General overview

The use of a codifier is an option that primarily ensures the functioning of tax and statistical government departments. The inspection’s task is to monitor the compliance of the declared and actual profile of the business, since when discrepancies are identified, many inconvenient questions arise.

If companies that indicate during the registration process that they provide logistics services begin to issue invoices to clients for information promotion or repair work, there is a possibility that they are being used as ordinary “fly-by-night” companies. The main purpose of such offices is usually money laundering or unjustified VAT refunds from the budget. In this case, tax authorities must conduct an audit and clarify whether there is an error in determining the legal status, or whether there is a fact of deliberate fraud.

Rosstat (Federal State Statistics Service), in turn, is obliged to maintain an analytical database, reflecting how many enterprises and entrepreneurs operate in a particular industry. If an individual entrepreneur or organization operates not in accordance with OKVED, works without a code, or provides services without registration, a violation is recorded, which serves as the basis for the application of legal sanctions.

At SEA BANK you can connect to trade acquiring and have the opportunity to pay for goods and services with any bank cards, regardless of currency!

Responsibility for carrying out activities without OKVED

If tax authorities identify the fact of carrying out activities not included in the Unified State Register of Legal Entities, they may be subject to administrative liability under Art. 14.25 of the Code of Administrative Offenses of the Russian Federation:

- under Part 3 – in case of violation of the notification period, i.e. when it is submitted later than three days. For this violation, a warning or a fine for an official or individual entrepreneur in the amount of 5,000 rubles is provided;

- under Part 4 - if the notification of the new OKVED was not submitted at all. The fine for such a violation ranges from 5,000 to 10,000 rubles.

The practice of bringing to administrative responsibility for carrying out a type of activity not specified in the Unified State Register of Legal Entities shows that when several unregistered types are identified, a protocol for each of them is drawn up separately, i.e. a fine is imposed for each type of activity not specified. But punishment is possible only if such activity was carried out for more than two months and the tax authorities were able to prove this fact (Article 4.5 of the Code of Administrative Offenses of the Russian Federation).

In addition, the tax service may refuse a VAT refund for an unregistered type of business, as well as oblige you to provide reporting that corresponds to this activity. In this case, the courts take the side of the taxpayer, since assigning an organization a specific OKVED code does not deprive it of the right to carry out other types of activities, and the tax benefit received from their conduct meets the criterion of being justified (for example, Resolution of the Federal Antimonopoly Service of the Volga Region dated April 26, 2012 in case No. A49-1563/2011).

In addition to the Federal Tax Service, claims under unregistered OKVED may arise from the Social Insurance Fund, because The rate of contributions for “injuries” depends on the type of main activity. Therefore, its change cannot take place without appropriate notification of social insurance. There is no fine for such a violation, but the calculation of insurance premiums by the Social Insurance Fund will be carried out at an increased rate if, according to the OKVED code registered in the state register, a higher tariff for contributions is provided than for the type of activity actually carried out, but not included in the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs.

Where should they be indicated?

Information about the types is included in official registers when registering a legal entity or obtaining entrepreneurial status. Codes are also included in applications filled out in situations where it is planned to change the main profile - such documentation is also reflected in the Unified State Register of Legal Entities (Unified State Register of Legal Entities) and Unified State Register of Individual Entrepreneurs (Unified State Register of Individual Entrepreneurs). In accordance with the current rules established within the provisions of the fifth paragraph of Article 5 No. 129-FZ, the duration of the period allotted for providing updated data to the Federal Tax Service is three working days.

The list of current forms and standards for document preparation is provided within the framework of Order No. ED-7-14 / [email protected] In accordance with it, from November 2022, to comply with legislative requirements, forms No. P24001 and No. P13014 are used - for individual entrepreneurs and legal entities, respectively.

Why is it necessary to register codes?

When submitting an application to the tax office for registration of an individual entrepreneur or a legal entity, the section about the types of economic activity that the entrepreneur intends to carry out must be filled out, so is it possible to carry out activities without OKVED - no, information about them is indicated when registering a new taxpayer.

