Accounting under the simplified tax system using the cash method

What is accounting under the simplified tax system using the cash method? This is an accounting of income and expenses (if necessary) at the time of their payment. That is, even if the goods are shipped to the buyer, it will be possible to reflect this operation in KUDIR only after receiving actual payment, be it cash transferred to the cash register or receipt to the current account. True, in some cases other payment methods are used: in kind, barter, securities, offset.

As for expenses, accounting under the simplified tax system recognizes them not only after payment, but also subject to a number of other conditions:

- They must be included in the closed list, which is published in Article 346.16 of the Tax Code of the Russian Federation,

- Expenses must be reasonable: economically justified and incurred to generate profit.

- Mandatory documentary evidence.

Accounting under the simplified tax system

Accounting of the simplified tax system

The simplified taxation system is one of the least burdensome tax systems. The businessman himself chooses which object to pay tax on, the list of expenses is clearly regulated, and reporting is submitted only once a year. However, the use of the simplified tax system requires record keeping.

Income accounting

Income from simplified accounts is accounted for on a cash basis. This method means that receipts from customers are recognized as income upon receipt of money. In practice, entrepreneurs often have questions: how to take into account income if receiving money and fulfilling obligations to the client have a time gap. For example, a deed with a client was signed in one quarter, and the money was received in another. This happens both when the work is paid in advance and when it is paid for some time after completion.

By the way, you don't have to learn this!

Keep automatic records

The rule of the cash method is that neither the fact of fulfillment of contractual obligations nor the fact of execution of primary documents affects the accounting of income. In any situation, income arises precisely at the moment of receiving payment, be it advance payment or postpayment.

To accurately and timely record your income, it is important to record your bank statements on a timely basis. In the “My Business” service with connected online banking integration, this will take literally a minute. Just press a couple of keys, and the statement data will be uploaded to the accounting department.

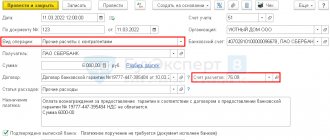

Expense accounting

Entrepreneurs who have chosen “income minus expenses” as the object of taxation must keep records of their expenses. To reduce the tax base when calculating tax, expenses are accepted if the following conditions are simultaneously met:

1) the expense must be paid,

2) closing documents must be drawn up for the payment (deed, invoice or universal transfer document),

3) the expense must be justified within the framework of commercial activities,

4) the expense must be provided for in a closed list given in Article 346.16 of the Tax Code of the Russian Federation,

5) in relation to goods purchased for resale, an additional condition is the fact of their further sale to the buyer.

Those who pay tax on the “income” object do not keep track of expenses. They can reduce the tax on insurance contributions to extra-budgetary funds. Individual entrepreneurs reduce tax on their fixed contributions. At the same time, entrepreneurs without employees can reduce the tax on the amount of contributions in full. Individual entrepreneurs have the right to reduce the tax by only half of its amount, but in addition to fixed contributions, they can also deduct contributions from employee salaries and paid sick leave. LLC employers can also halve the amount of tax under the simplified tax system at the expense of insurance contributions from employee salaries.

Calculating taxes in the “My Business” service will not cause any difficulties. A simple and understandable wizard for calculating payments to the budget will do this work for you; you just need to follow the link to the corresponding task in the Tax Calendar and go through all the steps of the tax calculation wizard.

Book of income and expenses

When applying the simplified tax system, you should keep records of your income and expenses in a special book - KUDIR. Performance indicators are recorded in it on the basis of primary documents in chronological order.

When applying the simplified tax system of 6%, only information about income (section 1) and paid insurance premiums (section 4) is filled in the book. Those who work on the simplified tax system of 15%, in section 1, in addition to income, fill out information about their expenses that affected the calculation of the tax. In section 2, they must separately reflect information on the costs of acquiring fixed assets and intangible assets. With this type of simplified tax system, entrepreneurs have the opportunity to transfer their losses to the future. This means that if a loss is made at the end of the year, its amount can be taken into account as an expense in subsequent years. Losses carried forward to subsequent years should be indicated in section 3 of KUDIR. Users of the “My Business” service can create a book automatically – the service itself will download the data for filling it out from the accounting system. All you have to do is download and print it.

