When legal entities can enter into a free transaction (agreement)

Two legal entities can enter into a gratuitous agreement if the following conditions are simultaneously met:

- such an agreement may be free of charge by virtue of law. For example, it is impossible to conclude a gratuitous rental agreement, since paying a fee for the use of the facility is a distinctive feature of this agreement. If you agree on the gratuitous provision of a thing for temporary use, your agreement will be a loan agreement and other rules will apply to it (Article 606, paragraph 1 of Article 614, paragraph 1 of Article 689 of the Civil Code of the Russian Federation);

- The law does not directly prohibit the conclusion of this agreement between legal entities. For example, an agreement on the alienation of an exclusive right may be gratuitous, but as a general rule, commercial organizations are prohibited from concluding such an agreement among themselves (clause 3, 1 of Article 1234 of the Civil Code of the Russian Federation). If you enter into an agreement in violation of a prohibition expressly expressed in the law, it will be void (clause 2 of Article 168 of the Civil Code of the Russian Federation, see Position of the Armed Forces of the Russian Federation);

- the transaction does not meet the criteria of a gift . This condition applies to contracts between commercial organizations. If at least one of the parties is a non-profit legal entity, it is not necessary to comply with it (Clause 1 of Article 575 of the Civil Code of the Russian Federation).

A distinctive feature of a gift is the obvious intention of one of the parties to transfer the ownership of a thing to the other (or transfer a property right, release from a property obligation) in order to benefit the donee. That is, the gratuitousness of the transaction is not related to any economic interest of the donor (see the Position of the Supreme Arbitration Court of the Russian Federation). For example, an agreement to forgive debt under a loan agreement is a gift, but an agreement to forgive accrued interest with the condition that the principal amount will be repaid as soon as possible is not.

If two commercial organizations enter into an agreement by virtue of which a gift occurs, it will be void as a violation of the prohibition expressly established by law. However, there may be exceptions. For example, the ban on gifts between commercial organizations does not apply if the parties to the transaction are a subsidiary and a main company (see the Position of the Supreme Arbitration Court of the Russian Federation). In addition, commercial organizations can give each other ordinary gifts worth up to 3,000 rubles. For example, flowers, sweets, business souvenirs (Clause 1, Article 575 of the Civil Code of the Russian Federation).

It is important to know! Article 368 of the Civil Code of the Russian Federation. Concept and form of independent guarantee

What contracts can be free of charge?

These may be contracts that are called gratuitous in the law or in respect of which the parties have agreed to be gratuitous.

According to the law, gratuitous contracts are those whose nature provides for the receipt of something by only one party. These are, in particular, agreements of donation and gratuitous use (clause 1 of article 572, clause 1 of article 689 of the Civil Code of the Russian Federation). They cannot be made compensatory at the will of the parties. If a party to such an agreement receives payment or other consideration, the agreement may be considered sham, and in this case the rules that govern the transaction actually completed by the parties will apply. For example, if the donor received money from the donee for the transferred item, the rules on purchase and sale will be applied to the relations of the parties (clause 2 of Article 170, clause 1 of Article 572, clause 1 of Article 454 of the Civil Code of the Russian Federation).

By agreement of the parties , any contracts may be gratuitous, except for those for which, due to their nature and (or) the law, the presence of consideration is mandatory. Such exceptions include, for example, purchase and sale, rent, agency (Clause 1 of Article 454, Article 606, 1006 of the Civil Code of the Russian Federation).

Please note that by default the contract is usually paid. To make it gratuitous, you must indicate in it that no fee (other consideration) is charged under the agreement (clause 3 of Article 423 of the Civil Code of the Russian Federation). Such a condition, as a general rule, can be agreed upon, for example, for storage, assignment, license agreement (clauses 1, 5 of Article 896, clause 1 of Article 972, clause 5 of Article 1235 of the Civil Code of the Russian Federation).

Please be aware that the law may prohibit certain individuals and/or conditions from entering into a gratuitous contract. For example, a commercial organization does not have the right, as a lender, to enter into an agreement for free use with its founder (clause 2 of Article 690 of the Civil Code of the Russian Federation). Therefore, we recommend that you first check your agreement by type, subject and status of the parties for the possibility of agreeing on a gratuitous clause in it.

