Creating a payment order

In order to transfer money from an organization’s current account to pay suppliers, pay taxes and other fees, you need to create a payment order. On the “Bank and cash desk” tab, select the “Payment orders” item:

A list of payment orders opens. In the upper left part of the document, click the “Create” button, a form for a new payment order opens. The following fields are filled in:

- Transaction type – selected from the proposed drop-down list according to the type of payment being made;

- Recipient – the required counterparty is selected from the counterparty directory, the recipient’s account and the agreement are filled in automatically from the counterparty’s details;

- Amount of payment;

- VAT – by default it is set from the counterparty’s data;

- VAT amount is calculated automatically;

- Purpose of payment.

It is important to correctly indicate the type of operation, since depending on the selected operation, the document details will change.

For example, when choosing the type of transaction “Payment of tax”, you will need to fill out the “Type of obligation” field, you can change the BCC and OKTMO code (by default they are filled in with current data). The order for payment to the supplier looks like this:

After completing a completed order to pay the supplier, no transactions are generated in 1C; it is just an information document that records the need to generate a similar payment order in the client-bank system (remember, we are talking about manual work).

Another way to create a payment order manually is through the “Pay” button, which, like the “Create” button, is located above the list of payment orders. When you click, a list opens from which you can select the desired type of payment: “Accrued taxes and contributions” or “Goods and services”:

When you select one of the items, 1C Accounting itself will analyze the organization’s debt and generate a list of documents for which payment is required:

To create payment orders to several creditors at once, you can mark the required documents in the list and click the “Create payment orders” button.

New payments will appear in the list. They are in bold and not posted because they need to be verified. After checking the correctness of filling and the correctness of the amounts, the order is carried out. In this case, you also need to duplicate the order in the client-bank system.

As soon as the bank has confirmed that this payment has been transferred to the recipient, the movement of funds in the accounts must be reflected in 1C and debited from the organization’s current account.

Accounting

Write off funds from the organization's current account in accounting by posting entries to the credit of account 51 “Current accounts”.

When writing off money to pay for obligations under an agreement with counterparties, make the following entries in your accounting:

Debit 60 (76, 62, 66, 67, 91-2...) Credit 51

– money is debited from the current account to pay obligations under the contract.

For information about what transactions need to be made if an employee of an organization pays contractors with a bank card, see How can you issue money on account?

Reflect the transfer of taxes to the budget by posting:

Debit 68 Credit 51

– funds were transferred to pay taxes.

When paying contributions for compulsory pension (medical, social) insurance, make the following entries in your accounting:

Debit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” Credit 51

– contributions to the Social Insurance Fund of Russia are transferred;

Debit 69 subaccount “Settlements with the Pension Fund” Credit 51

– pension contributions are transferred;

Debit 69 subaccount “Settlements with FFOMS” Credit 51

– contributions for health insurance to the Federal Compulsory Medical Insurance Fund are transferred;

Debit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” Credit 51

– contributions for insurance against accidents and occupational diseases are listed.

Record the write-off of funds for payments to employees (salaries, etc.) by posting:

Debit 70 (73, 71) Credit 51

– the debt to the organization’s employees has been repaid.

Reflect payments to founders in accounting by writing:

Debit 75-1 Credit 51

– dividends are transferred to the founders (if they are not employees of the organization).

This procedure is established in the Instructions for the chart of accounts.

Situation: how to reflect in accounting the funds that are in the organization’s current account? The bank servicing the organization has had its license revoked.

From the day the bank’s license is revoked, account for funds in account 55 “Special accounts in banks.” In accounting, reflect this by posting:

Debit 55 Credit 51

– the balance of funds in the bank account from which the license has been revoked is reflected.

After you submit an application to close the account and return the money, reflect the accounts receivable in your accounting in the amount of the balance of funds in the account:

Debit 76 Credit 55

– the bank’s receivables are reflected for the amount of funds in the account (as of the date of filing the application);

Debit 91-2 Credit 63

– a reserve for doubtful debts of the bank has been created.

