How to fill out the 6-NDFL calculation for the 4th quarter of 2016? Has the new form of calculation of 6-NDFL been approved? How to show the December salary paid in January 2022 in the calculation? How can legal entities reflect the annual bonus for 2016, which was transferred to employees in December? Is it necessary to include September salary data in the calculation? You will find answers to these and other questions in this article, and you can also use a specific example to see a sample of filling out the 6-NDFL calculation for 2016. This material has been prepared taking into account all the new rules for filling out reports, based on the latest clarifications from the Federal Tax Service.

Calculation deadline for 2016

Calculation in form 6-NDFL is submitted to the Federal Tax Service based on the results of each quarter. The deadline for submission is no later than the last day of the month following the quarter. So, for example, 6-personal income tax for 9 months of 2016 was required to be submitted no later than October 31, 2016. However, the deadline for submitting annual personal income tax reports is different. The annual calculation of 6-NDFL based on the results of 2016, as a general rule, must be submitted no later than April 1 of the year following the reporting year. This is stated in paragraph 3 of paragraph 2 of Article 230 of the Tax Code of the Russian Federation.

Tax legislation provides that if the deadline for submitting a 6-NDFL calculation falls on a weekend or non-working holiday, then the reports can be submitted on the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). April 1 and 2, 2022 are Saturday and Sunday. Therefore, the annual calculation of 6-NDFL must be submitted to the tax office no later than April 3, 2022 (this is a working Monday). See “Deadline for submitting 6-NDFL for 2016.”

It is worth noting that the annual calculation of 6-NDFL for 2016 is often referred to as “calculation of 6-NDFL for the 4th quarter of 2016.” However, calling it that is not entirely correct. The fact is that no later than April 3, 2022, the inspectorate is required to submit annual reports for the entire 2016, and not just for the 4th quarter of 2016. This is precisely what is emphasized in paragraph 3 of paragraph 2 of Article 230 of the Tax Code of the Russian Federation. Moreover, the indicators in section 1 of the 6-NDFL calculation are filled in with a cumulative total from the beginning of 2016, and not just for the fourth quarter. Therefore, we can say with confidence that it is the annual personal income tax reporting that is submitted, and not the quarterly one.

Advice

We recommend that you do not delay submitting your annual payment for 2016 until April. In April, the deadline for submitting 6-personal income tax for the first quarter of 2022 will be approaching. It must be submitted no later than May 3. See “Deadlines for submitting 6-NDFL calculations in 2022: table.”

Fines

Tax agents may be fined if the report is not submitted on time. For the organization, this will cost 1,000 rubles for each month of delay.

If the tax authority has not received notification of the reasons for non-submission of the declaration 6, it may make a request for forced blocking of current accounts after 10 working days after the deadline for submission.

If it is discovered that the calculation has been submitted on paper, the tax authorities will regard this as an unlawful submission of data, and it will cost the organization 200 rubles.

Who must submit the annual 6-NDFL

All tax agents must submit an annual calculation in form 6-NDFL for 2016 (clause 2 of Article 230 of the Tax Code of the Russian Federation). Tax agents for personal income tax are, as a rule, employers (organizations and individual entrepreneurs) who pay income under employment contracts. Also, customers who pay remuneration to performers under civil contracts can be considered tax agents. However, it is worth recognizing that the issue of the existence of the fact of payments and accruals in 2016 is quite individual and, in practice, there may be various controversial situations. Let's look at three common examples and explain when and to whom you need to submit 6-NDFL for 2016.

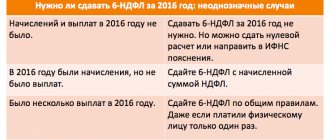

Situation 1. There were no accruals and payments in 2016

If from January 1 to December 31, 2016 inclusive, an organization or individual entrepreneur did not accrue or pay any income to individuals, did not withhold personal income tax and did not transfer tax to the budget, then there is no need to submit an annual calculation of 6-NDFL for 2016. In this case, there was no fact upon the occurrence of which the company or individual entrepreneur became tax agents (clause 1 of Article 226 of the Tax Code of the Russian Federation). In this case, you can send a zero 6-NDFL to the Federal Tax Service. The tax office is obliged to accept it. “Zero 6-NDFL: is it necessary to submit it and why.”

