Article 346.24 of the Tax Code of the Russian Federation obliges firms and individual entrepreneurs who have chosen the simplified tax system to keep tax records through the Book of Income and Expenses (hereinafter referred to as KUDiR, Book). Violation of this requirement threatens the company with a fine of up to 10 thousand rubles per tax period. If the violation affects more than one such period, the fine will be up to 30 thousand rubles (Article 120). The KUDiR matrix, as well as the rules for filling it out, were approved by order of the Federal Tax Service of Russia dated October 22, 2012 No. 135n. If we talk about the 1C: Accounting program, then it allows you to implement the functionality of creating a Book in absolute compliance with the law.

Why is KUDiR needed?

A simplified individual entrepreneur does not keep accounting records. But in order to correctly calculate the tax on the simplified tax system, an individual entrepreneur must keep tax records in a special Book of accounting for income and expenses of organizations and individual entrepreneurs using the simplified taxation system (hereinafter referred to as KUDiR).

Also, all organizations using the simplified tax system work with KUDiR.

It is worth saying that many banks in which individual entrepreneurs or organizations have a current account now provide services that keep a ledger of income and expenses automatically (without user participation). It is very comfortable. But if you want to understand in more detail the formation of KUDiR indicators, you can watch this video:

Maintaining a book of income and expenses

Maintaining KUDiR

is considered a mandatory procedure.

At the same time, it is worth knowing who should fill out the book for keeping records of income and expenses

.

Types of KUDiR:

1. Applicable for the simplified tax system - it is filled out not only by individual entrepreneurs who are on the simplified tax system, but also by LLCs that have also chosen this taxation system. As for the form for filling out this reporting document, it will be of the same type, regardless of the chosen object of taxation;

2. Used for PSN - entrepreneurs who use the patent taxation system when filling out KUDiR

Only information about the income received is entered there. The use of the book in this case is necessary only in order to be able to fully monitor compliance with the income limit. This is due to the fact that the use of PSN is possible only if the income does not exceed 60 million rubles;

3. In the case of OSN, filling out the KUDiR in this case is carried out exclusively by individual entrepreneurs who are on this taxation system. This is necessary for personal income tax calculations;

4. When using the unified agricultural tax by individual entrepreneurs.

How to fill out KUDiR correctly?

It is worth remembering that the book is stored for 4 years. At the same time, filling out the book is also possible in several ways:

1. Fill out the income and expense ledger manually

. In this situation, you need to purchase the book yourself, and also take care of the presence of a seal and a label on the last page containing the inscription “Stitched and numbered (number of) pages.” This sticker must contain the signature of the individual entrepreneur or director of the company.

2. Filling out KUDiR electronically

.

Most often they use filling out a book of income and expenses in an excel

document.

Cancellation of KUDiR from 2022: is it fake?

Soon, individual entrepreneurs and organizations using the simplified tax system will no longer keep a book of accounts according to the simplified tax system and submit simplified declarations. This was announced by Deputy Head of the Federal Tax Service of Russia Dmitry Satin on the air of the “Taxes” program. Information about this is on the official website of the Federal Tax Service at the link .

“As a representative of the Federal Tax Service noted, now individual entrepreneurs and companies using the simplified tax system must keep a book of income and expenses and annually submit simplified declarations. This takes time and knowledge. And the new simplified tax system online regime will allow simplifiers to completely abandon current reporting under the simplified tax system. “STS-online: entrepreneurs in this special mode who use online cash registers will be able to get rid of almost all reporting as early as next year. The tax authority will independently calculate the amount of tax based on the data transmitted by the online cash register and send a notification for payment.”

The new tax regime of the simplified tax system online was planned to be introduced from July 1, 2020. After this date, those who simplified the “income” object, using online cash registers, hoped to forget about submitting declarations and maintaining KUDiR. However, before the introduction of a new special tax regime, the book must be kept. It was never introduced in 2022.

Also see: Cancellation of declarations under the simplified tax system.

Electronic documents

KUDiR is a book of income and expenses that must be kept by: individual entrepreneurs on the simplified tax system, OSN, PSN, unified agricultural tax (i.e., everything except UTII), as well as organizations on the simplified tax system.

