How to write off materials from an off-balance sheet account?

Postings for capitalization and write-off from the account. 002 look like this:

| Debit | Credit |

| Acceptance of inventory items for storage | |

| Disposal of inventory items accepted for storage |

Write-off of inventory items from the account. 002 is carried out on the basis of:

- form MX-3 or a similar document developed by the organization (taking into account the requirements of paragraph 2 of Article 9 of Law No. 402-FZ) to record the return of valuables accepted under a storage agreement;

- TORG-12, UPD or other documents - upon disposal of inventory items that were taken into account on the account. 002 within the framework of the supply agreement.

For operations with customer-supplied raw materials, the executing organization uses an off-balance sheet account. 003:

| Debit | Credit |

| Received materials for processing | |

| Recycled materials were transferred to the customer |

If products are made from customer-supplied raw materials, then the entries in off-balance sheet accounting may be as follows:

| Debit | Credit |

| Received materials for processing | |

| Customer-supplied raw materials are transferred to production | |

| Products made from customer-supplied materials have been capitalized | |

| Manufactured products were transferred to the customer |

With account 003 materials are written off based on:

- report on the consumption of customer-supplied raw materials (Article 713 of the Civil Code of the Russian Federation);

- work acceptance certificate;

- invoice M-15 or other similar documentation agreed upon by the parties.

When selling goods under a commission agreement, the commission agent is accounted for according to the account. 004 there will be the following accounting entries:

| Debit | Credit |

| Goods received under a commission agreement were capitalized | |

| Products accepted for commission were sold |

Write-off of inventory items from an off-balance sheet account. 004 is carried out on the basis of the primary document drawn up upon the sale of valuables - TORG-12, invoice, UPD or other documentation agreed upon by the parties to the commission agreement.

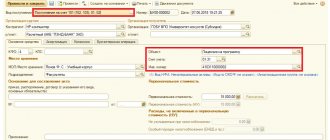

Filling out an inventory document in 1C: Accounting

For this operation, a separate item is provided in the program interface in the “Warehouse” section:

When you go to the section, a list of previously completed inventories opens, but we need to create a new document. This is done as standard by clicking the “Create” button:

Please pay attention to filling out the fields in the document header:

a date must be set. The balances will be filled exactly on this date;

You can generate a document by warehouse or by responsible person. When choosing the first method, the balances of the specified warehouse will be filled. In the second option, balances will be generated for all warehouses that are assigned to this responsible person.

Let's analyze the inventory of the warehouse. The document needs to be filled out; this is done automatically when you select a filling method from the drop-down menu of the “Fill” button:

A table will be generated with all the goods that are listed in the specified warehouse in 1C:

The table shows the item, its actual and accounting quantities. The document can be recorded and printed to be sent to the warehouse for direct inventory. A printable form is provided for this:

The form is filled out by warehouse employees, after which the actual data is entered into the corresponding column of the table:

The program itself calculates the deviation: shortages are indicated in red with a “-” sign, and surpluses are indicated in black. After filling out the column, the document is recorded and posted. Based on it, you can print out the necessary paper forms:

Inventory in 1C:Accounting itself does not write off or capitalize; separate documents are provided for these operations.

Balance sheet and off-balance sheet accounts

Despite the fact that both balance sheet and off-balance sheet accounts are used to control the activities of the company, ensure normal functioning and maximum information content of accounting, they work differently.

All property and sources of the company are recorded on balance sheet accounts, i.e. they are at the disposal of the company and are controlled by it, in particular, by drawing up the balance sheet and analyzing the results. Another thing is the use of off-balance sheet accounts. They combine and generate information about the availability and dynamics of values temporarily at the disposal of the company, and are also used to exercise control over operations related to securing obligations for issued or received payments, reflecting bad debts of debtors, etc.

Off-balance sheet accounts are auxiliary accounting accounts that disclose information that is not on the balance sheet. This information is accumulated in a certificate of the presence of off-balance sheet accounts, provided in the form of the enterprise’s balance sheet and submitted as reference information. It does not affect the financial result and is not included in the company’s reporting; it is only explained in the notes to the balance sheet.

Another difference between off-balance sheet accounting is the absence of double entry rules. Those. The receipt of an object is recorded on the debit of the account without correspondence with another account, the disposal is recorded on the credit, reflecting only the transaction performed. These are the main features of off-balance sheet accounts.

Off-balance sheet account MC 04, how to use it

Accounting and taxes 2020

The off-balance sheet account MTs.04 is used by users of the accounting program “1C: Accounting” to account for the inventory and household supplies transferred into operation. Inventory receipts are debited from this account, and disposals are credited to this account. Analytics is carried out in quantitative terms, by item items and financially responsible persons.

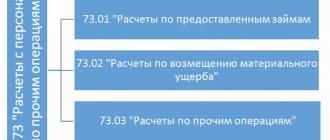

Why are off-balance sheet accounts of MC needed (MC.01, MC.02, MC.03, MC.04)

In the chart of accounts of the 1C: Accounting program there is a number of additional off-balance sheet accounts in addition to the 11 generally accepted ones. This is done for more thorough and convenient accounting.

