Cash transactions (related to the circulation of cash) are an important component in the life of any organization, both as a structural unit and as a technical means. Documentation of completed cash transactions is necessary to ensure the reliability of information on cash flow. In this case, it is necessary to comply with legally established standards related to cash flow. Also, the registration of documents at the cash register was influenced by legislation in the field of cash register systems in connection with the use of online cash registers.

Let's consider the procedure for preparing documentation for the cash register.

Purpose and foundation of PKO, what is it in accounting

This order is a document for the primary accounting of the arrival of cash at the cash desk. The term implies a complex of accounting operations: not a device that is installed at the point of sale, but a full-fledged system. Therefore, even if there is no store for retail sales, the obligation to issue a cash receipt order is not removed.

The form has a unified form under the number KO-1. You can see an empty sample in the photo:

Documentation becomes necessary at any time when funds are received. There is no limit to the amount taken into account in the document. The form must be completed even if the minimum payment has been received into the account.

Open a business account at SEA BANK and receive up to 6% on your account balance!

It is worth considering that documentation is drawn up only for the receipt of funds; for expenses there is its own analogue, called a “cash settlement order” (CSO). PKO, or as it is simply called, receipt, is a mini-report on the acceptance of cash.

The absence of such an accounting system is considered illegal; no organization has the right to conduct business without issuing warrants. All violators are strictly punished by the tax authorities.

The procedure for filling out RKO and PKO

Federal Law dated December 6, 2011 N 402-FZ defines the following requirements for the preparation of primary documents:

- full title

- date when the document was drawn up

- organization that compiled the document

- content of the operation performed

- quantity and units of measurement

- positions of persons who completed the operation

- signatures of persons and their decoding

Directly in PKO and RKO there are the following design features:

- the corresponding account is indicated

- basis for accepting (issuing) money

- the person to whom the money is given (from whom it is received)

- the amount is indicated in numbers and words

- the basis documents for issuance are listed with numbers and dates of their preparation

When is a cash receipt order issued?

Federal Law No. 402-FZ strictly defines the cases when such documentation is required. And part 3 of the regulatory legal act (NLA) states that the PKO will be needed in all cases of carrying out the activities of a business entity. This means that it is used every time funds are received at the cash desk.

It is also worth understanding that goods and materials (inventory assets) are not related to cash. And they act on the basis of capitalization. Accordingly, the above order is not filled in these cases.

Let's consider special cases when a warrant is definitely needed:

- Closing a shift. Yes, despite the fact that when purchasing goods, which can be several hundred during the day, each individual transaction is not completed by filling out the KO-1 form. It is confirmed by a cash receipt, nothing more. This category includes not only the sale of goods, but also the paid provision of any kind of services. The cash receipt order itself is filled out only once - when closing the entire shift. Regardless of whether the cash register is transferred to a replacement, or the store closes until the morning.

- Transfer from account. Regardless of whether this is a payment from a counterparty or the transfer has a different purpose.

- Debt repayment. That is, when receiving receivables from any persons, but only in cash (inventory assets are not included in this category).

- Replenishment of company capital. This includes all types of injections into both direct and working capital. Any form of subsidies in favor of improving the company - purchasing equipment, purchasing new goods, raw materials, services to create new turnover. Transfers to share capital also fall within this area.

- Refund. If funds were issued for certain purposes, but the amount was not spent or used in full. In this case, the cash receipt document is drawn up according to the general rules. You do not have to separately indicate the source of funds.

Formation of cash documents

All facts of economic activity are subject to registration with primary documents. In connection with the use of online cash registers, it is allowed to maintain cash documents both electronically (with an electronic signature) and paper form, as well as in a combined form. For example, in order for the person depositing money to the cash register to have a supporting document, the PKO can be drawn up in paper form, where the tear-off part of the PKO remains with the person who deposited the money to the cash register.

From 01/01/2013, standard forms are not mandatory for use; documents for conducting cash transactions remain mandatory (information of the Ministry of Finance of Russia No. PZ-10/2012).

RKO and PKO are used to confirm the fact of movement of money through the cash register. These documents are drawn up directly when money flows through the cash register, are generated in 1 copy by the cashier, signed by the manager and the chief accountant (or a person authorized for such actions), and the results of the movement of money must be recorded in the registration journal (KO-4), which individual entrepreneurs may not lead.

Decor

Errors and their correction are not allowed in the form. Therefore, if you make a mistake when filling out, you will have to start all over again. Several employees may be involved in entering information into the PKO, depending on the specific regulations established at the enterprise.

MARINE BANK offers to use trade acquiring services. Accept payments for goods and services by bank cards.