At the end of the year, the printed KUDIR is stitched, its sheets are numbered and sealed. The number of sheets of the book is certified by the manager’s signature and seal. There is no need to certify KUDIR to the tax office.

Declaration according to the simplified tax system

At the end of the year, based on the data in the book of income and expenses, a declaration according to the simplified tax system is filled out. Keep in mind that with a simplified tax system of 15% at the end of the year, in addition to the general tax calculation, the minimum tax is calculated. It is defined as 1% of the income received during the year. A businessman must compare the 15% tax according to the simplified tax system and the minimum tax and pay to the budget the one that turns out to be higher.

If in the reporting year activities were suspended and temporarily not carried out, the report is submitted in a standard form and within standard deadlines. But instead of numerical indicators, it will have dashes. Such a declaration is called a null declaration. Organizations must submit a declaration under the simplified tax system by March 31, and entrepreneurs by April 30 of the year following the reporting year. The tax calendar of the “My Business” service will help you not to miss the deadline for submitting your report.

You can submit your declaration to the tax office during a personal visit, sending it by mail with a valuable letter with a list of attachments or a file in a special format via electronic communication channels. By connecting an electronic signature, you can send a declaration from the “My Business” service without leaving your home.

Accounting policies in accounting under the simplified tax system

It is necessary to draw up an accounting policy in any case. By the way, individual entrepreneurs should also take care of the availability of this regulatory act for tax accounting purposes. But organizations in their accounting policies also prescribe accounting under the simplified tax system: methods of maintaining it, document flow, reporting, methods of maintaining a book of income and expenses, lists of persons authorized to sign, work with cash, etc. In addition to the document itself, an order for its approval is drawn up, which is signed by the director of the organization: separately for accounting, and separately for tax purposes.

What does this mean in practice?

For the purposes of calculating the single tax under the simplified tax system, individual entrepreneurs have organized tax accounting in the book of income and expenses (clause 4, clause 1, article 2, clause 1, clause 2, article 6 of Law No. 402-FZ, article 346.24 of the Tax Code of the Russian Federation) .

For small businesses, it is recommended to maintain accounting records using the following accounting register systems:

- a unified journal and order form of accounting for enterprises, approved by letter of the USSR Ministry of Finance dated 03/08/1960 No. 63;

- journal-order form of accounting for small enterprises and business organizations, approved by letter of the USSR Ministry of Finance dated 06.06.1960 No. 176;

- simplified form of accounting in accordance with the Standard Recommendations given in the order of the Ministry of Finance of the Russian Federation dated December 21, 1998 No. 64n.

Accounting under the simplified tax system - creating reserves

Before the obligation to keep accounting under the simplified tax system was officially imposed, hardly anyone thought about reserves. If there are reasons, then simplifiers are simply obliged to create them. This is especially important in cases where, after drawing up financial statements, an error is discovered and the information turns out to be distorted by more than 10%. Here are three types of reserves that organizations using the simplified tax system should form:

- Provision for doubtful debts - is created to protect yourself from the risks associated with the loss of funds on unpaid receivables. It is only necessary in cases of doubtful debt. The amount of the reserve must be specified in the accounting policy.

- A reserve for the depreciation of financial investments - it is created only if the organization’s balance sheet contains securities for which there are no income and if they gradually depreciate. The reserve is calculated based on the difference between the discount price and the current (reduced) price.

- A reserve for reducing the value of material assets is created for inventories that are obsolete or their price has dropped significantly. The reserve amount is calculated as the difference between the current market and book prices.

