As a general rule, in Russia all payments must be made in rubles (Article 317 of the Civil Code of the Russian Federation). However, the law makes it possible to include a condition in the contract, which in practice is called a currency clause. According to this formulation, the transaction price is determined in the conventional units required by the parties, and payment is made in rubles at the exchange rate on the date of invoice, conclusion of the contract, payment day or other time convenient for the partners (Article 317 of the Civil Code of the Russian Federation, Regulations of the Central Bank of December 22, 2014 No. 446-P, decision of the Supreme Court of the Russian Federation of October 13, 2015 No. 5-KG15-151, resolution of the East Siberian District Court of October 9, 2015 in case No. A19-11436/2014).

Most often, businessmen have to deal with indirect or direct currency clauses. The first is used when the contract currency and payment currency do not match. In this case, it is advisable to set the cost of the transaction in a reliable and stable currency, and payments in rubles. Then the payment amounts will depend on changes in the exchange rate of money relative to each other. In a contract, the wording with an indirect clause may look, for example, like this:

“...The price of goods is set in US dollars, payment is made in rubles. If the exchange rate of the US dollar to the ruble on the day of payment changes compared to the rate on the day the contract is concluded, then the contract price and the payment amount will change accordingly.”

As for the direct currency clause, it is used when the transaction currency and the payment currency are the same. In this case, a new currency is introduced into the contract - the so-called reservation currency, and the price of the agreement changes in the same proportion as the exchange rate of the reservation currency to the contract currency has changed. In this case, the contract may contain, for example, the following wording: “...The price of the goods and payment are established in Russian rubles. The currency of this clause is the United States dollar. If by the time of payment the exchange rate of the ruble against the US dollar changes compared to the rate on the day of conclusion of this Agreement, then the contract price and the payment amount will change.”

note

You should not hope that the reins of government can be taken over by the founder, who acted on behalf of the company without a power of attorney during its initial registration. The fact is that a participant who is not elected as a single individual executive in accordance with the procedure provided for by law does not have the right to do so. Only a director can represent a company without a power of attorney.

However, simply writing a currency clause in a contract is often not enough. Firstly, rates, at least slightly, change constantly, and then the clause will doom partners to countless recalculations and reconciliations even with the slightest fluctuation in the value of currencies. To avoid this, you can set a condition in which case the price will be revised: “...If by the time of payment the exchange rate of the Russian ruble against the US dollar changes by more than 2 (Two) percent, then the payment amount changes in proportion to the change in the euro exchange rate against the ruble by date of this payment."

In addition, it is in the interests of both the seller and the buyer to establish a so-called “currency corridor” (or “currency fork”), i.e. indicate below and above which indicators the applied exchange rate cannot be. In the agreement, this can be formulated, for example, as follows: “...Payments under this Agreement are made in ruble equivalent in US dollars, which is determined at the exchange rate of the Central Bank of the Russian Federation on the day of payment, but not less than 60 (Sixty) rubles and not more than 70 (Seventy) rubles for 1 (One) US dollar.”

Purpose of a currency clause and its main types

Let's look at the essence of currency clauses in a situation. Let’s say that counterparty A, located in Russia, entered into an agreement in 2022 with counterparty B, a foreign supplier, for the purchase of goods. Moreover, the main currency of the agreement is rubles, and the term of the agreement is 2 years. Total contract price: 10,000,000 rubles. Considering the situation with the ruble exchange rate, the Russian ruble can be considered an unstable currency, subject to fluctuations. Contractor-supplier B. has the following situation:

- at the time of conclusion of the agreement, the exchange rate was 62 rubles per 1 US dollar (i.e., the contract price in US dollars was conditionally 161,290 US dollars);

- at the end of the contract, in 2022, the rate was 67 rubles per 1 US dollar. The price of the contract in dollar equivalent was already 149,253 US dollars.

As you can see, the difference is quite significant - $12,037. And if counterparty B. also pays in dollars for the purchase or production of goods, which he then supplies to the Russian Federation under a contract, the losses of counterparty B. become obvious.

To avoid such losses, when concluding foreign exchange contracts, a technique called a currency clause is used. With a special clause, settlements under the contract are “linked” to a currency with a stable exchange rate, for example, the US dollar, pound sterling, euro, etc.

