What are fixed assets

Fixed assets include any property of an enterprise used to carry out its activities: these can be materials, machinery, instruments, equipment, etc., in other words, everything that is involved in the labor process.

It should be noted that any inventory items acquired by an organization for work must be listed on its balance sheet. Once materials, equipment or machinery become unusable, they must be written off.

Read more about the article: what are fixed assets?

Procedure

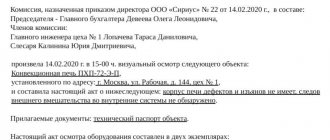

In order to write off fixed assets, it is necessary to first establish their unsuitability for further use. For this purpose, the company creates a special commission, the main task of which is to certify the fact of a defect, wear, etc.

The commission must include at least three people, including the financially responsible person.

Most often, only full-time employees of the enterprise are included in the commission, but in some cases, these may also be third-party experts who have the necessary knowledge and skills to determine irreparable failure, for example, of particularly complex equipment.

After the property is declared completely faulty, the commission draws up a special act, on the basis of which the organization writes an order to write off fixed assets. This order, in turn, serves as the basis for drawing up a write-off act.

Rules for writing off OS

The disposal of fixed assets (FPE) from accounting occurs for various reasons:

- sale;

- donation;

- exchange;

- transfer in the form of a contribution to the authorized capital;

- moral or physical obsolescence;

- liquidation (in emergency situations or partial);

- shortages or damage discovered as a result of inventory, etc.

If the first 4 reasons for disposal are drawn up with standard documents for acceptance and transfer between the transferring and receiving parties, then the procedure for disposal of fixed assets due to the last 3 reasons requires compliance with a special procedure. This procedure is specified in paragraphs. 77–80 Guidelines for fixed assets accounting, approved by order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n (hereinafter referred to as the Guidelines) and consists of the following steps:

- Creation of a commission for the disposal of fixed assets, which is approved by order of the head of the organization.

- Drawing up an appropriate conclusion by the commission after checking the disposed fixed assets.

- Signing an order for write-off or partial liquidation of an asset by the manager.

- Drawing up an act on write-off of fixed assets based on the order of the manager.

- Changing data in the OS inventory card and reflecting the operation in accounting.

ConsultantPlus experts explained how to correctly reflect the write-off of fixed assets in tax accounting:

Study the material by getting trial access to the K+ system for free.

For information on drawing up an order for write-off and the accounting entries that will follow, read the material “Drawing up an order for write-off of fixed assets - sample.”

How to draw up an act correctly

Today, the act of writing off fixed assets can be written in any form, however, most enterprise employees, in the old fashioned way, prefer to use previously generally applicable mandatory forms in their work. Their advantage is obvious: there is no need to rack your brains over the structure and content of the document, since all the necessary positions are indicated in it. Such unified forms also include form OS-4. This act can be filled out both when writing off one object or several at once.

An example of filling out the protocol of the commission for writing off fixed assets

As a visual illustration, let’s fill out the protocol step by step.

Step 1. Fill in the details of the institution. It is advisable to indicate not only the full name without abbreviations, but also INN, KPP, OKPO.

Step 2. Fill in the name and number of the document, for example, “Minutes No. 1 of the meeting of the commission on writing off fixed assets,” and also indicate the date of preparation.

Step 3. Fill in the place of origin (address of the commission’s location).

Step 4. Fill in the list of participants in the “Attending the meeting” section. It is required to indicate your full name and position in the organization, as well as your role in the commission.

Step 5. We indicate the agenda of the meeting, for example, “Consideration of the issue of writing off fixed assets of the institution.”

Step 6. Fill out the “Listen” section. It is required to indicate the details of the speakers (name and position) and the topics of the reports with a list of objects for disposal.

Step 7. Fill out the “Resolved” section. It is necessary to provide a description of the objects that have been decided to be written off, including the inventory number and book value. For example, “CDK device” manufactured in 2000, inv. No. 0001, manager No. D 000/1, book value RUB 117,000.00.”

Step 8. We fill out the section with information about the voting results and the section with the signatures of the participants (each person signs in the space provided for this).

The completed document will look like this.

Sample of filling out the OS-4 form

- At the beginning of the document, on its front side, the following is indicated:

- name of company,

- her TIN,

- checkpoint,

- the structural unit to which the written-off fixed asset belongs.

- Next, the basis for the write-off is written - here you need to put a link to some supporting document (usually an order from the manager) and the financially responsible person (only the employee’s full name is written here).

- On the right side of the form enter:

- OKPO code of the company (can be found in the constituent documents),

- date of write-off of fixed assets from accounting,

- number and date of issue of the document that became the basis for write-off,

- personnel number of the financially responsible employee.

- Below is the document number, the date it was compiled, and the reason for the write-off.

- On the right is a place for approval of the act by the director of the enterprise.

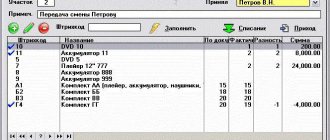

The next part is presented in the form of a table and relates directly to the property being written off:

- in the first column,

- in the second and third - inventory and serial numbers, respectively,

- on the fourth or fifth date of release of the product and the date of its acceptance onto the balance sheet of the organization.

