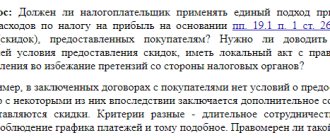

Moment of reflection of non-operating expenses in tax accounting

Non-operating expenses are reflected in tax accounting as follows:

| Type of non-operating expense | Moment of reflection of expenses in tax accounting |

| Expenses for the maintenance of property leased | Expenses are reflected depending on their type:

|

| Interest on debt obligations (loan agreements, debt securities, etc.), the validity of which falls on more than one reporting period | The last day of each month of the reporting period or the date of debt repayment. |

| Negative exchange rate difference from currency revaluation and foreign currency debt | The date of the transaction in foreign currency (for example, its transfer to a supplier, repayment of debt in foreign currency), as well as the last day of the current month. |

| Negative differences arising when selling or purchasing foreign currency at a rate that deviates from the official rate established by the Bank of Russia | Date of transfer of ownership of foreign currency. |

| Fines and penalties accrued for violation by a company of the terms of business contracts | The date the fine(s) were recognized or the date they were awarded by the court. |

| Amounts of contributions to reserves | Accrual date. |

| Other non-operating expenses | Accrual date. |

Non-operating income and expenses. What changed?

All changes discussed are retroactive, that is, from January 1, 2002. Moreover, some of them worsen the situation of firms. For example, publishing houses will no longer be able to write off expenses for unsold books, newspapers and magazines. Laws that worsen the situation of firms come into force only after the new tax period begins. For income tax, this period is equal to a year. Therefore, you can work under the old rules until the end of 2002. However, the tax authorities are unlikely to like this. Therefore, you will have to defend your case in court.

Non-operating income

The list of such income has changed. It additionally includes: - reserves for expenses not used at the end of the year for vacation pay, payment of annual remuneration for long service and for repairs of fixed assets; - the value of any surplus property that the company identified as a result of inventory. Let us recall that according to the old code, only surplus inventory items were classified as non-operating income. Another interesting innovation. Non-operating income now includes “the cost of media products and book products that are subject to replacement when returned or when such products are written off.” It is unclear what the meaning of such an amendment is. The fact is that previously such products were written off and taken into account as part of other expenses. This can be done now. But now a situation will arise when these products, on the one hand, must be taken into account in other expenses, and on the other hand, in non-operating income. According to the new code, it turns out that the media can no longer reduce their profits by the cost of such products. The following are excluded from non-operating income: - income from the revaluation of the company’s property, which is not subject to depreciation (for example, raw materials, materials, etc.). Now such income does not increase profits; - a positive difference between the value of the property received by the company when leaving the simple partnership and the amount of the initial contribution. But this change does not mean that the company should not take such a difference into account when calculating income taxes. Now it will be considered income from participation in a simple partnership.

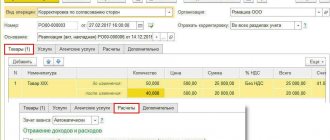

Example 1.

Mercury LLC transferred a computer worth 40,000 rubles as a contribution to a simple partnership.

At the end of the joint activity agreement, Mercury was given another computer. The cost of a new computer is 45,000 rubles. The Mercury accountant must make the following entries: Debit 58-4 Credit 01 - 40,000 rubles.

— a computer was transferred as a contribution to joint activities; Debit 01 Credit 58-4

- 45,000 rubles.

— the computer was returned after the expiration of the joint activity agreement; Debit 58-4 Credit 91-1

- 5000 rub. (45,000 - 40,000) - reflects the difference between the value of the transferred and received property. You must pay income tax on the difference between the cost of the transferred and received computer.

In a different way, you need to tax fines and penalties received by your company for violation of the terms of contracts by partners. Previously, they were taxed if any of two conditions were met: - penalties or fines were awarded to your company by the court;

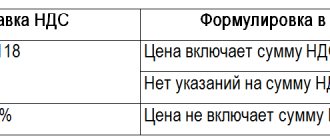

| Penalties for violating the terms of business agreements are subject to VAT |

- the company had the right to receive penalties (fines) under the terms of the agreement with your partner.

Now they must be taxed if they are recognized as a debtor or awarded to your company by a court. Let us remind you that penalties and fines are accrued in accounting in the same manner. Example 2.

Under a supply agreement, Aktiv CJSC sells goods to Passive LLC.

The cost of the goods is 500,000 rubles. (without VAT). The goods must be paid for by the buyer no later than July 10, 2002. The contract stipulates that the buyer pays a penalty for late payment. The amount of penalties is 0.1 percent of the cost of the goods for each day of delay. "Passive" paid for the goods only on July 30, 2002 (20 days overdue). Consequently, the company must pay a penalty in the amount of: RUB 500,000. x 0.1% x 20 days. = 10,000 rub. "Active" filed claims against "Passive" and demanded to pay a penalty. However, Passive did not recognize the claim and refused to pay. In this case, penalties are not taken into account in non-operating income of Aktiva.