This:

- Supervisor. Often in small companies based on individual entrepreneurs, it is he who deals with all the accounting work related to the receipt of funds.

- Chief accountant. In larger organizations, the task of preparing such documentation falls on the shoulders of the chief accountant.

- An accounting employee who has received authority confirmed by a written order from the director. A specialist is involved in cases where the chief accountant is busy or cannot perform his duties for other reasons. Most large organizations use this practice all the time.

After the document is drawn up, a feature of the cash receipt order is that it must be signed by the chief accountant, and in his absence, by the deputy or other authorized accounting employee. And only if none of them is currently able to sign, the manager does this. If he is not present, then the responsibility passes to the cashier. He, in turn, must be competent to draw up the paper, as well as know all the legal aspects that relate to the task at hand.

Setting a cash balance limit

The organization sets the cash limit independently based on the specifics of the organization’s activities and the volume of cash flows and approves it by order of the manager.

To calculate the cash limit, you can use the methods reflected in Central Bank Directive N 3210-U: based on cash flow (depending on the specifics).

The operating legal entity makes calculations based on the volume of receipts (issues) of cash, and the organized legal entity - based on the expected volumes of receipts (issues).

The balance limit is calculated using the formula:

Limit = volume of cash receipts (issues) / settlement period (1 – 92 days) * number of days due for delivery to the bank

Cases when the form is filled out

The aspect that often raises doubts is that entrepreneurs consider it unnecessary to manage cash flow documents if the enterprise operates without cash register equipment. This is quite acceptable for some types of individual entrepreneurs. But the absence of a cash register will not save the entrepreneur from accounting for incoming funds and studying the concept of a cash receipt order. And it makes no difference whether the equipment itself is used, whether a receipt is printed, and so on. If the fact of cash transfer took place, then it must be recorded accordingly.

Latest innovations in cash transactions

The following major changes in the procedure for conducting cash transactions were introduced by Bank of Russia Directive No. 4416-U dated June 19, 2017 and came into force on August 19, 2017:

- The cashier is allowed to draw up a general incoming and (or) outgoing cash order at the end of the day for the entire amount, which is confirmed by fiscal documents (checks and BSO online cash registers).

- Signatures on cash documents are verified only if the document is drawn up on paper.

- If an expenditure cash order is drawn up in electronic form, then the recipient of the money can put his electronic signature on it.

- If the cash receipt order is issued in electronic form, then the cashier can send the receipt at the request of the depositor to his email.

- Not only the cashier, but also another authorized employee can maintain a cash book.

The procedure for issuing money on account has also undergone a number of changes. Read about it here.

The latest edition of the cash procedure was introduced on November 30, 2020 (directive of the Bank of Russia dated October 5, 2020 No. 5587-U). From this date:

- changes were made to the design of settlements with accountants;

- separate divisions were allowed not to maintain a cash book if they do not store money, but hand it over to the cash register of a legal entity; the requirement to reflect in the payroll the deposit of unpaid wages on time has been eliminated;

- cashiers were required to monitor the solvency of cash when accepting it and were prohibited from issuing banknotes even with one damage (such banknotes must be handed over to the bank);

- the rules for conducting cash transactions using automatic devices without the participation of an employee have been determined.

Filling out a receipt

For this, the standard KO-1 form is used. There are certain requirements established by law that are mandatory for any organization that records the fact of transfer of funds using this receipt. First of all, this is the name of the organization and the correct date of transfer of funds. Next, the subject who transferred the money is entered, and the reasons for their transfer or specific purpose are also indicated. The full amount transferred for reporting is entered in a separate line. The form is supported by the signature of both the cashier and the accountant. Moreover, the last point is relevant, regardless of who signs the document (cash receipt order).

SEA BANK offers you to use a convenient banking system. Manage your business from anywhere in the world. Secure access to your accounts is always in your pocket.

The procedure for conducting cash transactions

The procedure for maintaining a cash register was approved by the Central Bank by Directive No. 3210-U dated March 11, 2014. Due to the widespread use of online cash registers, this procedure has been narrowed, which is determined by the organization or individual entrepreneur independently and prescribed in the Regulations (on the safety of cash, storage, transportation).

In this case, an important role is played by the fact that the Central Bank allows the registration of PKO and RKO in electronic form and a combination of electronic and paper documents is allowed. It should be noted that for electronic documents there must be an electronic signature of the cashier and chief accountant .

Responsibility for cash transactions rests with the cashier, but if the company is not large, then another responsible person (director or chief accountant) can take on the responsibilities of the cashier and this point must be included in the appropriate provision. In this case, the person responsible for the cash desk must be a full-time employee of the organization.