KUDiR can be carried out independently, i.e.

manually on paper. However, with a large number of income transactions, in order to save time and avoid errors when filling out the KUDiR, it is better to use our service “ Filling out the book of income and expenses online .” The service will help you create a book both automatically with downloading statements from your bank(s), and manually, and the service also allows you to use both filling options. When using automatic or semi-automatic generation, you need to receive a bank statement in 1C format, WIN encoding. The service allows you to download several statements from several banks, the main thing is that they are for the reporting period for which you are generating KUDiR. After filling out all the forms, you will receive a finished book in Excel format. All you have to do is check it, print it, number it, lace it up and certify it with your signature and seal. BE SURE TO CHECK THE BOOK YOU RECEIVE!!! Check payments with the word REFUND and its derivatives. If you have chosen a mixed filling mode, be sure to carefully review the received file to ensure that the same payments are added. Please note that the “income” column should not include funds:

- — from the Social Insurance Fund for payment of benefits;

- — on loans and borrowings;

- — as payment for the authorized capital;

- — pledge and deposit (with the exception of subsequent offset);

- — under an agency or commission agreement (you should only indicate your income);

- — return of the security deposit from participation in trades and auctions;

- — amounts from the return of low-quality goods or advance payment;

- — under an assignment agreement (you should only indicate your income);

- — dividends, if part of the share belongs to the company;

- — interest on deposits (only for individual entrepreneurs).

SUBMISSION AND CERTIFICATION OF KUDIR

You do not need to submit KUDiR to the tax office yourself, only upon request. However, a stitched and numbered KUDiR must be available for previous reporting periods, even in the absence of activity, profit or expenses, in this case a “zero” KUDiR is made. The fine for its absence for individual entrepreneurs is 200 rubles , for organizations - 10,000 rubles. On February 20, 2022, in the first reading, the State Duma adopted a bill abolishing KUDiR for simplified workers at the “Revenue” facility from July 1, 2022. This relaxation applies only to persons who make payments to buyers of goods (works, services) using cash register equipment.

Form (form) KUDiR in 2022

The form and procedure for filling out the accounting book were approved by Order of the Ministry of Finance dated October 22, 2012 No. 135n. Such a book for recording income and expenses on the simplified tax system is filled out not only by individual entrepreneurs, but also by organizations on the simplified tax system.

For the object “income” and “income minus expenses”, the form of the book of income and expenses is the same , only the sections differ.

For you:

- ;

- ;

- .

| STS “income” – 6 percent | STS “income minus expenses” – 15 percent |

If the object of taxation is “income”, then the following sections are maintained:

| If an organization or individual entrepreneur has chosen “income reduced by the amount of expenses” as an object of taxation, then in the KUDiR they fill out:

|

[/su_table]

A sample of how an individual entrepreneur can fill out a ledger for accounting income and expenses according to the simplified tax system with the object “income” can be viewed in ConsultantPlus here.

A sample of filling out the KUDiR of an organization on the simplified tax system with the object “income minus expenses” for 2022 in ConsultantPlus is posted here.

What services are suitable for individual entrepreneurs on OSNO

It turned out that most cloud services are not intended for maintaining records of individual entrepreneurs on OSNO.

Solutions from "Kontur" - "Kontur.Elba" and "Kontur. Accounting" are popular among entrepreneurs, but are only suitable for individual entrepreneurs using the simplified tax system and PSN.

"Bukhsoft Online" is a service for individual entrepreneurs in any modes except OSNO.

Online accounting "Sky" is also not suitable for individual entrepreneurs on OSNO.

Only two manufacturers of cloud accounting programs have provided the ability to work with individual entrepreneurs on OSNO. Naturally, this is the good old company 1C, which, based on the well-known “eight”, developed the product “1C: Entrepreneur” for individual entrepreneurs. In the cloud it is available in the 1C: FRESH application. An alternative is the “My Business” online accounting service, in which the service configuration is determined by the settings at the beginning of work.

