How to submit reports during reorganization

If you are reorganizing your business, there are important income tax changes to consider in 2022. Thus, from January 1, the Tax Code of the Russian Federation regulates the rules for submitting reports in this situation. This is a new paragraph 5 of Article 230, introduced by Law No. 335-FZ of November 27, 2022.

The main requirement is this: regardless of the type of reorganization - accession/separation/transformation/merger - the legal successor is obliged to submit Form 2-NDFL and report 6-NDFL for the reorganized structure to the Federal Tax Service at the place of its registration, if it has not done so. If there are several legal successors, then the responsibility of each is established by the transfer deed or separation balance sheet.

Also see “New rules for determining the tax period for various taxes for individual entrepreneurs and legal entities.”

Content

Vote Your opinion is important to us | The calculator has been updated to reflect changes for 2022. For ordinary income, the tax rate is 13% for the amount of income for the year not exceeding 5 million rubles. If the income for the year exceeds the amount of 5 million rubles, then a tax of 15% is taken from the excess. Certain types of income continue to be taxed at a rate of 13%. If you need to calculate the tax for such income, then use the “Other rate” switch and enter 13%. Calculation parameters

| ||||||

| Tax rate as a percentage |

Result

| Amount to be paid to an individual |

| Amount of tax to be paid. (Tax is rounded up and paid without kopecks) |

| total amount |

| This and other calculators in our Business Calculator for mobile devices can be downloaded from the links below. |

All income received by citizens of the Russian Federation and foreign citizens is subject to income tax. Its abbreviated name is personal income tax. Explanation: personal income tax.

The legislation approves personal income tax rates. They differ depending on the type of income received, as well as the category of taxpayer.

The Government of the Russian Federation has also approved several forms of personal income tax reports:

- 2-NDFL;

- 3-NDFL;

- 4-NDFL;

- 6-NDFL.

The Government has made changes to some of them, which will take effect in 2022.

Updating the income certificate form

The Russian Tax Service has developed an updated form for a certificate of income of an individual in form 2-NDFL. The draft corresponding order was published on the Unified portal for posting draft regulatory documents. It is expected that it will be relevant for income information for 2017.

Let us remind you that the appearance of the 2-NDFL certificate is fixed by the order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/485. Why did you need to update this form?

The essence is in the changes that we wrote about at the beginning of this article: so that the legal successors of the tax agent can submit 2-NDFL for him. For this purpose, 2 new fields have appeared in Section 1 “Tax Agent Data”:

- “Form of reorganization (liquidation)” (put the appropriate code from 0 to 6);

- “TIN/KPP of the reorganized organization.”

In other cases, these lines are not filled in.

According to the new rules, the legal successor indicates the OKTMO code at the location of the reorganized structure or its separate division.

In the “Tax Agent” field, the legal successor of the reorganized organization indicates exactly its name (or its divisions).

In addition, from Section 2 “Data about an individual - recipient of income”, lines related to the address of residence have been removed. And in Section 4 of the 2-NDFL certificate, investment ones are excluded from tax deductions.

Reporting Methods

There are several ways to submit a completed report to the Federal Tax Service:

- In paper form in the hands of the tax inspector - this is allowed only to those companies that have a small number of employees (up to 10 people).

- In paper form via postal service - the completed document can be sent to the Federal Tax Service by registered mail with a separately described attachment.

- In electronic form to the tax inspector - the report is filled out in a special program, after which the media with the file is handed over to the inspector. This method can be used if the number of employed workers does not exceed 3,000 people.

- Using electronic document management - for this you need to select a telecom operator and sign an agreement with it, as well as issue a digital signature.

You might be interested in:

TZV-MP new reporting for small businesses

Update of 6-NDFL calculation

A completely new 6-personal income tax will not be introduced from 2022, but amendments to it are already known. Let us remind you that the form of this calculation was approved by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/450.

The text of the draft order was published on the Unified portal for posting draft regulatory documents.