This procedure was recommended by the Russian Ministry of Finance in letter dated February 6, 2015 No. 07-04-06/5027.

Information about the revocation of licenses from banks can be found in the printed publication “Bulletin of the Bank of Russia” and the periodical printed publication at the location of the bank (clause 3 of Article 189.26 of the Law of October 26, 2002 No. 127-FZ).

You can write off the debt you have incurred from account 76 if one of the following cases occurs:

- the bank repaid the debt (for example, during bankruptcy proceedings) (clause 1 of Article 408 of the Civil Code of the Russian Federation);

- the bank was liquidated (Article 419 of the Civil Code of the Russian Federation).

If the bank has paid off its obligations to the organization, then reflect the amount received on account of the debt with the following entries:

Debit 51 Credit 76

– funds returned during the liquidation of the bank have been received;

Debit 63 Credit 91-1

– the reserve for the bank’s receivables has been restored.

If the bank is liquidated, its debt can be written off as uncollectible:

Debit 63 Credit 76

– the bank’s bad receivables are written off at the expense of the created reserve.

In this case, the bank is considered liquidated after the corresponding entry is made in the Unified State Register of Legal Entities (clause 9 of Article 63 of the Civil Code of the Russian Federation). An organization can find out about the exclusion of a bank from the Unified State Register of Legal Entities by submitting, for example, a request to the tax office (clause 20 of the Administrative Regulations, approved by Order of the Ministry of Finance of Russia dated January 15, 2015 No. 5n).

Situation: how to reflect the transfer of funds to a counterparty in accounting? The bank servicing the counterparty has had its license revoked.

In accounting, reflect the transfer of funds to the counterparty in the general manner.

Reflect the write-off of funds from the organization's current account in accounting by entries on the credit of account 51 “Current accounts”:

Debit 60 (76, 62, 66, 67, 91-2...) Credit 51

– money is debited from the current account to pay obligations under the contract.

But the counterparty will need to account for these funds in account 55 “Special accounts in banks.”

This procedure is established in the Instructions for the chart of accounts (account 51).

Situation: can an individual entrepreneur withdraw cash from a current account without restrictions for personal needs?

Yes maybe.

All income an individual entrepreneur receives from his activities is his personal funds, including cash. He can dispose of them at his own discretion, since an individual entrepreneur is not a legal entity and his property is not legally delimited (clause 1 of article 23, clause 24, clause 1 of article 861 of the Civil Code of the Russian Federation).

At the same time, the entrepreneur is obliged to comply with the procedure for conducting cash transactions and storing cash (clause 4 of article 346.11, clause 5 of article 346.26 of the Tax Code of the Russian Federation, clause 18 of the Regulations approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359, p 1 instructions of the Bank of Russia dated March 11, 2014 No. 3210-U). Amounts of cash in excess of the established limit, if the entrepreneur has established it, must be kept in a current account (clause 2 of the Bank of Russia Directive No. 3210-U dated March 11, 2014).

If necessary, an entrepreneur can withdraw funds from the current account for any needs without restrictions. There is no need to prepare an advance report on the amounts spent on personal needs. Similar explanations are given in the letter of the Bank of Russia dated August 2, 2012 No. 29-1-2/5603.

The procedure for calculating taxes depends on the tax system that the organization uses.

BASIC

If an organization uses the accrual method, then writing off money from the current account will not affect the calculation of income tax. This is due to the fact that the recognition of expenses in this case does not depend on the debiting of money from the organization’s current account (clause 1 of Article 272 of the Tax Code of the Russian Federation).

An example of how to reflect in accounting and taxation the debiting of money from a current account when making payments using collection orders. The organization uses the accrual method

On July 1, Torgovaya LLC entered into a long-term agreement with Alfa CJSC. Under the agreement, Alpha provides telephone services to Hermes. Hermes pays for the provided communication services on a monthly basis. The agreement provides for a collection form of payments (collection orders).

The agreement between Hermes and the bank servicing it contains a provision regarding the bank’s right to write off funds from the client’s account without his order.

