Procedure for submitting a VAT return for the 3rd quarter of 2022

Deadline: submit the declaration no later than October 25, 2021 (Clause 5, Article 174 of the Tax Code of the Russian Federation).

Form: the VAT return is submitted using the new form, approved. By order of the Federal Tax Service dated October 29, 2014 N ММВ-7-3/ [email protected] with amendments dated March 26, 2021, effective from reporting for the 3rd quarter.

Who is required to represent: taxpayers and VAT tax agents, as well as defaulters who issued invoices.

Where: to the Federal Tax Service at the place of registration.

View:

- electronic - all taxpayers;

- paper - tax agents who are not VAT payers under certain conditions (paragraph 2, paragraph 5, article 174 of the Tax Code of the Russian Federation).

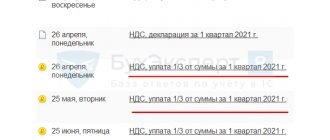

Payment: 1/3 no later than (clause 4 of article 174 of the Tax Code of the Russian Federation):

- 25.10.2021,

- 25.11.2021,

- 27.12.2021.

Payment in December is shifted because the final date falls on a weekend.

- Accountant's calendar for the fourth quarter of 2022 for filing reports

- Accountant's calendar for the fourth quarter of 2022 for the payment of taxes and fees

The VAT declaration consists of 12 sections:

- be sure to fill out - Title page , Section 1 ;

- fill in if there are relevant operations - 2-12;

- key sections that are almost always there - 1, 3, 8, 9.

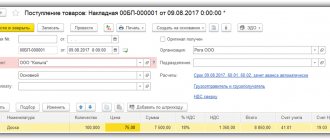

The VAT declaration in the 1C:Accounting 8.3 program is filled out based on data from tax registers, and not according to accounting entries.

Sanctions:

Avoid mistakes when filling out a declaration or making payments to the budget to avoid any troubles. You are facing:

- a fine of 5% of the unpaid amount of VAT according to the declaration for each full or partial month of delay (no more than 30% of the amount of VAT and less than 1,000 rubles) (clause 1 of article 119 of the Tax Code of the Russian Federation);

- blocking of the current account if the submission of the declaration is overdue by more than 20 working days (clause 1, clause 3, clause 11, article 76 of the Tax Code of the Russian Federation).

From 07/01/2021, failure to submit a declaration is equivalent to non-compliance with the control ratios mentioned in the Order of the Federal Tax Service dated 05/25/2021 N ED-7-15-/ [email protected]

More details:

- New control ratios for VAT returns - from July 1, 2021

- Important update in the Tax Code of the Russian Federation: when tax reporting will be considered not submitted

More nuances regarding section 9

ConsultantPlus experts explain in detail how to fill out section 9 for cash payments. To find out more, get free access to K+ and go to the recommendations.

In the letter of the Federal Tax Service of Russia dated April 19, 2018 No. SD-4-3 / [email protected], the controllers explained the specifics of filling out the VAT return (including section 9) by tax agents specified in clause 8 of Art. 161 of the Tax Code of the Russian Federation (buyers of scrap, waste of ferrous and non-ferrous metals, secondary aluminum and its alloys, raw animal skins).

We are talking about tax agents:

- who are not VAT payers;

- VAT payers who are exempt from fulfilling their duties as taxpayers related to the calculation and payment of tax.

These persons are required to fill out section 9 (in addition to section 2 of the declaration) with information about invoices received from sellers of the specified goods when transferring an advance payment and in the cases described in paragraphs. 5 and 13 art. 171 Tax Code of the Russian Federation:

- until 01/01/2020 - with a negative value when applying deductions in the generally established manner;

- after 01/01/2020 - for the purpose of applying deductions reflected in section 8.

When companies and individual entrepreneurs are not required to perform the duties of tax agents when purchasing scrap and hides, find out from this publication.

Checking the report

Check the declaration in several stages. Be sure to complete them all to avoid mistakes.

Check – Check the control ratios – checking the KS established by the Federal Tax Service.

If the KS are not completed, a form with errors will be displayed.

New control ratios for VAT returns - from July 1, 2021

Check - Check unloading - check of format and logical control. Finding these errors on your own is problematic - trust 1C to check.

If everything is correct, a message will appear.

Verification - Check counterparties - checking counterparties using the Federal Tax Service service.

After checking the counterparties, there should be a message on a green background that there are no errors.

If they are not present, an additional message is displayed.

Results

If in the reporting quarter a company or individual entrepreneur carried out transactions subject to VAT, section 9 must be included in the declaration. It contains information from the sales book and details the general indicators of the declaration. The absence of a completed section as part of a non-zero declaration will not allow it to pass logical control when audited by the tax office.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137

- Order of the Federal Tax Service of Russia dated October 29, 2014 No. MMB-7-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Sending a report to the Federal Tax Service

Send the reports to the tax authority after successfully completing all checks via Send (if 1C-Reporting is connected) / Upload (to be sent by another operator).