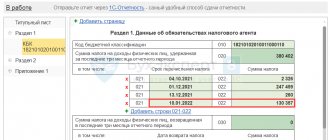

We list the main changes to 6-NDFL in 2022:

- title page; in particular, the barcode “15201027” has been changed to “15202024”;

- the largest taxpayers provide the TIN and KPP at the location of the organization as in the certificate of registration at the location (5th and 6th category of KPP - “01”);

- The successor organization submits calculations to the Federal Tax Service at its location for the last period of submission and updated calculations for the reorganized structure (in the form of accession/merger/division/transformation) indicating on the title page in the line “at the location (accounting) (code)” numbers "215"; in this case, at the top of the title you need to provide the TIN and KPP of the assignee;

- in the line “tax agent” indicate the name of the reorganized organization or its separate structure.

There are other amendments to the 6-NDFL calculation form from 2022 related to the reorganization. For example, a table of reorganization/liquidation codes (from “0” to “6”).

Accountants are required to use the updated form starting with the 2017 report. Let us remind you that the deadline for submitting 6-NDFL for 2022 is April 2, 2022 inclusive.

For more information, see “Deadlines for submitting 6-NDFL in 2022.”

Updating the declaration in form 3-NDFL

Also, the Russian Tax Service has prepared changes to the personal income tax return form in form 3-NDFL. It was approved by order of the Federal Tax Service dated December 24, 2014 No. ММВ-7-11/671. Apparently, the updated 3-NDFL form will be introduced in 2022, including for reporting for 2022.

So, we received a new edition:

- title page of the 3-NDFL declaration;

- Sheet D1 “Calculation of property tax deductions for expenses on new construction or acquisition of real estate”;

- sheet E1 “Calculation of standard and social tax deductions”;

- Sheet 3 “Calculation of taxable income from transactions with securities and transactions with derivative financial instruments (DFI)”;

- Sheet I “Calculation of taxable income from participation in investment partnerships.”

There are also amendments to other sheets of 3-NDFL.

In addition, the 3-NDFL declaration received a completely new sheet K entitled “Calculation of income from the sale of real estate.”

Also see “What documents to attach to the 3-NDFL declaration.”

Withholding personal income tax

Personal income tax is a tax that reduces the amount of income of individuals before they are paid. This means that before paying income (salaries, dividends, winnings, interest on deposits, etc.), the organization (or individual entrepreneur) reduces the amount of income by the amount of personal income tax and only after that pays it to the individual. The organization in this case acts as a tax agent that declares and pays tax. Art. 226, 226.1 of the Tax Code of the Russian Federation regulate the procedure and terms for payment of personal income tax by tax agents. In the “Personal Income Tax Withholding” you will find articles that will help you understand the calculation procedure, the responsibilities of the tax agent and accounting entries.

New rules for tax on winnings

Gamblers simply need to know what changes to personal income tax await them in 2022. The fact is that Law No. 354-FZ of November 27, 2022 radically changed the procedure for taxation of winnings from gambling and lotteries, as well as the deduction of personal income tax from them.

There are 3 basic rules (new provisions of Article 214.7 of the Tax Code of the Russian Federation):

| № | Winning amount | What about the tax? |

| 1 | The player was lucky for 4000 rubles or less | There is no need to pay personal income tax, since this is non-taxable income (new provision of clause 28 of article 217 of the Tax Code of the Russian Federation) |

| 2 | From 4,000 to 15,000 rubles | The lucky one himself transfers personal income tax from the income that was given to him by the organizer of the lottery or game |

| 3 | 15,000 rubles and more | All responsibilities lie with the tax agent |

Of course, no deductions are allowed for gambling pleasures. The corresponding phrase appeared in the second paragraph of paragraph 3 of Art. 210 Tax Code of the Russian Federation.

It is also clarified that the tax is calculated separately for each winning amount.

Personal income tax and Moscow renovation of housing stock

Those whose housing was subject to demolition and renovation in Moscow should be aware of what changes in income tax await them in 2022 and in the future.

According to Law No. 352-FZ of November 27, 2022, there will be no tax on income in the form (new clause 41.1 of Article 217 of the Tax Code of the Russian Federation):

- equivalent monetary compensation for old housing;

- housing (share in housing), which was provided instead of the one that was subject to renovation.

