Intermediary agreements often frighten accountants because of their complexity: after all, there are 3 parties involved in the transaction. In a programme

Features of the work of part-time workers Part-time work is always allocated time free from the main job (Article 282 of the Labor Code

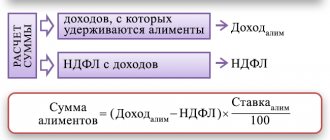

At what point should you start withholding alimony? The need to withhold alimony from an employee’s income arises when

Submit an application and receive a response from the bank in just 5 minutes → Submit an application

The inspectorate can begin the forced collection procedure only if the company has a debt

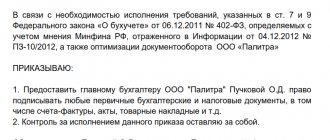

EDS or electronic digital signature will allow you to optimize the flow of documents within the company and outside it,

Appendix 1 to section 8. Information from additional sheets of the purchase book Frequently asked questions Appendix

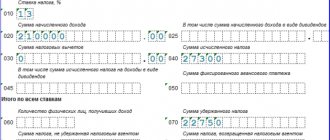

Line 090 of the 6-NDFL calculation form: what is included there The tax agent is the employer or

Accounting under the simplified tax system using the cash method. What is accounting under the simplified tax system using the cash method?

Article 346.24 of the Tax Code of the Russian Federation obliges firms and individual entrepreneurs who have chosen the simplified tax system to keep tax records