Method of administration

In 2022, KUDiR can be maintained both on paper and electronically. For each new calendar year, a new KUDiR is opened.

The paper KUDiR must be laced and numbered. On the last page, you must indicate the total number of pages it contains and certify it with the signature of the head of the organization and seal (if any). The individual entrepreneur certifies the Book with his signature and seal, if the individual entrepreneur has one.

The electronic KUDiR must be printed at the end of each quarter . At the end of the year, such a KUDiR is also laced, numbered and certified with a signature and seal.

How to fill out KUDiR

Maintaining KUDiR for imputators can be a problem: they were never obliged to keep a book. Therefore, let's talk about the rules and consider the instructions for preparing the document.

Rules for maintaining KUDiR

The Ministry of Finance regulates the rules for maintaining KUDiR for individual entrepreneurs and LLCs under OSNO and other tax regimes. They are as follows:

- The book of income and expenses for individual entrepreneurs must be printed, laced and numbered at the end of the tax period.

- The document must be sealed and certified by the signature of the head of the enterprise and seal (if any).

- The document is kept in chronological order.

- You only need to indicate the money that is included in the tax base (NB). For example, in the case of an individual entrepreneur, there is no need to indicate income on the simplified tax system, which is subject to taxes different from the basic rate for income tax/personal income tax.

- Entrepreneurs are required to fill out the document in Russian. If there is a need to attach documents in another language, they must have a translation.

Instructions for filling out the KUDiR

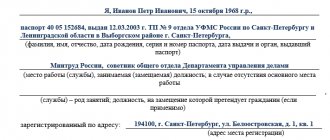

Let's start with the title page. There are no strict requirements for its design. The following information must be provided:

- start date of maintenance;

- object of taxation;

- information about the enterprise (full name of the entrepreneur or name of the organization, INN/KPP, current account, if any, and legal address).

Sample of filling out the title page of KUDiR:

The book of accounting for income and expenses for individual entrepreneurs on a patent is different from the others: the form has only two pages. The document for the patent system has only a title page and a page with income, so the filling procedure is much simpler than in the case of other modes.

Maintaining KUDiR for individual entrepreneurs on the simplified tax system depends on the selected taxation object. If an entrepreneur pays from income, he needs to fill out sections I, IV and V. To pay from the difference between profits and costs, pages I to III will be needed. Let's talk about each section and look at examples of filling out KUDiR:

- Income and expenses. The most important section. Here are the operations that need to be taken into account in the (NB). Moreover, they are registered upon receipt. Advances are also entered into the register. In the first section of KUDiR for individual entrepreneurs on the simplified tax system, income is filled in from the first to the fourth column. For the “Income minus expenses” object, all five are needed.

- Column 1: receipt or expense number;

- 2 columns: date of creation of the primary document and its number;

- 3 columns: content of the business transaction;

- 4 columns: income that is taken into account when calculating NB. The following is not taken into account: personal money, loans, refunds from the supplier, deposits, replenishment of the authorized capital and returned tax surpluses;

- Column 5: expenses that need to be taken into account when calculating NB.

- Calculation of expenses for the acquisition of fixed assets and intangible assets. Required to be filled out in KUDiR on the simplified tax system with the object “Income minus expenses”. Fixed assets are tangible assets that can be used for longer than a year and cost more than 100,000 rubles. For example, various commercial premises, vehicles and so on.

- Calculation of the amount of loss that reduces the NB. The obligation to fill out this section is also assigned to entrepreneurs who apply the simplified tax system and pay tax on the difference between income and expenses. If confirmed expenses exceeded income in previous tax periods, the loss is written here.

- Expenses that reduce the tax amount (advance tax payments). Filled out in a simplified manner when the company pays tax on revenue. This section indicates insurance premiums for employees and, if we are talking about individual entrepreneurs, for the entrepreneur.

- Trade fee. Must be filled out if the company pays tax on the simplified tax system on “income”. As the name suggests, this is where the trading fees paid are listed.