Also, the Tax Code of the Russian Federation stipulates a mechanism for providing a property deduction in the event of the sale of housing provided for renovation (new subparagraph 2, paragraph 2, Article 220 of the Tax Code of the Russian Federation). Income can be reduced by expenses associated with the purchase:

- vacated housing;

- and/or living space provided in connection with renovation.

And the period of ownership of the new apartment is combined with the period of ownership of the previous housing (new paragraph of paragraph 2 of Article 217.1 of the Tax Code of the Russian Federation).

Current personal income tax rates

Tax authorities collect personal income tax from the entire working population of the country, levying this tax on wages, dividends, deposits and winnings. The only exceptions are those types of income that are received in the form of social payments from the state - they, according to Russian legislation, are exempt from paying personal income tax. In 2022, personal income tax indicators for different types of income are expressed as follows:

- citizens of the Russian Federation who receive a salary pay personal income tax in the amount of 13% of its amount;

- individuals who received income in the form of dividends also pay 13% of the fee to the budget;

- citizens of Belarus, Kyrgyzstan, Kazakhstan and Armenia - countries that are part of the EAEU, officially working in Russia, pay a fee of 13%;

- the same rate (13%) must be paid by individuals belonging to the categories of refugees and immigrants;

- residents of the country who received winnings or made an investment must deduct 35% of this income;

- Non-residents carrying out labor or business activities in Russia pay a tax of 30% on income.

Thus, today in Russian tax practice a flat scale of taxation of income of Russians is used. At the same time, according to specialists from Rosstat, the average nominal salary in the country is 38,590 rubles, i.e. a person receiving such an amount pays a monthly contribution of just over 5,000 rubles. It is easy to calculate that in annual terms this will be approximately 60,000 - an amount that for Russians with the income mentioned above is very significant.

At the same time, experts who insist on the need to introduce a progressive tax scale say that today an increase in the amount of taxes collected is most often carried out at the expense of the least affluent categories of people. This practice leads to the fact that the gap between the richest and poorest Russians is growing at a catastrophic pace.

Compensation to shareholders is not assessed

Absolutely new for personal income tax from 2022 is paragraph 71 of Art. 217 Tax Code of the Russian Federation. Law No. 342-FZ of November 27, 2022 added to the list of non-taxable payments. These include compensation from the compensation fund received by the shareholder within the framework of the Law of July 29, 2022 No. 218-FZ “On the protection of the rights of shareholders in the event of bankruptcy of developers.”

Since many people got burned by this scheme for acquiring new housing, the state decided to support those who were not lucky enough to move into a completed house.

Tax deductions - what are they?

Roughly speaking, this is the figure that is subtracted from the amount you are charged as tax. It appears thanks to various benefits and allowances. Let's figure it out.

Types of tax deductions

- Standard

- Social

- Professional

- Property

Standard tax deductions

These are benefits for certain categories of people.

These include participants and disabled people of war and combat, military personnel who are already retired, people who were victims of disasters at the Chernobyl Nuclear Power Plant and the Mayak Production Association. These persons are provided with a benefit in the amount of 500 rubles.

Down payment for a car is not taxed

The list of non-taxable personal income tax payments has been supplemented with one more item. This is payment of part of the down payment towards the cost of the purchased car from the federal treasury when applying for a loan to purchase a car (the procedure is regulated by the Government of the Russian Federation. This is a new paragraph 37.3 of Article 217 of the Tax Code of the Russian Federation, which was introduced by Law No. 335-FZ of November 27, 2022.

The essence of this latest news about personal income tax changes in 2022 is that they are retrospective in nature. The exemption is effective from January 1, 2022.

New rules for taxing savings on interest on loans

Law of November 27, 2022 No. 333-FZ, from January 1, 2022, adjusted the provisions of subsection. 1 clause 1 art. 212 of the Tax Code of the Russian Federation. It has now become more clear when exactly saving on interest on a loan/loan leads to income tax.

