Purpose of form 6-NDFL

To improve control over the timely receipt of income tax into the budget, form 6-NDFL was developed.

This form is submitted by entrepreneurs and organizations that have employees or are tax agents for individuals. The task of those submitting the report is to provide reliable information on all calculated income, deductions, and tax payments. The task of the inspectors is to verify that the tax is calculated correctly and paid on time.

Data from tax registers must be used to complete the report. This is a requirement of Art. 80 Tax Code of the Russian Federation. The absence of such a register will be considered a violation and will be fined by controllers. This register can be developed independently by approving its form in the accounting policy. Every month you need to keep records of salary accruals and other income, tax calculation and withholding, and the dates of tax transfer to the budget.

You can see how to correctly compile such a register in our article “Sample of filling out a tax register for 6-NDFL” .

Form 6-NDFL has been updated for reporting for 2022. A sample from ConsultantPlus will help you fill out the annual calculation. You can watch it for free by getting trial online access to the system.

The data in section 2 of the calculation is indicated on an accrual basis from the beginning of the year, in section 1 - only for the last 3 months.

How to fill out the remaining lines of the new report is discussed step by step in ConsultantPlus. See the authoritative opinion of K+ experts in the Ready-made solution by receiving free trial access to the legal reference system.

Line 140 is in the second section of the report. Let's consider the algorithm for filling it.

What is cell No. 040 for?

Cell No. 040 is intended to reflect the amount of accrual of tax payments for the income of taxpayers. It is calculated from labor payments to employees of the enterprise minus the required tax deductions.

In accordance with Article 210 of the Tax Code of Russia, tax deductions, including income tax and profit tax, are determined from the tax base. Taxpayer income is calculated using the following formula:

(employee’s taxable income – required tax deduction) x by interest rate*

*In accordance with current legislation, the main percentage tax rates for residents are:

- 13% – for income in the form of wages, remunerations under civil servants’ contracts, profits from the sale of real estate and some other types of income;

- 35% – for income received from the difference in interest rates from operations with borrowed funds.

Important! Please note that when calculating personal income tax at different rates, in cell No. 040 information is indicated only at the rate of 13%. In this case, it is necessary to submit an updated form 6-NDFL, in which cells No. 010 to No. 050 inclusive are filled out. Please note that information that remains unchanged must also be transferred from the main to the updated form. Moreover, in both forms the amount of tax withheld (cell No. 070) is calculated at different rates, but is filled in in one line.

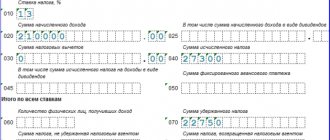

If we reconsider the calculation formula in relation to the report, it will look like this:

(cell No. 020 – cell No. 030) x cell No. 010 ÷ 100

Please note that the calculated indicator may not coincide with the amount indicated in the report. This may occur due to the fact that form 6-NDFL does not provide for the indication of kopecks, so rounding is applied. It is done as follows: up to 50 kopecks are completely discarded, multiples of 50 kopecks or more are rounded up to the nearest ruble. Therefore, a discrepancy of ±1 ruble is allowed for each employee. The error is calculated using the following formula:

cell No. 060 x 1 ruble x (number of lines x number of payments in the reporting period)

Example

There are 32 employees listed in cell No. 060, and payments were made three times during the reporting period. The amount of error can be:

32 x 3 = ±96 rubles.

Accordingly, the amount of the calculated indicator may differ from the amount indicated in cell No. 040 by ±96 rubles.

General rules for section 2 of the report

The second section is a summary table of personal income tax data for the period of provision - the tax base and indicators calculated by the agent.

For each tax rate, fill out a new section 2. If you have large salaries (there is a rate of 15%), or the employee received a financial benefit, or you employ a non-resident whose income is taxed at a rate different from that of a resident, you will have to fill out several sections 2 - one at a time for every bet.

You will indicate the amount of income in field 110 (with details in fields 111-115), the amount of deductions in field 130, and on page 140 (previously page 040) you will need to indicate the amount of calculated tax. Separately, here it is necessary to highlight the amount of tax calculated on dividends (line 141) and indicate the income of highly qualified foreign workers (line 142).

The most common errors in 6-NDFL are:

- Calculation in form 6-NDFL is not submitted untimely.

- Accountants indicate incorrect checkpoints and OKTMO.

- Personal income tax is not calculated correctly in the Calculation.

- Companies submit 6-NDFL calculations on paper, even when they have 25 or more employees. In this case, they must submit the report only electronically.

- Section 2 of Form 6-NDFL duplicates operations started in one reporting period and completed in another. You need to reflect the operation once - during the period of its completion.

- In the Calculation, inter-payment payments are not separated into a separate group: wages, vacation pay, sick leave, etc. And according to the Procedure for filling out the calculation, lines 100–140 of the section are filled out separately for each tax payment period.

- If an organization changes its location, accountants often submit the Calculation at the previous place of accounting.