In July, Alpha provided RUB 59,000. (including VAT – 9000 rubles). On August 1, Alpha’s accountant issued a collection order for this amount and submitted it to the bank servicing the organization.

On August 1, “Hermes” submitted information to the bank servicing it: – about the recipient of funds (“Alfa”), who has the right to issue collection orders to write off funds in an indisputable manner (full name, legal and actual address, telephone number, INN, KPP, OGRN, bank details, information about the manager and chief accountant); – on the agreement with Alfa for the provision of communication services.

The bank debited the money from the Hermes account on August 2.

The accountant of Hermes reflected the transactions performed in the accounting as follows.

July 30:

Debit 26 Credit 60 – 50,000 rub. – reflects the cost of communication services for July;

Debit 19 Credit 60 – 9000 rub. – input VAT is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 9000 rub. – accepted for VAT deduction (based on the supplier’s invoice).

August 2:

Debit 60 Credit 51 – 59,000 rub. – money was debited from the current account to pay for the services of the communication provider (based on a bank statement).

Hermes uses the accrual method, so debiting funds from the current account to pay for services to a supplier will not in any way affect the calculation of income tax.

If an organization calculates income tax using the cash method, then the reflection of money written off by the bank from the current account depends on its purpose. This is due to the fact that expenses under the cash method are recognized at the time of their actual payment (clause 3 of Article 273 of the Tax Code of the Russian Federation). For example, if an organization transfers money for the services of third-party contractors, then such expenses must be taken into account when calculating income tax at the time of debiting funds from the current account (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Situation: how to reflect the funds that are in the organization’s current account when calculating income tax? The bank servicing the organization has had its license revoked.

Funds in a current account in a bank that has lost its license can be taken into account when taxing profits only after the liquidation of such a bank.

After the license is revoked, the Bank of Russia begins bank bankruptcy proceedings if the credit institution shows signs of insolvency specified in Article 2 of Law No. 40-FZ of February 25, 1999. If these signs are not present, the Bank of Russia applies to the arbitration court with a demand to liquidate the credit institution forcibly. This procedure is provided for in Article 23.1 of the Law of December 2, 1990 No. 395-1.

In this case, the organization must declare its claims to the bank and be included in the register of creditors’ claims (Articles 50.28, 50.30 of the Law of February 25, 1999 No. 40-FZ).

During the bankruptcy procedure, the bank can repay its debt to the organization (Clause 1 of Article 408 of the Civil Code of the Russian Federation, Articles 50.30, 50.35 of the Law of February 25, 1999 No. 40-FZ). Do not reflect the amounts received, regardless of the method for determining income tax, in income (Articles 41 and 248 of the Tax Code of the Russian Federation).

If the bank has not paid the amount of debt in the form of funds listed on the organization’s current account, then it has the right to classify the specified amount as bad debts and write it off (clause 2 of Article 266 of the Tax Code of the Russian Federation). This can be done when the bank is liquidated (as a result of bankruptcy or forced liquidation) and an entry about this will be made in the Unified State Register of Legal Entities (Article 419, paragraph 9 of Article 63 of the Civil Code of the Russian Federation, letters of the Ministry of Finance of Russia dated March 4, 2013 No. 03 -03-06/1/6313, dated October 19, 2012 No. 03-03-06/1/559). This rule applies to both the accrual method and the cash method.

An organization can find out about the exclusion of a bank from the Unified State Register of Legal Entities by submitting a corresponding request to the tax office (clauses 20, 22 of the Administrative Regulations, approved by Order of the Ministry of Finance of Russia dated January 15, 2015 No. 5n).

Debiting from current account

You can debit your current account from the same payment order. In it you need to set the status to “Paid” and click on the hyperlink “Enter a debit document from the current account.”

After clicking on the link, the completed document opens. The data is entered from the payment order. Therefore, if everything in the payment slip is correct, then you can simply write it off:

The document “Write-off from the current account”, unlike a payment order, generates transactions in 1C.

