Why is OKTMO needed?

The state needs the OKTMO code to simplify and speed up the processing of information about business entities, create a unified database and predict economic development. In addition, it determines the territorial affiliation of the taxpayer and indicates the local budget to which the treasury will transfer the payment.

Entrepreneurs and heads of organizations must know their OKTMO code. It must be included in the details of reporting documents, tax returns and payment orders for taxes and other mandatory payments. Without the correct OKTMO, you cannot submit reports or receive tax deductions.

The code is assigned not to a specific organization or individual entrepreneur, but to the municipality in whose territory they are registered. Accordingly, one code can be assigned to several companies at the same time.

OKATO

The All-Russian Classifier of Objects of Administrative-Territorial Division is an integral part of the state standardization system.

In addition to its political and social purpose, OKATO also has the function of collecting information about the place of registration of a specific legal entity or individual entrepreneur.

Assigning an OKATO code to a legal entity allows you to:

- significantly reduce the time required for processing statistical data;

- ensure the maximum possible reliability of data on business entities.

Essentially, the OKATO code is a digital index of 8 or 11 characters, which includes:

- digital designation of the subject of the Federation;

- digital designation of the municipality;

- digital designation of a settlement.

Thus, if the place of registration of a legal entity is a municipality, then the code will be 8-digit. If the place of registration is a settlement at a level below the municipality, then the code, accordingly, will be 11-digit, since it will include an additional territorial unit.

Until 2014, the OKATO code was a mandatory requisite for business entities and was notified in accounting and other tax and payment documentation.

In 2014, OKATO was replaced by the OKTMO code.

OKTMO replaces OKATO

Payment documents must indicate the code. Before the introduction of OKTMO, the OKATO code (all-Russian classifier of administrative-territorial division objects) was used for the same purposes. Its disadvantage is that it does not indicate the city, urban area or village in which the enterprise is located. OKTMO clarifies this information. The main difference between the codes is the division principle. OKATO depends on the subject of the Russian Federation, and OKTMO depends on the municipality.

Until 2022, specifying the OKATO code instead of OKTMO was acceptable. Now the transition period is over, and incorrectly filling in the details will lead to sanctions. Payments using incorrect details fall into the “unclarified” category and slow down the redistribution of funds between budgets. If you indicated incorrect details, then submit an application to clarify the payment to the Federal Tax Service, Social Insurance Fund or Pension Fund, depending on the damaged document. Based on the application, government agencies will decide to clarify the payment and write off accrued penalties.

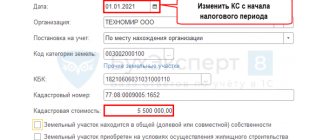

OKTMO in documents and reports in 1C

When filling out documents or generating reports, OKTMO is filled in automatically.

Let's consider a payment order (“Bank and cash desk” - “Payment orders”). When you select the type of transaction “Payment of tax” and select the Federal Tax Service as the recipient of the IRI, the fields for tax payments are filled in automatically. We also see our OKTMO, in the line in the form of a hyperlink, along with the payment code and other details.

Fig.4 OKTMO in documents and reports

When printing the “Payment Order” form, we see the completed OKTMO in the “Recipient” details field.

Fig.5 OKTMO in the payment order

Let’s open the regulated reports - “Reports” - “1C - Reporting” - “Regulated”.

Fig.6 Let's open regulated reports

Let's select any report (in our example it is 6-NDFL) and we will see that when filling out all the details are entered there, including we see OKTMO.

Fig.7 OKTMO in 6-NDFL

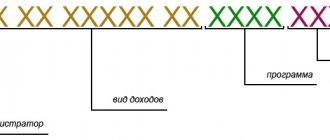

OKTMO code structure

OKTMO includes two sections: municipalities and settlements within municipalities. The codes of the first section consist of eight characters, the second - of eleven. The code contains the information:

- 1 and 2 signs indicate a subject of the Russian Federation;

- 3-5 - urban district or association equivalent to it;

- 6,7 and 8 - locality in which the organization or individual entrepreneur is registered.

The second section codes include these 8 characters, and 9, 10 and 11 designate a locality within a large municipality. In this case, values from 001 to 049 are assigned to cities, from 051 to 099 - to urban settlements, and from 101 to 999 - to rural settlements. The larger the settlement, the fewer signs OKTMO includes. For example, the city of Dmitrov in the Moscow region has a code of 46608000, and the village of Antropovo in the Kostroma region has a code of 34602403101.

How to fill out the OKTMO field in the 3-NDFL declaration

To fill out the OKTMO code, 11 cells are allocated in the declaration. But some municipalities are assigned codes consisting of only eight characters. In this case, according to clause 1.9 of the procedure for filling out 3-NDFL, as amended. Order of the Federal Tax Service dated October 15, 2021 No. ED-7-11/ [email protected] , after entering the code, there should be dashes in the empty cells to the right of it.