For example, in the situation under consideration, a sample currency clause in a contract could look like this: “The total cost of the goods is the equivalent of $161,290. Payment is made in Russian rubles at the rate in effect on the date of payment at the bank serving the buyer.” That is, if the Russian counterparty A. carried out settlements under the 2022 contract in 2022, he should have paid not 10,000,000 rubles, but about 10,806,430 (161,290 × 67).

Note! Many course options for “binding” are allowed. This could be the Bank of Russia, the national bank of the supplier’s country, or the internal exchange rate of the bank of one of the partners - this condition is determined only by the parties to the transaction.

Based on the range of risks covered by the currency clause, as well as the individual characteristics of the transactions being executed, we can highlight:

- direct and indirect reservations;

- unilateral and bilateral reservations;

- other clauses sometimes applied by the contracting parties.

What does it mean “the amount of monetary obligations under the contract is not determined”?

Answer. So far we cannot clearly answer this question. We believe that these are cases where the contract determines that the contract amount is the amount according to the specifications, invoices for the contract, etc. However, banks currently do not register a foreign exchange agreement without an amount (from practice). Perhaps these are cases when the amount of the monthly payment is determined, but there is no total amount under the contract and the contract provides for its automatic extension for the next year (unless either party states otherwise). Thus, if there is an amount of foreign currency payment for a month (for example, for advertising services, royalties, etc.) without indicating the total amount of payments under the agreement, such agreements may be subject to registration. Sometimes in contracts it is written “estimated contract amount”. There is also the question of whether this amount is considered certain. There is an issue with public contracts posted on websites. These agreements usually contain a reference to tariffs. But the tariff cannot be an amount, since a non-resident can pay for a set of services...

We will work on this issue, when the amount of monetary obligations under the contract is considered uncertain, and will publish the answer later.

The National Bank answered questions regarding the registration of foreign exchange agreements (link to article below).

What are direct and indirect currency clauses

The above example is an example of an indirect currency clause. Conditions are classified as indirect when payments under the contract occur in the national currency of one of the parties, and the price of the product is fixed in one of the stable currencies common in international payments.

With a direct clause, both the price of the goods and the currency of payment are expressed in one, relatively stable currency. However, to be on the safe side, a condition is included in the contract according to which the payment can be adjusted if the contract currency exchange rate changes significantly in relation to another stable currency.

Example

Currency clause: “The price of the goods under the contract is 250,000 USD. Settlements under the contract are carried out in USD. If on the date of payment the USD to GBP (pound sterling) rate on the New York Currency Exchange is lower than the USD to GBP rate on the date of conclusion of the contract, then the price of the goods and the payment amount in USD must be recalculated to increase, compensating for the corresponding change in the rate USD to GBP".

This means that if there is, say, 100,000 USD left to pay under the contract and on the day of the next payment the USD exchange rate against GBP has decreased, for example, from 1.3000 USD per GBP (on the date of conclusion of the contract) to 1.2350 USD per GBP, then :

- the contract price in USD for settlements will become: 100,000 + 100,000 × ([1.3000 – 1.2350] / 1.3000) = 105,000 USD;

- additional payment - 105,000 USD.

Important to consider! Recommendation from ConsultantPlus: Currency corridor. To protect yourself from losses caused by sharp fluctuations in the exchange rate, we recommend stipulating in the agreement a currency corridor - the minimum and/or maximum rate at which the payment will be made. For an example of how to do this, see K+.

What are unilateral and bilateral currency clauses?

The reservations we discussed above are so-called unilateral reservations. They insure only one party - the recipient of funds under the contract. In fact, a change in the exchange rate, of course, affects the one who pays under the contract. For example, in the example given at the beginning of the article, buyer A also cares whether he pays 10,000,000 or 10,800,000 rubles. Therefore, a clause in a contract can be drawn up in such a way as to take into account the interests of both parties - both the one who pays and the one who receives the funds. For example, a “fork” of rates may be provided, within which prices and payments under the contract are automatically recalculated, and if the rate jumps beyond the established values, another mechanism is used to level out negative impacts, for example, revising the terms of the contract by a separate agreement.

