General procedure and formula for calculating the average number of employees

The result of calculations of the average number of employees is entered into a special form P-4 “Information on the number and wages of employees,” which was approved by Rosstat in February last year.

Six months later, some changes were made to this form and certain instructions were drawn up for its completion. The report is mandatory for enterprises from January 2022. The calculation is submitted based on the results of the year, until January 21 of the next period. In case of violation of the deadlines, a fine of 200 rubles is imposed on the company.

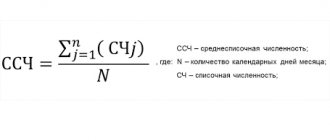

The formula for calculating the average number of employees is presented below:

To make the calculation, it is necessary to determine the number of employed employees for the specified period. Each employee is one unit. The calculation takes into account all employees with whom an employment contract has been concluded and who receive a salary.

Women who are officially employed but are on maternity leave are maternity leavers. This category of employees has the right to take advantage of certain advantages and benefits that the state guarantees to them. First of all, the woman retains her job during maternity leave, and the employer makes all necessary payments.

In this regard, any manager and accountant of an enterprise has a logical question: are women on maternity leave included in the average number of employees of the enterprise? A similar situation arises with external part-time workers – workers who are employed in several companies at once.

What is the SSC and does it include employees on maternity leave?

Average headcount is the main quantitative characteristic of an organization’s personnel. It represents the average number of employees over a period of time and is calculated according to the methodology approved by law.

The average headcount indicator affects:

- calculation of the amount of UTII;

- calculation of income tax (if there are separate divisions);

- determination of a quota for disabled employees (for exemption from land tax, VAT).

From 01/01/2018, on the basis (as amended on 12/29/2018) of the approval of the Instructions for filling out the federal statistical observation form, organizations submit information to the statistical authorities in form P-4 (clause 74):

- quarterly, if the average number of employees is no more than 15 people, taking into account part-time workers and those working under civil contracts;

- monthly, with an average number of more than 15 people.

There are 2 indicators of the number of employees in an organization: headcount (NH) and average headcount (AHR).

- The average payroll number is calculated for a month, quarter or other reporting period based on the payroll number of employees for each day of this period.

- The payroll number is determined for each day. The SC includes employees working under an employment contract on a permanent or temporary basis, as well as those hired for seasonal work. This takes into account both actually working employees and those absent from the workplace due to business trips, performance of government duties, or illness.

Some employees are included in the average payroll, but are not taken into account in the average headcount - this also applies to women during maternity leave. The owners of the organization who receive wages are also included in the payroll. More details about the inclusion of various categories of workers in the SC are described in paragraph 77.

Are employees on maternity leave and external part-time workers included in the general list?

Before answering this question, it should be noted that the calculation of the average number of employees is carried out based on the results of daily accounting of employees hired.

In addition, the payroll must include not only present employees, but also those who are absent, regardless of the reasons. The most important criterion in this case is the presence of this employee on the staff of the enterprise.

Women on maternity leave have the right to resume their work activities after the end of maternity leave. In other words, the woman retains her job and they are not excluded from the staff of the enterprise. Based on these factors, maternity workers and external part-time workers are included in the payroll.

However, there is a separate list of employees who are not included in the average headcount, although they are included in the payroll. These include:

- maternity leavers;

- external part-time workers;

- persons who went on leave to care for an adopted newborn;

- employees on maternity leave;

Thus, the question of whether maternity leavers and external part-time workers are included in the average payroll can be answered unequivocally - no. As a rule, the average number of employees is always less than the payroll number. An employee will be counted in the average headcount only after returning to work. Accounting for external part-time workers is maintained separately.

Payroll and average payroll

The accounting of hired workers is carried out according to two criteria of number - payroll and average, and in order to understand whether maternity leave is included in the average number, you need to clearly understand the difference between these two accounting positions.

The payroll number is the full composition of employees who, on the day of reporting, are in an employment relationship with the employer:

- under an open-ended or fixed-term employment contract;

- hired to perform seasonal or one-time work.

In addition to these categories of employees, the payroll also includes the owners of the organization if they actually work in it and receive wages.

Average headcount - calculation of the composition of hired workers actually involved in work. It is calculated based on data from time sheets of employees going to work.

Indicators for the average and payroll numbers may coincide, but in most cases they differ. Moreover, if the accounting data differs, then the payroll number is always greater than the average payroll.

Calculation example

Let's try to calculate the average headcount for an organization using an example.

The following data is known: as of April 8, the company employed 200 people. Since April 8, 12 more people were hired, and after the 15th, 18 employees were fired. One employee went on maternity leave on April 28, and another came back from maternity leave on the 29th.

Let's try to calculate the indicator:

- the first 8 days of the NSR is 200 people;

- from April 8 to April 15, the NFR was 200 + 12 = 212 people;

- from April 15 to April 28, the NCR is 212 – 18 = 194 people;

- as of April 28, the NFR is 194 – 1 = 193 people;

- as of April 29, 193 + 1 = 194 people;

- Let's use the formula and calculate the total NFR = (204* 8+ 212*7 + 194*13 + 193*1 + 194*2) / 30 = (1632+ 1484+2522+193+388)/30 = 6219/30= 207 people.