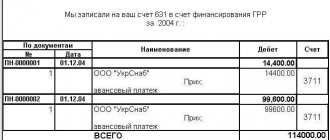

Synthetic accounting of cash transactions is carried out on account 50 (active) the debit reflects the receipt of money, the credit - the issue), for which the following sub-accounts are allowed to be opened:

- 1 Cash desk of the organization

- 2 Operating cash desk

- 3 Cash documents

For organizations, a cash limit must be set; amounts above the limit must be transferred to credit institutions (this does not apply to individual entrepreneurs - they have the right to keep as much cash as they see fit).

Samples

When starting to fill out the form, you should pay attention to the ready-made forms, as well as study the practice of correctly entering information. The currently compiled form KO-1 can be viewed in the photo below:

Payment for goods and services

This is the most common use of the form today, since most often the receipt of finance is associated with the execution of commercial activities. And the larger the company, the larger the volume and number of operations this array is expressed in. But it is still formalized with just one document. Example of a completed form:

Refund

As we remember, the basis for filling out a cash receipt order may be different. Return operation is not the most popular in practice, but it is important to know how to fill out the form correctly and indicate the reason for the return. The latter may be an unused array or a returned employee advance. An example can be seen in the photo below:

Money for salary

These are standard transfers for paying employees of an enterprise. Sample:

Finance in authorized capital

This category includes injections from the founders aimed at replenishing the authorized capital of the company. Form KO-1 is drawn up as follows:

SEA BANK (JSC) projects for salary transfer can be convenient and interesting for any enterprises and organizations, regardless of the number of employees working in them.

What is cash discipline?

This is a set of rules for processing cash transactions. They describe how you must accept, store and issue cash. It is very important in this matter not to confuse concepts such as “cash register” and “cash register”.

A cash register (cash register, cash register, online cash register) is a device that is used to accept cash from customers for goods or services. This operation is recorded for subsequent transfer to the Federal Tax Service, and the client is issued a fiscal receipt.

The enterprise cash register (operating cash desk) is a record of all actions in the company that relate to cash. Money accepted via cash register is also deposited into the organization’s general cash register. This money is then either issued for cash expenses or collected at the servicing bank for crediting to a current account. The cash desk physically stores the company's money and everything that happens to it must be confirmed by relevant documents. This is called cash discipline.

In general, when maintaining cash discipline, you need to rely on the following principles:

- All transactions with cash must be documented.

- It is important to strictly monitor compliance with the cash register limit.

- When issuing money for any needs, appropriate documents must be issued.

- The limit on cash payments between two business entities cannot be exceeded; today this amount should not exceed 100 thousand rubles per contract.

Algorithm of the cashier's work after depositing funds

It is already becoming clear to us in what cases a cash receipt order is issued, what the purpose of the document is and other aspects related to its execution. Accordingly, we will need an order every time a bank deposit is received at the cash register. Let's look at how exactly the cashier should act in this case.

Initially, the employee receives cash or a transfer and puts his signature on the receipt. There, the cashier writes down his last name and initials in full. This is where manipulations with the receipt end, all that remains is to open the corresponding PKO and certify both documents with a seal so that most of the drawing remains on the receipt, and part of it appears on the PKO itself. After this, at the place indicated in the dotted line (not always), a paper receipt is cut off and handed over to the entity that deposited the funds. The cash receipt order is signed and remains in the folder with the main cash register documentation. At the same time, the cashier enters the received information into the cash book in full accordance with the form numbered KO-4.

Regulatory regulation

Federal Law dated December 6, 2011 N 402-FZ defines the requirements for accounting and execution of primary documentation

Directive of the Bank of Russia dated March 11, 2014 N 3210-U establishes the procedure for conducting cash transactions

Bank of Russia Regulation No. 630-P dated January 29, 2022 regulates the procedure for conducting cash transactions, storage, collection

Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 N 88 approved unified forms of documentation for cash transactions and inventory

Federal Law of May 22, 2003 N 54-FZ on cash registers and the work of online cash registers

The Code of Administrative Offenses of the Russian Federation determines penalties for non-compliance with cash regulations

Possible fines for violations

If the PQR is filled out incorrectly, this is not a violation. But the taxation system in Russia is such that any errors automatically equate a completed document with an empty form. In other words, it doesn't exist. But there is a fine for lack of PKO. This is a simple scheme with the help of which the Federal Tax Service controls document flow.