You can see the transactions by clicking the “Show transactions” button:

Everything was filled out correctly: funds were transferred from the organization’s current account to the supplier’s current account, which is reflected by posting Dt60.01 - Kt51. In the list of payment orders, a check mark appears in the first column opposite paid documents:

Operations for debiting funds from a current account in 1C 8.3

By analogy with operations of receipts to a current account, the screen form of the document for debiting funds from the account and the accounting entries generated on its basis depend on the type of the selected operation.

The operations Payment to the supplier, Return to the buyer, Return of the loan to the counterparty, Return of the loan to the bank have the same principles of completion as operations for the receipt of funds to the account. It is important to choose the right type of transaction, counterparty, agreement and cash flow:

Expense transactions can also be loaded into 1C 8.3 from a text file, which is generated by the Internet Bank software application of the servicing bank, using the Load button on the toolbar:

Let us consider in detail the most frequently used transactions of debiting from a current account in 1C 8.3 and settlement accounts.

Paying tax

For this operation, it is important to select the correct tax account in the chart of accounts, as well as the type of payment: tax, penalty or fine. The accounting entry creates a record on the debit of the tax account entered with the filled-in analytics of the type of obligation (tax, penalty, fine) and the credit of account 51:

Transfer to an accountable person

When you select this operation in 1C 8.3, account 71 is automatically entered into the posting; in the Recipient attribute, you should select the employee’s full name from the Individuals directory:

Debiting wages from a current account in 1C 8.3

The document must indicate the payroll on the basis of which the payment is made:

Salaries can be transferred according to several statements. To select several statements, click on the Split payment link and in the pop-up window, enter the statements required for payment. Moreover, the 1C 8.3 program monitors already paid statements, therefore, if one is selected, it displays a message stating that the selected statement has already been paid:

Salaries can be transferred according to the register or separately to the employee’s card. For these purposes, the directory of types of operations provides corresponding lines.

Debiting from a current account in 1C 8.3 for bank services

In 1C 8.3, this operation is used, in particular, to write off funds for bank services.

Statements for Cash Receipt/Withdrawal transactions may not be carried out. For this purpose, cash documents Expenditure/Receipt Cash Order are used. But if you make statements of such transactions, then there will be no double accounting entries.

Receiving payments from buyers

To reflect the receipt of funds to the organization’s current account, use the “Bank statements” item in the “Bank and cash desk” section:

When you select this item, a journal opens that reflects all receipts and debits from the current account:

To enter information about receipt, use the “Receipts” button. The document “Receipts to the current account” opens, in which the following fields are filled in:

- Type of transaction – in our case, “Payment from the buyer” is set;

- Payer – the counterparty from whom the money came is selected from the directory;

- Sum;

- The VAT rate, agreement and movement item of the DS are filled in from the previously established values.

After filling out all the data, the document is posted:

Once done, you can check the wiring:

Posting Dt51 - Kt62.02 shows that money has been received from the buyer to our account.

The list of bank statements shows current information on the current account status for the current day:

Information is provided on the amount at the beginning of the day, on receipts and write-offs for the day, and the balance at the end of the day.

If you need to clarify information for any other day, you can use the calendar to select the desired date:

A list will be generated for the selected day, which will also show all information about the account status.

Bank statements in 1C: Accounting 8

Published 12/09/2014 23:39 Author: Administrator This article is about how to work with bank statements in 1C: Enterprise Accounting 8: how to reflect the receipt of funds to the current account and their debiting, as well as how to download data from the client bank; what transactions should be generated in the program, and what question about working with bank documents is most often asked by users.

So, in order to enter data into the program about the receipt of money to the settlement account, you need to go to the “Bank and Cash Desk” tab and select the “Bank Statements” item.

In order to manually enter a document, you must click on the “Receipt” button in the form that opens.

First of all, we select the type of operation, the composition of the remaining fields of the document depends on it, in our case it will be “Payment from the buyer. Then we select an organization (if there are several of them in the database) and a counterparty from the directory (if necessary, add a new element). The “Payer's account” field can be left blank, but the organization's bank account must be indicated. We enter the payment amount and add information about the counterparty’s agreement to the tabular section (you can also add it to the directory directly while entering the document), indicate the VAT rate and check the accounts for accounting for settlements and advances, in our case these are accounts 62.01 and 62.02. It is advisable to indicate the cash flow item, but not necessary to post the document.