Example

A direct clause, tailored to the interests of both parties, may look something like this: “If on the date of payment the USD to GBP exchange rate on the New York Currency Exchange changes in relation to the USD to GBP rate on the date of conclusion of the contract by an amount established within 5% in any direction, then the price of the goods and the amount of payment in USD must be recalculated, compensating for the corresponding change in the USD to GBP exchange rate. In other cases of fluctuations in the USD to GBP exchange rate (in excess of the 5% established by this paragraph), the contract price and further payments are subject to revision and additional agreement by the parties.”

A clause in the contract or bank insurance?

Enterprises can protect themselves from currency risks not only with the help of currency clauses in the contract, but also with the help of banking instruments such as hedging.

To understand the essence of a hedging transaction, let's look at an example again.

Example

A Japanese company entered into a 6-month contract to supply goods to the United States. Let's say payment under the contract - 1,000,000 USD - should also be received in 6 months, in USD. In case of fluctuations in the ratio of JPY to USD during the contract period, the selling company entered into an agreement with its bank that after 6 months the company would sell the bank, and the bank would purchase 1,000,000 USD at the rate of 0.0087 USD per 1 JPY (market average for day of conclusion of the contract). Even if the JPY exchange rate changes in a way that is unfavorable for the Japanese supplier in 6 months, its risks will be offset by an agreement with the bank, under which the bank will still buy the proceeds in USD at 0.0087.

Thus, bank insurance in relation to currency risks is the ability of a party to a contract to use banking instruments instead of introducing a clause into the contract. What to choose depends on each specific transaction and the general economic situation. For example, in Russia such operations are practically not common, but the rules for the repatriation of foreign currency earnings are in force (established by Article 19 of the Law of December 10, 2003 No. 173-FZ “On Currency Regulation”). That is, for Russian participants in foreign trade relations, the only option left is with a clause in the contract: it will not be possible to arrange hedging in Russia or receive proceeds into an account in a foreign bank where hedging is possible.

Of course, there may also be an option with “regular” insurance issued by an insurance company. If, of course, it is possible to insure currency risks against unstable currencies within the framework of an insurance contract.

When silence is recognized as a currency clause

“Please note,” emphasizes Moscow lawyer Serey Voronin, “even if the contract expresses a monetary obligation in foreign currency, but nothing is said about paying it in rubles, the arbitrators will most likely consider such an agreement on the currency clause, i.e., in accordance with clause 2 tbsp. 317 of the Civil Code of the Russian Federation (clause 3 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 4, 2002 No. 70) (hereinafter referred to as Letter No. 70). Moreover, this rule will also apply to non-contractual obligations (clause 7 of Letter No. 70). Moreover, if the transaction price was initially fixed in foreign currency, but by force of law this obligation cannot be fulfilled in foreign currency, then the arbitrators will consider the situation through the “prism” of the currency clause (this is also indicated in paragraph 3 of Letter No. 70).” .

Nuances: multi-currency clauses, “gold” clauses and clauses in the loan agreement

We examined the main types of clauses on currency risks. Other clauses that may occur in practice are derived from the main ones.

Examples of the most common clauses include:

- Multicurrency - when, instead of the rate of one stable currency, a certain settlement rate for a group of currencies (basket) is taken as a “peg”.

- “Gold” - the price of gold is used as a “peg”: the established value of the contract is expressed in gold equivalent. For example, the exchange value of 1 troy ounce of gold accepted by the parties as of January 25, 2017 is 1,196.00 USD. The cost of goods under the contract concluded on the same day is 1,000,000 USD. Then the contract price under the clause will be 836.12 troy ounces. If the exchange price of gold changes, contract settlements will change in accordance with it.

As a separate nuance, one can also highlight the clauses included in loan agreements. For example, in similar agreements between residents of the Russian Federation you can often find a condition that the ruble amount in the agreement must be calculated based on “conventional units”. The role of such units is usually the same stable currency. Simply, due to the current currency restrictions in the Russian Federation on foreign exchange transactions between residents, the parties prefer to avoid concluding loan agreements directly in foreign currency.