- in the sixth column (i.e., the time that the property was actively used in work),

- in the seventh - the cost of the object at the time of its acceptance for accounting,

- in the eighth - the amount of accrued depreciation,

- in the ninth - residual value (the value in the last paragraph is the difference in indicators from the two previous columns).

Minutes of the meeting of the commission on write-off of fixed assets

The form is not unified and is approved by the head of the institution as an annex to the order, which establishes the procedure by which federal (regional, municipal) property is written off.

The protocol may contain the following details:

- name of the institution;

- Title of the document;

- Document Number;

- Date of preparation;

- place of compilation (address of the commission's location);

- composition of participants indicating which of them was present;

- meeting agenda (list of property that needs to be written off);

- who was listened to and what was considered (which objects need to be written off, inventory numbers, year of manufacture, state of inspection, period of use, technical condition, economic feasibility of repairs, conclusion of a technical examination);

- what they decided;

- voting results;

- signatures of participants.

Sample of filling out the reverse side of the OS-4 form

The reverse side of the act also contains two tables. The first contains individual parameters that serve as part of the characteristics of the object, including information about the content of precious metals.

Below the table there are several lines in which the commission taking part in the write-off of fixed assets makes its conclusion (in this case, on the write-off).

If necessary, a list of additional documents accompanying this act is indicated.

Then the commission puts its signatures next to the indicated positions with their full names.

The last table includes information about:

- expenses incurred for write-off of fixed assets,

- remaining inventory items suitable for further use,

- funds proceeds from the sale of written-off property.

Finally, the act is certified by the signature of the organization’s chief accountant.

How to correctly draw up an act of write-off of fixed assets in the OS-4 form

The act can be filled out manually or on a computer.

There is only one important condition: it must contain the original signatures of the head of the enterprise, as well as members of the write-off commission.

There is no strict need to certify the form with a seal - since 2016, legal entities have been exempted by law from the obligation to use various types of cliches and stamps in their work.

The act is drawn up in at least two copies :

- one of which is transferred to the accounting department of the enterprise, so that in the future, on its basis, the accountant can reflect the write-off of the property specified in the act,

- the second remains with the financially responsible person, who then gives it to the warehouse in order to either dispose of the fixed asset or sell it.

If necessary, additional copies of the act can be created.

How is the meeting going?

The commission for writing off fixed assets is created by order of the head of the organization. This order approves the composition, which includes a chairman and several responsible persons.

The chairman can be either the chief accountant or the head of the enterprise himself.

It is the responsibility of members to check exactly how the equipment subject to write-off works, what its depreciation is, whether repairs are possible and economically feasible, and also which parts from the OS can be reused.

Based on the results of the work, the commission draws up a conclusion with a decision, to which the minutes of the meeting are attached.

If the commission decides that a fixed asset really needs to be written off due to its physical wear and tear or obsolescence, then a write-off act is drawn up in form OS-4 or OS-4a or OS-4b, depending on the specific asset that is subject to write-off.

If management approves the commission’s decision to write off the funds, then the equipment is written off. If any parts remain in use, this is reflected in documents indicating the cost of the preserved equipment.

How is the act drawn up?

The form of the protocol that the commission fills out is not strictly mandatory, but the basic information must be presented in it:

- The name of the organization where the write-off is carried out, as well as its legal status.

- Title of the document.

- Serial number of the protocol.

- Date of preparation.

- Place of the meeting (place of drawing up the minutes).

- Full list of participants with a list of those who were absent.

- Agenda indicating all property that is subject to disposal.

- Information about the work of the commission: technical examinations, inspection reports, the need and feasibility of repairs, year of manufacture, condition of the equipment during inspection.

- What was decided by the voting results?

- Signatures of all participants.

Already on the basis of such a document, the head of the organization, represented by the general director, can directly sign a write-off order in order to subsequently dispose of or disassemble the equipment.

Possible reasons for deregistration of OS

The protocol also indicates the reasons for deregistration. These may include physical wear and tear, obsolescence, and shortages during inventory.

Physical wear and tear is the inability to use an asset in the future due to a high degree of depreciation or constant breakdowns due to long-term use.

If the equipment can be repaired, then the impracticality of repair must be indicated.

This reason must be documented, in particular inspection reports and technical examinations.

If the breakdown occurred due to external factors, for example, an accident or natural disaster, then this information must be reflected in the protocol.

Obsolescence of equipment is indicated if the OS is outdated and cannot meet the organization’s needs to perform certain functions, as well as when expanding the organization or replacing equipment.

Also, obsolescence can be supported by an indication of the difficulties in purchasing parts and finding a specialist to repair such equipment.

In addition, documents with accounting calculations on the initial cost of equipment, the percentage of depreciation and residual value must be attached to the protocol.

Such calculations must be made by the accounting department, and the chief accountant is required to be present on the commission for writing off fixed assets.

minutes of the commission meeting with the decision to write off fixed assets – word.