employee's family member?

Who are the employee's family members?

According to the Family Code, family members include spouses, parents and children, adoptive parents and adopted children. Close relatives include parents, children, grandparents, grandchildren, as well as brothers and sisters.

But to exempt from personal income tax the amount of financial assistance paid in connection with the death of a family member, the definitions from the Family Code are not enough.

These must be persons related by kinship and living together, that is, leading a joint household.

Therefore, to receive financial assistance in connection with death, in addition to the death certificate, you need a document confirming joint residence (see letter of the Ministry of Finance dated December 2, 2016 No. 03-04-05/71785).

In other cases

In addition to the above, to amounts exempt from assessments, Art. 422 of the Tax Code of the Russian Federation refers to one-time payments for compensation for damage from natural disasters, terrorist attacks and other emergency circumstances. There is no annual limit for such compensation.

In all other cases, the general taxation procedure applies. For example, if a company has decided to provide financial assistance to an employee due to a difficult financial situation or an anniversary, a non-taxable limit of 4,000 rubles applies. in year. Accrual is made on the basis of an order drawn up in any form:

Thus, the tax-free base will be 4,000 rubles, and taxes should be charged on 6,000.

Financial assistance for a wedding

Let's look at the calculation of financial assistance for a wedding.

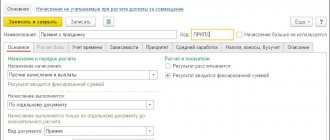

Setting up the accrual type

Let's go to the menu “Salaries and personnel - Directories and settings - Salary settings”.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

Let's go to the "Accruals" link.

Let's create a new accrual type and fill it out:

- We will indicate the name and unique code.

- In the “Personal Income Tax” section, set the “Taxed” option and select income code 2760. This type of income is partially subject to personal income tax, namely, it is not taxed in the amount of up to 4,000 rubles.

- We will indicate the method of reflecting financial assistance in accounting in the “Method of reflection” field.

- In the “Insurance premiums” section, we will set the type of income “Financial assistance, partially subject to insurance premiums.” There are also no contributions up to 4,000 rubles.

- We do not include expenses in income tax.

Calculation of financial assistance for a wedding

The calculation is performed when calculating salaries.

After automatically filling out the document, we will select an employee to accrue financial assistance, click the “Accrue” button and select the desired type of accrual, in this case “Material assistance for a wedding.”

We enter the payment amount, the deduction code is automatically entered and the deduction amount is 4,000 rubles. Click "OK".

The accrual amount in the document has changed.

By clicking on the link in the “Accrued” column, you can see a detailed explanation.

Let's look at the document postings.

When do you have to pay injury insurance premiums?

The same categories of cash payments that are not subject to insurance premiums are exempt from deductions for injuries, namely:

- amount of 4000 rubles. during the billing period;

- at the birth or adoption of a child (within 50,000 rubles);

- in connection with the death of a close relative;

- for compensation for damage from natural disasters, terrorist attacks and other emergency circumstances.

In all other cases, deductions for injuries are made in the generally accepted manner.

If you still have questions about whether financial assistance is subject to insurance premiums or not in 2022 (for injuries), then refer to Art. 20.2 of Law No. 125-FZ, which lists all categories of income exempt from assessment of contributions.

Financial assistance: taxation 2022, insurance premiums

Is financial assistance subject to insurance premiums in 2020? Since financial assistance does not relate to income related to the employee’s performance of his work duties, it cannot be subject to contributions. However, this provision has a number of limitations. That is, the manager cannot pay his employees any amount as financial assistance. Since 2022, issues related to fees for employee insurance are explained in Chapter 34 of the Tax Code of the Russian Federation. Situations when you do not have to pay are contained in Art. 422 codes. Amounts from one-time financial assistance paid under the following circumstances are not calculated:

- the employee received money to compensate for damage caused by a natural disaster or emergency;

- the victim of a terrorist attack on the territory of the Russian Federation was compensated for damage to health;

- the employer helped with money in the event of the death of a member of his family;

- an amount of up to 50,000 rubles was paid as support for the birth of a child. Not only each parent, but also the adoptive parent and guardian have the right to it;

- the amount of financial assistance does not exceed 4,000 rubles during the year.

We remind you that 4000 rub. - this is tax-free financial assistance (2020). If payments are higher, they are subject to insurance premiums. In this case, the goals may be different, for example, for partial compensation of expenses for additional education, to cover the costs of purchasing medicines, for vacation. Note that the situations listed apply to all existing types of compulsory insurance: pension, medical, social, as well as injuries. In addition, they apply to assistance in both in-kind and cash forms. So, 4000 rubles for financial assistance. (taxation 2020) insurance premiums are not charged