It is worth noting that some accountants consider it advisable, instead of “zeros,” to send letters to the tax inspectorate explaining why 6-NDFL was not submitted. With this option, it is better to send such a letter no later than April 3, 2022. See “Letter about zero 6-NDFL: sample”.

Situation 2. Salaries were accrued but not paid

In conditions of the economic crisis, there are common cases where there were no real payments to individuals in 2016, but the accountant continued to accrue wages or benefits. This, in principle, is possible when a business, for example, does not have money to pay earnings. Should I submit reports then? Let me explain.

If during the period from January to December 2016 inclusive there was at least one accrual, then you need to submit the annual 6-NDFL calculation for 2016. This is explained by the fact that personal income tax must be calculated on accrued income, even if the income has not yet actually been paid (clause 3 of Article 226 of the Tax Code of the Russian Federation). Therefore, the accrued amount of income and accrued personal income tax must be recorded in the annual calculation of 6-personal income tax for 2016. Actually, for these purposes, reporting in Form 6-NDFL was introduced, so that tax authorities could track accrued but not paid amounts of personal income tax.

Situation 3. The money was paid once

Some tax agents may have paid income only once or twice in 2016. For example, the CEO - the only founder could receive a lump sum payment in the form of dividends. Is it then necessary to fill out and send the annual 6-NDFL to the Federal Tax Service if there are no employees in the organization? Let's assume that the income was paid in February (that is, in the first quarter of 2016). In such a situation, the annual calculation of 6-NDFL for 2016 should be transferred to the tax authorities, since in the tax period from January to December there were accruals and payments. Use a similar approach if the income was paid, for example, only in the fourth quarter of 2016. Then you also need to submit an annual calculation.

If payments took place, for example, only in the first quarter of 2016, then in the calculation of 6-personal income tax for the 4th quarter of 2016, you only need to fill out section 1. Section 2 is not required. This follows from the Letter of the Federal Tax Service dated March 23, 2016 No. BS-4-11/4958, which discussed the issue of a one-time payment of dividends. See “Filling out section 1 in 6-NDFL”.

Form 6-NDFL for the 4th quarter of 2016 and general requirements for filling it out

For the annual calculation, use the form of previous periods; no changes have been made to it. 6-NDFL consists of a title page and two sections: section 1 summarizes the indicators for the entire tax period, that is, 2016, on a cumulative basis, and section 2 includes income and withheld tax of the last quarter. Both sections are placed on one page, but there may be more pages if all the indicators do not fit on it.

The general requirements for filling out 6-NDFL for the 4th quarter of 2016 are as follows:

- You cannot correct mistakes made using corrective means, print out the calculation on paper on both sides and fasten the sheets together;

- All pages of the calculation must be numbered, starting with the title page;

- If there is no indicator for a digital field, then “0” is indicated;

- Each page of 6-NDFL is signed by the tax agent (or his representative) and the date of signing is indicated;

- For each territorial OKTMO code, you need to fill out a separate 6-NDFL calculation;

- Only those tax agents whose number of individuals who received income in 2016 did not exceed 25 people can report on paper; the rest submit their calculations electronically.

If there are separate divisions, 6-NDFL for the 4th quarter of 2016 must be submitted separately for each, even if they all belong to the same Federal Tax Service, such clarifications are given by the Federal Tax Service in letter No. BS-4-11/13984 dated August 1, 2016.

The annual 6-NDFL data on the number of individuals who received income from the agent must coincide with the number of 2-NDFL certificates provided (with the sign “1”). Also, the sum of the corresponding indicators of the 2-NDFL certificates must correspond to: the total amount of income, including dividends, calculated by the personal income tax, and the tax not withheld by the agent (letter of the Federal Tax Service dated March 10, 2016 No. BS-4-11/3852).

New form 6-NDFL for 2016: approved or not?

The new form for calculating 6-NDFL for filling out and submitting to the Federal Tax Service for 2016 was not approved. Therefore, prepare the annual report 6-NDFL in the form approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450. Changes to this form have never been made before. You used it throughout 2016. Download the current 6-NDFL calculation form in Excel format and the procedure for filling it out from this link.

