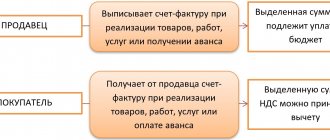

The invoice journal is necessary to record both issued and received documents. This register confirms the correctness of the accrued VAT. The register is submitted to the Federal Tax Service on a quarterly basis and is maintained by business entities engaged in intermediary activities - freight forwarders, agents, as well as developers and persons, incl. exempt from the duties of a taxpayer, or not being such (clause 3.1 of Article 169 of the Tax Code of the Russian Federation). The form of the journal and the procedure for its execution are regulated by Government Decree No. 1137 dated December 26, 2011. The updated version of the document is valid from July 1, 2022, its introduction is associated with the emergence of a national product traceability system (Government Decree No. 534 dated April 2, 2021).

Who submits the invoice journal

Only intermediary organizations are required to submit an invoice journal to the Federal Tax Service. An exception is when an agreement has been reached between the counterparties not to issue invoices.

In October 2016, the Russian Ministry of Finance, in letter dated October 31, 2016 No. 03-11-11/63683, provided clarification on the following issue. The seller and the agent using the simplified tax system agreed that they will not issue invoices. In this case, the agent buys goods for the individual principal. It turns out that invoices are not issued to the latter either. Will the agent violate the law if he neither maintains nor submits to the Federal Tax Service a journal of invoices regarding these commercial transactions?

The Ministry of Finance of the Russian Federation clarified that this will not be counted as a violation. When the buyer does not pay VAT, he and the seller can sign an agreement not to issue invoices. It turns out that since invoices are not issued, the agent is not required to maintain an invoice log regarding the procedures for purchasing goods for a given principal.

The obligation to keep a journal does not depend on whether you pay VAT. It is carried out by those who pay tax, are exempt from it, or are not payers at all.

Submit electronic reports via the Internet. Extern gives you 14 days for free!

Try for free

General overview

The document flow carried out as part of trade transactions between counterparties allows each party to receive official confirmation of the completed transaction, which is necessary for both internal accounting and external reporting. The traditional practice of issuing accompanying physical documentation, a package of which accompanies the shipment of products or a certificate of completion of work, has increasingly faded into the background in recent years. Its place is taken by the issuance of electronic invoices, issued and registered through authorized operators, even in cases where the buyer does not actually belong to the category of value added tax payers.

Sample of filling out the journal (the intermediary does not pay VAT)

The customer JSC Gamma-Sigma signed commission agreement No. 15 dated January 19 with Psi-Omega LLC, an intermediary who is not a VAT payer. The terms of the agreement are such that Psi-Omega sells a batch of 300 books, which belong to Gamma Sigma by right of ownership. A batch of goods costs 750,000 rubles (including VAT - 125,000 rubles).

As a remuneration for the services of the intermediary, an amount of 25,000 rubles is provided. On February 10, “Psi-omega” and JSC “Proizvodstvennaya” entered into an agreement for the supply of a batch of books (300 pieces). On February 20, the goods were shipped to the buyer, and at the same time Psi-Omega issued an invoice dated February 20, No. 28, to Kappa Lambda and gave a copy of it to Gamma Sigma.

In the accounting department of Psi-Omega, this document was registered in part 1 of the invoice journal; this invoice was not registered in the sales book.

For the amount of goods sold, Gamma-Sigma issued an invoice dated February 20, No. 128, to Psi-Omega. In the accounting department of Psi-Omega, this document was registered in part 2 of the invoice journal, in the Psi-Omega sales book. Omega" this invoice was not registered.

Since Psi Omega is not a VAT payer, it does not issue an invoice to Gamma Sigma for the amount of its remuneration.

Sample of filling out the journal (the intermediary is a VAT payer)

The customer Mu-upsilon JSC concluded a commission agreement dated June 2 with the intermediary Zeta-theta LLC, which pays VAT. Under the agreement, Zeta-Theta sells a batch of dictionaries (200 pieces) owned by Mu-Upsilon. The batch costs 320,000 rubles (including VAT - 53,333.33 rubles). The intermediary is provided with a remuneration of 16,500 rubles (including VAT - 2,750 rubles).

On June 15, Zeta-Theta entered into a supply agreement with Xi-omicron JSC for the supply of a batch of 200 dictionaries. Delivery took place on June 18. At the same time, Zeta Theta issued an invoice dated June 18, No. 812, to Xi-omicron, and a copy of it was given to Mu-upsilon. This document was registered in the Zeta-Theta accounting department in part 1 of the invoice journal, but not in the sales book.

