The rules for maintaining a cash register and working with cash have been changed since the end of 2022

Material assistance Material assistance is usually understood as a payment that is not directly related to

An example of an application for time off at your own expense (without pay) to the Director of Perspektiva LLC

Compensation for delayed wages is not payment for labor Labor Code and other federal

Legislative abolition of stamps The mandatory use of stamps when preparing documents at the legislative level has been abolished

Expert consultation Federal Law No. 305-FZ dated 07/02/2021 adopted another package of amendments to

When working in the 1C 8.3 Accounting program, input errors are not that rare.

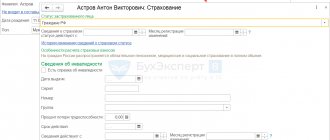

Having purchased an organization (business), its new owner acquires not only a property complex, but also a set of

Photo: pixabay.com Updated: 03/27/2020 Are maternity benefits subject to taxation? No, payments related to maternity

What are direct payments? This is a payment scheme in which the insured persons (employees) receive almost