The annual 6-NDFL calculation form includes:

- title page;

- section 1 “Generalized indicators”;

- Section 2 “Dates and amounts of income actually received and withheld personal income tax.”

Next, we will explain the specifics of filling out each section of 6-NDFL for 2016 and answer the most controversial questions about the reporting of carryover wages for September and December 2016.

General requirements for filling out 6-NDFL

To reduce the likelihood of errors when filling out 6-NDFL, you must refer to the Instructions for filling out form 6-NDFL, which can be found in the order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] General requirements for filling out form 6 -Personal income tax, in particular, includes:

- Filling Calculation text and number fields from left to right, starting from the leftmost cell

- putting dashes in unfilled cells, while in unfilled cells for total indicators zero is indicated in the leftmost cell, the remaining cells are crossed out

- ban on double-sided printing of Calculations on paper

- using black, purple or blue ink

- When preparing the Calculation on a computer and subsequent printing, dashes can be omitted; in this case, Courier New font should be used with a height of 16 - 18 points

Filling out the title page

When filling out the annual 6-NDFL for 2016, at the top of the title page, mark the INN, KPP and the abbreviated name of the organization (if there is no abbreviated name, the full name). If you need to submit a settlement in relation to individuals who received payments from a separate division, then fill in the “separate” checkpoint. Individual entrepreneurs, lawyers and notaries only need to indicate their TIN.

In the line “Adjustment number” of the annual calculation, if the calculation is submitted for the first time for 2016. If they submit a corrected calculation, then they reflect the corresponding adjustment number (“001”, “002”, etc.).

In the line “Submission period (code)”, enter 34 - this means that you are submitting 6-NDFL for 2016. In the “Tax period (year)” column, mark the year for which the semi-annual calculation is submitted, namely 2016.

Indicate the code of the division of the Federal Tax Service to which the annual reports are sent and the code on the line “At location (accounting).” This code will show why you are submitting 6-NDFL here. Most tax agents reflect the following codes:

- 212 – when submitting a settlement at the place of registration of the organization;

- 213 – when submitting the calculation at the place of registration of the organization as the largest taxpayer;

- 220 – when submitting a settlement at the location of a separate division of a Russian organization;

- 120 – at the place of residence of the individual entrepreneur;

- 320 – at the place of business of the entrepreneur on UTII or the patent taxation system.

If filled out correctly, a sample of filling out the title page of the annual 6-NDFL calculation may look like this:

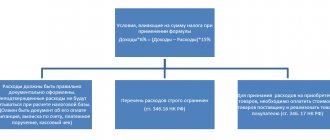

Completing section 1

In Section 1 6-NDFL for 2016 “Generalized Indicators”, show the total amount of accrued income, tax deductions and the total amount of accrued and withheld tax for the entire year. The first section is filled out with a cumulative total for the first quarter, half a year, nine months and 2016 (letter of the Federal Tax Service of Russia dated February 18, 2016 No. BS-3-11/650). Therefore, Section 1 6-NDFL for 2016 should reflect the summary indicators from January 1 to December 31, 2016 inclusive. Take the information to fill out from the personal income tax registers. See “Tax register for 6-NDFL”.

Section 1 looks like this:

Let us explain which lines of generalized values are in section 1:

| Line | What is shown |

| 010 | Personal income tax rate (for each rate, fill out section 1). |

| 020 | The amount of accrued income. |

| 025 | Income in the form of dividends from January to December 2016 inclusive. See “Dividends in 6-NDFL: filling out a sample calculation.” |

| 030 | The amount of tax deductions “Tax deductions in 6-NDFL: we reflect the amounts correctly.” |

| 040 | The amount of calculated personal income tax since the beginning of the year. To determine the value of this indicator, add up the personal income tax amounts accrued from the income of all employees. |

| 045 | The amount of personal income tax calculated on dividends on an accrual basis for the entire year 2016: from January 1 to December 31, 2016. |

| 050 | The amount of fixed advance payments that are offset against personal income tax on the income of foreigners working under patents. However, this amount should not exceed the total amount of calculated personal income tax (letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11/3852). |

| 060 | The total number of individuals who received income during the reporting (tax) period. |

| 070 | The amount of personal income tax withheld. |

| 080 | The amount of personal income tax not withheld by the tax agent. This refers to amounts that a company or individual entrepreneur should have withheld until the end of the 4th quarter of 2016, but for some reason did not do so. |

| 090 | The amount of personal income tax returned (under Article 231 of the Tax Code of the Russian Federation). |

Also see “Filling out the lines in the 6-NDFL calculation.”

