Issues discussed in the material:

- Does the tax office control the transfer of money to cards of individuals?

- How to transfer money to cards of individuals

- How can an LLC transfer money to individual cards?

- Can the tax office check an individual after transferring money?

Not long ago, information appeared on the Internet that individuals will no longer be able to transfer money from card to card for free - a tax will be charged for the operation. Today we will tell you whether this is really the case, and also whether organizations have the right to transfer money to cards of individuals.

What you need to know about tax control over individuals

The Internet is replete with reports that from June 1 or July 1, 2018, the transfer of information about all movements in individuals’ accounts to the Federal Tax Service began. And this is supposedly a consequence of the adoption of amendments to Art. 86 of the Tax Code of the Russian Federation. The authors of these articles claim that the tax service is now aware of all cash receipts of citizens and will begin to demand an explanation of the origin of the money. If there are none, the individual will be required to pay tax.

If you analyze such articles, it becomes clear that the “informants” are completely unfamiliar with the provisions of Article 86 of the Tax Code of the Russian Federation. We are aware of the essence of the changes, so we tell you what they are and when they come into force.

On June 20, 2022, the tax office made an official refutation of rumors that the accounts of individuals are being monitored and will automatically charge taxes on each cash receipt on the card.

In reality the situation is like this:

- Since June 1, 2022, changes have appeared in the Tax Code of the Russian Federation - several articles mention accounts in precious metals.

- There were no changes in terms of control over bank accounts. The obligation of financial institutions to provide tax information on transactions and account balances upon request existed previously.

- Checking the movements of funds on the card is carried out by employees of the Federal Tax Service only if there are legal grounds for this. There can be no automatic accruals.

- For additional charges, evidence of violation is required. Not all transfers to cards of individuals are taxed.

- Messages about total control are stuffing, fake and provocation.

Some provisions in the Tax Code of the Russian Federation have indeed changed since June 1, 2022, but they do not affect the control of the movement of money through bank cards. They belong to metal accounts.

The following rules were established:

- You can directly deposit precious metal or its cash equivalent into a metal account.

- It is possible to withdraw money or metal from the account by its owner - an individual or legal entity.

- The law does not provide for insurance of such deposits by an insurance agency.

- If there are reasons for checking, the Federal Tax Service may request information on such accounts and even write off funds from them to pay off the debt. With regard to cash accounts, such control and write-off have been possible since 2013 and even earlier.

- If a citizen’s money is written off against a debt, then first they do it from a ruble account, then a foreign currency account, and lastly from a metal account.

The tax conditions for transactions on the sale of precious metals and stones have also been clarified. However, there are no provisions establishing total control over the cards of individuals and additional taxes on transfers that do not have documentary evidence.

Control of transfers is regulated by Article 86 of the Tax Code of the Russian Federation. Banks are required to inform the Federal Tax Service about the opening of an account by a citizen or organization, as well as its details. In response to an official request, the tax bank is obliged to provide information about the balances of money in the accounts and the transactions carried out on them. These provisions have been in effect since 2013.

Transfer money between cards of individuals

Transfers of money to cards of individuals are taxed only if they are recognized as income. For example, if a citizen provided a service to someone (fixed the electrical wiring) and took payment for it, then he is considered to have received income. And if a person’s debt is returned, this is not income.

Selling unnecessary things, equipment, etc. through an Internet service, as well as renting them out, is a commercial activity, and the proceeds from this are counted as profit. However, when a friend transfers money to an individual on a card for a broken camera he borrowed, this does not apply to income. There is also no need to pay tax on gifts, pensions, alimony and some other transfers.

Top 3 articles that will be useful to every manager:

- How to choose a tax system to save on payments

- How to minimize taxes and not interest the tax authorities

- How to create an electronic signature quickly and easily

However, if a salary comes to an individual’s card, and it doesn’t matter whether it is a one-time transfer or a regular one, tax must be paid on it. It makes no sense to evade payment - the tax office has the right to monitor movements in citizens' accounts and request information from banks about all transactions. And if the transfer amount exceeds 600 thousand rubles, a notification is sent automatically.