Use the statuses: In progress / Prepared / Passed - this is useful reference information.

After uploading the report, set the Passed to protect the report from editing.

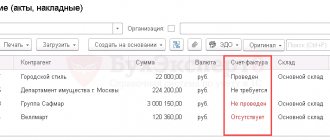

Purchasing goods through an intermediary

Registration of the SF “reissued” by the Commission Agent (Agent) to the Principal (Principal):

The moment of acceptance of VAT for deduction under an intermediary purchase agreement for the principal (principal):

- when the general conditions for accepting VAT for deduction on the amount of goods purchased by an intermediary are met, provided that the SF is correctly “re-issued” by the intermediary to the principal;

- upon provision of intermediary services - in the amount of the intermediary’s remuneration, incl. with the additional benefit of the commission agent.

The principal receives from the intermediary the reissued invoice and, if the conditions for VAT deduction are met, registers it in the Purchase Book, where:

- in gr. 11-12 Information about the intermediary - indicate the name and TIN/KPP of the intermediary who purchased the goods and services for the principal.

Information from the Purchase Book must be reflected in Section 8 of the VAT Declaration:

- page 140 TIN/KPP of the intermediary (commission agent, agent, forwarder, developer) - indicates the TIN/KPP of the intermediary who purchased the goods and services for the principal.

The codes of the types of transactions for the principal and the commission agent must be the same, there must be a mirror image of the transactions (Note to the Order of the Federal Tax Service of the Russian Federation dated February 14, 2012 N ММВ-7-3 / [email protected] ). Those. The consignor will indicate the following codes in the Purchase Book:

- 01 and 02 – when the commission agent reissues a purchase invoice to the principal;

- 27 and 28 - when the commission agent reissues a consolidated purchase invoice to the principal.

If the commission agent (agent) is a VAT payer

The commission agent issues the SF for remuneration to the Principal. The principal, if the conditions for deducting VAT on intermediary services (commission agent's remuneration) are met:

- reflects the SF for remuneration in the Purchase Book with the transaction type code “01” (as for purchased services),

- fills out Section 8 of the declaration.

Payment of tax to the budget

Automatically generate a payment order for tax payment in a convenient way from the section:

- The main thing is the tasks of the organization - Payment of VAT at 1/3 of the amount for the 3rd quarter;

- Reports - VAT reporting - from the VAT assistant.

We looked at how to fill out a VAT return for the 3rd quarter of 2022 in 1C 8.3 Accounting, the deadlines for paying VAT for the 3rd quarter of 2022, and how to check the correctness of the VAT return in 1C.

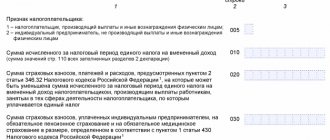

When you need to complete Appendix 1 to Section 8

Appendix 1 to Section 8 of the VAT declaration is used when preparing additional lists for the purchase book, reflecting the appearance of corrective or adjustment invoices issued by the supplier in a period later than the original reporting period.

In terms of content, Appendix 1 to Section 8 on lines 005–190 corresponds to the form of the additional list approved by Decree of the Government of the Russian Federation No. 1137. It will also have to be filled out in a number of pages equal to the number of corresponding transactions, increasing this number if it is necessary to show different dates for paying taxes or accepting acquisitions to accounting (lines 100–120) or information about different sellers (line 130).

Appendix 1 to section 8 also now contains lines for traceability details - numbered 200-230.

Like section 8, the appendix to it has line 001 for the code indicating the relevance of the submitted data (with the same values and rules for indicating this code) and line 190, intended to reflect the final total amount of tax and filled out only on the last page of the appendix.

How to reflect the counterparty's adjustment invoice in the declaration?

An adjustment invoice is drawn up by the seller of goods, works or services in the event of a change in cost indicators (if the price, quantity or volume of supplies increases or decreases).

The procedure for reflecting such an invoice in the declaration depends on the type of adjustment and the role of the counterparty in the transaction (seller or buyer).

| Counterparty | The procedure for reflecting an adjustment invoice |

| Salesman | At decrease delivery cost:

|

At increasing delivery cost:

| |

With simultaneous decrease and increase delivery cost:

| |

| Buyer | At decrease delivery cost:

|

At increasing delivery cost:

| |

With simultaneous decrease and increase delivery cost:

|

For example, Master Plus LLC in March 2022 shipped a batch of 100 wooden doors to Omega OJSC. at a price excluding VAT of 30,000 rubles, issuing invoice No. 35 for a total amount of 3,600 thousand rubles. This invoice was registered in the sales book of Master Plus LLC and is reflected in section 9 of the VAT return for the 1st quarter of 2021.

The buyer had this invoice registered in the purchase book and reflected in section 8 of the declaration for the 1st quarter of 2021.

At the time the buyer accepted the goods, it was discovered that the seller had shipped the goods in quantities not of 100, but of 105. The buyer decided to accept all the goods, having agreed with the seller. Master Plus LLC, in turn, issued the buyer an adjustment invoice No. 42 to increase the cost of delivery in the amount of 180 thousand rubles, incl. VAT 30 thousand rubles, reflecting it in the sales book and in section 9 of the VAT declaration.