Account MC.04 is a subaccount of the MC account “Material assets in operation” along with three more subaccounts:

- MC.01 “Fixed assets in operation”,

- MC.02 “Workwear in operation”,

- MTs.03 “Special equipment in operation.”

МЦ.02—an off-balance sheet account used to account for special clothing issued to an employee to perform his official duties. Account MTs.03 accumulates information on special tools and equipment transferred into operation. Account MTs.01 is often used if the fixed asset is reflected differently in tax and accounting.

The introduction of these accounts into accounting is due to the need to control property written off from the organization’s balance sheet, included in costs, but used in the organization’s economic activities.

Entries on the debit of account MTs.04

According to the Chart of Accounts (order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), the balance sheet account 10.09 is used to capitalize inventory and household supplies. To reflect this business operation in the 1C: Accounting program, the document “Receipt of goods and services” is provided.

When instruments and other inventory are accepted for accounting, a new document is created with the transaction type “Purchase, commission”.

The document is filled out indicating:

- what has to happen

- from whom,

- in what quantity,

- at what price.

Account 10.09 “Inventory and household supplies” is selected as a debit accounting account.

An entry in the credit of account 10.09 occurs when inventory and other household property are transferred into operation. For this purpose, a document “Transfer of materials into operation” is created and carried out.

When transferring inventory, fill out the “Inventory and Household Supplies” tab:

- the nomenclature of transferred values is selected by position,

- the employee accepting them for use,

- the accounting account 10.09 and the method of reflecting costs are indicated.

When posting a document, values are written off from accounting account 10.09 to the cost account. At the same time, these values are debited to account MTs.04 in the context of nomenclature, quantity and financially responsible persons. In this way, proper control over the safety of the organization’s property can be organized.

The document “Transfer of materials into operation” allows you to print the issue record sheet (form MB-7) or the demand invoice (form M-11). If necessary, you can change the financially responsible person responsible for the safety of economic assets recorded on the balance sheet.

Tax Credit Claims

Entries on the credit of account MC.04

An entry in the credit of account MTs.04 occurs upon the actual disposal of property. To do this, a new document “Decommissioning of materials” is created.

In this document, fill out the “Inventory and Household Supplies” tab:

- the nomenclature and quantity of disposed property is indicated,

- document transferring it into operation,

- the person responsible for its storage.

The document allows you to print out the Write-off Certificate (form MB-8).

Inventory of account MC.04

For organizations, conducting an inventory is a mandatory procedure (clause 27 of the Regulations on accounting, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n). In this case, both balance sheet and off-balance sheet accounts must be audited.

Off-balance sheet accounting of inventory and other business property is carried out to monitor its safety.

Article taken from the website Nalog-nalog.ru

Transfer of special clothing into service

Step 1. Create in 1C 8.3 the document “Decommissioning of materials into operation”

Go to the “Warehouse” section (1) and click on the “Transfer of materials for operation” link (2). A window for generating a document will open. In the window that opens, click the “Create” button (3). A document will open for you to fill out. In the form to fill out, please indicate:

- your organization (4);

- transfer date (5);

- warehouse from which work clothes are written off (6);

- department to which special clothing is transferred (7).

MOVING FROM “1C” TO “BUKHSOFT” Transferring data from your “1C” is now easy! BukhSoft transfers all data without loss and checks it!

Step 2. Fill out the “Workwear” tab in the document “Decommissioning of materials”

In the “Workwear” tab (1), click the “Add” button (2). In the “Nomenclature” field (3), select the required workwear from the nomenclature directory. Next, fill in the fields:

- "Quantity" (4). Indicate the quantity of protective clothing to be transferred;

- "Individual" (5). Select the employee to whom the workwear is transferred;

- “Purpose of use” (6). Here, specify the accounting parameters for writing off workwear. Use the cost repayment method “Repay the cost upon transfer into operation.” In the method of recording expenses, indicate the write-off account, for example “01/20”.

The “Account Account” (7) and “Transfer Account” (8) fields will be filled in automatically. To complete the operation, click the “Record” (9) and “Pass” (10) buttons. Now in the accounting records there are entries for the transfer of special clothing into operation. Click the “DtKt” button (11) to view the accounting entries for this operation. The entries show that account 10.11.1 “Special clothing in use” reflects the transfer of special clothing (12) and the write-off of its cost as expenses (13). The write-off is reflected in the debit of account 20.01 “Main production” (14). On the special account MTs.02 “Workwear in operation” (15) in 1C 8.3, a record of workwear is kept for each employee to whom one was issued. If the workwear has become unusable, write it off from this account using the document “Write-off of materials from use.”

Entries on the debit of account MTs.04

According to the Chart of Accounts (order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), the balance sheet account 10.09 is used to capitalize inventory and household supplies. To reflect this business operation in the 1C: Accounting program, the document “Receipt of goods and services” is provided.

When instruments and other inventory are accepted for accounting, a new document is created with the transaction type “Purchase, commission”. The document is filled out indicating:

- what has to happen

- from whom,

- in what quantity,

- at what price.

Account 10.09 “Inventory and household supplies” is selected as a debit accounting account.

An entry in the credit of account 10.09 occurs when inventory and other household property are transferred into operation. For this purpose, a document “Transfer of materials into operation” is created and carried out.