There is personal income tax when:

- the money was received from an interdependent organization/entrepreneur or there is an employment relationship with them;

- in fact, savings are material assistance or a form of counter-fulfillment of an obligation to the borrower (for example, when the latter delivered goods, performed work, provided a service)

There is a benefit when the borrower received money at an interest rate less than 2/3 of the rate of the Central Bank of the Russian Federation.

Until 2022, personal income tax arose if a loan at a low interest rate was issued not only to an interdependent individual.

Why do we pay personal income tax?

The list is quite extensive, and it’s easier to name why we don’t pay this tax. However, let's figure it out:

- This is the salary (officially specified in the agreement or contract).

- This is the money you receive after renting out an apartment or other real estate.

- This is the interest you can receive after sharing in the company's profits. (That is, if you invested in the project, received income, give part of it to the state).

- This is part of any material benefit

- This is money received after you sold something: a car, real estate, securities, a share in a company.

- This includes salary, bonuses and one-time incentive payments.

- These are bonuses to wages and benefits for length of service.

- These are any coefficients that increase your income (for example, those that give an increase in salary based on territorial location).

There are also cases when personal income tax is not collected only up to a certain point. But if this limit is passed, please pay. Limits are set for each phenomenon. But here is a list of what applies to these partially taxable items:

- Gifts begin to be subject to income tax when their annual value exceeds 4 thousand rubles.

- Any financial assistance. As in the case of gifts, the limit is 4 thousand rubles of annual value.

- Maternal capital for the birth of a child. Limit - 50 tr.

- Severance pay. Here the border is at the level of three times the average salary.

- Daily allowances also begin to be taxed if they exceed the amount of 700 rubles per day for the territory of the Russian Federation, and 2.5 thousand rubles per day for trips abroad.

If you need a legal basis for the calculation and taxation of personal income tax, pay attention to articles of the Tax Code of the Russian Federation number 210,218,219,220,221 and 224.

Taxation of interest on domestic marketable bonds is changing

By virtue of Law No. 58-FZ of April 3, 2022, from January 1, 2018, the procedure for taxation of income in the form of interest on circulating bonds of domestic firms and enterprises that have been issued for circulation since 2022 has been changed.

In fact, these interests are now subject to personal income tax as deposits in banks at a rate of 35% (new edition of clause 2 of article 224 of the Tax Code of the Russian Federation). Namely, the difference between the amount of interest payment (coupon) and the amount of interest, which is calculated:

- by bond par value;

- the refinancing rate of the Central Bank of the Russian Federation, increased by 5 percentage points and valid during the period of payment of coupon income.

Example

Interest on bonds owned by E.A. Shirokov, paid every year. The nominal value of the bonds is 2000 rubles. The Central Bank refinancing rate at the time of payment of income is 8.25%.

This means that 435 rubles will be subject to personal income tax:

2000 × 35% – 2000 × (8,25% + 5%)

Let us recall that until 2022, the entire amount of income on outstanding bonds was subject to tax.

Attention!

The new procedure does not apply (letter of the Federal Tax Service dated July 24, 2017 No. BS-4-11/14422, information from the Federal Tax Service of Russia <On personal income tax taxation of interest on bonds>):

- for securities not traded on the organized market;

- income from any mutual funds;

- bonds denominated in foreign currency;

- bonds issued before 01/01/2017.

Then the tax is taken from the entire income of an individual.

Also see: Key Bet in 2022.

Personal income tax and its changes in 2022

Close-up of the hands of a business woman sitting at desk while checking numbers printed on paper

rates in 2022.

Basic personal income tax rate

· for residents – 13 percent

· for non-residents – 30 percent

Tax residents are considered to be employees who actually stay in the Russian Federation for at least 183 calendar days over the past year.

Certain types of income may be taxed at a higher or lower personal income tax rate. When calculating taxable income, it can be reduced by the amount of deductions: standard, property and social.