Transfer of money to cards of individuals. Personal income tax. Tax crimes of individuals. How to make a translation correctly?

However, this does not mean that an individual must pay 13% to the budget for each large cash receipt. First, the Federal Tax Service will have to establish that the funds are indeed profit and not a gift, for example, from parents for a honeymoon. There is a pleasant nuance: a citizen does not have to provide evidence that he did not receive income. The tax service will figure this out itself. The presumption of innocence works here.

- Transfers between your accounts

Many people use this operation. For example, they transfer money to a card with more favorable conditions or top up a credit card account, or transfer money to a separate account for certain purposes - purchases, travel, etc. Such transactions are not taxable, they can be performed absolutely free.There are no restrictions on transfers between your accounts. Both in terms of the number of transactions and amounts.

- Transfers from relatives

You also don’t have to worry about taxes being charged to those who transfer money to cards for their family members. You can send funds to parents, children, and spouses without fear.However, if a person works for a relative and he transfers wages from his card, this will be considered income. As does payment, for example, for gardening work, even if only for a family member.

Another question is that in this case a citizen can easily prove that the money was given to him or that the debt was simply repaid. And in this case, the tax office does not have the right to demand the filing of a declaration and payment of tax.

- Transfers from third parties

There are often situations when a group of friends, after sitting in a restaurant, decide not to split the bill, and everyone transfers money for themselves to someone else’s card, and its owner pays off in full. Or the team wants to congratulate the manager on his anniversary, and the money for the gift is transferred to the card of the colleague responsible for purchasing the gift.Although transfers in such situations are not between family members, they are not taxable. But if a girl goes to a manicurist at home for a manicure or provides cosmetology services at home, paying taxes cannot be avoided.

Postal transfers

Despite the fact that there are more convenient options for sending money - from card to card, for example - many still use postal transfers. Firstly, not everyone has bank cards. Secondly, Russian Post branches are located in all regions, unlike banks: even the largest Sberbank is inferior to Russian Post in terms of the number of branches. Thirdly, the older generation is accustomed to interacting with mail and it is much more convenient for them to receive or transfer money in this way.

In order to send money, you need to use the money transfer service, since sending funds simply in an envelope, like a regular letter, is prohibited by the rules of the postal service.

Types of postal transfers

Russian Post offers three types of offline transfers and three online. In the first case, you need to come to the branch, fill out a form and hand over the money to the cashier. Secondly, everything is done on the website: you don’t even need to leave your home.

You can send money offline:

- By regular postal transfer. Money arrives within 2–6 days. You can receive funds in cash at branches or to a bank account - this point is indicated when making a transfer.

- Instant transfer "Fast and Furious" - addressed or unaddressed. You can withdraw your funds within an hour. If an address transfer was made, then you can receive the funds at a specific branch, if an addressless transfer - at any one.

- Through the Western Union service - used to send money abroad. The transfer can take from several minutes to two days. Western Union is a separate payment system: Russian Post acts as an agent here. You can pick up money at Russian Post offices, banks, hotels, airports, and currency exchange offices.

As for remote transfers, you can send money on the Russian Post website:

- From your bank card with further receipt in cash. The addressee can either pick up the money himself at the post office or receive it from the courier. The money will be available the very next day.

- From card to card. Regular non-cash transfer, which is offered by all banks. The transaction takes place instantly. Transfers are made only from Russian cards.

You can also use a terminal or Qiwi virtual wallet. The addressee will be able to receive money either at the branch or by courier delivery. The transfer will be available the next day after sending. To register through the terminal, you need to provide your contact information and addressee's index. To conduct a transaction through the application or personal account - only the recipient's address.

Please note that each transfer is subject to a fee. Its size directly depends on the amount and type of transaction - you can familiarize yourself with the conditions on the official website of the Russian Post. The fee is charged to the sender, not the recipient.

How to track a money transfer

In the usual sense, there is no way to track a money transfer, since such transactions are not assigned a tracking number. The only exception is sending through Western Union and Qiwi terminals.

