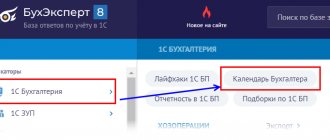

Adjustment of the calculation of insurance premiums 2022 → → Current as of: February 20, 2022

How to take into account the “Platonic” fee and transport tax (advance payments) in tax expenses? How to reflect

The obligation to pay contributions to pension insurance (hereinafter referred to as PIP) currently affects all individual entrepreneurs

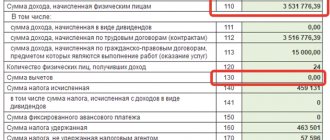

Calculation of 6-NDFL is one of the most confusing, even in automatic mode the accounting program does not

The certificate of completed services is the final document that is formed at the stage of closing the contract and

Procedure for submitting a VAT return for the 3rd quarter of 2022 Deadline: submit the return no later than

Moment of reflection of non-operating expenses in tax accounting Non-operating expenses are reflected in tax accounting as follows:

Cash transactions (related to the circulation of cash) are an important component in the life of any

Where to pay contributions for injuries Social contributions are divided into 2 types: deductions for accidents

What are fixed assets? Fixed assets include any property of an enterprise used to carry out