When transferring inventory, fill out the “Inventory and Household Supplies” tab:

- the nomenclature of transferred values is selected by position,

- the employee accepting them for use,

- the accounting account 10.09 and the method of reflecting costs are indicated.

When posting a document, values are written off from accounting account 10.09 to the cost account. At the same time, these values are debited to account MTs.04 in the context of nomenclature, quantity and financially responsible persons. In this way, proper control over the safety of the organization’s property can be organized.

The document “Transfer of materials into operation” allows you to print the issue record sheet (form MB-7) or the demand invoice (form M-11). If necessary, you can change the financially responsible person responsible for the safety of economic assets recorded on the balance sheet.

Transfer of equipment and household supplies into operation

Step 1. Fill out the “Inventory and Household Supplies” tab in the “Materials Write-off for Operation” document

In 1C 8.3, household equipment, as well as workwear, is transferred in the document “Writing off materials for use.” How to create a document and fill out its basic details is written in step 1 of the section “Transferring workwear into operation.” To transfer household equipment, the “Inventory and Household Supplies” tab (1) is provided. In this tab, click the “Add” button (2). Next, fill in the fields:

- "Nomenclature" (3). Select the required inventory from the item directory;

- "Quantity" (4). Indicate the quantity of transferred inventory;

- “Individual” (5). Select an employee responsible for storing inventory;

- “Method of recording expenses” (6). In this directory, choose a method for recording expenses, which indicates an account for writing off the cost of inventory as expenses, for example, account 25.

The “Account” field (7) will be filled in automatically. To complete the operation, click the “Record” (8) and “Pass” (9) buttons. Now in accounting there are entries for the transfer of inventory into operation. Click the “DtKt” button (10) to view the accounting entries for this operation. The entries show that the write-off of the cost of inventory is reflected in the debit of account 25 “General production expenses” (11). On a special account MTs.04 “Inventory and household supplies in operation” (12) in 1C 8.3, inventory is kept track of the employees to whom it is issued. If the inventory has become unusable, write it off from this account using the document “Write-off of materials from use.”

Off-balance sheet account MC 04 - what is it and how to use it?

In the details of the invoice we indicate the returned equipment/working clothes:

(If equipment/working clothing was written off immediately upon transfer to operation, then there is no need to return this equipment/working clothing).

Decommissioning of MBP from service

We create the operation “Decommissioning of MBP from operation”. In the header of the invoice we indicate the write-off account and the employee whose equipment/workwear being written off is in use:

In the details of the invoice, if equipment/working clothing is written off as scrap, then in the field “Received scrap for the amount” we indicate the amount of scrap received, otherwise we leave this field blank. Based on the amount of scrap received, the scrap capitalization table of the MB-8 form is filled out.

If in the operation “Transfer of the IBP into operation” this inventory (working clothes) has already been written off from operation, then in this case the inventory/work clothes will be written off only from the credit of the off-balance sheet account “MC”, otherwise the write-off will be carried out to the write-off account specified in the invoice header .

Home — Articles

MC 04 off-balance account what is it

He creates a business transaction, the content of which sounds like “capitalization of surplus inventory.” This option cannot be considered correct, because surpluses, as is known, appear as a result of inventory, but in this case it was not carried out.

The only way that helps solve the problem is to use the “Sales of goods and services” document. When creating it, in the “Account Account” tab, you should indicate the off-balance sheet account from which you want to write off the asset (as a rule, this is account MTs04).

In the “Income Account” tab, you need to put account 91.01. Then, using this document, a posting will appear in accounting reflecting the receipt of income in the form of revenue for the sold object. At the same time, the object will be written off to the credit of an off-balance sheet account. Here it is necessary to take into account one important nuance.

When selling, the program must write off the same asset that was previously put into use.

Why is there no off-balance sheet account mts.04 in the chart of accounts?

In addition, their cost must be taken into account in the off-balance sheet account MTs.03 “Special equipment in operation.” Now in the 1C document “Transfer of materials into operation” you need to fill out the “Special equipment” tab.

We fill in the purpose of use similarly to the previous example, while for the mold the method of repayment of the cost must be specified as linear with a period of use of 12 months, and for the stamp - repay the cost upon transfer to operation. Accounting account for special equipment – 10.10, transfer account – 10.11.2.

After posting, the document makes accounting entries according to the settings for the purpose of use: the cost of the stamp is immediately written off in accounting (the write-off account is determined by the method of reflecting expenses), and the cost of the mold is written off in tax accounting, the accounting cost will be repaid in parts at the close of each month during the period use. PS

Accounting for fixed assets worth up to 20,000 rubles. in “1C:Enterprise”

According to the accounting rules in the Russian Federation, assets that are used to produce products, provide services or the organization’s own needs and whose service life is less than or equal to 12 months, regardless of cost, are recognized as inventories.

Such assets include special clothing, special equipment and equipment. When these inventories are transferred into operation, the fact of transfer must be reflected in the organization’s primary documentation and in the accounting registers.

Let's see how the transfer of materials into operation is implemented in 1C 8.3 Accounting (rev. 3.0). Working clothes and equipment Example 1. To mechanic Vintikov I.I.

for work in the production workshop, special clothing was issued - a work suit with a service life of 6 months (during this period the cost of the suit should be written off).