In the first case, you can view the status on the payment system website:

- go to the “Translation Status” section;

- enter the KNDP (money transfer control number) - it is indicated on the receipt;

- if there is no number, click “Don’t know KNDP” and restore the data using one of two forms - by the sender’s phone number or the names and surnames of both participants in the transaction.

For more specific search results, enter the amount sent or received and the date of the transaction.

In the second case, you will need to open the “Checking a payment made through QIWI terminals” section on the payment system website and copy the data from the receipt you received when depositing funds into the form that opens.

As for other types of transfers, here clients can only activate SMS notification to receive brief information about the transaction. There are two types of notifications:

- on arrival at the destination - for the recipient;

- about receipt of the transfer - for the sender.

Each message will cost 1 ruble. To activate the service, you need to fill out a separate form when making a transfer.

Important: contacting a Russian Post office or hotline is pointless. Employees do not see information about the payment status. At most, they can guide you on the timing of delivery of funds.

When can the tax office check an individual?

Now the tax service is checking not only legal entities, but also individuals. And if a citizen works for himself and does not pay taxes, falsifies 2-NDFL certificates, receives large sums into his accounts, then the Federal Tax Service will one day definitely show interest and check it.

The tax office may initiate a thorough inspection of an individual for the following reasons:

1. Study of the 3-NDFL declaration.

Filing such declarations is necessary when a citizen receives additional income from the provision of private services, the sale of real estate, or payment for educational or medical services. Having received the 3-NDFL declaration, the tax service checks the information from it with the database data. This is necessary to detect cases of fraud.

2. Checking for illegality of business.

Nowadays, unofficial work or part-time work is not uncommon. Often citizens rent out their homes, engage in freelancing and do not pay tax on the income they receive. Some people don’t even imagine that the tax office might come to them with an audit. There is an opinion that the Federal Tax Service is only interested in those who receive large sums into their accounts. However, the Criminal Code of the Russian Federation does not establish a minimum amount of income at which an inspection can be initiated. Practice shows that suspicion of illegal business may arise among regulatory authorities after two identical transactions have been completed.

When tax inspectors check individuals for illegal circulation of funds, they must take into account the following:

- are there any buyers who paid the person being inspected for the goods purchased or services received;

- whether the citizen advertised his products/services, whether he had an exhibition of samples;

- whether he constantly purchases any goods in large quantities;

- whether there are concluded contracts for the rental of real estate;

- what is the scale of money turnover in individual bank accounts;

- Does he keep records of transactions made?

Based on legal practice, the purpose of on-site tax audits of individuals may be to clarify the following data:

- does the citizen continue to carry out entrepreneurial activities after being deregistered;

- whether the person being audited is trying to reduce the amount of his taxable income through expenses;

- whether the private person is conducting illegal business activities;

- Is the 3-NDFL declaration for property deductions filled out correctly?

As a rule, the Federal Tax Service checks individuals if there are suspicions about them.

However, an audit can also be initiated if the tax office receives a complaint in writing from another individual or legal entity.

In general, citizens are rarely checked, which is due to the heavy workload of tax officials and, as a consequence, lack of time for a total check of the population. However, those who engage in business illegally still need to keep their eyes open, as it is possible that they may be subject to complaints from dissatisfied customers, neighbors or competitors. And if during the inspection it is determined that a citizen has illegal income, he may be given not only a fine, but also punishment.

If the amount of illegally obtained profit on the card exceeds 1.5 million rubles. per year, the person is criminally liable.

Taking into account the fact that the tax office conducts on-site inspections on the territory of the taxpayer’s residential premises, the rights of inspectors are limited.

The law allows them:

- request from the citizen documents that need to be examined;

- inspect property (but not in residential premises);

- seize documents that an individual did not provide to the Federal Tax Service on time if there are suspicions that the data was hidden, destroyed or distorted;

- interrogate the person being audited to clarify the circumstances relating to his activities and demand the provision of documentation related to the case in accordance with Article 93.1 of the Tax Code of the Russian Federation;

- evaluate tax audit materials with the involvement of third-party experts in accordance with Articles 95-96 of the Tax Code of the Russian Federation.