Example:

| 1 | 2 | 4 | 4 | 5 | 6 | 9 | 9 | – | – | – |

Under no circumstances should you pad the code with zeros. The number of characters in OKTMO indicates whether we are talking about a municipality (8 characters) or a settlement included in it (11 characters).

For other nuances of filling out the 3-NDFL report, read the publication “Sample for filling out a 3-NDFL tax return . ”

However, incorrect completion of the OKTMO field in the 3-NDFL declaration is not grounds for refusal to accept the declaration. The Federal Tax Service gave explanations about this in a letter dated April 18, 2014 No. PA-4-6/7440. But still, some inspectors accepting reports sometimes refuse to accept a declaration with an error in OKTMO. If such a situation occurs, the unlawfulness of the specialist’s actions should be reasonably explained, referring to clause 4.1 of Art. 80 of the Tax Code of the Russian Federation, which, from July 1, 2021, contains an exhaustive list of grounds on which a refusal to accept reports is possible. But it’s better to immediately indicate the correct code.

Do you want to know how tax authorities check your 3-NDFL returns and what they may require from you during the audit? Get free trial access to ConsultantPlus and access expert comments.

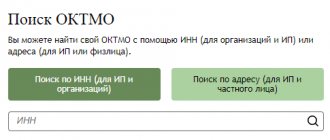

How to find out the OKTMO code

We already know that OKTMO is necessary to fill out many documents, so it is imperative to know it. The code is assigned to organizations and individual entrepreneurs automatically by the tax authority at the place of registration. Notification of the assignment of statistics codes is sent by mail. If this is your first time filling out declarations and payment documents or your code has changed due to a change of registration address, then the question arises of how to find out your OKTMO.

To do this, you can submit an application to the tax authority at the place of registration with a request to inform you of the assigned code in writing, you will receive a response within 5 days. You can contact the tax office via the hotline; if you’re lucky, they will tell you the code you need, but most likely they will offer you to use the Federal Tax Service website and give you advice.

When contacting the tax office directly, temporary delays occur. It's easier and faster to use the Internet. There are many resources on the Internet that offer to find out statistics codes, but to obtain reliable information, contact official sources.

Results

The OKTMO statistical code is one of the important indicators of any tax return. In the 3-NDFL report, it indicates the registration address of the individual submitting the report. Incorrect reflection of this code in the declaration may result in the tax authority requesting clarification.

Sources:

Order of the Federal Tax Service dated October 15, 2021 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to find out OKTMO online at

You can quickly obtain the OKTMO code, knowing the address or cadastral number of the land plot, using online services implemented on the sites:

- www.nalog.ru

- fias.nalog.ru/

On the tax website

To use the first of them, you need to go to the main page of the website of the Tax Inspectorate of the Russian Federation and select the “All services” section. After which you are redirected to a general list of available online services, in which you need to find the item “Find out OKTMO”.

In the form that opens, you need to fill out two information fields . The first of them is “Subject of the Russian Federation”. Here you can select a position from the drop-down list. This is easy to do if you know the code of the region where the site whose details you need to find is located. If this code is unknown, then you will have to search for the desired item by name.

Next, in the “Municipal entity” column, you must enter the name of the city, village, village indicated in the address of the land plot. To do this, you need to type the first few letters of the name of the object and then select the required item from the list of prompts that appears.

Then you can click the “Find” button located under the information fields. The program will process the entered data and produce the required code.

With the help of FIAS

An alternative way is to search for OKTMO using FIAS, the Russian federal information address system .

On the main page of this Internet portal there is a catalog of subjects of the Russian Federation, in which you need to find the one where the land plot of interest is located. After which a list of cities and districts in this region will appear on the screen.

Having selected the required municipality, at the top of the page you can see the required OKTMO code and a number of other information.

If the object is located not in the city, but in the region, after choosing its name you will need to specify the location by finding the name of the village, village council or village in the list of sites proposed by the program.

Of course, there are many more sites with programs that allow you to determine the OTKMO code in various ways, including searching by the address of the land plot.

Most often, the information they provide is based on data from the tax service . However, there is still a risk of receiving incorrect information. Therefore, it is recommended to use the above two government portals.

Thus, knowing the cadastral number of a land plot, you can use various online services to obtain comprehensive information about this property.

How to find the address of a land plot by cadastral number

Knowing the cadastral number of any property, including a land plot, you can obtain comprehensive information about it, which includes its location.

The easiest way to do this is using a public cadastral map :

- To do this, you need to type the address https://pkk5.rosreestr.ru in your browser or create a request in any search service and follow the link provided.

- In the window that opens, you need to enter a known cadastral number. The "Lots" category is used for searching by default.

- After this, the program will offer to view the card of the selected object. Address information is located on the “Information” tab.

Access to this resource is provided free of charge .

In addition to the public map, there is another way to view the address of a land plot, knowing its cadastral number.

To do this, you need to go from the main page of the Rosreestr portal to the “Reference information on real estate objects online” tab.

The article dedicated to it will tell you more about working with this Internet service.