It is important to know! Article 408 of the Civil Code of the Russian Federation. Termination of obligation by performance

VAT on gratuitous transfer of goods (work, services)

Any organization at least once had to transfer its property or provide services free of charge, i.e. for nothing. According to the norms of Chapter 21 of the Tax Code of the Russian Federation, such an operation is recognized as a sale, and therefore VAT will have to be paid on the cost of the gift. How to determine the tax base for VAT in this case? Is it possible to deduct “input” VAT on property that is intended to be a gift? If you want to do everything correctly, read this article...

T. KRUTYAKOVA, tax consultant

When selling goods (work, services) free of charge, the tax base is determined as the cost of these goods (work, services), calculated on the basis of prices determined in a manner similar to that provided for in Art. 40 of the Tax Code of the Russian Federation, including excise taxes and excluding VAT (clause 2 of Article 154 of the Tax Code of the Russian Federation).

The wording of clause 2 of Art. 154 of the Tax Code of the Russian Federation means that for the purposes of calculating VAT, the value of gratuitously transferred goods (work, services) must be determined based on their market prices on the date of transfer.

The obligation to pay VAT to the budget on the cost of goods (work, services) transferred free of charge arises for the taxpayer in the tax period when the goods were actually shipped (work, services).

When making a gratuitous transfer of goods (work, services), the taxpayer issues an invoice indicating the market value of the transferred goods (work, services) and the amount of VAT calculated for payment to the budget. This invoice is registered in the sales book in the period when the goods were shipped (work performed, services provided).

We would like to pay special attention to the procedure for applying tax deductions in relation to the amounts of “input” VAT on goods (work, services) used later in carrying out operations related to the gratuitous transfer of goods (work, services).

In accordance with paragraph 2 of Art. 171 of the Tax Code of the Russian Federation, amounts of “input” VAT on those goods (work, services) that are used in carrying out transactions subject to VAT are accepted for deduction. In this regard, the amounts of “input” VAT on goods (work, services) intended for use in carrying out operations related to the gratuitous transfer of goods (work, services) are subject to deduction in the generally established manner (letter of the Ministry of Finance of Russia dated April 10, 2006 N 03- 04-11/64).

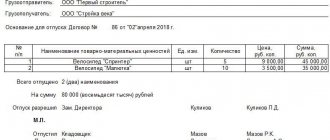

Example 1. The management of an enterprise, in connection with the celebration of the 50th anniversary of the founding of the enterprise, decided to give gifts to the ten oldest employees. For this purpose, the company purchased 10 color televisions by bank transfer with a total cost of 118,000 rubles. (including VAT - 18,000 rubles). The decision to issue gifts was formalized by a corresponding order from the head of the enterprise.

The televisions were purchased in March 2007. The gifts were presented to employees in April 2007. Since the televisions were purchased by the enterprise from a trading organization, the purchase price of the televisions corresponds to the level of market prices for similar televisions.

In enterprise accounting, the purchase and issuance of gifts is recorded using the following entries.

March:

Debit 41 - Credit 60 - 100,000 rub. — TVs were capitalized at cost excluding VAT;

Debit 19 - Credit 60 - 18,000 rub. — VAT is reflected on purchased TVs;

Debit 68 - Credit 19 - 18,000 rub. — submitted for deduction of VAT on purchased televisions.

April:

Debit 91 - Credit 41 - 100,000 rubles. — reflects the book value of televisions donated to employees of the enterprise;

Debit 91 - Credit 68 - 18,000 rubles. — VAT is assessed for payment to the budget at a rate of 18% of the market value of donated televisions <*>.

————————

<*> The amount of VAT accrued on the cost of goods (work, services) transferred free of charge does not reduce the tax base for income tax (letter of the Ministry of Finance of Russia dated September 22, 2006 N 03-04-11/178).

In what order should the tax base be determined for the gratuitous transfer of property recorded on the balance sheet at cost, including VAT? Today there is no clear answer to this question.

For the purpose of calculating VAT, the gratuitous transfer of property is recognized as the sale of this property (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation), therefore, in our opinion, in the case of a gratuitous transfer of property recorded at cost including VAT, the tax base should be determined in in the manner provided for in paragraph 3 of Art. 154 Tax Code of the Russian Federation. This means that the amount of tax payable to the budget should be determined in this case at a calculated rate of 18/118 or 10/110 of the difference between the market price of the transferred property and its book (residual) value.

If the market value of the transferred property is lower than its book (residual) value, then the tax base will be zero. In this case, the taxpayer will not have an obligation to pay VAT when transferring such property free of charge.

Example 2. The management of an enterprise decided to give its employee a car that is on the company’s balance sheet. The car was purchased by the company in 2000 as a service vehicle and was recorded on account 01 at its cost including VAT. The book value of the car is 60,000 rubles, the amount of depreciation accrued at the time of transfer of the car to the employee is 50,000 rubles.