An interesting point in such agreements is that the currency clause in this case insures the parties not so much against the risk of currency exchange rate fluctuations on the international market, but rather against a decrease in the purchasing power of the ruble within the country, which is expected during the course of the loan agreement itself. That is, if a resident lender of the Russian Federation lends 70,000 rubles and knows that today he could buy a new iPhone with this money, then he wants to be sure that at least he will be able to buy an iPhone on the day he receives his money back from borrower.

The agreement is in foreign currency, and the payment is in rubles. What points need to be taken into account?

Firms that buy goods for foreign currency and sell them for rubles may encounter a situation where the dollar or euro is rising too quickly. What to do with the contract?

Concluding a contract where the obligation is expressed in foreign currency and payments are provided for in rubles will help you get out of the situation without losses. Irina Dudkina, leading specialist of the legal and tax consulting department of AKG “BUSINESS PROFILE”, will tell you how to sign such an agreement.

Since the sales price is set in rubles, often with deferred payment, a situation arises when these same rubles already received from buyers are not enough to purchase currency for settlements with the supplier. The same problem can occur with services, loans and other items of transaction. A kind of insurance against such situations is precisely the conclusion of an agreement in which: prices are expressed in foreign currency, for example in euros, and payments are provided in rubles at the rate specified in the agreement on the date of payment.

Everything is according to the law

The possibility of concluding such a contract is provided for in paragraph 2 of Article 317 of the Civil Code. It follows from the law that it is possible to establish any conventional units for an obligation in an agreement, these can be the euro or the US dollar, and fix any method of converting conventional units into rubles when paying. All conditions for converting amounts from foreign currency into rubles when paying must be specified.

in the agreement. In particular, the document must include a clause stating at what point the buyer’s obligation to pay for goods is considered fulfilled: at the time funds are written off from his current account or when money is credited to the supplier’s account. These may be different calendar days with different rates of the currency used for conversion.

If the parties mistakenly did not indicate in the contract the method of converting currency into rubles, then the monetary obligation should be considered as payable in rubles in an amount equivalent to a certain amount in currency or in conventional monetary units (clause 3 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 4, 2002 No. 70 “On the application by arbitration courts of Articles 140 and 317 of the Civil Code of the Russian Federation”). Now let's look at how such an operation is reflected in accounting and tax accounting.

Accounting

Accounting for contracts in conventional units is regulated by PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency” (Order of the Ministry of Finance of Russia dated November 27, 2006 No. 154n). In accordance with paragraphs 4–7 of PBU 3/2006: the value of assets denominated in foreign currency is subject to conversion into rubles on the date of the transaction at the rate established by the agreement. Recalculation of funds is carried out on the reporting date. The exception is for advances received or issued - they do not need to be revalued. With a 100% prepayment, the seller's sales are equal to the amount of the prepayment; exchange rate differences do not arise in this case. When paying after shipment, the sale is accounted for at the exchange rate on the date of shipment. Then you need to revaluate the accounts receivable at the reporting date, assigning the exchange rate difference to other income or expenses. After this, at the time of receipt of payment, you need to calculate the final exchange rate difference. Now let's look at the buyer's accounting. With 100% prepayment, the cost of delivery is equal to the amount of the prepayment; exchange rate differences do not arise. When paying after receiving the goods, you must capitalize it at the rate on the date of purchase, but you must keep in mind that the cost of the goods is not subsequently adjusted. After this, it is necessary to re-evaluate accounts payable as of the reporting date, assigning the exchange rate difference to other income or other expenses. Then, at the time of payment, the final exchange rate difference is calculated. Both the seller and the buyer, after the final calculation and write-off of exchange rate differences, should have a balance equal to zero.