For what purposes is the off-balance sheet account “mts” used in the configuration?

Important

Production workshop, Yuryev Vladimir Anatolyevich. On 04/01/11 the facility was decommissioned. Let's draw up the document Receipt of goods and services with the transaction type of the document Purchase, commission.

When filling out the Products tab, enter in the Nomenclature field the element Fan heater, located in the Inventory and household supplies group of the Nomenclature directory. This arrangement of the element in the directory will allow the system to automatically fill out the accounting account, indicating 10.09. It should be noted that when using the Nomenclature directory, elements can be arranged in a way that is convenient for the accountant; using predefined groups is not necessary, although it is convenient, since this leads to automatic completion of accounting accounts in documents.

We formalize the sale of material assets recorded on an off-balance sheet account

To perform this, we will use the document Decommissioning of materials (Production Decommissioning of materials). Here we fill out the tabular part Inventory and household supplies (Fig. 2.

18): Nomenclature: Fan heater Batch of materials in operation: Transfer of materials into operation (document with which the object was transferred into operation) Individual: Yuriev Vladimir Aleksandrovich Quantity: 1 enlarge imageFig. 2.18.

Off-balance sheet accounts

Automatic repayment will be carried out in monthly installments at the end of the month according to the method specified in our document. After this, the temporary difference will be eliminated. We enter the plumber’s hammer in the same document on the “Inventory and Households” tab. accessories".

Add a line, select a nomenclature, physical. person, method of recording expenses. The cost of inventory will be immediately written off according to this method of reflection.

The document will generate accounting entries for the transfer of our inventory into operation:

- Dt 20.01 Kt 10.09 (for our example);

- in Dt off-balance sheet account MTs.04 “Inventory and household items. accessories in use."

By clicking the “Print” button, the document allows you to print the completed forms of the MB-7 issue record sheet and the M-11 invoice requirement. Special equipment Example 2. Special equipment - a stamp and a mold - was transferred to the production workshop for operation.

Transfer of materials into operation in 1c 8.3 accounting 3.0

OS (clause 4 of PBU 6/01), but the cost of which does not exceed 40,000 rubles. per unit, are taken into account as part of inventories (clause 5 of PBU 6/01). In the “Method of reflecting expenses” field, click on the “Select from list” button. This opens the directory “Methods of reflecting expenses” (Fig.

4), in which you need to select the desired element or create a new one. In accordance with the specified method of reflecting expenses, when posting a document, the cost of the object will be written off as expenses.

In the dialog form that opens, indicate the name of the method, cost account and analytics to which the costs will be attributed at the time the object is put into operation (Fig. 4). The “Account Account” field is filled in automatically; you need to check it. Rice. 3 Fig.

4 Result of posting the document “Transfer of materials into operation” (Fig. 5): To view the transactions, click the button Show transactions and other movements of the document.

Fixed assets: accounting, depreciation

Receipt of low-value fixed assets from the supplier 10 60 Bill of lading, Receipt order, Receipt invoice, Certificate of acceptance of equipment 2 Reflection of incoming VAT 19 60 Invoice, accounting statement 3 Payment of debt to the supplier 60 51, 50 Bank statement, payment documents, cash settlement 4 Acceptance to deduction of input VAT 68 19 Invoice, accounting certificate 5 Transfer of low-value fixed assets into operation 20, 26 and others 10 Requirement-invoice, accounting certificate 6 Reflection of fixed assets transferred for operation on the off-balance sheet account MTs.04 Requirement-invoice, accounting certificate 7 Write-off earlier transferred objects from operation MC.04 Write-off act, accounting certificate With this accounting scheme, the object is credited to account 10, after which it is transferred into operation with the cost of the object completely written off to the cost account - in the case of the main production, this will be account 20. Other possible options for the repayment method - repayment upon commissioning or in proportion to the volume of products (works, services). There is also a field for choosing a method for reflecting expenses (you can choose from a directory) in order to correctly write off the cost of inventories to the expense account. After completion, accounting entries will be generated in 1C 8.3, reflecting the transfer of workwear into operation:

- Dt 10.11.1 Kt 10.10;

- posting to Dt off-balance sheet account MTs.02 “Working clothes in use.”

But repayment of the cost of workwear according to the method of reflection (for us it is Dt 20.01 Kt 10.11.1) occurs only in tax accounting (TA). As a result, a temporary difference (TD) appears between tax and accounting data. The cost in accounting will be repaid during the period of use of the inventory.

In the month of purchase, the equipment was put into operation, and 6 months later it was sold to the buyer for RUB 17,405.00. (including VAT 18% – RUB 2,655.00). 1. Accounting for the receipt of a personal computer To perform the operations “Receipt of a personal computer” and “Accounting for input VAT”, it is necessary to create the document “Receipt (act, invoice).” Creating the document “Receipt (act, invoice)” (Fig.

1):

- Call from the menu: Purchases – Purchases – Receipts (acts, invoices).

- Click the “Receipt” button and select the document transaction type “Goods (invoice)”.

- In the “Invoice No.” and “from” fields, enter the number and date of the receipt document.

- By clicking the “Settlements” hyperlink, you can change the accounts of settlements with counterparties and the rules for offsetting the advance.

