Special legal regime of maternity benefits for individual entrepreneurs

A complete list of categories of citizens subject to compulsory social insurance (OSI) in case of temporary disability and in connection with maternity is given in Art.

2 of Federal Law No. 255-FZ. The main one is citizens of the Russian Federation working under employment contracts. But individual entrepreneurs (IP), due to their special legal nature, as a general rule, are not insured citizens, and they do not pay insurance contributions to the Social Insurance Fund for themselves. However, individual entrepreneurs can become insured citizens, but only if they voluntarily enter into a relationship under OSS in case of temporary disability and in connection with maternity and pay insurance premiums for themselves (Clause 3, Article 2 of Federal Law No. 255-FZ).

Conclusion one: if a woman who is an individual entrepreneur plans to give birth to a child and receive maternity benefits, she must voluntarily register with the Social Insurance Fund.

Individual entrepreneur and maternity benefits - is this compatible?

Payment of maternity benefits is one of the forms of social security for women in Russia.

However, it is not available to everyone. The benefit is intended for working women, from whose income the employer makes contributions to the Social Insurance Fund (SIF). In this case, the employer acts as the insured, and the employee as the insured person. The Social Insurance Fund accumulates funds received from employers and directs them to finance social benefits, which include maternity benefits. Since social insurance for persons registered for permanent work is mandatory, maternity leave payments are guaranteed if we are talking about a woman working at the time of registration of maternity leave.

An individual entrepreneur is a self-employed person, i.e., without an employer. Although situations cannot be ruled out when an entrepreneur acts in two capacities at the same time: both an employee and a person working for himself. If an individual entrepreneur has an employer, then he, as a person insured by the Social Insurance Fund, has the right to apply for maternity leave at the place of work.

Compulsory social insurance does not apply to self-employed persons. However, they can insure themselves with the Social Insurance Fund voluntarily in order to, subject to certain conditions, benefit from social payments (Clause 3, Article 2 of the Law “On Compulsory Social Insurance...” dated December 29, 2006 No. 255-FZ).

Thus, the possibility of receiving maternity payments as an individual entrepreneur is directly related to whether a woman entrepreneur is insured by the Social Insurance Fund.

Does an individual entrepreneur who applies the NAP have the right to pay voluntary insurance contributions to the Social Insurance Fund of the Russian Federation in order to then be able to receive maternity benefits? You will find the answer to this question in ConsultantPlus. Trial access to the system can be obtained for free.

Application to the FSS

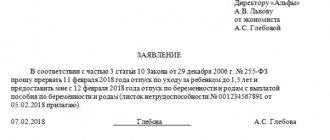

You can enter into voluntary legal relations under OSS by submitting an appropriate application to the territorial body of the FSS.

The application form is given in Order of the Ministry of Labor of Russia dated February 25, 2014 No. 108n. The application can be submitted in person, sent by mail or electronically. In addition to the application, a copy of an identity document of an individual is required.

The territorial body of the Social Insurance Fund will register the individual entrepreneur as an insurer within a period not exceeding three days from the date of receipt of the application and issue a corresponding notification.

Amount of insurance premiums

If an entrepreneur has become an insured person, he must also pay insurance premiums to the Social Insurance Fund.

The amount of insurance premiums in this case is calculated based on the cost of the insurance year, which is defined as the product of the minimum wage established by federal law at the beginning of the financial year for which insurance premiums are paid, and the rate of insurance premiums established by paragraphs. 2 p. 2 art. 425 of the Tax Code of the Russian Federation in terms of insurance contributions to the Social Insurance Fund, increased by 12 times.

Based on Art. 1 of Federal Law No. 82-FZ the minimum wage as of 01/01/2019 is set equal to 11,280 rubles. Therefore, the cost of an insurance year in 2022 is RUB 3,925. 44 kopecks (RUB 11,280 x 2.9% x 12).

How are maternity payments made if the individual entrepreneur is also employed as an employee?

In a situation where an individual entrepreneur is also employed as an employee, maternity benefits can be received twice - at the place of work and from the Social Insurance Fund as an individual entrepreneur.

With regard to payments until the child is one and a half years old, the situation is different; these payments will have only one source and only one of the spouses will be able to receive them.

Recommendation. Due to the fact that legislation changes quite often, to clarify the procedure and amount of maternity payments, it is advisable to contact local government agencies that handle issues of social protection of the population.

Procedure for paying insurance premiums

Payment of insurance premiums in this case is made to the account of the territorial body of the Social Insurance Fund no later than December 31 of the current year, starting from the year of filing the application. The procedure for paying insurance premiums for individual entrepreneurs is determined by Decree of the Government of the Russian Federation No. 790. At the same time, you can pay either in parts or in a one-time payment.

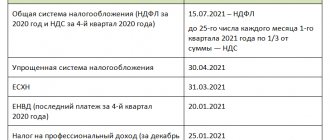

Thus, in order to acquire the right to receive insurance coverage under OSS in case of temporary disability and in connection with maternity, the last day for payment of insurance premiums by individual entrepreneurs who voluntarily entered into the legal relationship in question, in the established amount, is December 31 of the current year (Letter of the Ministry of Labor of Russia dated November 28. 2018 No. 17‑0/OOG-1613).

To avoid missing the deadline for paying insurance premiums, the FSS recommends that territorial bodies inform entrepreneurs registered with the FSS about the need to fulfill their obligation to pay in full, as well as about the consequences that arise in the event of non-payment or incomplete payment of insurance premiums.

Federal payments

As a rule, the moment of registration of an individual entrepreneur and the news of pregnancy are separated in time.