Control ratios for checking form 6-NDFL

Let's present the main control ratios for form 6-NDFL in the form of a table.

| Ratio | Comments |

| line 020 “Amount of accrued income” ≥ line 030 “Amount of tax deductions” | In form 6-NDFL, the amount of tax deductions (line 030) cannot be more than accrued income (line 020). |

| (line 020 “Amount of accrued income” − line 030 “Amount of tax deductions”) * line 010 “Tax rate, %” / 100 = line 040 “Amount of calculated tax” | If the ratio is not met, then the tax amount is underestimated or overestimated. In this case, it is allowed to deviate the calculated tax from line 040 in both directions by no more than the following amount (in rubles): line 060 “Number of individuals who received income” * number of lines 100 “Date of actual receipt of income” |

| line 040 “Amount of calculated tax” ≥ line 050 “Amount of fixed advance payment” | The amount of fixed advance payments cannot exceed the amount of calculated tax. The tax office will also request clarification if line 050 is completed, but the tax agent was not given notices of the right to reduce personal income tax on the tax of foreigners with a patent |

In addition, the tax agent can compare not only the data of Form 6-NDFL with each other, but also the Calculation indicators with accounting data and tax registers.

So, if the amount of the difference between lines 070 “Amount of tax withheld” and 090 “Amount of tax returned by the tax agent” exceeds the amount of personal income tax paid for this year according to the tax agent, then this may indicate non-payment of personal income tax to the budget. The tax office also checks this data with the Card of settlements with the tax agent's budget. Similarly, the inspectorate can compare the actual date of personal income tax transfer with the card with the date declared by the tax agent on line 120 “Tax transfer deadline” in relation to the tax amount reflected on line 140 “Amount of withheld tax.”

Also, at the end of the year, to check Form 6-NDFL, the tax inspectorate can compare the indicators of Form 6-NDFL with the data on individual income certificates (Form 2-NDFL), and the income tax return (Appendix No. 2).

Completing section 2

Section 2 of the annual report 6-NDFL indicates:

- dates of receipt and withholding of personal income tax;

- deadline established by the Tax Code of the Russian Federation for transferring personal income tax to the budget;

- the amount of income actually received and personal income tax withheld.

When filling out section 2, reflect the transactions performed in chronological order. Let us explain the purpose of the lines in section 2 in the table:

| Line | Filling |

| 100 | Dates of actual receipt of income. For example, for salaries, this is the last day of the month for which salaries are accrued. For some others, payments have different dates (clause 2 of Article 223 of the Tax Code of the Russian Federation). |

| 110 | Personal income tax withholding dates. |

| 120 | Dates no later than which the personal income tax must transfer the budget (clause 6 of article 226, clause 9 of article 226.1 of the Tax Code of the Russian Federation). Typically, this is the day following the day the income is paid. But, let’s say, for sick leave and vacation pay, the deadline for transferring taxes to the budget is different: the last day of the month in which such payments were made. If the tax payment deadline falls on a weekend, line 120 indicates the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). |

| 130 | The amount of income (including personal income tax) that was received on the date indicated on line 100. Also see “Line 130 6-NDFL is not reduced by deductions.” |

| 140 | The amount of tax withheld as of the date on line 110. |

Keep in mind that section 2 of the annual 6-NDFL for 2016 should include only indicators related to the last three months of the reporting period (letter of the Federal Tax Service of Russia dated February 18, 2016 No. BS-3-11/650). That is, you need to show income and personal income tax - broken down by date - only for transactions made in October, November and December 2016 inclusive. Do not include 2022 transactions in section 2.

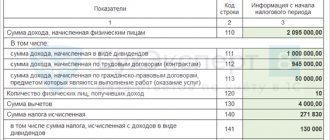

An example of filling out sections 1 and 2 of the annual calculation

Now we will give an example of filling out the 6-NDFL calculation for 2016, so that the general principle of filling out the sections is clear. Let's assume that in 2016, 27 people received income from the organization. In total, for the period from January to December, the summarized indicators for section 1 are as follows:

- the total amount of accrued income is 8,430,250 rubles (line 020);

- the amount of tax deductions is 126,000 rubles (line 030);

- the amount of calculated personal income tax is 1,079,552 rubles (line 070);

- the amount of tax not withheld by the organization is 116,773 rubles (line 080).

