How to submit reports during reorganization In the event of a business reorganization, an important change in income tax should be taken into account

Question No. 1 Sometimes, when sending an employee on a business trip, atypical situations arise. What regulatory

Many accountants have already heard that from October 1, 2022, the employment service needs

STS (simplified taxation system) is a special type of tax regime that is valid throughout

Special cases In an effort to protect the social rights of workers, the Labor Code of the Russian Federation seriously limits the possibility of their dismissal.

Organization of on-site inspections of the Pension Fund of Russia. In accordance with Art. 3 of the Federal Law of July 24, 2009 No.

Regulations on cash payments Uniform requirements for cash payments are established by the Directive of the Bank of Russia

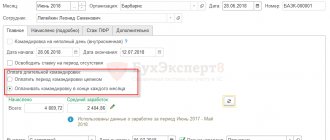

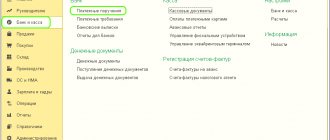

Creating a payment order In order to transfer money from the organization's current account to pay suppliers, pay

How to fill out the 6-NDFL calculation for the 4th quarter of 2016? Has the new payment form been approved?

Settings for accounting for exchange rate differences in 1C Let's consider a situation in which with a foreign company