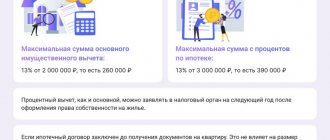

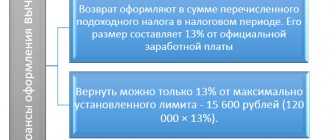

What is the tax deduction amount?

Each person is given a property deduction when purchasing a home once, subject to a limit of 2 million rubles. You can return 13% of this amount, but only within the limits of the funds actually spent on the apartment, that is, up to 260 thousand rubles. There is also a deduction for mortgage interest, but there is a separate limit for it - 3 million rubles.

Interesting materials:

How to bleach washed laundry at home? How to bleach washed clothes at home? How to bleach yellow tulle at home? How to whiten white socks at home? How to bleach white clothes at home? How to bleach tulle at home? How to bleach things at home? How to bleach curtains at home? How to fatten broilers at home? How to unscrew a rusty screw at home?

Additional information about tax deduction

Main types of tax deduction

Tax deductions exist in several formats:

- If income is received, it reduces the amount on which taxes must be paid. Basic situations: sale of a car, apartment, land, cottage or other real estate.

- In case of expenses, filing a tax deduction will help to return part of the taxes previously paid to the budget. Basic situations: expenses for education, treatment, purchase of medicines, purchase of housing.

- Standard tax deduction. Basic situations: child tax deduction.

When can I file my tax return?

A tax return is filed any time after the end of the year in which you had the income or expenses for which you want to take a tax deduction.

Let’s summarize what to do if you don’t receive a tax deduction

- Make sure the deadline has actually passed. If you submitted an application immediately when filing your return, the period for receiving the payment is a maximum of 4 months. If the application was submitted after a desk audit, which lasts 3 months, then the deadline for receiving money is 1 month after filing the application.

- Please keep in mind that transfers to your bank account may take up to 3 business days. If the Federal Tax Service sent the money on time, this will not be a violation.

- The very next day after receiving the payment, you can draw up a complaint to the Federal Tax Service and submit it through the taxpayer’s personal account or in person at the Federal Tax Service department where you submitted the application.

- Within 15 days, your application will be considered by a higher authority. If the complaint is found to be justified, your requirements will be promptly satisfied. Including the penalties you are entitled to.

If a complaint to the Federal Tax Service does not help, you can file an application with the court. If the amount of the claim is more than 50,000 - to the district. If less - in the world. But in practice such cases are rare.

Usually, if the tax office is late in paying a deduction, filing a complaint resolves everything very quickly; the money is received even at the consideration stage, when no answer has been given. Because initially the complaint falls into the hands of the Federal Tax Service, which committed the violation. She will clearly do everything possible to settle the matter without sanctions from the supervisory authority.

Give your rating

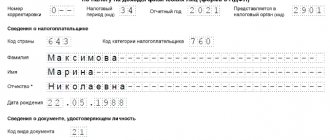

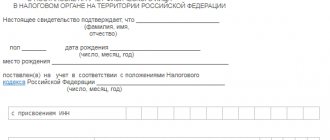

How to check the 3-NDFL declaration by TIN

The results of the declaration verification can be found on the website ]]> Federal Tax Service through the “Taxpayer Personal Account for Individuals” ]]> . But you won’t be able to immediately see at what stage the verification of the 3-NDFL declaration by TIN is; you still need to get a password to log in. To do this, you will have to personally visit any tax office once. At your tax office, it is enough to present any identification document. When contacting an inspectorate where you are not registered, in addition to your identity card, you must also take with you a copy of the certificate of receipt of the TIN. Login is also possible if you have an account on ]]> State Services portal ]]> .

The declaration is submitted not only upon receipt of income, but also if it is necessary to obtain a property or social tax deduction. Tax authorities must check all declarations within 3 months, for which they conduct a desk audit (clause 2 of Article 88 of the Tax Code of the Russian Federation). The correctness of calculation of income tax, the application of tax rates and benefits, whether the declaration is filled out correctly, whether all related documents are provided, and whether the deduction is justified is checked. If errors are identified, you will have to submit an updated declaration.