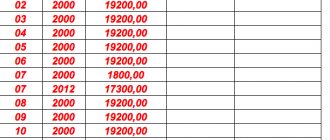

As for the fourth quarter of 2016 itself, income, deductions and personal income tax were distributed as follows:

| Income date | Type of income | Amount of income | Amount of deductions | Personal income tax amount | Personal income tax rate | Personal income tax was withheld | Paid personal income tax |

| 30.09.2016 | Salary for September 2016 | 562 000 | 3000 | 72 670 | 13 | 05.10.2016 | 06.10.2016 |

| 30.10.2016 | Salary for October 2016 | 588 000 | 3000 | 76 050 | 13 | 03.11.2016 | 07.11.2016 |

| 28.11.2016 | Sick leave | 14 200 | — | 1846 | 13 | 28.11.2016 | 30.11.2016 |

| 30.11.2016 | Salary for November 2016 | 588 000 | 3000 | 76 050 | 13 | 05.12.2016 | 06.12.2016 |

| 30.12.2016 | Salary for December 2016 | 654 000 | 3000 | 84 630 | 13 | 31.12.2016 | 09.01.2017 |

| 30.12.2016 | Annual bonus | 250 000 | 3000 | 32 103 | 13 | 30.12.2016 | 09.01.2017 |

Under such conditions, in section 1 you need to show generalized information from the beginning of 2016 on an accrual basis, and in section 2 you need to distribute accruals and payments relating to the 4th quarter of 2016. It will look like this:

Please note that in the conditions of our example, the salary for December and the annual bonus for 2016 appear, which were paid to employees on December 30, 2016. However, we did not reflect these payments in the annual report 6-NDFL. It does not matter when you actually paid your December salary and annual bonus: in 2016 or 2022. They need to be reflected in section 2 of the 6-NDFL calculation for the first quarter of 2022, since these operations will be completed in 2017. According to the latest clarifications from tax authorities, “completion of the operation” should be determined by the latest date when personal income tax should be transferred to the budget. We will consider in more detail the issue of reflecting “carryover” payments in 6-NDFL below.

Salary for December was paid in December: how to reflect it in 6-NDFL

The most controversial issues regarding filling out 6-NDFL are payments during transition periods. They are encountered when a salary or bonus is accrued in one reporting period and paid in another. The situation with salaries for December 2016 was particularly ambiguous. The fact is that some employers paid salaries for December before the New Year (in December). Other organizations and individual entrepreneurs paid salaries and annual bonuses in January 2022. See “Salary payment deadlines for December 2016.” How to show December accruals in the report so that tax authorities accept 6-NDFL the first time? Let's look at specific examples of filling out 6-NDFD for 2016.

What kind of information will be checked by the Federal Tax Service?

Let's assume that the salary for December 2016 was paid on December 30, 2016. The month has not yet ended on this date, so it is impossible to regard such a payment as a salary for December in the full sense of the word. In fact, money paid before the end of the month is correctly called an advance. As of December 30, the employer is not yet obliged to calculate and withhold personal income tax, since wages become income only on the last day of the month for which they are accrued - December 31 (clause 2 of Article 223 of the Tax Code of the Russian Federation). Despite the fact that December 31 is a Saturday, personal income tax cannot be calculated or withheld before this date (letter of the Federal Tax Service of Russia dated May 16, 2016 No. BS-3-11/2169).

Example 1

The organization transferred the “salary” to the employees for December on the 30th in the amount of 180,000 rubles. From the payment made on the same day, personal income tax was calculated and withheld in the amount of 23,400 rubles (180,000 x 13%). The accountant transferred this amount on the first working day of 2022 - January 9.

Under such conditions, in section 1 of the 6-NDFL calculation for 2016, the accountant should correctly reflect the salary as follows:

- in line 020 – the amount of the December “salary” (RUB 180,000);

- in lines 040 and 070 - calculated and withheld personal income tax (RUB 23,400).