When posting a document in this case, the advances account is used - 62.02, because the buyer makes an advance payment; data on the sale of goods or services to him is not yet reflected in the program.

To reflect the debit from your current account in the form of a bank statement, you need to click the “Write-off” button. In the document form that opens, we also first select the type of operation and organization. We will reflect the advance payment to the supplier. To do this, we indicate the counterparty (select or add a new one), the payment amount, and the organization’s bank account, if it is not filled in automatically.

In the tabular part we add a separate line for each contract; in our case there will be one contract. Select a cash flow item and VAT rate; We check the settlement accounts and the amount. The “Payment purpose” field is filled in automatically, but it can be adjusted manually.

When posting a document, the following account movements are generated:

Another example of writing off funds from a current account with a different type of transaction is discussed in detail in the article Expenses for bank services - how to reflect in 1C.

You can also download an extract from the “Bank-client”, this method is described in the article Downloading an extract from the Bank-client into 1C: Accounting - how to set it up?

After the data is uploaded, I would recommend reconciling the end-of-day balance against the statement; you may need to go into some of the uploaded documents, adjust accounting accounts or other fields and post them. For example, to write off funds for salary transfers, you must select the appropriate payment statements in the documents.

Another issue that I would like to talk about is printed forms of payment orders. Unfortunately, the document “Write-off from the current account” cannot be printed. Another document is intended for these purposes - “Payment order”, which can also be found on the “Bank and cash desk” tab or created from a write-off document by clicking on the “Enter payment order” link at the bottom of the form.

If you still have questions about working with bank statements in 1C, you can ask them in the comments to the article.

And if you need more information about working in 1C: Enterprise Accounting 8, then you can get our book for free using the link.

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 #19 Victoria 09/03/2021 16:08 Hello! We have 2 accounts in different banks. I am making a statement from one bank, everything is fine. Today I did it from the second and the write-off was loaded, but the DS did not arrive. There was a receipt - the supplier’s bank returned the money because its account was closed. despite the fact that when I click on the “download report” link next to the “Download” button when exchanging with the bank, then you can see the line received - the amount. new 1c does not load this refund and the amounts for the rest of the day do not add up. What could be the reason?

Quote

0 #18 Irina Plotnikova 03/05/2021 23:06 I quote Anzhelika:

Good afternoon How can you configure the 1C8.3 program so that when loading statements, the type of transaction in the receipt document on the account is not “payment from the buyer” (set automatically), but “other receipts” and, accordingly, settlement account 86.02?

Good afternoon, Angelica!

Since you need a settlement account 86.02, then most likely you are a non-profit organization. In the standard program 1C: Enterprise Accounting ed. 3.0 such functionality does not exist. Therefore, you have 2 options for the development of events: 1. Buy an industry-specific program for non-profit organizations 2. Contact programmers to add this functionality to your database. In this case, you need to remember that from the moment something is added to the database, it becomes non-standard and any update may affect your added functionality and disrupt its operation. We'll have to turn to the programmers again. Quote 0 #17 Angelika 03/05/2021 16:09 Good afternoon! How can you configure the 1C8.3 program so that when loading statements, the type of transaction in the receipt document on the account is not “payment from the buyer” (set automatically), but “other receipts” and, accordingly, settlement account 86.02?

Quote

0 #16 Irina Plotnikova 01/28/2021 17:11 I quote Natalya:

Good afternoon! We are now switching to 8.3 and when posting a bank statement manually, I encountered the problem of writing off personal income tax - the posting is not generated. All payments are generated in our client bank

Natalya, good afternoon.

Check the transaction type, it should be “Tax payment”. Accounting account 68.01.1 Quote 0 #15 Natalya 01.27.2021 23:29 Good afternoon! We are now switching to 8.3 and when posting bank statements manually, I encountered the problem of writing off personal income tax - the posting is not generated. All payments are generated in our client bank

Quote

0 #14 Elena 01/17/2020 11:16 Good afternoon. How can I set up the display of cash balances and cash flows in a bank statement in 1C:Accounting 8 (rev. 3.0)? Clicking the more button—show/hide totals—nothing happens.