One of the common reasons for errors when filling out 6-NDFL is that control ratios are not observed. For example, calculations in which:

- the amount of accrued income on line 020 of section 1 of calculation 6-NDFL turned out to be less than the sum of the lines “Total amount of income” of certificates in form 2-NDFL;

- the amount of calculated tax on line 040 of Section 1 of calculation 6-NDFL is less than the sum of the lines “Amount of tax calculated” of certificates in form 2-NDFL for 2016;

- line 025 of section 1 at the corresponding rate (line 010) does not correspond to the amount of income in the form of dividends (according to income code 1010) of certificates of form 2-NDFL with attribute 1, submitted for all taxpayers.

Data to be reflected on line 140 (formerly line 040) 6-NDFL

According to Art. 210 of the Tax Code of the Russian Federation, tax is calculated as a percentage of the tax base. In this case, the tax base is the total income of the taxpayer, reduced by the amount of deductions provided in accordance with the Tax Code of the Russian Federation.

The main interest tax rates for residents currently in effect are as follows:

- 13% - this may be salary, remuneration under civil partnership agreements, income from the sale of real estate or some other income;

- 15% - rate on income over 5 million rubles;

- 35% - from the amount of savings on interest when receiving borrowed funds in terms of exceeding the established amounts.

Our section “Personal Tax Rate” will help you understand the general picture of personal income .

The calculation formula for calculating tax by a tax agent is simple:

(Individual's income - Deductions provided) × Tax rate for this type of income

It is this amount that will appear in line 140 (previously 040) of the 6-NDFL calculation. That is, in relation to the report it will look like this:

(Page 110 – Page 130) × Page 100 / 100 .

If the calculated indicator does not coincide with the specified amount, this will not always be an error. The tax is calculated in full rubles. According to rounding rules, the tax amount is less than 50 kopecks. is discarded, and 50 kopecks. and more is rounded to the nearest ruble (rounding error). A discrepancy in any direction of up to 1 ruble is acceptable. for each individual.

For example, if on line 120 “Number of people” you have 54 people indicated and during the reporting period income was paid 3 times, then the amount on line 140 for the 1st quarter may be 162 rubles. differ from that calculated by the formula (54 × 1 × 3).

IMPORTANT! But if the discrepancy exceeds the maximum error, then the tax authorities will consider that the amount of accrued personal income tax is underestimated or overestimated. This will result in a letter asking for clarification and an adjustment calculation.

How to do this, see our article “How to correctly fill out the clarification on form 6-NDFL?” .

After filling out lines 100–155, you can move on to line 160 (previously page 070), which will summarize the withheld tax.

IMPORTANT! The amounts of calculated and withheld taxes (lines 140 and 160, respectively) may not coincide. This is possible if some income has already been accrued, the tax on it has been calculated, but the income has not yet been paid. For example, in a situation where salaries are accrued in one quarter and paid in the first month of the next quarter.

Let's compare the tax calculation dates and the withholding dates.

| Income | Tax calculation deadline | Tax withholding period |

| Salary | Last day of the month worked | On the day of payment in cash |

| Payments upon dismissal | Last working day | On the day of payment |

| Sick leave and vacation pay | On the day of payment | On the day of payment |

| Dividends | On the day of payment | On the day of payment |

| Travel expenses (not documented, “extra daily allowance”) | Last day of the month of approval of the advance report | On the day of salary payment for the month in which the advance report is approved |

| Income in kind | On the day of transfer of income | On the day of payment of the next income in cash |

Thus, we see that the dates for tax calculation and withholding do not coincide quite often. This means that inequality between lines 140 and 160 is common.

More information about the dates of receipt of income is described in the article “Date of actual receipt of income in form 6-NDFL”.

To learn how to reflect dividends in 6 personal income tax, read the article “How to correctly reflect dividends in form 6-personal income tax?”

How is data generated for line 040 in 6-NDFL?

Filling out Section 1 is subject to the following requirements (clause 3.1-3.3 of Appendix No. 2 to Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] ):

- The figures included in it for each of the reporting periods during the year are formed on an accrual basis, which is dictated by the need to calculate the total amounts of tax payable based on the data accumulated for the year (Article 216, paragraph 3 of Article 224, paragraph 2 of Article 226 of the Tax Code of the Russian Federation );

- the presence of income to which different tax rates are applied leads to the division at these rates of sets of lines 010-050, reflecting the tax calculation process, which helps to ensure control over the application of deductions only to income taxed at a rate of 13% (clause 1 of Article 225 Tax Code of the Russian Federation), and the correctness of the arithmetic operations performed when calculating personal income tax for each of the rates;

- in relation to income taxed at a rate of 13%, it is mandatory to reflect information on dividends in separate lines, which is due to the need to calculate tax on them separately from other income taxed at the same rate (clause 2 of article 210 of the Tax Code of the Russian Federation) and the possibility of using this calculation of a special algorithm (clause 2 of Article 275 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated June 17, 2015 No. 03-04-06/34935).

These rules lead to the fact that filling out information related to the 13% rate turns out to be the most difficult, but, nevertheless, makes it possible to check the correctness of the generalized tax calculations made.

An exception to the verification will be the calculation of tax on dividends, which is subject to a special algorithm.

Results

Reflection of the calculated personal income tax in the 6-NDFL report is a process that requires knowledge of the nuances of the legislation. At the same time, the existing basic formulas for calculating report indicators will help you independently check the correctness of your accounting data, without waiting for a request from the tax office.

Sources:

Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.