The market price for similar cars on the date of transfer was 30,000 rubles. In this case, the amount of VAT payable to the budget when transferring a car free of charge is determined at a rate of 18/118 of the difference between the market price of the car (30,000 rubles) and its residual value (10,000 rubles) and amounts to 3,050.85 rubles . ((30,000 rub. - 10,000 rub.) x 18/118).

In the accounting of an enterprise, the transfer of a car to an employee is documented with the following entries:

Debit 01/"Disposal of fixed assets" - Credit 01 - 60,000 rub. — the book value of the car is written off;

Debit 02 - Credit 01/"Disposal of fixed assets" - 50,000 rubles. — the amount of depreciation is written off;

Debit 91 - Credit 01/"Disposal of fixed assets" - 10,000 rubles. — the residual value of the car transferred to the employee is written off;

Debit 91 - Credit 68 - 3050.85 rubles. — VAT is charged to the budget on the difference between the market and residual value of the car.

Note! Many accountants in practice “forget” about the need to include in the VAT tax base the cost of free work performed (services provided).

Most often, such “forgetfulness” is observed when property is transferred for free use to third parties. But in this case, the organization provides a monthly service to a third party to provide property for use. Moreover, this service is provided free of charge. Therefore, every month the organization must include in the VAT tax base the market value of the service provided (the market rent charged for the rental of similar property).

The validity of this approach is confirmed by numerous arbitration practices (see, for example, decisions of the FAS of the Volga-Vyatka District dated 03/27/2006 N A82-9753/2005-14, Northwestern District dated 07/28/2006 N A26-10169/2005-216).

***

Considering the issue of calculating VAT when transferring goods free of charge, we will dwell in more detail on one situation that is often encountered in practice, which traditionally raises numerous questions among accountants. We are talking about goods (samples) provided free of charge for advertising purposes. Is it necessary to charge VAT on the cost of goods transferred free of charge?

Until January 1, 2006, the issue of the need to charge VAT on the cost of goods (work, services) distributed free of charge for advertising purposes was controversial.

Tax authorities (see letters from the Ministry of Taxes and Taxes of Russia dated 02/26/2004 N 03-1-08/528/18 and dated 07/05/2004 N 03-1-08/1484/ [email protected] ) and the Ministry of Finance of Russia (see letter from the Ministry of Finance of Russia dated 31.03.2004 N 04-03-11/52) have always insisted that the free distribution of goods for advertising purposes should be considered as a gratuitous transfer of goods and, therefore, should be subject to VAT. However, many organizations managed to prove the opposite in court <*>.

————————

<*> See, for example, resolutions of the Federal Antimonopoly Service of the North-Western District dated December 14, 2004 N A05-3624/04-22, Moscow District dated August 19, 2003 N KA-A40/5796-03P.

From January 1, 2006, it became pointless to argue with tax authorities on this issue. The fact is that from this date a new VAT benefit came into force, providing for the exemption from taxation of transactions for the transfer for advertising purposes of goods (work, services), the cost of acquiring (creating) a unit of which does not exceed 100 rubles. (Subclause 25, Clause 3, Article 149 of the Tax Code of the Russian Federation).

By introducing this new benefit, the legislator indirectly confirmed that the advertising distribution of goods (works, services) is, in principle, subject to VAT. When distributing low-value (up to 100 rubles) goods (works, services) for free, you can take advantage of the discount and not charge VAT. If more expensive goods (works, services) are distributed, VAT must be charged. In this case, “input” VAT related to distributed products (goods, works, services) is accepted for deduction in the general manner (see letter of the Ministry of Taxes of Russia dated February 26, 2004 N 03-1-08/528/18).

Example 3. A company entered into an agreement with an advertising agency for the production of advertising booklets and calendars with the company’s logo. The cost of manufacturing these products is 118,000 rubles. (including VAT 18% - 18,000 rubles), including the cost of production: - booklets (1000 pcs.) - 35,400 rubles. (including VAT - 5400 rubles); — calendars (500 pcs.) — 82,600 rub. (including VAT - 12,600 rubles).

The products were received in December 2006. In January 2007, the company took part in the exhibition. All produced booklets and calendars were distributed free of charge to exhibition visitors.

The cost of one booklet was 30 rubles. (excluding VAT), therefore, free distribution of booklets for advertising purposes is not subject to VAT on the basis of subclause. 25 clause 3 art. 149 of the Tax Code of the Russian Federation. This means that the “input” VAT on booklets (5,400 rubles) is not accepted for deduction.