Quote

+2 #13 Maria 05/27/2019 09:43 Good afternoon. I uploaded a bank statement in the amount of 197,000 rubles into 1C Enterprise 3.0. And she writes off 394,000 rubles. I can't understand why. It was me who transferred the amount from one bank to another bank. And only for this operation there was a double write-off. Please tell me where to look for the catch?

Quote

+1 #12 Maria 05/14/2019 06:24 How can I check whether the bank statement has been posted correctly, or rather the invoice for payment has been linked using the SALT or some other report? To understand whether the invoice has been paid

Quote

0 #11 Natalya Ivanova 01/24/2019 22:44 Good afternoon, I am making an extract (USN) for the accounting entries, the amount was divided into 2 parts after re-posting into 3, I filled out the USN journal with one amount, KUDir also 3 amounts. The simplified tax system is also 3 amounts. How can I fix it somewhere in the settings? I always correct 60.2 to 60.1 in statements

Quote

+2 #10 Alexandra 06/03/2018 14:10 Hello! BP rev 3.0. When loading a bank statement, in the Transaction Type field 1c puts other write-off - and this is the bank commission (in the payment purpose, everything is loaded correctly by the Bank Commission). Please tell me that when downloading a statement, the correct type of transaction is entered into the Bank Commission, where should it be configured? Thank you.

Quote

+1 Ukhova Natalya 05/28/2018 00:15 I quote Alexander:

Hello! We have two accounts - I upload the statement one at a time (I haven’t set up the second one yet). Then I go into each document and correct the field where 60.01 is indicated. and the advances account is also 60.01 (corrected to 60.02). Tell me why this happens, do I need to configure/check a box somewhere? The second question is that the bank commission is written off, when loading the 1c statement, it is set to Other write-off, I also correct it on the bank commission. Why does he put it this way, please tell me? 3. - Salary accounting is kept in ZUP2.5, I enter transactions in BP3.0 manually through Transactions entered manually - when written off by account 1s it does not go to kudir and when we pay taxes - the type of transaction costs the payment of tax, it does not go to kudir either . I correct everything manually for other write-offs and then correct everything in the fields. How can I make it fit correctly, please tell me? Thank you.

Good afternoon

1) Accounts are entered in accordance with the information register “Accounts for accounting of settlements with counterparties”, the main menu is located - all functions - accounting accounts. The 1c configuration accounting methodology uses advance subaccounts for settlements of advances 60.02 and 62.02, and with correct accounting, closing advances always occurs correctly. 2) Support for ZUP configuration ed. 2.5 ended in April of this year, from the 2nd quarter of 2022 I recommend switching to the new edition of ZUP 3.0 and already there setting up the correct ZUP-BP exchange, which creates the document “Reflection of wages in accounting”, which makes the necessary entries and movements in the KUDiR registers , and also transfer statements for salary payments. Quote 0 Alexandra 05/26/2018 11:24 Hello! We have two accounts - I upload the statement one at a time (I haven’t set up the second one yet). Then I go into each document and correct the field where 60.01 is indicated. and the advances account is also 60.01 (corrected to 60.02). Tell me why this happens, do I need to configure/check a box somewhere? The second question is that the bank commission is written off, when loading the 1c statement, it is set to Other write-off, I also correct it on the bank commission. Why does he put it this way, please tell me? 3. - Salary accounting is kept in ZUP2.5, I enter transactions in BP3.0 manually through Transactions entered manually - when written off by account 1s it does not go to kudir and when we pay taxes - the type of transaction costs the payment of tax, it does not go to kudir either . I correct everything manually for other write-offs and then correct everything in the fields. How can I make it fit correctly, please tell me? Thank you.