In section 2 of the 6-NDFL calculation for 2016, the December “salary” paid on December 30 should not appear in any way. You will show it in calculations for the first quarter of 2022. After all, when filling out section 2, you need to focus on the date no later than which personal income tax must be transferred to the budget. That is, paid income and withheld personal income tax must be shown in the reporting period in which the deadline for paying personal income tax falls. Such clarifications are given in the letter of the Federal Tax Service of Russia dated October 24, 2016 No. BS-4-11/20126. In our example, personal income tax must be transferred on the next working day in January – January 9, 2022. Therefore, in section 2 of the calculation for the first quarter of 2022, the December salary will need to be shown as follows:

- line 100 – December 31, 2016 (date of receipt of income);

- line 110 – December 31, 2016 (date of personal income tax withholding);

- line 120 – 01/09/2017 (date of transfer of personal income tax to the budget);

- line 130 – 180,000 (amount of income);

- line 140 – 23,400 (personal income tax amount).

Keep in mind that the tax withholding date on line 110 of section 2 of the 6-NDFL calculation for the 1st quarter of 2022 will be exactly December 31, and not December 30, 2016 (when the payment was made). The fact is that it was on December 31, 2016 that you had to accrue the December salary and offset it against the previously paid advance (which, in fact, was the December salary). The situation is similar with payments until December 30. If, for example, the salary calculation for December was made in the period from December 26 to 29, then the date of personal income tax withholding should still be the date “12/31/2016”.

Withholding personal income tax until the end of the month

Example 2

The organization transferred “salaries” for December to the employees on December 26 in the amount of 380,000 rubles. On the same day, personal income tax was withheld in the amount of 49,400 rubles (380,000 x 13%). The withheld amount was transferred to the budget the next day - December 27, 2016.

In order to fill out 6-NDFL, the accountant turned to the letter of the Federal Tax Service dated March 24. 2016 No. BS-4-11/5106. In this letter, it was recommended to withhold personal income tax on the day of actual payment of salaries (December 26), and transfer the withheld amount to the budget the next day (December 27). In addition, tax authorities advise reflecting these same dates in the 6-NDFL calculation. However, we do not recommend following such recommendations and filling out section 2 of the 6-NDFL calculation for 2016 in this way, for at least two reasons:

- a 6-NDFL calculation filled out in this way will not pass format-logical control and will return with the error “the date of tax withholding must not precede the date of actual payment”;

- withholding personal income tax from wages until the end of the month contradicts later recommendations of the Russian Ministry of Finance in a letter dated June 21. 2016 No. 03-04-06/36092.

Personal income tax was withheld from the January advance

Some accountants withheld personal income tax from the December salary at the next payment of income - from the advance payment for January 2022. How to fill out 6-NDFL in this case? Let's understand it with an example.

Example 3

The organization transferred the salary for December on the 30th in the amount of 120,000. The organization did not calculate and withhold personal income tax from the payment made. The accountant calculated personal income tax on December 31, 2016. The tax amount turned out to be 15,600 rubles (120,000 x 13%). This amount was withheld from the next payment - from the advance payment for January 2022, issued on January 19, 2022.

Under such conditions, the salary for December 2016 will be transferred to line 020 of the 6-NDFL calculation for 2016, and the personal income tax from it to line 040 of section 1 of the 6-NDFL calculation for 2016. Moreover, the tax that was not withheld must be shown on line 080, since the organization should have withheld it, but did not.

In section 2, the operation in the 6-NDFL reporting for the first quarter of 2022 can be shown as follows:

- line 100 – December 31, 2016 (date of receipt of income);

- line 110 – 01/19/2017 (withholding date);

- line 120 – 01/20/2017 (date of payment to the budget);

- line 130 – 120,000 (amount of income);

- line 140 – 15,600 (personal income tax amount).

Such completion and actions of the accountant, in our opinion, cannot be called correct, since the requirement of paragraph 6 of Article 226 of the Tax Code of the Russian Federation has been violated, according to which personal income tax from wages under an employment contract must be transferred no later than the day following the day of payment of income. Accordingly, line 120 must contain a date no later than 01/09/2017. Moreover, it is not entirely clear what prevented the accountant from withholding tax in December and not postponing this operation to the next year. We do not rule out that the above-mentioned filling option may also be returned to the tax agent marked “error.” However, according to our information, some tax inspectorates recommend filling out the 6-NDFL calculation this way. Therefore, in such a situation, we recommend additional consultation with your Federal Tax Service.