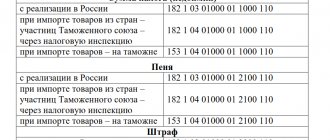

Tax accounting

The main difference between accounting and tax accounting of transactions under contracts in conventional units is that the latter does not provide for the revaluation of receivables or payables at the reporting date. For the seller, with 100% prepayment in accounting, sales are equal to the amount of the prepayment. There are no amount differences. There are no tax accounting specifics. When paying after shipment, sales are accounted for at the exchange rate on the date of shipment; the VAT tax base is not adjusted for subsequent amount differences (Clause 4, Article 153 of the Tax Code of the Russian Federation). Then, at the time of receipt of payment, you need to calculate the final amount difference, which does not contain VAT and is attributed to non-operating income or expenses when determining the taxable base for income tax (clause 11.1, clause 1, article 250; clause 5.1, clause 1, article 265 , paragraph 1, paragraph 7, article 271, paragraph 9, article 272 of the Tax Code of the Russian Federation). For the buyer, with 100% prepayment, the cost of delivery of the goods is equal to the amount of the prepayment; there are no specific tax accounting requirements for either VAT or income tax. When paying after receiving the goods, the buyer must capitalize it at the rate on the date of purchase. VAT is deductible in the amount indicated in the invoice. The price of the product is not subsequently adjusted. At the time of payment to the supplier, an amount difference arises, which also applies to non-operating income or expenses (clause 11.1, clause 1, article 250; clause 5.1, clause 1, article 265, clause 2, clause 7, article 271, Clause 9 of Article 272 of the Tax Code of the Russian Federation).

Filling out the “primary”

The requirements for primary documents are determined by paragraph 1 of Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”. Clause 2 of Article 12 of Law No. 402-FZ establishes that monetary measurement of accounting objects is carried out in rubles. In this case, according to the general rule established by paragraph 3 of this article, the cost of accounting items expressed in foreign currency is subject to conversion into rubles. Filling out primary forms is carried out only in rubles, including agreements in conventional units. For purchase and sale agreements, this primarily concerns the analogue of the Torg-12 form that is valid in each organization.

If full prepayment has been made, the exchange rate on the date of prepayment must be applied. If payment took place after shipment, then the rate will be the same as on the day of shipment (PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency”, approved by Order of the Ministry of Finance dated November 27, 2006 No. 154n).

Filling out forms in foreign currency is considered a violation of the requirements of the legislation of the Russian Federation for primary documents (Letters of the Ministry of Finance dated January 12, 2007 No. 03-03-04/1/866, Federal Tax Service of Russia for Moscow dated April 21, 2009 No. 16 -15/038922).

If it is necessary to demonstrate initially the cost of goods in conventional units, the organization can include additional columns in the standard form of the document (clause 13 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

Filling out acts of service provision occurs in the same way: either in rubles, or in rubles and in foreign currency.

Invoicing for unit contracts can be considered fully regulated. Clause 7 of Article 169 of the Tax Code of the Russian Federation stipulates that amounts in paper can be expressed in foreign currency if the agreement is concluded in currency units. However, in the later adopted Rules for filling out documents used in VAT calculations (Resolution of the Government of the Russian Federation of December 26, 2011 No. 1137) for contracts in foreign currency it is established (clause 1 of Section II of Appendix No. 1 to the Rules): “... when selling goods (works, services), property rights under contracts, the obligation to pay for which is provided in Russian rubles in an amount equivalent to a certain amount in foreign currency or in conventional monetary units, the name and code of the currency of the Russian Federation are indicated.”

Explanations for filling out invoices when selling in foreign currency are given in the Letter of the Federal Tax Service dated September 12, 2012 No. AS-4-3 / [email protected] Requirements for invoices issued for payment under contracts in currency units. in terms of the currency used, they are practically absent. In practice, the invoice repeats the currency of the obligation from the contract with a mandatory indication that the payment is in rubles, as well as a link to the exchange rate of whose currency and on what date the calculation is made.

Source: Press service of AKG “BUSINESS PROFILE”, “Raschet” magazine (October 2014)

Results

A currency clause is a way to offset the losses of the parties to a foreign exchange contract from fluctuations in exchange rates. For these purposes, a certain basic unit is introduced into the contract as a separate clause, by which the parties are guided when making calculations. Such a unit can be the rate of one stable currency, the average rate of a basket of currencies, or even the exchange price of precious metals. The clause may protect the interests of only one party to the contract or both parties. The characteristics of the clause in each specific case depend only on the agreements between the parties to the contract.

Read more about the peculiarities of working under foreign exchange contracts in the Russian Federation:

- “Currency transactions between residents and non-residents”;

- “Repatriation of foreign currency to the Russian Federation by residents is...”;

- “What is the essence of currency control in customs authorities?”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.