The accrual dates for some types of non-operating income have changed. We present these changes in the table.

| Type of income | Date of accrual of income in tax accounting | |

| Before changes | After changes | |

| License payments for the use of intellectual property, as well as income from rental property | The earliest date: - day of receipt of money; — the day of transfer of settlement documents for payment to the partner (bills, invoices) | The earliest of the dates: - the day when the money should be received according to the agreement; — the day of transfer of settlement documents for payment to the partner (bills, invoices) — the last day of the reporting or tax period |

| Income from the sale or purchase of foreign currency | Day of actual settlement | Day of transfer of ownership of the currency |

| Targeted revenues (except for budget money) | The day the money arrives in the bank account or cash register | The day when the money was used for other purposes or in violation of the terms of its issuance |

| Interest on loan agreements | Quarterly | Based on the results of the reporting period (quarter or month) |

All these rules relate only to tax accounting. You can find out how to reflect non-operating income in accounting from the “Correspondence of Accounts” berator (page VIII/91/06).

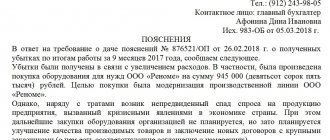

Non-operating expenses

The list of non-operating expenses has also changed. Now these include: - costs of liquidating property whose installation is not completed (for example, unfinished construction projects); — expenses for conservation and re-preservation of production equipment; — the residual value of fixed assets that have been written off.

Example 3.

OJSC “Zavod” writes off a machine due to an irreparable breakdown.

The useful life of the machine has not expired. The cost of the machine is 220,000 rubles. It is subject to depreciation in the amount of RUB 85,000. We spent 10,000 rubles on disassembling and removing the machine. The accountant of the “Plant” made the following entries: Debit 02 Credit 01 subaccount “Disposal of fixed assets” - 85,000 rubles.

— depreciation on the machine is written off; Debit 91-2 Credit 01 subaccount “Disposal of fixed assets”

- 135,000 rubles 0) - the residual value of the machine is written off;

Debit 91-2 Credit 10 (69, 70)

- 10,000 rubles.

— expenses for disassembling the machine are written off. The "plant" can reduce profits by all costs associated with writing off the machine. The amount of these expenses will be: 135,000 rubles.

+ 10,000 rub. = 145,000 rub. The loss from the revaluation of property for which depreciation is not charged (for example, raw materials, materials, etc.) is excluded from non-operating expenses. Now the loss from such revaluation does not reduce profit. This revaluation is carried out at the end of the year.

| Expenses on canceled orders are written off as expenses under the act |

Now the code says how to record expenses for canceled orders, as well as costs for production that did not produce products. Such costs can be included in non-operating expenses if you have an act for their write-off. There is no special form for such an act. Therefore, compose it in any form. It might look like this, for example:

| APPROVED by the head of Passive LLC _____________/A.N. Ivanov/ Certificate of write-off of expenses for a canceled order |

| 1. | Date and number of the contract canceled by the customer | Agreement dated August 10, 2002 No. 234 |

| 2. | Reason for canceling the contract | Buyer lacks money |

| 3. | The amount of costs for production of products under the canceled contract | RUB 45,800 |

| Head of Production Department | _____________________ | /HELL. Somov/ |

Now the fines and penalties that your company must pay for violating the terms of contracts are taken into account differently. Previously, they reduced profits if penalties or fines were awarded to your partner by the court or you had to pay them under the terms of the agreement with your partner. Now they are included in non-operating expenses if they are recognized by you or you have to pay them in court. The accrual date for certain types of non-operating expenses has changed. We will present all the changes in the table.

| Type of consumption | Date of accrual of expenses in tax accounting | |

| Before changes | After changes | |

| Rent | The earliest of the dates: - day of transfer of money; — the day when payment documents for rent (invoices, invoices) were received | The earliest of the dates: - the day when the money needs to be transferred under the agreement; — the day when payment documents for rent (invoices, invoices) were received — the last day of the reporting or tax period |

| Expenses from the sale or purchase of foreign currency | Day of actual settlement | Day of transfer of ownership of the currency |

| Deductions to the reserve for doubtful debts | Evenly throughout the reporting or tax period | Last day of the reporting or tax period |

| Interest on loan agreements | Quarterly | Based on the results of the reporting period (quarter or month) |

You can read about the rules for reflecting non-operating expenses in the “Correspondence of invoices” section on page VIII/91/06.

Y. SAVITSKAYA, expert of the magazine “Practical Accounting”

The material was published in the 8th issue of the magazine

Expenses in the form of fines, penalties, penalties

Fines, penalties, penalties are reflected in non-operating expenses (clause 13, clause 1, article 265 of the Tax Code of the Russian Federation), if:

- the organization recognized the penalty in writing (Article 331 of the Civil Code of the Russian Federation),

- the court decision entered into legal force.

The date of recognition of expenses in the NU is either the date of recognition of the amount of the fine, or the date of entry into force of the court decision.

What is Operations

In addition to carrying out normal activities, the organization may:

- rent out your own property or sell it;

- grant rights to use your intellectual property or patents;

- provide a loan and receive interest from the borrower;

- take part in other businesses by acquiring an authorized share.

Such business events are reflected in the income statement separately from revenue from ordinary business processes (lines 2310-2350 of the Statement of Financial Results).

The costs of this activity include all activities associated with generating income from it.

Operating expenses include:

- interest expenses on borrowed funds;

- maintenance of leased property;

- costs of participation in other companies;

- creation of reserves for doubtful debts.