For this purpose, you need to create transactions: DEBIT 62 CREDIT 91 subaccount “Revenue” - shows the proceeds from the sale of the asset; DEBIT 91 subaccount “Expenses” CREDIT 68 - VAT is charged on the sale of the asset; DEBIT 51 (or 50) CREDIT 62 - revenue received from the buyer In tax accounting, it is also necessary to reflect income from sales and show them in the income tax return. As for expenses in the form of the purchase price of a sold asset, they should not be shown either in accounting or tax accounting. The fact is that these costs were already taken into account at the time of transfer to operation, and repeated reflection will lead to a distortion of the tax base and financial results. Is it necessary to restore the asset on the balance sheet? In practice, many accountants are not limited to the above entries. They create an additional operation, the essence of which is to restore previously written-off values on the balance sheet. Often organizations sell inventory and household supplies that were previously in use. As a rule, this causes certain difficulties, since such assets are most often recorded off-balance sheet, and most modern programs do not provide for the sale of goods from off-balance sheet accounts.

https://www.youtube.com/watch?v=hIbZF4LHzr0

In practice, accountants use a number of techniques that allow them to circumvent difficulties and correctly reflect the sale of inventory. We studied the experience of our forum participants and summarized it in this article.

Introductory part Most companies have assets that meet the criteria of fixed assets, and the value of which does not exceed 40,000 rubles. for a unit. These are tools, overalls, various equipment, etc. Such objects are most often included in inventories (MPI) on the basis of paragraph 5 of PBU 6/01 “Accounting for fixed assets”.

Source: https://dobropom.ru/mts-04-zabalansovyj-schet-chto-eto/

Transfer of materials into operation

The focus of accounting solely on taxation purposes often becomes the reason for ignoring off-balance sheet accounting, since it is not related to the formation of tax bases.

However, if you go beyond expecting fines from a tax audit, then everything will fall into place.

Let me give you an example. If the issued pledges and guarantees significantly exceed the value of not only net assets, but also the value of the balance sheet currency, then only an unqualified or unscrupulous auditor can ignore the risk of violating the principle of business continuity of the organization.

Indeed, in the event of demands for repayment of obligations, the organization does not have the opportunity to satisfy them. This fact must be reflected in the auditor's report. And our experience shows that often only after receiving an audit report with such a reservation, organizations begin to evaluate negative factors that could lead to a reduction in activities or liquidation of the organization.

Another common situation. Often, information about leased properties is not included in accounting due to the fact that the cost of the leased property is not agreed upon by the parties.

However, the absence of such information in financial (accounting) statements does not give users of these statements a complete picture of the company’s property status. For example, often, judging by the reports, production does not need production equipment at all, trade does not need warehouse space, and management does not need an office. Such information about the organization cannot in any way be considered reliable, and the auditor, if the volume of leased assets not reflected in the reporting is significant, is obliged to include a corresponding clause in the auditor’s report.

To properly account for the organization, it is necessary to agree on the value of the leased objects in the contract with the lessor, and if this is not possible (lessors often shy away from providing such information) - to independently estimate their value. Such a non-contractual assessment will still be a lesser distortion of the data than their complete absence.”

So, it is better to keep off-balance sheet accounting. Moreover, it is not difficult to do this - it is carried out according to a simple scheme without using the double entry method. Is it difficult, for example, to reflect the cost of a rented office on account 001?

It is also convenient to use off-balance sheet accounting to monitor assets or liabilities that have already been written off from balance sheet accounts. For example, for low-value objects, the cost of which is written off as expenses upon commissioning.

The Chart of Accounts does not provide for off-balance sheet accounts to account for these assets. But you can use an open account yourself (for example, in the working chart of accounts it can be called account 012 “Assets with a useful life of more than 12 months and a value of less than 20,000 rubles”).

Of course, it is possible to control the movement of low-value objects without using off-balance sheet accounting. But why invent something when there is a ready-made version of such accounting.

* * *

As we see, off-balance sheet accounting is undeservedly deprived of the attention of accountants. If users of your reporting need complete information and you don’t want problems with the tax authorities, you need to keep off-balance sheet accounting

If users of your reporting need complete information and you do not want problems with the tax authorities, off-balance sheet accounting is necessary.

Transfer of special equipment into operation

If the cost of special clothing is completely written off when issued to employees, then the cost of special equipment can be written off in three ways:

- proportional to production output;

- straight-line write-off method;

- once in full amount upon commissioning.

The write-off method is configured in the “Purpose of Use” directory. Read on to find out how to do this.

Step 1. Fill out the “Special Equipment” tab in the “Decommissioning of Materials” document

In 1C 8.3, special equipment, as well as special clothing, is transferred to production using the document “Writing off materials for use.” How to create a document and fill out its basic details is described in step 1 of the previous section. To transfer special equipment to production, the “Special equipment” tab (1) is provided. In this tab, click the “Add” button (2). In the “Nomenclature” field (3), select the equipment for commissioning from the nomenclature directory. In the “Quantity” field (4) indicate the quantity of equipment to be transferred.