Quote

0 Ukhova Natalya 03/07/2018 10:29 I quote Ksenia2018:

Good afternoon, I’m switching to 1 from 8, please HELP just with the statement - I paid 20 kopecks more (rounded up) and my whole life is over - I can’t check out for a day ((((((((( I backed up 2 statements. I paid on before

Hello!

Do you pay wages according to payroll? If yes, then it is very important that the amount on the statement coincides with the payment slip, because a bank document makes movements in the personal income tax register (withheld personal income tax), so even minor changes in the amount bring the program to a standstill, because It is unknown which of the employees withhold personal income tax from 20 kopecks. In your case, either correct the statement or create a second one for 20 kopecks. and in debiting from the current account (type of operation: payment of wages according to statements) add 2 statements. Quote 0 Ksenia2018 03/06/2018 19:03 Good afternoon, I’m moving to 1 from 8, please HELP just with the statement - I paid 20 kopecks more (rounded up) and my whole life is over - I can’t check out for a day ((((((( ( (reinforced 2 statements.t paid in advance

Quote

0 Ukhova Natalya 02.12.2016 16:17 I quote Igor:

Hello! Please tell me why, after downloading bank statements and posting them, balances for the day appear with a minus sign. Thank you

Hello, i.e.

before downloading the statement, the balances in the list of documents “Bank statements” are correctly marked with a + sign, after downloading at the end of a busy day already with a -? If so, then you need to look at the posting of documents “Receipt to the current account” for busy days. See whether the receipt documents form the postings and whether the form details are filled out correctly. Quote 0 Igor 12/02/2016 06:17 Hello! Please tell me why, after downloading bank statements and posting them, balances for the day appear with a minus sign. Thank you

Quote

+4 AndreyDem 10/04/2016 16:22 Hello. I have the same question, but I need to change the “type of operation” parameter in a large number of statements at once. Tell me, are there any ways to change the “type of transaction” of several bank statements at once? There is an option to “change selected documents”, but there is no access to change this parameter.

Quote

0 Olga Shulova 10/12/2015 08:16 Quoting Anna1:

Hello. Tell me, are there any ways to change several bank statements at once? It is necessary to change the “Article of the movement of money. funds" in each statement. I have about 500 of these statements, so far the only way I have found is to edit each one, which takes a huge amount of time. Thank you in advance

Hello!

By statement do you mean the documents Debit from the current account and Receipt to the current account? Or something different? If we are talking about documents (they contain such details as a cash flow item), then you can use the “Group change of details” processing, it will be just right for your purposes (we are talking about the 1C configuration: Enterprise Accounting 8 edition 3.0, according to which article was written) Quote +1 Anna1 10.10.2015 12:06 Hello. Tell me, are there any ways to change several bank statements at once? It is necessary to change the “Article of the movement of money. funds" in each statement. I have about 500 of these statements, so far the only way I have found is to edit each one, which takes a huge amount of time. Thank you in advance

Quote

Update list of comments

JComments

Register of documents

To obtain summary information on transactions on a bank account, use the “Register of Documents” report; the button of the same name for creating it is located in the journal of bank statements. After clicking the button, a document is generated for printing:

You can print a list of documents for any period, which is set by selecting a date on the calendar.

You can open any document from the report by double-clicking on the name of this document.

Other ways to enter bank documents

Payment orders and bank statements can be entered not only using the methods discussed above, but also on the basis of purchase and sale documents. For example, when receiving payment from a buyer, this is done like this. A list of sales opens, in which the document for which the buyer transferred money is selected. Using the “Create based on” button, select the desired form “Receipt to current account”:

An already completed document is created; all that remains is to post it after verification:

The counterparty's debt for this sale is extinguished, and the receipt automatically falls into the sales subordination structure:

Payment orders are issued in a similar manner based on purchases and receipts of services.

Checking the status of your current account

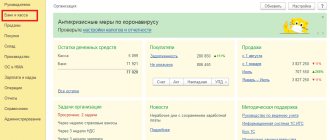

You can check the status of your current account both in the journal of bank statements and through the “Start Page” on the main page of 1C:

Also, to check the account, you can use the account balance sheet (51 accounts for ruble transactions, 52 for foreign currency transactions):