Let's move on to the calculations

The average number of employees per month is equal to the sum of the number of employees for each calendar day of the month, divided by the number of calendar days in the month.

Please note: the calculation takes into account holidays (non-working days) and weekends. The number of employees for these days is equal to the payroll number for the previous working day. Moreover, if weekends or holidays span several days, then the payroll number of employees for each day will be the same and equal to the payroll number for the working day preceding the weekend or holiday. This condition is contained in paragraph 87 of the Resolution.

Example 1. LLC “Kadry Plus” employs 25 people under employment contracts. The established work schedule is a 40-hour, five-day work week. The headcount as of November 30 was 25 people.

From December 3 to December 16 inclusive, employee Ivanov went on his next annual paid leave.

On December 5, accountant Petrova went on maternity leave. To fill this position, from December 10, employee Sidorov was hired on the basis of a fixed-term employment contract.

From December 10 to December 14 inclusive, student Kuznetsov was sent to the company for practical training. No employment contract was concluded with him.

On December 18, 19 and 20, 3 people (Alekseeva, Bortyakova and Vikulov) were hired under an employment contract with a probationary period of two months.

On December 24, driver Gorbachev submitted his resignation and did not return to work the next day.

It is necessary to calculate the average number of employees for December.

Weekends and holidays in December were the 1st, 2nd, 8th, 9th, 15th, 16th, 22nd, 23rd, 30th, 31st. Therefore, on these days the payroll number of employees will be equal to the payroll for the previous working days. That is, this figure on December 1 and 2 will be equal to the payroll number for November 30, December 8 and 9 - for December 7, and so on.

Of the workers listed above, the December payroll will include:

Petrov’s accountant is not taken into account in the average headcount (from December 5). And student Kuznetsov is not included in the payroll at all, since he does not hold any position in the company.

For clarity, let’s draw up a table that defines the payroll for December 2007:

The number of employees of LLC "Kadry Plus" in December 2007

| Day of the month | Headcount, people. | Of these, they are not included in the average headcount, people. | Included in the average headcount, people. (gr. 2 - gr. 3) |

| 1 | 2 | 3 | 4 |

| December 1 (day off) | 25 | 0 | 25 |

| December 2 (day off) | 25 | 0 | 25 |

| December 3 | 25 | 0 | 25 |

| December 4 | 25 | 0 | 25 |

| 5th of December | 25 | 1 | 24 |

| December 6 | 25 | 1 | 24 |

| December 7 | 25 | 1 | 24 |

| December 8 (day off) | 25 | 1 | 24 |

| December 9 (day off) | 25 | 1 | 24 |

| December 10 | 26 | 1 | 25 |

| December 11th | 26 | 1 | 25 |

| 12 December | 26 | 1 | 25 |

| December 13th | 26 | 1 | 25 |

| December 14 | 26 | 1 | 25 |

| December 15 (day off) | 26 | 1 | 25 |

| December 16 (day off) | 26 | 1 | 25 |

| December 17 | 26 | 1 | 25 |

| December 18 | 27 | 1 | 26 |

| December 19th | 28 | 1 | 27 |

| 20th of December | 29 | 1 | 28 |

| 21 December | 29 | 1 | 28 |

| December 22 (day off) | 29 | 1 | 28 |

| December 23 (day off) | 29 | 1 | 28 |

| December 24 | 29 | 1 | 28 |

| December 25 | 28 | 1 | 27 |

| September 26 | 28 | 1 | 27 |

| 27th of December | 28 | 1 | 27 |

| December 28th | 28 | 1 | 27 |

| December 29th | 28 | 1 | 27 |

| December 30 (day off) | 28 | 1 | 27 |

| December 31 (day off) | 28 | 1 | 27 |

| Total | 802 |

Let's calculate the average headcount for December:

802 person-days : 31 days = 25.87 people

In whole units it will be 26 people.

The rules for calculating the average number of employees for a quarter, year or other period are as follows: it is necessary to add up the average number of employees for each month of the period and divide by the number of months. For example, if you want to know the indicator for a quarter, then you need to divide by 3, if for a year - by 12. In this case, the indicator obtained for the month should not be rounded to whole units. Only the final result of the average headcount for the billing period is subject to rounding.

How long does maternity leave take?

Women who are in a position and have official employment have the right to apply to the head of the enterprise for leave. The state guarantees the provision of maternity leave based on the certificate of incapacity for work received by the employee.

The length of leave can be different and vary depending on a number of circumstances:

- 70 days before and after the birth of the child;

- 70 days before and 110 days after the birth of two or more children;

- 70 and 86 days before and after the birth of the baby if complications arise;

- 70 and 84 days before and after the birth of children in case of multiple pregnancy.

During pregnancy, the woman is paid funds for the period of incapacity for work on behalf of the employer. Subsequently, the company applies to the Social Insurance Fund and receives compensation for this expense item.

Payment is calculated based on the total number of vacation days, regardless of how many days the woman used before the birth of the child and after this event.