Tax authorities are mainly suspicious of rare transfers by individuals of money from one card account to another. They are not interested in transactions with small amounts. For example, the attention of the Federal Tax Service may be drawn to a citizen who does not have an official source of income and does not pay personal income tax.

If a person works under the Labor Code of the Russian Federation or a civil contract, and the employer pays tax for him, then he has no reason to worry. They won't check it.

More situations

Citizens who, due to their type of activity, independently pay deductions and fill out a declaration may come under suspicion.

There is an opinion that the Federal Tax Service receives information from the immigration service for registration of citizens of neighboring countries. This is a theory; it has not been officially confirmed. So, supposedly, on the basis of the information received, checks can be carried out on the rental of real estate (unofficial) and tax evasion on income received from the rental of an apartment.

In principle, such a theory is hard to believe, since there are many “weak” points. But cases still happen: neighbors can complain to the police, and they will come with an inspection.

Why does the Tax Inspectorate check apartments owned by pensioners?

When else can the tax service initiate an audit:

- When a freelancer enters into an agreement with a client, it is necessary to carefully read all clauses of the agreement. Often, civil law agreements and other contracts indicate who reports to the Federal Tax Service and in what way.

In such a situation, the catch is that a transfer from a legal entity to an individual always raises suspicion if there is no relationship within the framework of an employment agreement.

- The Russian government has launched a trial project on tax holidays and registration of self-employed people in certain regions of the Russian Federation. There is no need to pay taxes if a person has voluntarily registered with the Tax Inspectorate. As for the rest, checks will probably take place in 5 years.

Article 208 of the Tax Code of Russia lists all sources of income of an individual that are subject to tax.

Possible fines when receiving money on cards of individuals

Violators of tax laws are fined. The Tax Inspectorate checks the intended purpose of transfers to cards of individuals. If it turns out that the operation was financially beneficial for the recipient of the money, he is obliged to pay personal income tax on the transferred amount. If a citizen ignores this requirement, he is given a fine. Sometimes the card account is even temporarily blocked.

In accordance with Art. 227 of the Tax Code of the Russian Federation, the fine for concealing income is 20% of the amount of arrears. If an individual deliberately evades payment, the fine is doubled. In addition, a penalty is charged.

Citizens who fall under the category of self-employed are most at risk. These are individuals who receive income from providing certain services to individuals or organizations, but are not hired workers and do not have individual entrepreneur registration.

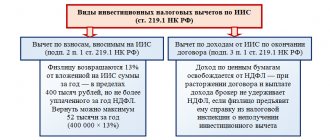

In the Russian Federation, there are legal alternatives to paying personal income tax for self-employed individuals. For example, a person can pay tax on transferring money for work performed to a Sberbank card. To do this, he needs to register and obtain self-employed status. For such citizens, there is a tax holiday period until the end of 2022. From January 1, a special tax regime for the self-employed is available to residents of the capital, Moscow and Kaluga regions, as well as the Republic of Tatarstan.

After receiving such status, an individual pays only NAP:

- 4% - when working with individuals;

- 6% - with organizations.

Self-employed citizens report their income remotely using the “My Tax” mobile application. After installing it, the user links his bank card to it, to which transfers are made for services provided. Income tax will also be deducted from it. If an individual does not pay the NAP, he will be fined (fine amount 20–100%). But sanctions will begin to be applied in 2022.

What to do if a person receives not only wages, but also other transfers on his card? How to avoid claims from the tax authorities?

Tax control over transfers to the card from 2022. Personal income tax and VAT:

There is no need to worry about this if all income is declared and taxes are paid. In this case, there is no risk of receiving additional charges on all cash receipts on the card. Therefore, there is no need to invent anything.

Those who are still afraid of “angering” the tax office should follow the following advice.

Ask senders to accompany the translation with a comment. For example, “Wedding gift”, “Darling, this is for your watch”, “Repayment of debt”, etc.

If the transfer is large, it is better to prepare the documents. Checking all small payments is beyond the capabilities of the tax office. But large monthly income, for example, 100 thousand rubles, will definitely interest her. If a friend transfers this money to you to pay off a debt, it is advisable to have documentary evidence of this fact. This could be a loan agreement or, in extreme cases, a receipt. If you sold a TV and the buyer transferred money to your card, you will need a document confirming the transaction. In this case, you also need evidence that you have been using the TV for more than three years - in this case, you do not need to declare income or pay tax on it.