Let's figure out why they are required and what they affect. There are several reasons to pay attention to them - for example, these codes depend on:

- professional risk class and insurance rate;

- application of various taxation systems. Not all types are suitable for special regimes.

According to the Civil Code of the Russian Federation, is it possible to engage in activities without OKVED - the answer is contained in Art. 49. A person has the right to engage in any work not prohibited by law. This norm is general, tax legislation contains special regulation, and the obligation to enter information is provided for by Federal Law No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs” dated 08.08.2001.

ConsultantPlus experts discussed how to make changes to the Unified State Register of Legal Entities in connection with changes in the OKVED code. Use these instructions for free.

What happens if you enter the OKVED code incorrectly

The fundamental position of the regulatory agency is as follows: each market entity must operate in accordance with the current classifier selected during the registration process. At the same time, some businessmen refer to the provisions of the Civil Code of the Russian Federation, which indicates that any activity that is not prohibited by law can be carried out. However, such an approach, accompanied by a violation of standards, ultimately becomes the reason for penalties applied to those responsible. To avoid negative consequences, you should study the nuances associated with this issue in advance.

What OKVED codes are valid?

Regular updating and addition of the classifier, which is the official state register of small and medium-sized businesses, ensures the presence in it of almost all forms and varieties of economic activity existing today. For ease of navigation, the internal structure is divided into sections marked in alphabetical order, and those, in turn, are differentiated into classes, groups and subgroups.

In the case of each individual identifier, additional explanations are provided to clarify exactly what types of ED (operational documents) it covers. It is worth noting that for work that is similar in specifics, but different in terms of classification, additional links are provided that allow you to quickly find the correct option.

OKVED codes require comparison with another register, OKPD2, which contains nomenclature values assigned to goods and work. The relationship is explained logically - in the first category we are talking about production activities, while in the second we are talking about its results expressed in material form. This division is distinguished by a greater degree of detail, which is determined by the possible correspondence of different types of commercial products to the same processes leading to their production. So, for example, there are several different varieties of wheat - from soft to winter - but its production is classified the same in all cases.

It is impossible to talk about complete correspondence between the classifiers, but most of the code designations coincide. The only difference is in the verbal formulations used, characterizing the specific occupation of the taxpayer.

How to resolve the issue with unregistered OKVED?

In order not to have to deal with the tax authorities in court, and also not to lose the right to state support if necessary, an individual entrepreneur should still register the OKVED codes under which he operates.

To do this, you need to select current new codes in the OKVED classifier, and then decide which code will be the main one for the individual entrepreneur and which ones will be additional ones.

There is a misconception that the main OKVED code cannot be changed. But that's not true. You can change both the main and additional codes, or all at once.

When choosing the main code, you need to focus on the type of activity from which the individual entrepreneur receives the maximum income. And this type of activity may change over time depending on the market situation.

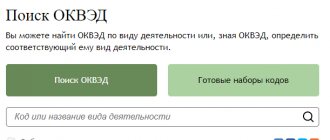

You can find OKVED or determine the type of activity corresponding to it using our Classifier.

In the search field, just enter the desired type of activity and click on the “Search OKVED” button. Let's show you how to do it:

After selecting the codes, an application is filled out in form P24001 and submitted to the Federal Tax Service where the individual entrepreneur is registered. You do not need to fill out the entire form, but only separate sheets:

- on the title page - information about yourself and the reason for submitting the application;

- sheet D - new OKVED codes and codes that are no longer planned to be used;

- Sheet E - telephone number and e-mail of the entrepreneur.

You can submit documents in the following ways:

- in person at the Federal Tax Service;

- in person at the MFC;

- by proxy to the tax office or MFC;

- by registered mail;

- in your personal account on nalog.ru.

An entry sheet from the Unified State Register of Individual Entrepreneurs with new OKVED codes will be sent to the entrepreneur’s e-mail in 5 working days.

It should be kept in mind that according to the law, a new OKVED code must be registered within 7 working days from the moment the individual entrepreneur began to conduct a new type of activity (Clause 5, Article 5 of Law No. 129-FZ of 08.08.2001). If the code is registered later, the individual entrepreneur will be fined for late submission of the application. The fine amount is 5,000 rubles. (Part 3 of Article 14.25 of the Code of Administrative Offenses of the Russian Federation).