At the same time, every woman knows that at the birth of a child she is entitled to payments from the state: a benefit for registering with a medical institution in the early stages of pregnancy, a maternity benefit, a one-time benefit at the birth of a child and a monthly child care benefit until the child reaches 1,000 years of age. 5 years. Federal Law No. 81-FZ of May 19, 1995 establishes a unified payment system that provides state-guaranteed material support for maternity, paternity and childhood.

Important

Federal Law No. 243-FZ allows individual entrepreneurs not to pay insurance premiums at a certain time caused by cessation of work.

Federal Law of December 29, 2006 No. 255-FZ (as amended on July 23, 2013) “On compulsory social insurance in case of temporary disability and in connection with maternity”, taking into account that individual entrepreneurs can be both women and men, granted businessmen of both sexes the right to choose insurance in the Social Insurance Fund, namely, only those entrepreneurs who voluntarily registered with the Fund and pay contributions for themselves in accordance with Article 4.5 No. 255-FZ receive benefits. Please note that businessmen with hired employees are insured under compulsory social insurance, that is, they are required to register with the Social Insurance Fund and pay contributions on the accrued salaries of hired employees in the amount of 2.9 percent (Part 1 of Article 2.1 No. 255-FZ) .

If an individual entrepreneur has not expressed a desire to be insured by the Social Insurance Fund, then he is deprived of the right to maternity benefits, and can receive federal payments due to both insured and uninsured persons from the social security authority at his place of residence. These include: a one-time benefit for the birth of a child (RUB 13,087.61), the minimum monthly benefit for caring for the first child up to 1.5 years of age (RUB 2,453.93), the minimum monthly benefit for caring for the second and subsequent ones children under 1.5 years old (RUB 4,907.85). These figures are valid for 2013 and may be calculated differently in the future.

Right to receive insurance coverage

For businessmen who have voluntarily entered into legal relations with the Social Insurance Fund, a special procedure has been established for receiving insurance coverage: the right to receive benefits arises only if insurance premiums are paid for the calendar year preceding the calendar year in which the insured event occurred.

If an individual entrepreneur has submitted a corresponding application to the Social Insurance Fund, but has not paid insurance premiums for the corresponding calendar year by December 31 of the current year, the legal relationship under the Social Insurance Fund in the event of temporary disability and in connection with maternity is considered terminated.

Thus, in order to acquire the right to receive insurance coverage under OSS in case of temporary disability and in connection with maternity in 2022, an individual entrepreneur must pay insurance premiums in the amount of 3,925 rubles. 44 kopecks until December 31, 2019.

Conclusion two: in order for a female individual entrepreneur to receive maternity benefits, she needs to register with the Social Insurance Fund in the calendar year preceding the year in which the insured event occurs and pay insurance premiums on time.

Going on maternity leave: basic rules

Facts relevant for expectant mothers:

- A woman can go on maternity leave only after reaching 30 weeks of pregnancy. If more than one child is expected, the period increases.

- Leave is taken on sick leave, which is issued for 140 days. This period covers the time before and after childbirth.

- Sometimes the period of maternity leave is extended to 160 days. Typically, such relief is given to women who experience complications during pregnancy or childbirth.

You can receive payments from the state not only during preparation for childbirth and a short period after it, but also for several months while caring for a child. It is permissible to apply for maternity leave not only for a woman, but also for her husband. The maximum period of maternity leave is 36 months, but you can only receive significant payments from the state for 18 months.

All women, without exception, including unemployed people, have the opportunity to receive benefits. The only condition in order to be able to submit the appropriate application is to pay contributions to the Social Insurance Fund in advance. People working in enterprises do not have to worry about this stage, since deductions are written off automatically. For individual entrepreneurs, this procedure is optional and is performed on a voluntary basis.

Important! If a female individual entrepreneur decided to go on maternity leave, but did not pay her contribution to the Social Insurance Fund, she is not entitled to benefits. In order not to encounter difficulties, but to have stable financial assistance until the child turns 3 years old, it is necessary to pay contributions in advance. The total amount will be more than 2000 rubles. in year. A woman has the opportunity to repay the amount monthly or pay it immediately.

Purpose and amount of maternity benefits

To receive maternity benefits, an individual entrepreneur registered with the Social Insurance Fund must submit a certificate of incapacity for work and an application for payment of benefits (in any form) to the territorial body of the fund.

The territorial branch of the Social Insurance Fund, where the individual entrepreneur transferred contributions, assigns and pays benefits within 10 calendar days from the date of receipt of the necessary documents from the entrepreneur.

Maternity benefits are paid in the amount of 100% of average earnings. For female individual entrepreneurs, the average earnings, on the basis of which maternity benefits are calculated, are taken to be equal to the minimum wage established by federal law on the day of the insured event (clause 2.1 of Article 14 of Federal Law No. 255-FZ).

Conclusion three: maternity benefits to a businessman are paid in the amount of 100% of average earnings, which is taken to be equal to the minimum wage on the day the insured event occurs.

How many fees do you need to pay?

The amount of contribution that an entrepreneur must pay to the Social Insurance Fund is tied to the minimum wage. It is calculated using the following formula:

Contribution amount = minimum wage as of January 1 of the current year × 2.9% × 12.

In 2022, the minimum wage is 12,792 rubles. It turns out that an entrepreneur who will become a mother in 2022 must pay by the end of 2022:

12 792 ₽ × 2,9 % × 12 = 4452 ₽.

In this case, she will be entitled to maternity benefits.