Receipts on the card are subject to tax. But not always, there are exceptions.

Receipts on individual cards are subject to tax. According to Art. 209 of the Tax Code of the Russian Federation, when determining the tax base for personal income tax, all income of the taxpayer received by him both in cash and in kind is taken into account. But, there are exceptions to this rule. Article 217 of the Tax Code of the Russian Federation lists income that is not subject to personal income tax. The following receipts into the account are not taxed if:

- The income received is associated with the sale to an individual of property owned for more than 3-5 years, the calculation of the period has its own peculiarities, Article 217, 217.1 of the Tax Code of the Russian Federation);

- The income received is associated with the sale of the inheritance;

- You received income in the form of alimony, transferred to you by an individual. face;

- You received income under a gift agreement from close relatives (clause 18.1. p. 217 of the Tax Code of the Russian Federation is directly named)

- You received income under a gift agreement not from close relatives (except for real estate). Income is not subject to personal income tax. This is explained by letters from the Ministry of Finance of Russia dated 09/05/2012 N 03-04-05/1-1065, dated 06/04/2012 N 03-04-05/5-684, dated 04/20/2012 N 03-04-05/6-532, Federal Tax Service of Russia dated July 10, 2012 N ED-4-3/ [email protected] The Federal Tax Service adheres to a similar point of view.

- Other income, see Art. 217 of the Tax Code of the Russian Federation, the list is quite extensive.

Transfers of LLC to cards of individuals

An LLC can transfer funds from its current account to an individual’s bank card. And this does not have to be an employee of the organization; you can send money to third parties.

What translations are allowed:

- Transfer of salaries.

- Transfer of the accountable amount.

- Issuing a loan.

- Payment for products or services of an individual.

Any of these cases involves the collection of a commission by the bank, so it is better to pay salaries on cards issued as part of the salary project, and transfer money for reporting purposes to corporate cards. For example, at Tochka you can open an unlimited number of corporate cards at all tariffs.

You can pay wages to a special salary card or any other card issued to an employee. Transferring remuneration for work to a salary project card is more profitable - the commission for it is lower.

If money was transferred to an employee on account, he must provide expense receipts to the accounting department to confirm the intended use of the company’s funds. If there are no checks, the tax office may consider the transferred amount to be the employee’s income and charge a tax of 13% on it.

In accordance with the regulation of the Central Bank dated December 24, 2004 No. 266-P, there are the following accountable items:

- expenses related to the activities of a legal entity on the territory of the Russian Federation;

- entertainment and travel expenses;

- other expenses not prohibited by Russian law.

Only employees of the organization are allowed to issue loans on the basis of a borrowing agreement. To provide loans to third parties, you must have a license from the Central Bank to conduct such activities. To transfer funds to the card of an individual or a supplier of goods/services, you need to conclude an agreement in accordance with the norms of the Civil Code of the Russian Federation.

If a transfer of more than 600 thousand rubles is made to an individual’s card, then such an operation is strictly controlled by the state. Whereas in Tinkoff Bank, for example, there are no restrictions on the size of money transfers.

You can transfer both wages and money for reporting purposes to the bank card of the company manager from the LLC account. Let's consider both cases.

If a salary is transferred, then it is necessary to indicate the details of the director’s personal card account, his full name and the transfer amount. Let us remind you that you do not need to pay VAT on the transfer of money to an individual’s card. But it is mandatory to pay personal income tax on the amount of earnings, as well as transfer contributions to the Pension Fund and the Social Insurance Fund.

It is not difficult to transfer money to a director’s card (both salary and personal) under reporting, but this operation requires attention from an accountant, since the transfer may be recognized as income of an individual.

To avoid this, it is necessary to indicate the purpose of the payment, for example, “Issuance on account for the purchase of travel tickets...”, “Issuance on account for payment of accommodation...”, etc. To avoid problems with the Federal Tax Service, it is necessary to specify the purpose as precisely as possible.