For the amount of dictionaries sold, “Mu-upsilon” issued an invoice to “Zeta-theta” dated June 18, No. 375. The invoice received from “Mu-upsilon” was registered in the accounting department of “Zeta-theta” in part 2 of the invoice journal. invoices, but not in the purchase book.

Since “Zeta-theta” is a VAT payer, he issued an invoice to the customer dated June 18, No. 987, for the amount of his remuneration. This document is subject to registration in the sales book, but not in the invoice register.

Operation type codes

When cross-checking suppliers and buyers who participate in an intermediary transaction, inspectors pay attention to how correctly the transaction type codes are indicated. As you know, in accordance with the Order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3 / [email protected], codes of types of VAT transactions must be indicated in the invoice journal. These are 24 codes that are included in one table.

The tax authorities also explained what values of codes and other details must be entered in the journal in order to reflect certain transactions of the intermediary. For example, if an intermediary sells goods belonging to the principal, then the invoice issued by the intermediary in the name of the buyer is reissued by the principal and is reflected in the sales book of the principal (principal) and in part 2 of the intermediary's journal. Also, KVO - 01 is entered in both parts of the journal.

Another situation is when an intermediary sells the principal’s goods and at the same time his own goods, that is, he is both a commission agent and a supplier. In this case, the intermediary issues an invoice for all goods - both those that belong to the consignor and his own. In this case, the intermediary is registered as the seller. This document under code KVO 15 must be registered both in the intermediary’s sales book and in part 1 of the intermediary’s journal. And in the buyer’s purchase book it is necessary to enter KVO 01.

Next, the consignor re-issues an invoice, where he enters only his goods. This invoice must be reflected under code 01 in the principal's sales book and under code 15 in part 2 of the intermediary's journal.

Let's look at an example:

The commission agent Tau-Iota LLC shipped 30 goods to the buyer Phi-Hi-Psi LLC, 22 of which are the property of the principal JSC Gimel-Yod and are sold under an intermediary agreement. Gimel-iodine products cost 264,000 rubles (including VAT - 44,000 rubles). The remaining 8 products belong to Tau-Iota and cost 178,000 rubles (including VAT - 29,666.67 rubles).

Tau-Iota LLC issued invoice No. 657 in the name of Phi-Hi-Psi LLC for a total amount of 442,000 rubles (264,000 + 178,000) indicating 20% VAT in the amount of 73,666.67 rubles (44,000 + 29,666.67). This invoice was registered by both Tau-Iota LLC and Phi Phi LLC.

Then Tau-Iota LLC transferred the figures of invoice No. 657 to Gimel-Yod JSC, and the accountant of Gimel-Yod JSC issued invoice No. 909 in the name of Tau-Yota in the amount of 264,000 rubles, including VAT. in the amount of 44,000 rubles. This document was registered with Gimel-Iod JSC and Tau-Iota LLC.

Let's look at another case - the intermediary makes purchases of goods for the consignor. Here the supplier issues an invoice in the name of the intermediary, and the intermediary enters it in part 2 of the journal. The supplier also registers it in the sales book. Next, the intermediary re-issues an invoice in the name of the principal, where he registers the actual supplier as the seller. This document must be registered both in the first part of the intermediary's journal and in the principal's purchase book. In all cases, the operation code is 01.

For example, the intermediary Nun-lamed LLC purchased goods from the supplier Kaf-he LLC. At the same time, part of the goods was purchased for the consignor JSC Zain-mem under an intermediary agreement. The cost of purchases for Zain-mem amounted to 609,000 rubles (including VAT - 101,500 rubles). “Nun-lamed” purchased the rest of the goods for himself. The cost of goods purchased for Nun-lamed amounted to 389,000 rubles (including VAT - 64,833.33 rubles).

"Kaf-he" issued invoice No. 1026 in the name of "Nun-lamed" in the amount of 998,000 rubles (609,000 + 389,000) indicating 20% VAT in the amount of 166,333.33 rubles (101,500 + 64,833.33 ). This document was registered with Kaf-he and Nun-lamed.

After this, Nun-lamed issued invoice No. 262 in the name of Zain-mem JSC. This document reflects goods in the amount of 609,000 rubles purchased from Kaf-he for Zain-mem JSC, and indicates VAT 20% on the amount of 101,500 rubles. Invoice No. 262 is registered with Nun-lamed and Zain-mem.

About consolidated invoices

In 2014, the Government of the Russian Federation allowed the preparation of so-called consolidated invoices - data is entered there when goods are purchased from several sellers at once. This reduces the number of invoices when processing transactions.

For example, the customer JSC Het-bet, in order to erect a structure, turns to the developer Omega-upsilon LLC. The latter, in turn, cooperates with several contractors and suppliers and reissues the invoices received from them to Het-bet.