Tax residents are considered to be employees who actually stay in the Russian Federation for at least 183 calendar days over the past year. 9% personal income tax rate 2018

, it is subject to:

o Income of foreign citizens who are non-residents: highly qualified specialists, people working under a patent, citizens of the EAEU.

o Interest on mortgage-backed bonds issued before January 1, 2007

15% personal income tax rate

2018

, it is subject to:

o Income received by the founders of trust management of mortgage coverage. Such income is required to be received on the basis of mortgage participation certificates that were issued to mortgage coverage managers before January 1, 2007.

o Dividends received from Russian companies by citizens who are not tax residents of Russia

15% personal income tax rate 2018

, it is subject to:

o All income of non-residents. The exceptions are dividends and income of foreigners: highly qualified specialists; foreign citizens working for individuals on the basis of a patent or from the EAEU.

30% personal income tax rate 2018

, it is subject to:

o Rewards and winnings in organized games, competitions and other promotional events. Tax is paid on the value of such rewards and winnings, which exceeds four thousand rubles per year.

35% personal income tax rate 2018

, it is subject to:

o Interest on bank deposits insofar as they exceed the amount of interest, which is calculated as follows:

For deposits in rubles - based on the refinancing rate of the Central Bank of the Russian Federation, increased by five percent. In this case, for such purposes, they take the refinancing rate that is relevant during the interval for which the presented interest is accrued. If the refinancing rate changed during this period, the new rate should be applied from the moment it was established.

For deposits in foreign currencies - based on nine percent per annum.

Material benefits from saving on interest on credit (borrowed) funds. At the same time, you must pay income tax in 2022 on the following amounts:

o For credits (loans) in rubles - from the amount of excess of the interest calculated taking into account 2/3 of the current refinancing rate (key rate), which was established by the Central Bank of the Russian Federation at the time of payment of interest, over the interest calculated on the basis of the terms of the agreement.

o For credits (borrowings) in foreign currency - from the excess amount of interest, which is calculated based on nine percent per annum, over the amount of interest calculated on the basis of the terms of the agreement.

o Income of shareholders from an agricultural credit consumer cooperative or a credit consumer cooperative:

1. payment for the use of funds contributed by shareholders by a consumer credit cooperative;

2. interest on the use of money by the agricultural credit consumer cooperative, which is attracted from shareholders in the form of loans.

3. The calculation of personal income tax is required to be carried out on the part of the excess of the amount of the indicated income over the amount of interest calculated on the basis of the refinancing rate of the Central Bank of the Russian Federation, increased by five percent.

Personal income tax rate on wages of foreign citizens (in percentage) in 2022.

In 2022, the personal income tax rate on the wages of a foreign worker is also directly dependent on his tax status. However, for certain foreign borrowers, special rules remain relevant, which apply to:

o refugees or people who have received temporary asylum in the Russian Federation;

o highly qualified specialists;

o people working in the Russian Federation for hire on the basis of a patent;

o residents of states that are members of the EAEU.

Personal income tax on the income of foreign citizens who are residents of Russia is calculated at the same rates as on the income of Russian residents (see above). Documentary proof of tax resident status is required.

If a foreign worker works abroad, including at home at his place of residence or in a foreign branch (representative office) of a Russian company, his remuneration for the performance of his work duties is classified as income received from foreign sources. A foreign citizen who has the status of a resident of the Russian Federation independently pays personal income tax on income that was received abroad. Personal income tax is not always collected on the income of foreign citizens who are not residents of the Russian Federation. Based on the place of their employment, remuneration paid to them is classified either as income that was received from sources on the territory of the Russian Federation, or as income from foreign sources. Income that was received by non-resident foreign employees outside the Russian Federation, are not subject to personal income tax.

Personal income tax of EAEU citizens in 2022

Labor regulation of citizens of the EAEU (Belarus, Kyrgyzstan, Armenia, Kazakhstan) is carried out in accordance not only with the tax and labor code of the Russian Federation, but also with the treaty on the EAEU. The norms of the international treaty remain a priority. For this reason, the income of people who are citizens of states from the EAEU, working on the basis of civil law and labor contracts, is taxed at a rate of 13 percent from the first day of employment. It does not matter how long the person actually stayed in Russia at that moment. If a foreign citizen from the EAEU loses the status of a tax resident of his state, he will also lose the right to preferential taxation. For this reason, personal income tax on his income will need to be recalculated in accordance with the rate of 30 percent , as for a non-resident.