You can learn everything about the tax amnesty for individual entrepreneurs from the ConsultantPlus system. If you do not have access to K+, get it for free by signing up for a trial access to the system.

What to do if there is no type of activity for your business

The absence of OKVED in the Unified State Register of Legal Entities does not negate liability for violation of the rules. If none of the proposed options fully describes the specifics, it is recommended to select several at once, indicating the priority among the general list.

Thus, in the current edition of the reference nomenclature there is no identifier that would be exactly suitable for designating pole dancing training studios that have been popular in recent years. However, there are two alternative options that comply with the general provisions. The first classifies education in the field of sports and leisure, the second classifies the activities of dance floors, schools and discos. If a businessman is now, or in the future, planning to purchase ownership and subsequently equip a separate non-residential premises for his business, it is worth paying attention to the identifier assigned to fitness centers. Any of these options can be identified as the main one - the law allows for subsequent adjustments and changes in the standard manner.

How to add or change OKVED code

The regulations for individual entrepreneurs and legal entities are different. In the first case, the service is provided, including online - just follow the following procedure:

- Log in to your personal account on the Federal Tax Service website.

- Fill out the standard form P24001.

- Submit an application through the portal.

If you wish, you can also print out the form and bring it in person - but this is a waste of time.

For organizations, the procedure requires a mandatory visit to the inspection with a pre-collected package of documents. To avoid liability for carrying out activities without OKVED - including types not listed in the Unified State Register of Legal Entities according to the classifier list - you will have to try a little and go through the entire cycle:

- Document the decision to adjust the code. For companies with one founder, it is enough to draw up an appropriate act, but if there are several owners, an official meeting is scheduled, following which a protocol is signed.

- Determine the need to make changes to the statutory documentation. It all depends on the initial formulations. If the Charter initially provides for the possibility of conducting any type of activity, nothing needs to be changed.

- Select the appropriate application form and fill it out according to the standard template. There are two options - P 130001 for those who change the constituent status (with payment of a state fee of 800 rubles), or P140001 - if a replacement is not required (without additional fees).

- Notarization of the application is a mandatory condition, regardless of who exactly acts as the bearer.

- Submit the collected package to the tax office at the place of registration within three days from the date of registration of the decision. Delay, as well as engaging in activities that are not in accordance with OKVED or without it at all, entails a fine, the amount of which reaches 5,000 rubles.

Thus, the set of documents provided by the Federal Tax Service includes the corresponding resolution of the founder (or protocol), a couple of copies of amended statutory documents, with an attachment in the form of a receipt for payment of the duty, as well as a statement certified by a notary.

Is OKVED mandatory?

A clear answer to this question is given by clause 5 of Art.

5 of Federal Law No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”, which specifies the obligation of legal entities and individual entrepreneurs to notify tax authorities of changes in activities within 3 days. Note that the law does not specify whether the main type changes or an additional one appears, therefore any change in the OKVED codes must be registered in the prescribed manner and entered into the Unified State Register of Legal Entities. Consequently, the answer to the question whether it is possible to carry out activities without OKVED is unambiguous - the implementation of activities, the code of which is not included in the information about the organization or entrepreneur in the state register, is not permitted by current legislation. You will find a complete current list of OKVED in ConsultantPlus. If you do not yet have access to the ConsultantPlus system, you can sign up for a free trial access for 2 days.

Read also: Changing OKVED codes: step-by-step instructions

At the same time, it is not prohibited to indicate several types of activities during registration and not actually carry them out. But it should be taken into account that some OKVEDs provide for the use of only a general taxation system or require licenses for their implementation.

Read also: List of licensed activities 2022 according to OKVED

What happens if a legal entity does not operate in accordance with OKVED

Technically, each code represents data contained in legally established registers and available to all market participants. The legal regulations governing the procedure for obtaining or replacing are also publicly available, allowing businesses to freely comply with applicable regulations. Nevertheless, situations related to the discrepancy between the planned and actual processes implemented within the business still happen. And in this regard, the legislator has provided appropriate sanctions, enshrined within the Code of Administrative Offences.