The sanction itself under Article 120 of the Tax Code entails a fine of 10 thousand rubles. But the main danger lies in another aspect. Since a cash receipt order is a primary document, if it is missing, there are grounds for canceling the simplified taxation system in a business entity. And it’s not for us to explain what troubles and losses such a decision by the tax authorities entails. Therefore, in case of any error, you should reprint the entire form and format it in accordance with the established requirements. This is especially true if the date is entered incorrectly on the form, and the signature of the responsible person is missing, which occurs quite often. The human factor plays a role, especially if for an employee this is already the hundredth paper of the day that needs precise execution.

Basis for conducting cash transactions

An organization that carries out cash circulation is required to have a cash register, a special room and a financially responsible person (cashier).

Conducting cash transactions is based both on compliance with legislative acts and on local acts (regulations, orders, etc.) developed within the organization that do not contradict the law. Cash must be held in accordance with the requirements for this process.

Thus, the company forms a certain set of rules for conducting cash transactions, compliance with which is cash discipline .

Shelf life

As with all primary documentation, the same rule applies here. More precisely, it should be stored for exactly five years. The countdown of the period begins not from the moment of creation and completion, but from the stage at which a specific reporting period ends, which, according to tradition, is the end of the year. Therefore, add more time to the deadline until the end of the period. It is also worth remembering that all responsibility for proper storage rests with the enterprise. And it is very difficult to prove the fact that the KO-1 form was lost due to circumstances beyond the entrepreneur’s control. And the difficulties and red tape associated with this are very great.

Results

Filling out cash documents is a strictly regulated procedure. Cash documents can be paper, or they can be generated electronically, but then they must be signed with an electronic signature.

For more information about the procedure for conducting cash transactions, including taking into account the transition of most taxpayers to online cash registers, read the section “Online cash registers of cash registers of cash registers”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who signs?

The cash receipt order is signed by the chief accountant. If a specialist is unable to perform his task, it is assigned to an authorized accounting employee, and then to the manager. And only if all the persons indicated above have already transferred their powers, then the right passes to the cashier.

The corporate card of SEA BANK Visa Business is a convenient means of organizing and controlling entertainment and travel expenses for company employees.

How to delegate signing authority

Since the manager and chief accountant are very often busy, in any enterprise with more than three employees, management tries to transfer this concern to the cashier. And it is much more convenient for him to perform this task on his own. After all, the cashier is always on site and personally monitors the receipt and transfer of funds.

There are two ways to delegate responsibilities. The first is to draw up a full power of attorney, if we are talking about an accountant who is abdicating his duties. But this is not the easiest and fastest way. It is much easier to publish an order, which also has legal force, indicating the transfer of powers. But only a leader can do this. Often it is the order form that is used in various companies.

If you have any difficulties with drawing up a power of attorney and any other operations related to accounting and the movement of funds, you can always use the help of SEA BANK. Any volumes and directions of transfers, support of operations and standard efficiency in completing tasks are only a small part of the main qualities of a financial organization.

In the article, we looked at the requirements for issuing a cash receipt order and figured out why it is needed in principle. As the review showed, PQR is of particular importance. At a minimum, because it records any movement of funds within the enterprise. And together with RKO, these two papers can easily be called the most frequently used in the activities of a business entity. Therefore, you should get to know him with special attention.

RKO

Filling out the cash book

If we talk about registration of KO-4, then the following requirements must be met:

- the title page of the cash book reflects the details of the organization and the responsible department (if any);

- the form corresponds to one financial year;

- Each page must be numbered.

You can fill it out manually or in accounting programs.

Some institutions maintain the form manually. On the first sheet, serial numbering opens. Entries are made with a ballpoint pen with black and blue ink. When entering information into the columns, the cashier uses a carbon copy to duplicate the entry being made. The detachable part is the one on which the “live” recording is applied. The duplicate portion remains in the cash book. Each part is signed separately. Information about RKO and PKO is included in each line. It should be the same in each of the two parts of the cash book. If on the reporting day many transactions with funds are made, and one page is not enough to deposit them, then “transfer” is marked. This column reflects the incoming and outgoing values at the time of transfer. Entries on the next sheet begin with the same number.

The end of the period is recorded by the results of PKO and RKO, and the cash balance at the end of the day is displayed. The chief accountant reconciles with primary receipts and expenditures and certifies the cash book.

The journal is stitched at the end of the year, the period is from January 1 to December 31 of the financial year. Each sheet must be numbered, stitched and stamped on the last page. It is also necessary to indicate the number of sheets stitched. The entry “In this book there are _______ sheets numbered and laced together” is required. It is certified by stitching together the signatures of the head and chief accountant of the organization (Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88).