Step 2. Set up the “Purpose of Use” directory to account for the write-off of special equipment

As we wrote earlier, there are three ways to write off the cost of special equipment. The write-off method is configured in the “Purpose of use” field (1). Click button (2) to configure the payment method. The “Use Purpose” settings window will open. In this window, in the “Repayment method” field (3), select one of three methods, for example “Linear”. In the “Useful life (in months)” (4) field, indicate how many months the cost will be repaid with a straight-line write-off. In the method of recording expenses (5), indicate the write-off account, for example, 20.01. To save the setting, click “Save and close” (6).

Step 3. Reflect in accounting the transfer of special equipment into operation

The “Account Account” (1) and “Transfer Account” (2) fields in the “Special Equipment” tab will be filled in automatically. To complete the transfer of special equipment to production, click the “Record” (3) and “Pass” (4) buttons. Now in the accounting records there are entries for the transfer of special equipment into operation. Press the “DtKt” button (5) to check the wiring. The posting window will open. The postings show that account 10.11.2 “Special equipment in operation” reflects its movement upon transfer to the workshop (6) and the write-off of its value as expenses (7). In our example, the linear cost repayment method is established. Therefore, in accounting, the amount is repaid through depreciation when the “Month Closing” operation is launched. In tax accounting, the amount is repaid immediately (8). The write-off is reflected in the debit of account 20.01 “Main production” (9). On a special account MTs.03 “Special equipment in operation” (10) in 1C 8.3, equipment records are kept for each department. If the equipment has become unusable, write it off from this account using the document “Write-off of materials from use.”

There is no accounting - there is responsibility

To begin with, the accountant is most interested in liability for failure to keep records.

For violation of accounting rules, an organization may be held liable under Art. 120 of the Tax Code of the Russian Federation, and its officials (which include an accountant) - under Art. 15.11 Code of Administrative Offences. However, the last article is not applicable in this case, since it provides punishment only for distortion of reporting items.

To reflect the data of off-balance sheet accounts in the balance sheet (Form No. 1), a section is provided “Certificate of the availability of values accounted for in off-balance sheet accounts.” These data are also reflected in the Appendix to the balance sheet (Form No. 5). But you need to keep in mind that these forms are not mandatory, but recommended for use. An organization may use other forms. The main thing is that they contain all the data provided for by PBU 4/99. And according to this PBU, the data reflected in off-balance sheet accounts is disclosed in the notes to the balance sheet. However, what these explanations should look like is not directly established by the Regulations. Therefore, you can reflect data on off-balance sheet accounts in the explanatory note to the balance sheet.

In this case, there simply will not be any separate lines of reporting items for off-balance sheet accounts, which means that it is impossible to punish for their distortion.

But to bring the organization to justice under Art. 120 of the Tax Code of the Russian Federation for a gross violation of accounting rules is possible, since such violations include the systematic failure to reflect transactions on accounting accounts. And off-balance sheet accounts are also accounting accounts, since they are provided for in the Chart of Accounts. If an organization does not take into account at least two transactions, it will be fined 5,000 rubles. And some courts agree with this position.

But, as practice shows, tax authorities, when conducting an audit, are very fond of fining organizations under Art. 120 Tax Code of the Russian Federation. If you don’t keep off-balance sheet accounting, you’ll be fined for it; if you do, they’ll find something else. At the same time, the failure to reflect any data on off-balance sheet accounts does not affect the calculation of taxes. Therefore, an increased fine of 15,000 rubles. (for the offenses specified in paragraph 1 of Article 120 of the Tax Code of the Russian Federation, if they were committed during more than one tax period) can always be avoided. Since in this situation it is not clear which tax period should be taken into account.

Moreover, if an organization does not have data on the value of off-balance sheet assets (for example, the value of leased property) or on the amount of off-balance sheet liabilities and for this reason it did not reflect the information on the balance sheet, the courts refuse to collect a fine from the tax authorities under Art. 120 Tax Code of the Russian Federation.

An off-balance account is

Inventory assets are displayed at the contractual value or at the value indicated in the acceptance certificates. Leased fixed assets are displayed at the cost specified in the operating lease agreements. Strict accounting forms are displayed at conditional value in the prescribed manner.

Accounting

Account 001 “Leased fixed assets” Account 002 “Inventory assets accepted for safekeeping” Account 003 “Materials accepted for processing” Account 004 “Goods accepted for commission” Account 005 “Equipment accepted for installation” Account 006 “ Strict reporting forms" Account 007 "Debt of insolvent debtors written off at a loss" Account 008 "Collateral

Why do you need off-balance sheet accounting and will you be punished for its absence?

And off-balance sheet accounts are also accounting accounts, since they are provided for in the Chart of Accounts. If an organization does not take into account at least two transactions, it will be fined 5,000 rubles. And some courts agree with this position. But, as practice shows, tax authorities, when conducting an audit, are very fond of fining organizations under Art. 120 Tax Code of the Russian Federation.

If you don’t keep off-balance sheet accounting, you’ll be fined for it; if you do, they’ll find something else. Off-balance sheet accounts are subsidiary accounts of accounting, the balances of which should not be reflected in the balance sheet. They are used when the accountant needs information that is not on the balance sheet accounts.

2) information is collected that needs to be disclosed in the explanations to the balance sheet and the financial results statement, clause 27 of PBU 4/99, clause 32 of PBU 6/01.