Deadline for a desk audit of the 3-NDFL declaration and how to find out the result

The consequences of a desk audit are no less serious if violations of tax legislation are revealed - additional assessment of taxes, fees, contributions and penalties, imposition of fines, freezing of accounts, forced collection of debts, etc.

To send a declaration via telecommunications channel, you must enter the password for the electronic signature. Individuals can receive an electronic signature in their personal account. Its registration takes a few minutes, and generation takes from half an hour to a day.

Deadline for a desk audit of the 3-NDFL declaration and how to find out the result

If your return was rejected, the status would be appropriate - the tax authority has not confirmed the amount of tax deduction claimed by the taxpayer. And confirmation of a refund when its amount is zero indicates technical reasons for the situation.

You definitely need to contact technical support or call the desk inspection department and find out what’s going on. But, as a rule, camera officers say that the result of the declaration is positive and you need to wait for the overpayment to be transferred.

How to check step by step through government services whether the verification of the personal income tax declaration has ended

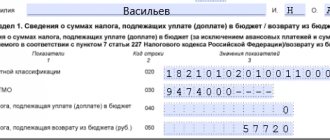

Paragraph 6 of Article 78 of the Code establishes that the amount of overpaid tax is subject to refund upon a written application from the taxpayer within one month from the date the tax authority receives such an application. With the launch of the service, taxpayers have the opportunity to track the status of desk audits of 3-NDFL tax returns.

The “3-NDFL Check Status” menu of the service displays the status of the declaration check (the progress of the desk check: completed or in progress, the result of the desk check, information on refund decisions, the amount of tax to be refunded). To connect to the “Personal Account”, a taxpayer can contact any tax office, regardless of place of residence and registration. In all tax inspectorates of the Rostov region, priority reception of citizens wishing to connect to the service has been organized

08 Aug 2022 jurist7sib 166

Share this post

- Related Posts

- Maternity and childbirth benefits in 2022 for those working in Ufa How much

- Denial of Medical Care at the Clinic of the Ministry of Internal Affairs to a Pensioner of the Ministry of Internal Affairs to a Participant in the War in Afghanistan

- Transport Card trips in Orel from February 1, 2022

- Unified Portal of State Services Application for Obtaining a Transport Card

Simple taxes

Not certainly in that way. If an overpayment amount appears, this only means that your declaration has been entered into the inspection database. That is, the operator entered it into your personal card. But the check is not finished yet; it may not even have begun. The tax office has 3 months from the date of submission of documents to verify the declaration.

You will see the number assigned to your declaration, the date of submission, and the date of registration. We are interested in the “Progress of the desk audit.” When the status becomes COMPLETED, then from this completion date we count one month for transferring money. The date, as you can see in the picture, appears next to the status.

We recommend reading: Transport Tax in the Lipetsk Region, Benefits for Pensioners

Where to track the 3-NDFL tax deduction on State Services

Citizens registered in the service can receive up-to-date information about tax debts without personally contacting the tax authority. The “3-NDFL check status” menu displays the status of the declaration check

On the government services website, later through the catalog of services using a search you can find “Acceptance of tax returns of individuals (3-NDFL)”, click “get service” (on the right, blue button) and if you have already submitted a return to the tax office, you will see all the information on it, including your return application.

How to find out when the tax deduction for an apartment will be transferred

- Apartments, houses, rooms that were purchased with the taxpayer’s own funds. In case of a shared purchase, an individual can return the overpaid tax only on his part of the property.

- Land plots for development, which have been assigned the status of individual housing construction.

- Plots on which any residential building is already located.

We recommend reading: Veteran of Labor Benefits From What Age in the Sverdlovsk Region

When purchasing a home with a mortgage, you can also receive compensation from the amount of interest paid to the bank. The maximum amount of mortgage interest to return the property benefit should not exceed 1 million rubles. Thus, the estimated base of mortgage housing for income tax refund is 3 million rubles.