In accordance with the provisions of part four of Art. 14.25 of the Administrative Code, in cases where an organization or individual entrepreneur is engaged in activities not specified in the Unified State Register of Legal Entities and not included in the OKVED, liability for the corresponding violation is assigned in the form of a fine imposed on officials. The amount of monetary recovery varies in the range from five to ten thousand rubles.

In this case, it is worth considering a number of characteristic legal features:

- An entity may be fined for each unaccounted code that must be entered into the registry.

- The statute of limitations for bringing the perpetrators to justice is one year, and the countdown begins from the expiration of the three-day period, by default, allotted by 129-FZ for filing the relevant application.

- The law does not differentiate the liability of individual entrepreneurs and legal entities, establishing identical punishment.

Is it possible to carry out activities without consequences if there is no OKVED in the Unified State Register of Legal Entities, is it permissible to carry out work not on permanent, but on one-time transactions? In theory, yes, but you should be prepared for the fact that the tax office will ask for justification for such operations.

What is the fine for working without codes for legal entities and individual entrepreneurs?

Codes are information that is contained in registers provided for by law and is publicly available, but what are the risks of conducting business without OKVED, and how necessary is it to introduce new ones if the direction of work has changed? The Code of Administrative Offenses of the Russian Federation provides for the liability of an LLC for carrying out activities without OKVED (failure to provide or inaccurate presentation of information) in the form of a fine for officials from 5,000 to 10,000 rubles (Part 4 of Article 14.25 of the Code of Administrative Offenses of the Russian Federation).

Features of application:

- a fine is imposed for each code that is not specified, but was subject to entry into the register;

- the limitation period for attraction is 1 year, begins to be calculated from the end of the three-day period provided for by Federal Law No. 129-FZ for submitting information;

- does not apply to one-time transactions, but the nature of these transactions must be justified.

The Code of Administrative Offenses of the Russian Federation does not differentiate between the liability of individual entrepreneurs for activities without OKVED and organization; the fine amount is the same.

Related Issues

Previously, we have already considered the reasons why the Federal Tax Service and Rosstat monitor the compliance of the declared and actual forms of doing business.

Difficulties with counterparties

The more solid the contract is, the more thorough the verification of its participants. Potential partners may well check the availability of codes in the documentation and refuse to confirm the transaction, avoiding the potential risks of increased attention from both the servicing bank and tax authorities.

Problems with banking support

The provisions enshrined in Federal Law No. 115 oblige financial institutions to suspend access to funds in a client’s current account in cases where the requested transaction is suspicious. If there are grounds, it is possible to check documents, which will result in refusal of further cooperation, as well as transfer of materials to regulatory authorities.

Financial consequences of running a business outside the codes

In addition to the administrative fine, there is another risk that also needs to be taken into account.

Refusal to deduct VAT

The Federal Tax Service has the right to make an initial refusal decision on the refund of value added tax, based on the fact that there is no record in the state register about the possibility of the enterprise conducting the activity for which the refund was applied. This practice is rare, which is determined by the position of the judicial authorities, which clarify that in this case the basis for obtaining a benefit is the fact of a transaction that does not contradict the norms of the law, while the assignment of a code relates to the issue of compliance with the regulations for its execution. However, an attempt to refuse entails a lengthy trial in court, requiring not only time, but also money for legal advice.

What to do if the counterparty does not have OKVED

It is not difficult to check whether a potential business partner is officially registered in the area of activity you are interested in. The information is publicly available - just use the tax service website. Particular attention should be paid to this issue in transactions that provide for the availability and possibility of VAT refund. Any doubts arising both from the Federal Tax Service and financial organizations may ultimately negatively affect business performance indicators.

The cash settlement service offered to clients of MORSKOY BANK (JSC) allows you to eliminate sudden problems and protect yourself from risky transactions. Qualified specialists provide support on any issue - from connection, registration of salary projects and corporate cards, to support of foreign trade activities. 24-hour access to account management is provided by convenient applications, and official bank guarantees are provided for those planning to participate in government procurement.