001 “Leased fixed assets”; 002 “Inventory assets accepted for safekeeping”; 003 “Materials accepted for processing”; 004 “Goods accepted for commission”; 005 “Equipment accepted for installation” 001 “Leased fixed assets”; 011 “Fixed assets leased”; 008 “Securities for obligations and payments received”; 009 “Securities for obligations and payments issued” The organization can also open off-balance sheet accounts not provided for in the Chart of Accounts.

To the west.s. accounting is maintained using a simple system without the use of double entry. These accounts do not correspond with each other or with balance sheet accounts... Legal encyclopedia Off-balance sheet account - Off-balance sheet accounts are intended to summarize information about the availability and movement of assets temporarily in use or at the disposal of the organization (leased fixed assets, material assets in safekeeping, in... ... Dictionary : accounting, taxes, business law off-balance sheet account - an accounting account reflecting monetary rights or obligations that can be realized under certain conditions... Dictionary of economic terms OFF-BALANCE BALANCE ACCOUNT - (OFF-BALANCE SHEET) one of the accounting accounts, the balance of which is not included in the balance sheet.

An off-balance sheet account is an account designed to control finances that are not on the balance sheet of a particular enterprise.

Off-balance sheet accounts do not overlap with balance sheet accounts. They cannot correspond with each other.

https://www.youtube.com/watch?v=PdTuSYEAlL4

Modern legislation of the Russian Federation has a clear classification of off-balance sheet accounts, which they must comply with. The regulation was introduced to avoid unaccounted income for companies and a more transparent system of off-balance sheet accounts.

OFF BALANCE ACCOUNTS - (eng. off balance accounts) - accounting accounts, data on the movement of property and liabilities for which are reflected behind the balance sheet. To the west.s.

takes into account the presence and movement of values that do not belong to the organization, but temporarily... ... Financial and credit encyclopedic dictionary Off-balance sheet accounts are accounting accounts designed to account for values temporarily held by an enterprise or organization that do not belong to them (for example, leased fixed assets, materials accepted for storage, etc.) But for many objects they are not installed. If necessary, the organization itself can open new accounts or add subaccounts to existing ones. Such innovations must be prescribed in the company's accounting policies. According to the definition given in the Instructions. approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n. Off-balance sheet accounting accounts can be divided into three groups: off-balance sheet accounts for accounting for property that does not belong to the organization; off-balance sheet accounts for accounting for collateral and liabilities; off-balance sheet accounts for accounting of other property. So, for example, leased fixed assets are taken into account in off-balance sheet account 001.

Off-balance sheet accounts in budget accounting

This is a debt owed by students of educational institutions for property, equipment, tools, linen, etc. that they have not returned. Strict reporting forms. Diplomas, certificates, certificates, work books, which are issued against a report, against signature.

Vouchers that were issued free of charge from trade unions or public organizations. Liabilities and assets that are written off.

The debt is taken into account over a five-year period and the possibility of collecting it from the debtor if he becomes solvent is monitored.

Source: https://urist-pomojet.com/zabalansovyj-schet-ehto-75731/

Write-off of materials to an off-balance sheet account

An organization can take into account not only other people's material assets on its balance sheet, but also its own. An example would be low-value property, household supplies and inventory that are used for more than 1 year, costing less than the limit for accepting an object for accounting as fixed assets (the organization sets this limit independently in its accounting policy, but it cannot be more than 40,000 rubles in accordance with p. 5 PBU 6/01).

Such materials are written off as expenses at a time. But due to the long period of use, it is necessary to organize control over their safety. For this purpose, you can create a record sheet for household supplies and equipment in use, or you can keep off-balance sheet accounting. In the Chart of Accounts, approved. By order No. 94n, there is no special account for these purposes, so the organization can develop an off-balance sheet account independently and approve the chosen procedure for writing off low-value materials in the accounting policy.

If you use the 1C:Enterprise computer program for accounting, then in the chart of accounts of this program, special off-balance sheet accounts are provided for accounting for low-value materials written off the balance sheet:

If the company decides to take into account the low value off the balance sheet, then the postings will be as follows:

| Debit | Credit |

Accounting for fixed assets worth up to 20,000 rubles. in "1C: Accounting 8.0"

The procedure for reflecting such assets in accounting and tax accounting is the same.

To account for assets that meet the criteria for inclusion in fixed assets, but according to the accounting policy of the organization must be reflected in the accounting records as part of inventories, and according to the rules of the Tax Code of the Russian Federation as part of material expenses, it is recommended to use the mechanism for accounting for inventory and household supplies. Such objects can be reflected on account 10.09 “Inventory and household supplies” . According to the Instructions for using the chart of accounts (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n), this account is intended to record the availability and movement of inventory, tools, household supplies and other means of labor, which are included in the funds in circulation.

The posting of such materials is reflected in the program in the same way as any other materials. To do this, use the document “Receipt of goods and services” with the transaction type “purchase, commission” . As an account for accounting for incoming inventories, you should indicate account 10.09 “Inventory and household supplies” (for both accounting and tax accounting for income tax).

To transfer such inventories into production you should use the document “Transfer of materials into operation” , on the tab of which “Inventory and household supplies” the item is indicated, the method of reflecting the costs of repaying the cost of the item, the number of inventories objects transferred into production, the materially responsible person, as well as accounts for inventory items in the warehouse.