Salaries for December were paid in January

Many employers paid salaries for December in January 2017. If so, then show the December salary issued in January 2017 in the 6-NDFL reporting for 2016 only in section 1. After all, you recognized income in the form of wages in December and calculated personal income tax on it in the same month. Therefore, when calculating 6-personal income tax for 2016, distribute payments as follows:

- on line 020 – accrued income in the form of December salary;

- on line 040 – calculated personal income tax.

Line 070 of the 6-NDFL calculation for 2016, intended for withheld tax, is not increased in this case, since the withholding took place already in 2022 (letter of the Federal Tax Service of Russia dated December 5, 2016 No. BS-4-11/23138). In section 2 of the annual calculation, do not show the December salary paid in January (letter of the Federal Tax Service of Russia dated November 29, 2016 No. BS-4-11/22677)

Salaries for December were issued after the New Year

On January 9, 2022, the organization gave employees salaries for December 2016 - 250,000 rubles. Personal income tax was withheld from the payment on the same day - 32,500 rubles. (RUB 200,000 × 13%). Add this amount to line 070 of the 6-NDFL calculation for the first quarter of 2022. In section 2 of the same calculation, distribute the dates along lines 100–140:

- line 100 – December 31, 2016 (date of receipt of income);

- line 110 – 01/09/2017 (date of personal income tax withholding);

- line 120 – 01/10/2017 (date of transfer of personal income tax to the budget).

How to fill out the calculation of 6 personal income taxes for the 3rd quarter when calculating sick leave and vacation pay

The norm that regulates the procedure in this situation is defined in Tax Code Art. 223. Personal income tax should be calculated on the day the income is transferred. Its transfer to the treasury can be made until the end of a given calendar month.

If compensation is transferred for unused leave upon dismissal, income tax must be transferred on the next working day.

These transfers must be reflected in different blocks of the second section.

For example, an employee of a company received the following income in the 3rd quarter:

- In August of the current quarter, sick leave was 7,050 rubles, the tax was 975 rubles;

- vacation pay in the same month - 8,000 rubles, income tax - 1040 rubles;

- compensation upon dismissal for unused labor leave in August – 15,000 rubles, tax amounted to 1950 rubles.

Filling out the report:

Salaries for September were paid in October

The deadline for paying personal income tax on salaries for September is October 2016. Therefore, when calculating for nine months, the accountant showed this payment only in section 1. Now these amounts need to be transferred to the reporting for 2016. See “6-NDFL for 9 months of 2016: example of filling out”.

In section 2 of the 6-NDFL calculation for 2016, you need to show the salary for September paid in October. Let's assume that the September salary was paid on October 10. The accountant will fill out section 2 of the annual calculation of 6-NDFL as shown in the example. The validity of this approach is confirmed, for example, by the Letter of the Federal Tax Service of Russia dated 01.08. No. BS-4-11/13984.

How to reflect bonuses in annual calculations

If bonus payment transactions were completed in the fourth quarter of 2016, then they must be shown in the annual calculation of 6-NDFL. However, keep in mind that salary and bonus in section 2 of form 6-NDFL must always be separated from each other. The fact is that the date of receipt of income in the form of wages is the last day of the month for which the employer accrued income (clause 2 of Article 223 of the Tax Code of the Russian Federation). A bonus is a bonus, not a salary, so the date of receipt of income is the day of payment (letter of the Federal Tax Service of Russia dated 06/08/2016 No. BS-4-11/10169). This means that the dates in rows 100 for income will differ. When paying salaries and bonuses, the tax agent needs to fill out two blocks of lines 100–140, even if the salary and bonus were paid on the same day. Let's explain with an example.

How to show bonuses in the annual 6-NDFL

On December 9, 2016, the organization gave employees a salary for November in the amount of 340,000 rubles. and a bonus - 210,000 rubles. Personal income tax from salary – 44,200 rubles. (340,000 rubles × 13%), and from the bonus – 27,300 rubles. (RUB 210,000 × 13%). The date of receipt of salary income is November 30, 2016, and bonuses are December 9, 2016. The accountant will distribute these payments in different lines 100 - 140 of the 6-NDFL calculation for 2016. In this case, the indicators of the 100 rows will differ.