An example of this section of KUDiR:

So, we looked at examples of filling out the KUDiR income and expense book. It is a must for most entrepreneurs. It makes no sense to examine the KUDiR on the patent in detail: it is simple and has only two pages. An example of filling out a ledger for accounting income and expenses on a patent can be seen in the screenshots:

Generating a report

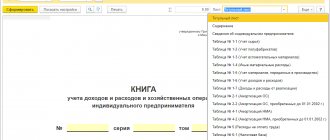

By clicking the Generate , the report will be built according to the form specified by the settings.

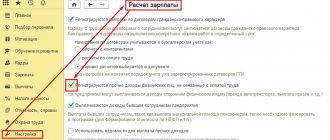

Based on the report, we check the fulfillment of the conditions - salary:

- accrued;

- paid;

- accepted to NU.

As can be seen from the report, despite the fact that employee Kalinina S.V. wages were accrued and paid, the third condition was not met for including the costs of paying wages in the expenses of the simplified tax system: column Reflection in NU - Not accepted . The error lies in the information specified for Kalinina S.V. the method of reflecting salary expenses in NU.

By changing the Reflection in the simplified tax system and re-posting the accrual and payment documents, the report will generate the correct data:

- Reflection in the simplified tax system - Accepted .

Accordingly, the salary expenses of Kalinina S.V. will be reflected in KUDiR for 1 quarter. 2022 PDF

According to the reviewed report, it is easy to find the reason why labor costs, taxes and contributions are not included in KUDIR, and determine what needs to be done to correct the situation.

To avoid having to configure the report again each time, BukhExpert8 advises saving the settings in 1C by clicking the Save report option .

After entering the name of the setting, for example, Checking the inclusion of labor costs, taxes and contributions to KUDiR, you do not have to set up the report again each time. Select settings button to access the saved setting.

Settings can be downloaded or sent by mail. More details:

- How to send settings by email

- How to upload and download settings

The Universal report settings can be downloaded to other computers and databases by clicking MORE - Other - Change report option. To do this, in the settings form that opens, select the Load settings : the MORE button - Load settings.

See also:

- The procedure for recognizing expenses for the purchase of goods (OU)

- Register of Expenses under the simplified tax system

- Statuses of payment of expenses of the simplified tax system

- Accountant Assistant – Universal Report

- Checking the filling in the cost of goods sold in KUDiR

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- A universal report for checking the cost of goods sold in the book of income and expenses When working on the simplified tax system, it is not always clear why some expenses...

- Principles of accounting for labor costs You do not have access to view To gain access: Complete a commercial…

- Universal report on checking the payroll sheet T-51 It happens that an accountant makes an error when creating a payroll sheet T-51,...

- A universal report on checking an organization’s salary arrears...

Error filling in expenses in KUDiR remuneration

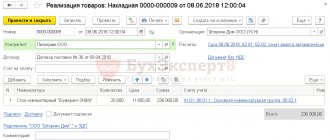

The 1C program supports automatic completion of the report Book of Income and Expenses of the simplified tax system : section Reports - simplified tax system - book of income and expenses of the simplified tax system. Sometimes a situation arises when the data in the report is filled in incorrectly, information is missing or is reflected incorrectly. At the same time, the report does not provide any “explanations”, and it is completely unclear where to look for the error.

January 01, 2022 The organization hired a new employee Kalinina S.V. for the position of seamstress with a salary of 35,000 rubles.

For the months of January, February and March, the employee was accrued and paid, but the amount of income paid to Kalinina S.V. was included in the expenses of KUDiR. didn't hit.

To check the data on unaccepted salary expenses, we will use the settings of the Universal report for the Expenses under the simplified tax system register.

Maintaining KUDiR in Excel or Google spreadsheets

This is already a better option. The calculation of taxes payable can be partially automated; it is enough to know how to use formulas in Excel. Losing an electronic KUDiR is much more difficult. Viruses can “eat” it, but to be safe, keep a backup file on a flash drive or in the cloud.

But there are also disadvantages. If you didn't have a backup, you'll have to spend time restoring the book. The formula for automatic calculations may contain an error that will only come back to haunt you at the end of the year when calculating taxes. And the automation you get is quite truncated. Other reports will have to be completed manually.