The following are subject to personal income tax above the limit:

o gifts whose value exceeds four thousand rubles per year;

o financial assistance exceeding four thousand rubles per year;

o financial assistance in the event of the birth of a child, exceeding fifty thousand rubles;

o severance payments that are higher than three times the average salary;

o daily allowance exceeding seven hundred rubles per day for business trips within the Russian Federation and 2,500 rubles for business trips abroad.

If you found our article about personal income tax rates in 2022 useful, please upvote or share information on how to pay payroll tax in 2022 on social media. networks.

What income is/is not subject to personal income tax in 2022?

The following are exempt from paying personal income tax in 2022:

o benefits for employees with children – for childbirth and pregnancy, child care, etc.;

o payment of education to employees;

o reimbursement of mortgage interest;

o payment for an exam to determine whether an employee meets a professional standard.

Personal income tax in 2022 is levied on:

o wages, as well as bonuses (for example, in the case of overtime work);

o remuneration under civil law contracts (except for copyright);

o disability benefits;

o remuneration to members of the board of directors;

o compensation for unused vacation;

o vacation pay;

o dividends.

Taxed above the limit:

o gifts whose value exceeds four thousand rubles per year;

o financial assistance exceeding four thousand rubles per year;

o financial assistance in the event of the birth of a child, exceeding fifty thousand rubles;

o severance payments that are higher than three times the average salary;

o daily allowance exceeding seven hundred rubles per day for business trips within the Russian Federation and 2,500 rubles for business trips abroad.

No personal income tax with targeted social assistance

Law No. 304-FZ of October 30, 2022 clarified the wording of paragraph five of paragraph 8 of Article 217 of the Tax Code of the Russian Federation from 01/01/2018. According to it, amounts of targeted assistance to citizens who are legally entitled to receive social support are not subject to income tax.

The source of these payments may be:

- federal treasury;

- regional budget;

- municipal budget;

- off-budget fund.

The appearance of this amendment is due to the fact that the current legislation does not disclose who “socially vulnerable categories of citizens” are.

What personal income tax does not apply to

To find out, you need to refer to the Tax Code of the Russian Federation, where the following points are approved in Article 217:

- These are benefits. But not sick leave, which is issued due to one’s own poor condition or the condition of a child.

- These are pension contributions

- These are various types of compensation payments

- Alimony will also not be subject to income tax.

- Some part of the maternal capital that is paid for the birth of a child. However, not entirely, but only fifty thousand rubles per child. The rest will also be taxable funds.

- One-time social payments.

- Payment for donation

- Scholarships

- Severance pay, but only those given upon dismissal

- Not considered compensation income after injury

- Travel expenses (up to a certain limit)

There is also a category that will only be partially taxed on income (no more than 4 thousand rubles):

- Cash equivalent of a gift from the organization

- Cash equivalent of the prize at the regional level

- Math help

- Payment for drugs and medicines, the costs of which will be documented

Deflator coefficient for foreigners with a patent

Order of the Ministry of Economic Development of Russia dated October 30, 2022 No. 579 for the 201st year established a deflator coefficient of 1.686. Let us recall that in 2022 it was 1.623.

In 2022, the fixed advance payment of 1,200 rubles for obtaining or renewing a work patent for a foreigner will be increased by this figure (clause 3 of Article 227.1 of the Tax Code of the Russian Federation). You should also not forget about the coefficient that is set in your region.

Taking into account the new deflator coefficient, the fixed advance in 2018 will be 2032.2 rubles (1200 rubles × 1.686). But the final amount for a patent depends on the coefficient in a particular region of Russia.

Let us remind you that in 2022, an employer can reduce the tax on a foreigner’s income by fixed payments if such an employee submits an application and the Federal Tax Service issues a special notice to the company (clause 6 of Article 227.1 of the Tax Code of the Russian Federation).

Also see “2-NDFL for a foreign worker”.