Inventory when maintaining accounting using the simplified tax system

Organizations conducting accounting under the simplified tax system are required to conduct an inventory of property and liabilities before preparing annual reports. All results must be properly documented. It is necessary to draw up inventory records and acts in two copies. They must contain information about the actual cost and/or quantitative expression of the inspected object and accounting data. Based on them, appropriate conclusions are drawn about the state of accounting, the presence of surpluses and shortages. All documents must be signed by the persons listed in the orders for approval of the inventory commissions. All forms of documents for carrying out this procedure are unified and can be found in the appendices to the Guidelines for the inventory of property and financial obligations, approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49.

The main types of inventory that are necessary for accounting under the simplified tax system to be error-free:

- Inventory of fixed assets.

- Inventory of intangible assets.

- Inventory of inventory items.

- Cash register inventory.

- Inventory of receivables and payables.

Accounting form using accounting registers

A “Simpler” engaged in the production of products (works, services) can use the following accounting registers to record business transactions, the forms of which are given in the appendices to the Standard Recommendations, approved. by order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n.

For example, accounting statements:

- fixed assets, accrued depreciation;

- industrial stocks and goods;

- production costs;

- cash and funds;

- settlements and other transactions;

- implementation;

- settlements and other transactions;

- settlements with suppliers;

- wages.

For example

, monthly, if there is movement of fixed assets, the amounts of their turnover are calculated and the balance of fixed assets is displayed on the 1st day of the month following the reporting month.

The internal movement of fixed assets is not reflected in the statement.

To control the amounts of accrued depreciation using the accelerated method and from the beginning of operation of fixed assets for all fixed assets, the statement provides corresponding columns for accounting for depreciation with an accrual total.

Entries in the statement of accounting for settlements with accountable persons and other debtors and creditors are maintained in a positional manner, displaying at the end of the month the expanded balance of debt to a small enterprise - debit of the account and debt of the small enterprise - credit of the account for each debtor and creditor based on data from primary documents.

can conduct simplified accounting using the cash method (clause 12 of PBU 9/99 “Income of the organization” and clause 18 of PBU 10/99 “Expenses of the organization”).

ACCOUNTING SERVICES USN

Accounting under the simplified tax system - reporting

The reporting period for providing financial statements is a year. The date by which the report must be submitted to the tax office is March 31. Organizations that maintain accounting under the simplified tax system may not prepare interim financial statements. As for the forms, companies that can be classified as small (the majority of them in the simplified taxation system) can submit abbreviated statements consisting of a balance sheet and a profit and loss statement, as well as, if necessary, an explanatory note.

Simplified accounting

Organizations that have the status of small and micro enterprises can conduct simplified accounting under the simplified tax system. This means that you can take advantage of such privileges as:

- Have an abbreviated chart of accounts.

- Maintain simplified registers instead of filling out accounting statements.

- Submit financial statements in a simplified form.

- Micro-enterprises can do without debit and credit, i.e. Do not conduct accounting using the simplified tax system using the double entry method.

Accounting under the simplified tax system requires an accounting program. There is no way to get around this (vital) requirement. But, the presence of an accountant is sometimes called into question - is it necessary? Sometimes the business is not complicated, there are “savvy” entrepreneurs, there are also situations when you want to do accounting under the simplified tax system yourself. Or by giving only a small amount of work to an accountant. And in such cases, the most important role is played by the accounting program; ideally, it should be extremely simple, despite accounting, which by definition is not simple, extremely automated and autonomous (no need to go to Yandex or Google, consultant plus, forums, tax websites etc. ). Simultaneous work (accountant, entrepreneur, managers) is also desirable. All these desires are very successfully combined in online accounting, it is always up-to-date and does not require updating on the part of the user, and it not only keeps records and generates reports (all accounting programs can do this), but also submits reports to regulatory authorities! The cost of work in Kontur Accounting starts from 1,500 rubles per quarter. After registration, you can work for free for a month (limitation - you cannot submit reports online):

Registration (14 days free)