How to check the status of a 3-NDFL desk audit in a taxpayer’s personal account

The results of checking reports and documents for tax refunds are tracked in the taxpayer’s personal account on the official website of the Federal Tax Service on the “3-NDFL” tab. This electronic service contains all the necessary information about registration, progress and confirmation or refusal of property deduction payments.

We recommend reading: New in Anti-Corruption Legislation 2022

If a taxpayer does not know how to view the progress of a desk audit on the updated website, there are several tips below. The user needs to go to the Federal Tax Service website and fill out the fields in the form: “login”, “password”. To change the login parameters, select the appropriate section to the right of the login button: Digital signature, State services. Further details.

Taxpayer personal account

You can track tax deductions in real time, without bothering Federal Tax Service employees with frequent calls, by using the online service “Taxpayer Personal Account”.

This resource allows citizens to:

- receive information about taxes (accrued, paid, overpayments and debts);

- fill out tax receipts, download them and print them;

- pay debts via online payments;

- contact the Federal Tax Service.

To find out the status of the tax deduction, you should find among the online tools of your “Personal Account” a request form related to the desk audit of 3-NDFL declarations.

There are two ways to get to your “Personal Account”.

First, enter the login and password that are in the registration card issued by the Federal Tax Service. To get a card, you need to come to the tax authorities with your passport and the original certificate with TIN. If a taxpayer has lost his login and password, it is easy to restore them by contacting the Federal Tax Service office again with the same documents as during registration.

Secondly, you can enter your “Personal Account” using a Universal Electronic Card (more precisely, an electronic signature attached to it). You can obtain a key with an electronic digital signature at one of the certification centers (as a rule, their functions are performed by regional branches of Sberbank). One of the advantages of the second method is that you can set and change the password yourself.

Both methods of logging into the “Taxpayer’s Personal Account” are free. There are currently about 2 million UEC holders in Russia.

Filing for a tax deduction online through State Services: step-by-step instructions

- On the main page of the nalog.ru website, in the “ Individuals ” section, click the “ Login to your personal account ” button.

- Select the function “ Log in/register using a government services portal account .”

- A window will appear to log into your personal account on State Services. Enter your details.

- Click on the “ Provide ” button, allowing the site to view your account information on State Services.

- Check the box to accept the Agreement. Click on the “ Register ” button.

- A warning will appear that the data in your personal account will be generated within three days. You may not be able to immediately find out the status of your tax return review.

- You have entered your personal account on the Federal Tax Service portal. Open the section “ Personal Income Tax and Insurance Contributions ” and click “ Declaration on Form 3-NDFL ”.

- View information about the status of the 3-NDFL check.

- Upon completion of the audit, you will receive a notification informing you of approval or denial of the tax deduction.

The application for a tax deduction can be filled out by portal users who have a verified account. The document will need to be signed with an electronic signature: enhanced qualified or enhanced unqualified.

Tax deduction through government services

Today, in order to submit a 3-NDFL format declaration to the Federal Tax Service, a citizen does not have to use or come to the district inspectorate in person. You just need to go to the government services portal and follow these steps:

- If a citizen has the title of Hero of Russia or is a combat veteran, or a veteran of the Great Patriotic War, as well as mothers raising 3 or more children, including those with adopted children, all these and some other categories of the population receive standard tax compensation in the amount from 500 to 12,000 rubles from each accrued penalty for the past reporting period.

- In the event that parents spend money on their children’s education or the citizens themselves are students, graduate students or residents of Russian universities, as well as residents of the Russian Federation whose health condition forces them to undergo expensive operations or preventive procedures, including palliative treatment, as well as persons who, according to their social status, are classified as pensioners for old age, loss of a breadwinner and other categories, they also have the right to receive compensation for personal income tax.

- If, while working, a citizen spent all or part of his honestly acquired and officially declared taxable income on the purchase of his own residential real estate using accumulated funds or a mortgage, he is entitled to a partial refund of the income taxes paid.

- If an employed person works for the benefit of the state and his work activity involves daily mortal danger, the state provides him with various tax breaks.

- If a citizen helps the state by providing his acquired wealth for temporary use to various promising investment funds, the state rewards him with tax benefits.