Omega OJSC registered the adjustment invoice received from the seller in the purchase book and reflected it in section 8 of the declaration.

How to fill out an updated declaration if there is an error in the invoice details?

If errors are discovered as a result of which VAT was not underestimated, it is not necessary to submit an updated declaration. Errors in the invoice details (incorrect number and (or) date) do not affect the calculation of the tax base and the amount of deductions, so an updated declaration does not need to be submitted. If the tax authority in this case asks for clarification, then it is necessary to respond to the request by indicating the correct data.

However, the taxpayer can voluntarily, without waiting for the Federal Tax Service's request, submit an updated declaration.

In this case, you can use different options for clarifying the data in the declaration. The most common are the following:

- 1) when filling out an updated declaration, in the section in which the invoice with incorrect details is indicated, it is necessary to indicate the relevance. To do this, in the “Adjustment” field. Previously submitted information”, select the “requires correction” and indicate the correct invoice details;

- 2) the section of the declaration in which the invoice with incorrect details was indicated remains unchanged, for which purpose in the “Adjustment” field. Previously submitted information”, “does not need to be corrected” attribute is selected (as if everything there is correct). But in this case, it is necessary to fill out Appendix 1 to Section 8 or 9, first reflecting in it the data on the invoice, during the registration of which an error was made, with a negative value, and then register the same invoice correctly. If Annex 1 was previously included in the updated declaration, it should have the “needs to be corrected” .

For example, Master Plus LLC, in its initial declaration for the 2nd quarter of 2021, incorrectly indicated the date of invoice No. 201 received from Omega OJSC.

Having discovered the error before the tax authorities and without waiting for a request from the Federal Tax Service, Master Plus LLC decided to submit an updated declaration. In this case, you can make corrections using the first option:

- open the submitted primary declaration and indicate “1” “Adjustment number”

- sections that contain no errors should be left unchanged;

- in section 8, in which the incorrect invoice was indicated, indicate the relevance indicator “needs correction” and the correct date of the invoice. Leave everything else in the section unchanged.

You can also correct the data using the second option:

- open the submitted primary declaration and indicate “1” “Adjustment number”

- sections that contain no errors should be left unchanged;

- in section 8 indicate the relevance indicator “no correction required” and do not make any changes;

- in Appendix 1 to Section 8, indicate the relevance indicator “needs correction” , reflect the data on the erroneous invoice with a “minus” sign and register the invoice with the correct details.

The procedure for filling out an updated declaration

The updated declaration is filled out in the same form as the primary one. This declaration includes:

- - all sections that were present in the previously submitted declaration (even if there were no errors in them);

- — additional sections in which you need to reflect data not specified in the primary declaration.

To create an updated declaration you need:

- — on the title page in the “Adjustment number” , indicate the serial number of the updated declaration;

- — in the “Adjustment” field. Previously submitted information” select the indicator of the relevance of previously submitted information.

“no correction required” sign is indicated if the previously submitted section information is reflected correctly and does not require correction. In this case, such a section is not sent again as part of the updated declaration.

“needs to be corrected” sign is indicated if previously submitted information was reflected with errors or was not provided at all. In this case, this section with the changes made to it is re-sent as part of the updated declaration. To create and fill out a section that was not in the primary declaration, this attribute is also selected.

What is the liability for failure to submit or errors in the declaration?

For failure to submit a tax return, the employer and the responsible person may be subject to administrative liability, as well as a fine. The amount of the fine depends on:

- 1000 rubles – if the tax has been paid or the amount according to the declaration is zero;

- If the tax has not been paid, then 5% of the amount indicated in the declaration for each month of delay, but not more than 30% and not less than 1000 rubles.

Important!!! An error in the VAT return format is not subject to a fine.

If the VAT is not paid, you will be charged a penalty; if the penalty is not paid, your current account may be blocked and the bank will be obligated to write off the amount of the debt for the penalty from you. If the declaration is submitted incorrectly, the tax office will send a request asking for an explanation of this fact.

In order to avoid a fine you must:

- Submit an updated declaration before the deadline

- Submit a clarification before the payment deadline

General information on VAT

Value added tax (VAT) - if we formulate its concept in simple words, then this is the so-called consumption tax; in other words, it is the difference between the purchase and sale prices.

The VAT rate is not the same for all enterprises; it depends on their types of activities.

Basically, on the territory of the Russian Federation the tax is 18%, but there is also a mixed VAT.

Using the table as an example, let’s analyze the existing rates:

| Bet size | What goods are included and subject to this rate? |

| 18% | For almost all goods in the Russian Federation |

| 10% | Medical products, some grocery products and children's products |

| 0% | Goods that are exported, some passenger transportation and others |

VAT is paid exclusively by the buyer when purchasing products. The seller company is an intermediary between the buyer and the budget.