If you paid the annual bonus for 2016 to employees in 2017, then, of course, it will not fall into section 2 of the annual 6-NDFL. You will show the bonus in the calculations for 2017.

For which accruals and payments must a 6-NDFL report be submitted?

The calculation of 6-NDFL must reflect income that is subject to taxation. If the payment is not taxable, then it is not reported. In the calculation of 6-NDFL the following income must be reflected:

- Salary received;

- Remuneration received in accordance with the terms of the civil contract;

- Accrued vacation pay;

- Temporary disability benefits;

- Bonus payments;

- Additional payments and allowances in accordance with the current remuneration system at the enterprise;

- Receiving one-time financial assistance;

- Dividend payment;

- Income received in kind.

Payments under a civil contract: payment in January

Let's consider another situation when an act for work performed (services rendered) under a civil contract with an individual was approved in December 2016, and payment for it took place in January 2017. In this case, the remuneration under the contract and personal income tax from it should be shown in sections 1 and 2 of the calculation for the first quarter of 2022. Do not show the operation in the calculations for 2016. This follows from the letter of the Federal Tax Service of Russia dated December 5, 2016 No. BS-4-11/23138.

If in December an advance was issued under a civil contract, then it should fall into section 2 of the annual calculation.

Advance under a contract

The organization paid an advance to an individual under a contract on December 19, 2016 in the amount of 20,000 rubles. The tax withheld from this amount amounted to 2600 rubles. (20,000 x 13%). The balance is planned to be issued in January 2022 - after completion and delivery of all work.

In such a situation, reflect the advance to the contractor in the payment period (in December). The date of receipt of income in this case is the day when the company transferred or issued the money to the person. It does not matter whether the company issues money before the end of the month for which the service is provided, or after.

In section 2 of the 6-NDFL calculation for 2016, show the advance by line:

- 100 “Date of actual receipt of income” – 12/19/2016;

- 110 “Tax withholding date” – 12/19/2016;

- 120 “Tax payment deadline” – 12/20/2016;

If income is received in kind: details of filling

The valuation of income is reflected in both sections of the declaration. If income tax cannot be withheld due to the fact that a person does not have earnings in this company, these personal income tax amounts are included in field 080. The lines must be filled out as follows:

- 20 – estimated amount of income;

- 40 – income tax accrued on this income;

- 80 – income tax that cannot be withheld;

- 100 – date of payment of income in kind;

- 110 – date of withholding of income tax, coincides with field 100;

- 120 – the next working day after the specified date in column 100;

- 130 – valuation of income;

- 140 –0.

- This standard is defined in BS 4-11/5278 dated March 28, 2016.

Method of transferring the annual calculation to the Federal Tax Service

Send calculations in Form 6-NDFL for 2016 to the tax authorities electronically via telecommunications channels. “On paper” reporting can be submitted in the only case - if during the reporting or tax period the number of individuals (recipients of income) was less than 25 people. This follows from the provisions of paragraph 7 of paragraph 2 of Article 230 of the Tax Code of the Russian Federation.

Possible fines and account blocking

For late submission of 6-NDFL for 2016, a fine is possible - 1000 rubles for each full or partial month from the date for submitting the calculation (clause 1.2 of Article 126 of the Tax Code of the Russian Federation). But also, if you do not submit the annual calculation within 10 days starting from April 3, 2022, then the Federal Tax Service has the right to block the bank account (clause 3.2 of Article 76 of the Tax Code of the Russian Federation). In addition, if, based on the results of the audit, tax officials find false information in the calculation, the fine for each calculation with such data will be 500 rubles.

Line 080 of form 6-NDFL: filling procedure

If during the reporting period the tax agent calculated personal income tax amounts that cannot be withheld in the current year, then such amounts are reflected on line 080 “Amount of tax not withheld by the tax agent” in form 6-NDFL. The tax agent must notify the individual and his tax office no later than March 1 of the following year about the impossibility of withholding personal income tax and the amount of income from which tax is not withheld (clause 5 of Article 226 of the Tax Code of the Russian Federation).