When posting a document, the cost of inventory items transferred for production will be written off from the materials account in the warehouse to the production costs (selling expenses) account specified in the method of recording expenses. At the same time, in order to ensure proper control over the movement of these objects in production or operation, they will be automatically reflected in the debit of the special off-balance sheet account MTs.04 “Inventory and household supplies in operation .

Off-balance sheet account MTs.04 “Inventory and household supplies in operation” is intended to ensure proper control over the movement of inventory and household supplies in operation. Analytical accounting for this account is carried out in the context of nomenclature, batches of materials in operation and materially responsible persons.

Upon actual disposal of inventories, they can be written off from the off-balance sheet account MTs.04. To do this, use the document “Decommissioning of materials” , on the tab of which “Inventory and household supplies” the nomenclature, batch of materials in operation, materially responsible person and the number of inventory items being written off are indicated.

When posting the document, the inventory item will be written off from the credit of the off-balance sheet account 10.MC.

If in tax accounting an asset must be included in depreciable property, whereas in accounting the organization’s accounting policy requires its reflection in the inventory, its capitalization in the program should be reflected as a receipt of an object of non-current assets using the document “Receipt of goods and services” with the form equipment operations .

Since the useful life of such an object exceeds 12 months, and the value at the time of receipt is not always fully formed, then before a special decision is made to include this asset in the inventory, it should be credited to account 08.04 “Acquisition of fixed assets” ( both in accounting and tax accounting).

After the value of the asset is finally formed, it must be reflected in accounting as part of the inventory, and in tax accounting - included in fixed assets. To reflect this operation, the program uses the document “Acceptance for accounting of fixed assets” with the type of operation “equipment” , where on the “Accounting” it is enough to select the accounting procedure for the asset “Reflection as part of inventory”. Then you need to indicate the inventory item, as well as the accounting account and warehouse where it will be posted.

On the “Tax Accounting” , you should specify the parameters of depreciation of fixed assets according to tax accounting.

Fixed assets, which are accounted for as part of inventories in accounting, should be reflected in tax accounting in a separate account 01.MC “Fixed assets accounted for as part of inventories in accounting records . This is required to correctly reflect the amounts of temporary differences, and also allows for separate accounting of such depreciable property.

If a fixed asset is reflected in accounting as part of inventory, the “Accrue depreciation” on the “Tax accounting” will be unavailable, since depreciation in tax accounting can only begin after the material has been transferred to production. When posting the document, the program will reflect the reclassification of the asset in accounting - its value will be written off from the account for investments in non-current assets, and new material will be credited to the inventory account.

When posting the document, the inventory item will be capitalized according to accounting to the warehouse and item accounting account specified in the document in an amount equal to the number of fixed assets accepted for accounting, indicated in the tabular section “ Fixed assets” of the document “Acceptance for accounting of fixed assets” . In tax accounting, the value of the asset will be transferred to the fixed assets account of the organization.

If the organization applies the provisions of PBU 18/02 “Accounting for income tax calculations,” then when posting the document, positive temporary differences in the assessment of the cost of materials (account 10.MC) and negative temporary differences in the assessment of the cost of fixed assets (account 01. MC). This is auxiliary data intended to reflect deferred tax assets that should be reflected in the period when the item will be written off as an expense in accounting.

Tax accounting account 10.MC “Materials accounted for as part of fixed assets in NU” is intended to reflect the amounts of temporary differences on materials taken into account in tax accounting as part of fixed assets.

To transfer inventories into production in accounting, you should use the document “Transfer of materials into operation” , on the tab of which “Inventory and household supplies” the item is indicated, the method of reflecting the costs of repaying the cost of the item, the number of inventories objects transferred into production, the materially responsible person, as well as accounts for inventory items in the warehouse.

Tax accounting account 10.MC should be specified as a tax accounting account for the inventory items transferred into operation to correctly reflect temporary differences in the valuation of assets, since in tax accounting these inventory items were reflected as part of fixed assets.

When posting a document, the cost of inventory items transferred for production will be written off from the materials account in the warehouse to the production costs (selling expenses) account specified in the method of recording expenses. At the same time, in order to ensure proper control over the movement of these objects in production or operation, they will be automatically reflected in the debit of the special off-balance sheet account MTs.04 “Inventory and household supplies in operation .

If the organization applies the provisions of PBU 18/02, then when posting the document, the amount of temporary differences in the valuation of materials reflected in tax accounting as part of fixed assets will be transferred from account 10.MC to the production costs (selling expenses) account indicated in the way expenses are reflected.

After the transfer of the industrial plant object into operation is reflected in the accounting records, in tax accounting it is necessary to set the checkbox for calculating depreciation for the corresponding fixed asset object. This checkbox can be set by the document “Change in the status of the OS” , which needs to be completed only for tax accounting. As a result, depreciation will be accrued monthly on the fixed asset listed in tax records (starting from the month following the one in which this box was checked). This document is called up from the menu “Assets and intangible assets – Depreciation parameters – Change of asset status”.

Upon actual disposal of inventory items, they can be written off from the off-balance sheet account MTs.04. Also, upon actual disposal of an inventory item, you can write off the corresponding fixed asset item in tax accounting.