The cost of one calendar is 140 rubles. (excluding VAT), so free distribution of calendars must be subject to VAT. In this case, the “input” VAT on calendars (12,600 rubles) is accepted for deduction in the general manner in December 2006. The following entries are made in the company’s accounting records.

December:

Debit 60 - Credit 51 - 118,000 rubles. — money was transferred to the advertising agency;

Debit 10 - Credit 60 - 35,400 rub. — the receipt of booklets at the company’s warehouse is reflected (at cost including VAT) (Clause 2 of Article 170 of the Tax Code of the Russian Federation);

Debit 10 - Credit 60 - 70,000 rub. — the receipt of calendars at the company’s warehouse is reflected (at cost excluding VAT);

Debit 19 - Credit 60 - 12,600 rubles. — reflected “input” VAT according to calendars;

Debit 68 - Credit 19 - 12,600 rubles. — submitted for deduction of “input” VAT according to calendars.

January:

Debit 44 - Credit 10 - 35,400 rub. — the cost of free booklets distributed is reflected in advertising expenses;

Debit 44 - Credit 10 - 70,000 rub. — the cost of freely distributed calendars is reflected in advertising expenses;

Debit 91 - Credit 68 - 12,600 rubles. — VAT is charged on the cost of freely distributed calendars.

In the VAT Declaration for January 2007, the cost of freely distributed calendars (70,000 rubles) is reflected in Section 3 in column 4 of line 100, and the amount of accrued VAT (12,600 rubles) is reflected in column 6 of the same line. The cost of free booklets distributed (RUB 35,400) is reflected in the same Declaration, but in Section 9 (transaction code 1010275).

Note! If the free transfer of goods (performance of work, provision of services) is carried out within the framework of charitable activities, then such transfer is exempt from taxation on the basis of subsection. 12 clause 3 art. 149 of the Tax Code of the Russian Federation.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

In what cases can a contract for the provision of services be concluded free of charge?

The possibility of concluding a contract for the provision of services free of charge depends on who the parties to the contract are.

Commercial organizations and individual entrepreneurs cannot provide services to each other free of charge.

Most often, gratuitous agreements are found in relation to non-profit organizations within the framework of charitable activities.

To ensure that the contract you conclude is free of charge, clearly indicate in it that the services are not subject to payment.

In what cases is a service agreement free of charge?

A contract is gratuitous when there is no need to pay for services rendered or give any other consideration (transfer goods, provide counter services, etc.) (Clause 2 of Article 423 of the Civil Code of the Russian Federation).

We believe that it is possible to conclude a free government contract for the provision of services, since Law No. 44-FZ does not prohibit this.

Please note that the mere fact that there is no price or obligation to pay for services in the contract does not make it gratuitous. As a general rule, the contract will be considered compensated (clause 3 of Article 423 of the Civil Code of the Russian Federation). In this case, the recipient of the services will have to pay for them at the price that, under comparable circumstances, is usually charged for similar services (clause 3 of Article 424 of the Civil Code of the Russian Federation).

However, if the payment condition for a specific contract is essential, in its absence the contract may not be concluded (Clause 1 of Article 432 of the Civil Code of the Russian Federation).

Therefore, if you want to enter into a gratuitous contract, indicate directly in it that no payment or other consideration will be made for the provision of services (Clause 2 of Article 423 of the Civil Code of the Russian Federation).

Donation

Donation is a bilateral transaction that involves the gratuitous transfer by the donor of his property in favor of the donee. The latter, in turn, has the right to accept or refuse to accept the gift. The transfer of rights as a result of a gift must be registered with Rosreestr. Only those objects that belong to the donor are subject to donation. You can also donate property rights, for example, the right to claim an apartment in a new building.

There are a number of restrictions when donating real estate:

- Legal representatives cannot donate property to their wards: incapacitated or minors

- The gift agreement cannot contain a condition on the transfer of the right to the object only after the death of the donor

- If the property is jointly owned, it requires obtaining consent from all owners.

In certain cases, the gift can be canceled. Such conditions are listed in the Civil Code of the Russian Federation. For example, the basis for canceling a donation may be the recipient causing serious harm to the health of the donor, or an attempt on his life or the life of his family members.

Legal assistance in real estate registration

Consultation in the office and by phone

+7(495) 728-99-14

Help from a lawyer. 19 years of experience in real estate registration!