In the first quarter, Omega-upsilon received invoice No. 743 dated July 27, 2022 from the supplier Shin-ain JSC, and invoice No. 219 dated July 27, 2022 from the contractor Sameh-pe JSC.

Based on these invoices, Omega Upsilon compiled a consolidated invoice and issued it to Het-bet JSC on July 27, 2022. Omega-upsilon registered the consolidated invoice issued to Het-bet and the invoices received from the performers in the invoice journal. Het-bet recorded the resulting consolidated invoice in Part 2 of the invoice journal.

Submit electronic reports via the Internet. Extern gives you 14 days for free!

Try for free

Frequently asked questions ↑

Even having sorted out filling out invoices, company management and accountants still have questions. We will answer the questions that are most often asked on the Internet.

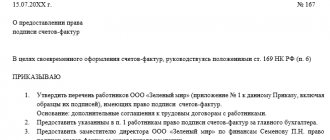

Is facsimile signature allowed?

The use of facsimile signatures on primary documentation, except in cases where financial consequences are possible, may be justified by written agreements of the parties.

In other cases, including when issuing invoices, disagreements arise that payers resolve in court.

There are two positions. The tax authority is of the opinion that companies do not have the right to use facsimile signatures when presenting amounts for VAT deductions.

Justification - if the invoice is drawn up in violation of the norms prescribed by law (clauses 5, 5.1, 6 of Article 169 of the Tax Code), the company will not be able to deduct the tax.

In accordance with Art. 169 clause 6 of the Tax Code of the Russian Federation, the document must be signed by the head of the organization, the chief accountant or an authorized representative. The article does not contain provisions allowing the use of an electronic or facsimile signature.

If such a signature is affixed, then the payer will not be able to submit tax amounts for deduction, and also does not have the right to register such forms in the accounting books.

The court has a different point of view. In judicial practice, there are frequent situations when the payer can reimburse the amount of VAT from the treasury that was paid earlier if the form contains a facsimile signature.

The judges argue their position as follows - in Art. 169 there is no indication of how the signature should be placed. It only talks about who has the right to put it up.

In this regard, when affixing a facsimile (analogous to the signatures of authorized persons), when the goods are capitalized and the tax is paid, taxpayers have the right to accept VAT amounts as deductions.

In this case, it is worth focusing on the rules of Art. 171 clause 2, art. 172 clause 1 of the Tax Code. Permission to put facsimile signatures is established by other regulatory documents.

For example, a company may provide for the affixing of such types of signatures in contracts in cases where it is not possible for the director to sign the documentation due to his absence.

If you follow the rules followed by the courts, there is a high probability of a dispute with tax authorities. You will have to resolve this issue in court.

Is there a stamp on the invoice?

There are no provisions in the legislative acts of Russia and in Resolution No. 1137 that require payers to put stamps on invoices. You just need to sign the form.

Correction after passing

Intermediaries who do not pay VAT may have a question: if an organization submitted a journal and then found errors there, should it submit a corrected invoice journal to the Federal Tax Service? The answer here is the following: the law does not stipulate that the corrected journal must be submitted to the Federal Tax Service. However, it is better to do this. To make changes to the document, cancel the incorrect invoice. This means, indicate the cost of goods and the amount of tax with a “–” sign. Register the correct invoice with a “+” sign.

For example, an intermediary purchased goods for a customer. The intermediary's accounting department saw that the incorrect details of the invoice received from the seller were entered in the accounting journal for the second quarter. Indicated: No. 9769 dated March 9, 2022. Should be: No. 3131 dated February 18, 2022. Moreover, the journal is already in the inspection. Then the accountant canceled the incorrect entry in Part 1 of the journal and indicated the total indicators with a “–” sign. In the next line I entered the same as in the canceled line and corrected column 12 by indicating the correct invoice number. Cost indicators - indicated with a “+” sign.

In Part 2 of the journal, I canceled the incorrect entry and reflected the totals with a “–” sign. In the next line he indicated the same thing as in the canceled one, but corrected column 4, where he corrected the invoice number. Cost indicators are indicated with a “+” sign.

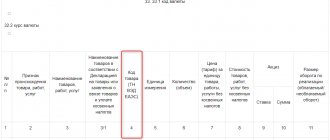

VAT accounting registers

Accounting registers contain data from primary documents and are lists of transactions that are grouped by accounting accounts and arranged chronologically. This category includes statements, reports in tabular form, etc.

The forms are approved in the accounting policy. Accounting registers must include the following mandatory details:

- register name;

- name of the organization / full name of the entrepreneur;

- the period for which the register was compiled;

- grouping of accounting objects;

- units;

- list of officials responsible for maintaining the register.